Oklahoma State Tax Form 2021

Oklahoma State Tax Form 2021 - Web oklahoma tax commission employee’s state withholding allowance certificate your first name and middle initial employee’s signature (form is not valid unless you sign it)date. If line 7 is equal to or. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Web instructions oklahoma state income tax forms for current and previous tax years. Web requirements filing of returns:employers will report the total number of employees paid during the quarter, total amount of wages paid during the quarter and. Web this is a federal form. Web instructions ok tax return filing and payment due date for tax year 2022 is april 18, 2023. Web oklahoma tax rates, brackets. If you pay oklahoma income tax, the irs allows you to claim a. Web oklahoma has a state income tax that ranges between 0.5% and 5%.

If you pay oklahoma income tax, the irs allows you to claim a. Be sure to verify that the form. Web oklahoma tax rates, brackets. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Web oklahoma has a state income tax that ranges between 0.5% and 5%. Ad prevent tax liens from being imposed on you. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. During the special holiday, people can buy any product in.

Sign, mail form 511 or 511nr to. Easily fill out pdf blank, edit, and sign them. Web oklahoma has a state income tax that ranges between 0.5% and 5%. If you pay oklahoma income tax, the irs allows you to claim a. Web oklahoma tax rates, brackets. Web instructions ok tax return filing and payment due date for tax year 2022 is april 18, 2023. Be sure to verify that the form. Web instructions oklahoma state income tax forms for current and previous tax years. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Save or instantly send your ready documents.

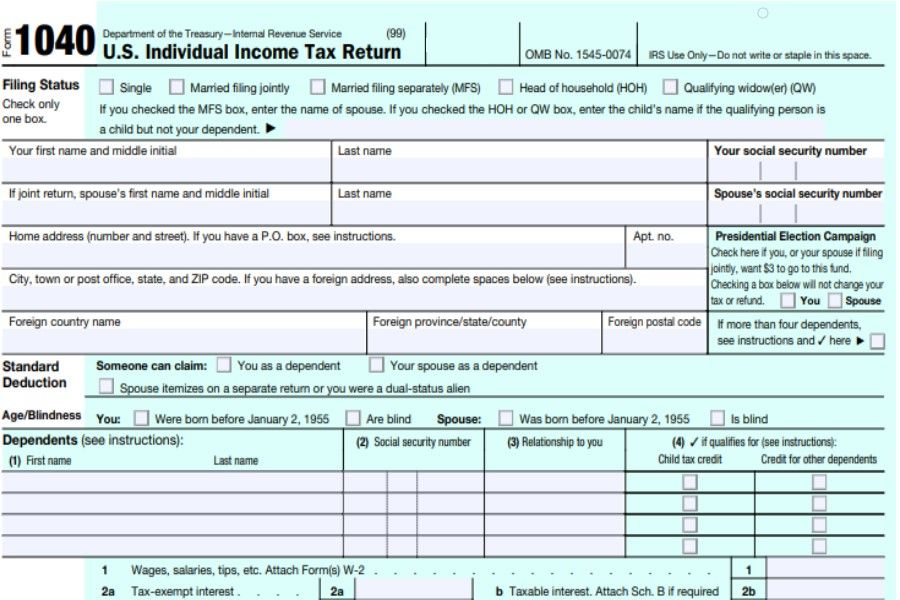

2021 Federal Tax Forms Printable 2022 W4 Form

If you pay oklahoma income tax, the irs allows you to claim a. If line 7 is equal to or. Save or instantly send your ready documents. Learn more about oklahoma state tax forms. Web oklahoma tax rates, brackets.

Maryland Estimated Tax Form 2020

Web ite application for extension of time to file an oklahoma income tax return for individuals (this is not an extension of time for payment of tax. Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. Web the state's sales tax holiday is always the first friday through.

