Opportunity Zone Tax Form

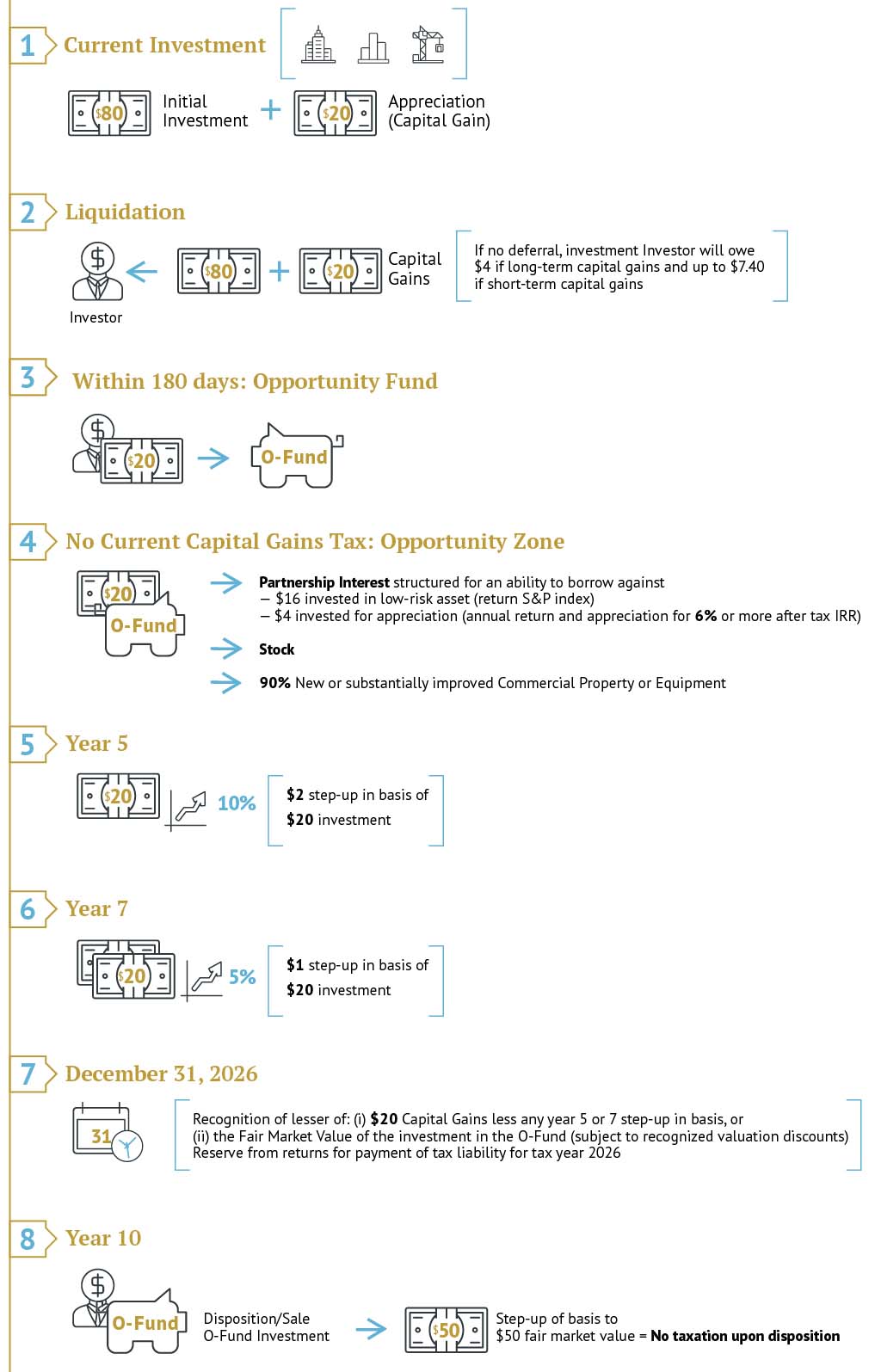