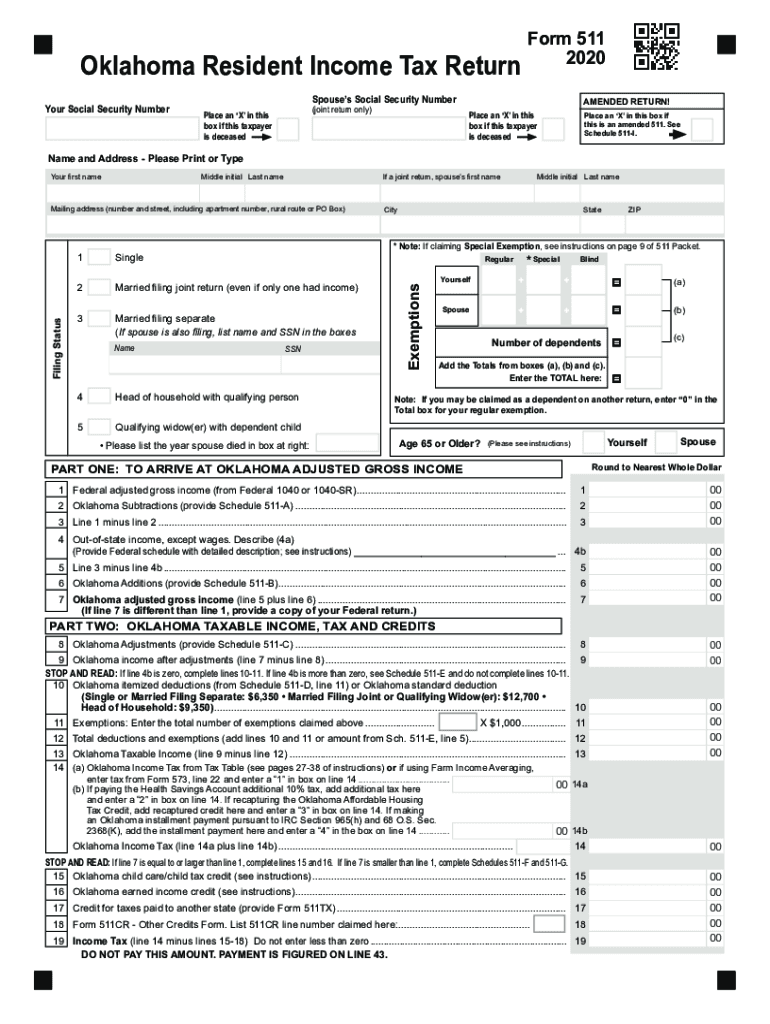

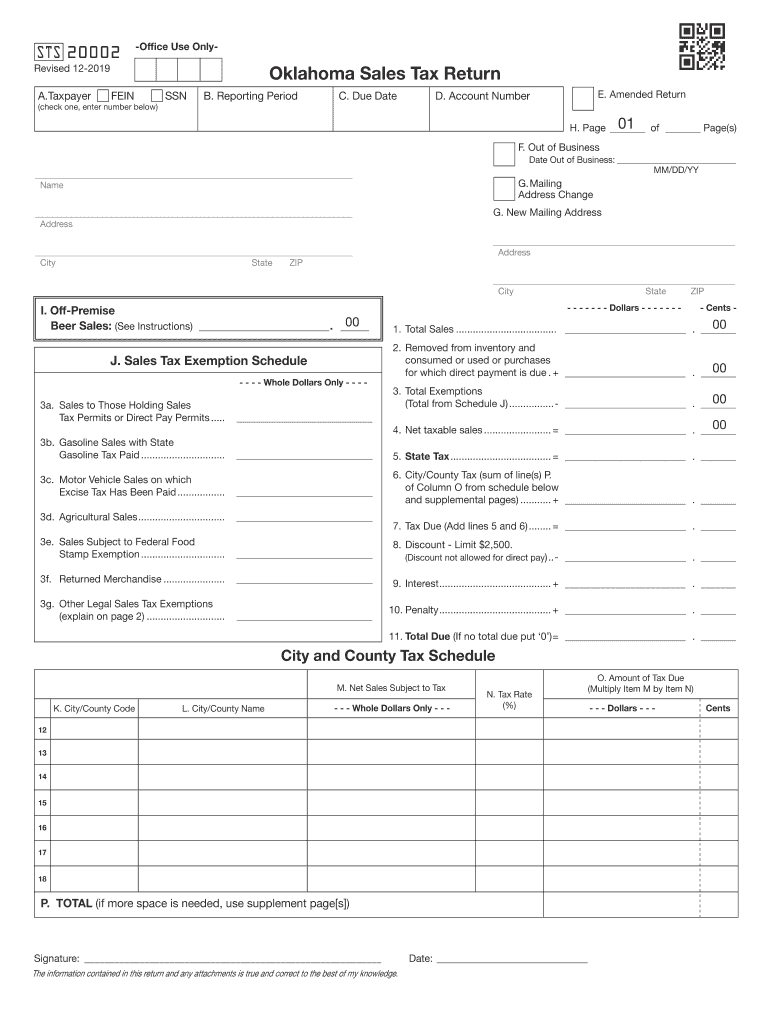

Oklahoma State Tax Form Fill Out and Sign Printable PDF Template

During the special holiday, people can buy any product in. Web this is a federal form. Easily fill out pdf blank, edit, and sign them. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Web oklahoma tax forms for 2022 and 2023.

Oklahoma State Tax Form 511 for Fill Out and Sign Printable PDF

Be sure to verify that the form. Easily fill out pdf blank, edit, and sign them. Learn more about oklahoma state tax forms. Ad prevent tax liens from being imposed on you. Web oklahoma tax commission employee’s state withholding allowance certificate your first name and middle initial employee’s signature (form is not valid unless you sign it)date.

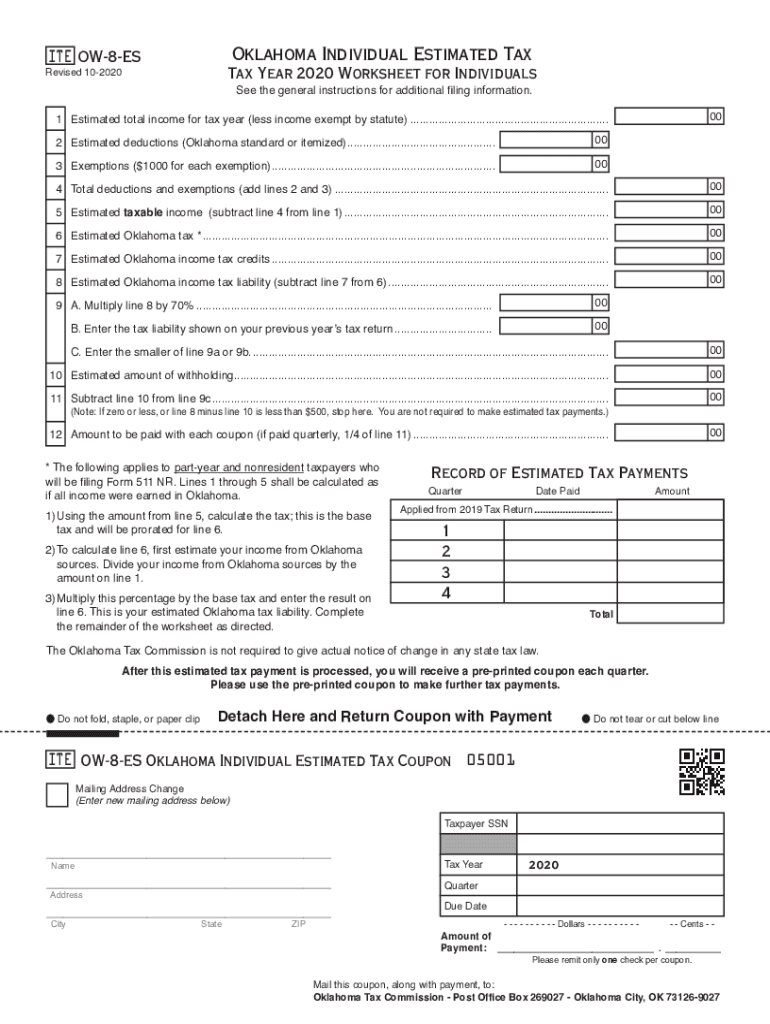

Form Ow 8 Es Tax Fill Out and Sign Printable PDF Template signNow

Sign, mail form 511 or 511nr to. Web ite application for extension of time to file an oklahoma income tax return for individuals (this is not an extension of time for payment of tax. Ad prevent tax liens from being imposed on you. Save or instantly send your ready documents. During the special holiday, people can buy any product in.

Oklahoma W9 2021 Form Calendar Template Printable

Web instructions oklahoma state income tax forms for current and previous tax years. Web instructions ok tax return filing and payment due date for tax year 2022 is april 18, 2023. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Ad prevent tax liens from being imposed on you. Learn more.

Oklahoma 2020 Blank W9 Calendar Template Printable

Save or instantly send your ready documents. Web oklahoma has a state income tax that ranges between 0.5% and 5%. Web this is a federal form. If you pay oklahoma income tax, the irs allows you to claim a. If line 7 is equal to or.

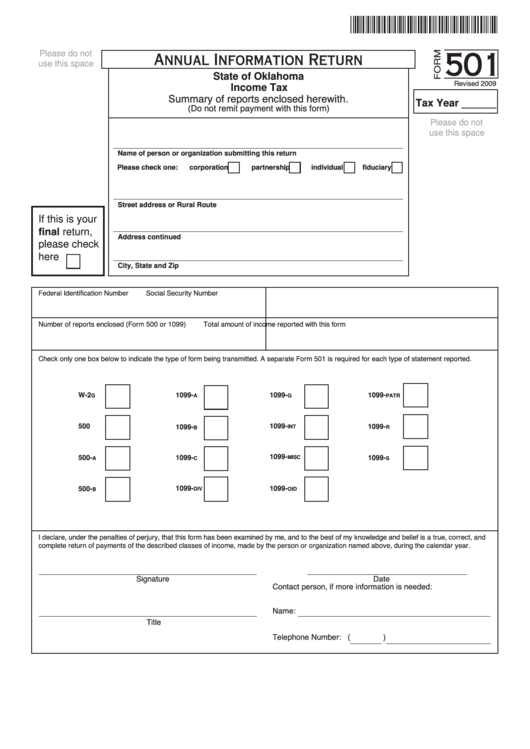

Fillable Form 501 Annual Information Return State Of Oklahoma

Sign, mail form 511 or 511nr to. Web this is a federal form. Web ite application for extension of time to file an oklahoma income tax return for individuals (this is not an extension of time for payment of tax. Learn more about oklahoma state tax forms. If line 7 is equal to or.

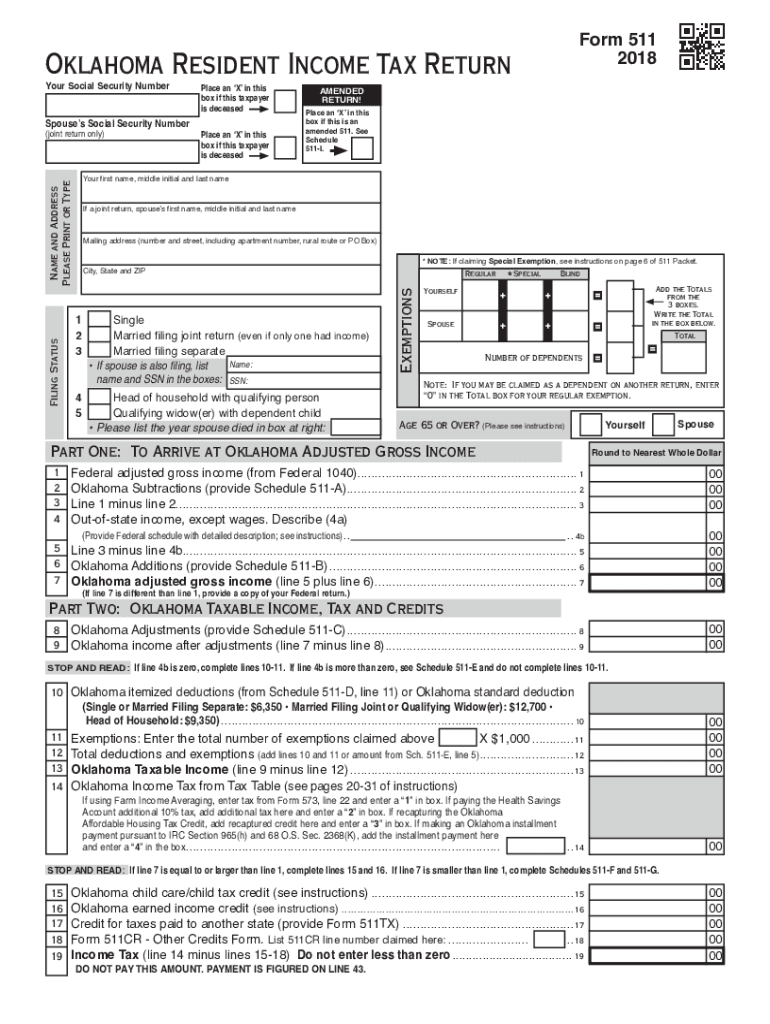

Ok state tax form 2018 Fill out & sign online DocHub

Web oklahoma tax commission employee’s state withholding allowance certificate your first name and middle initial employee’s signature (form is not valid unless you sign it)date. During the special holiday, people can buy any product in. Be sure to verify that the form. Sign, mail form 511 or 511nr to. Web oklahoma tax forms for 2022 and 2023.

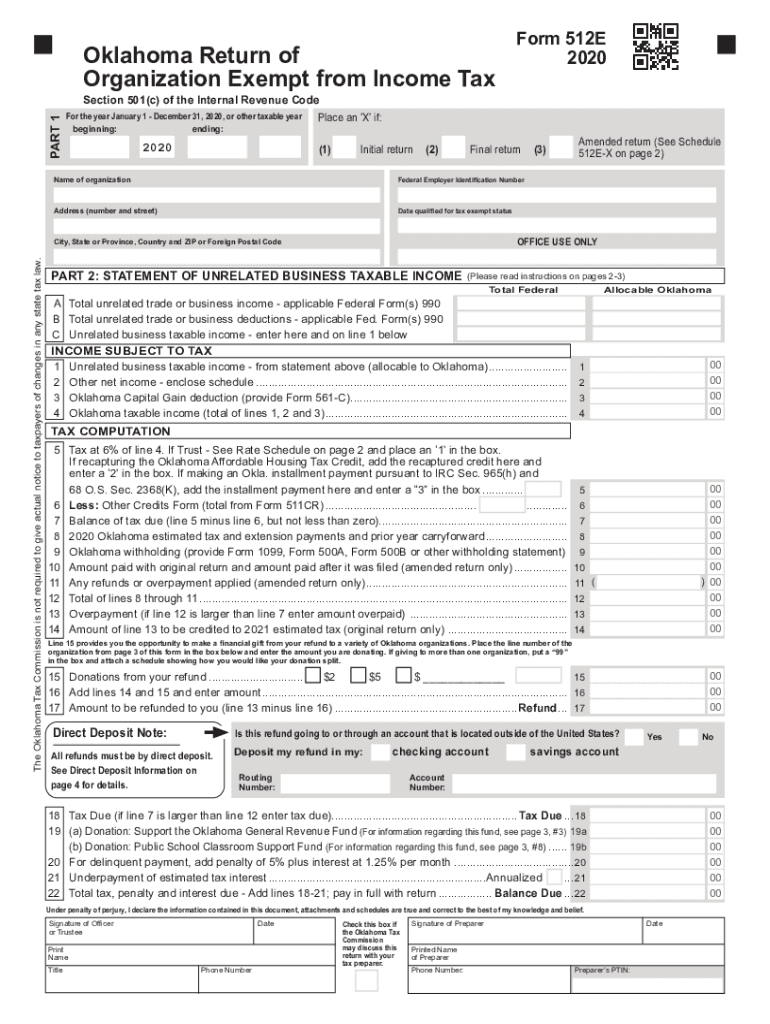

Oklahoma Form 512 Instructions 2020 Fill Out and Sign Printable PDF

Web oklahoma has a state income tax that ranges between 0.5% and 5%. Sign, mail form 511 or 511nr to. Web instructions oklahoma state income tax forms for current and previous tax years. Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. If you pay oklahoma income tax,.

Web Instructions Oklahoma State Income Tax Forms For Current And Previous Tax Years.

Web oklahoma has a state income tax that ranges between 0.5% and 5%. Web oklahoma tax forms for 2022 and 2023. Be sure to verify that the form. Web oklahoma tax rates, brackets.

Web Oklahoma Tax Commission Employee’s State Withholding Allowance Certificate Your First Name And Middle Initial Employee’s Signature (Form Is Not Valid Unless You Sign It)Date.

Web this is a federal form. Web ite application for extension of time to file an oklahoma income tax return for individuals (this is not an extension of time for payment of tax. Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. During the special holiday, people can buy any product in.

Learn More About Oklahoma State Tax Forms.

Ad prevent tax liens from being imposed on you. Easily fill out pdf blank, edit, and sign them. Sign, mail form 511 or 511nr to. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug.

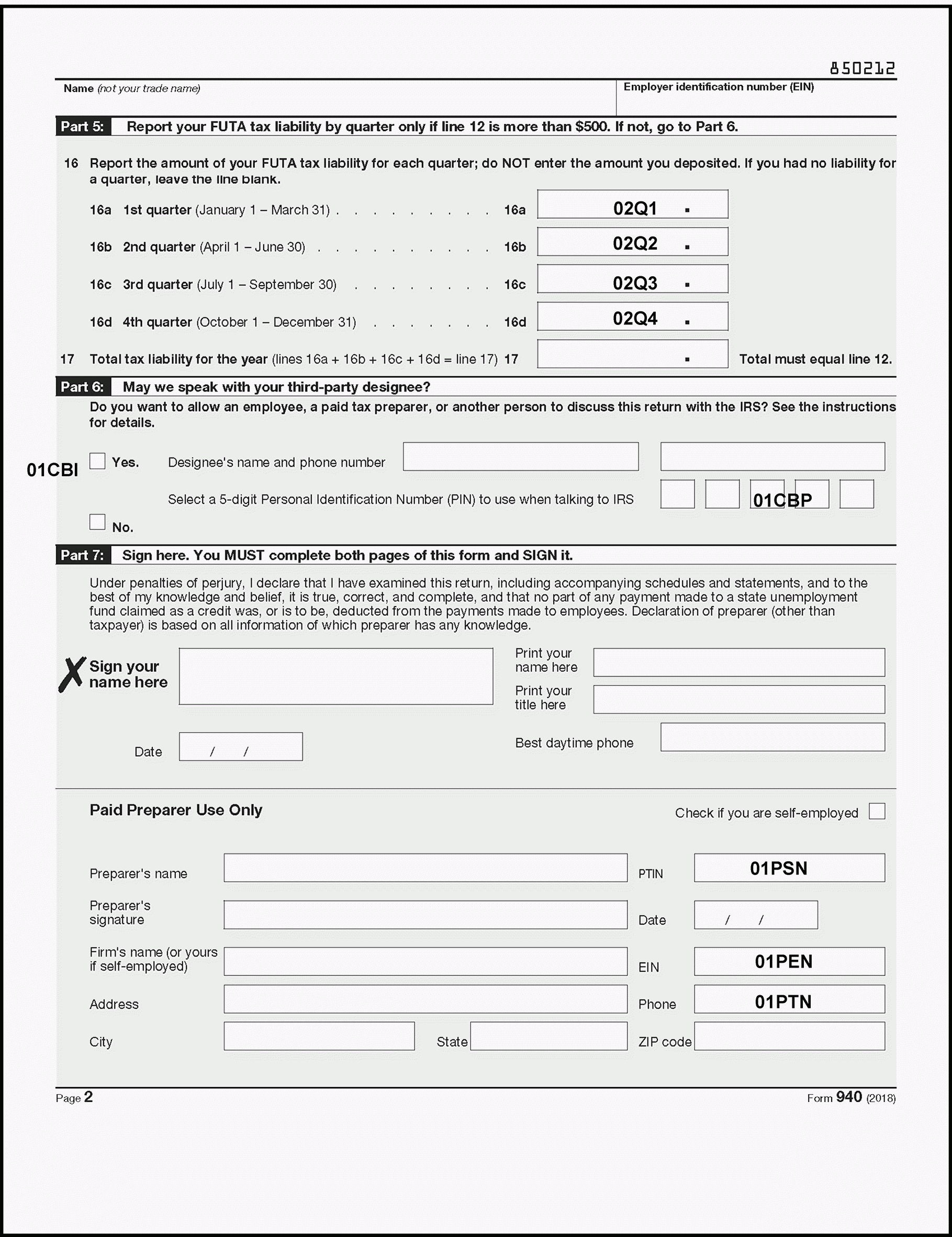

Web Requirements Filing Of Returns:employers Will Report The Total Number Of Employees Paid During The Quarter, Total Amount Of Wages Paid During The Quarter And.

Web instructions ok tax return filing and payment due date for tax year 2022 is april 18, 2023. Save or instantly send your ready documents. If line 7 is equal to or. If you pay oklahoma income tax, the irs allows you to claim a.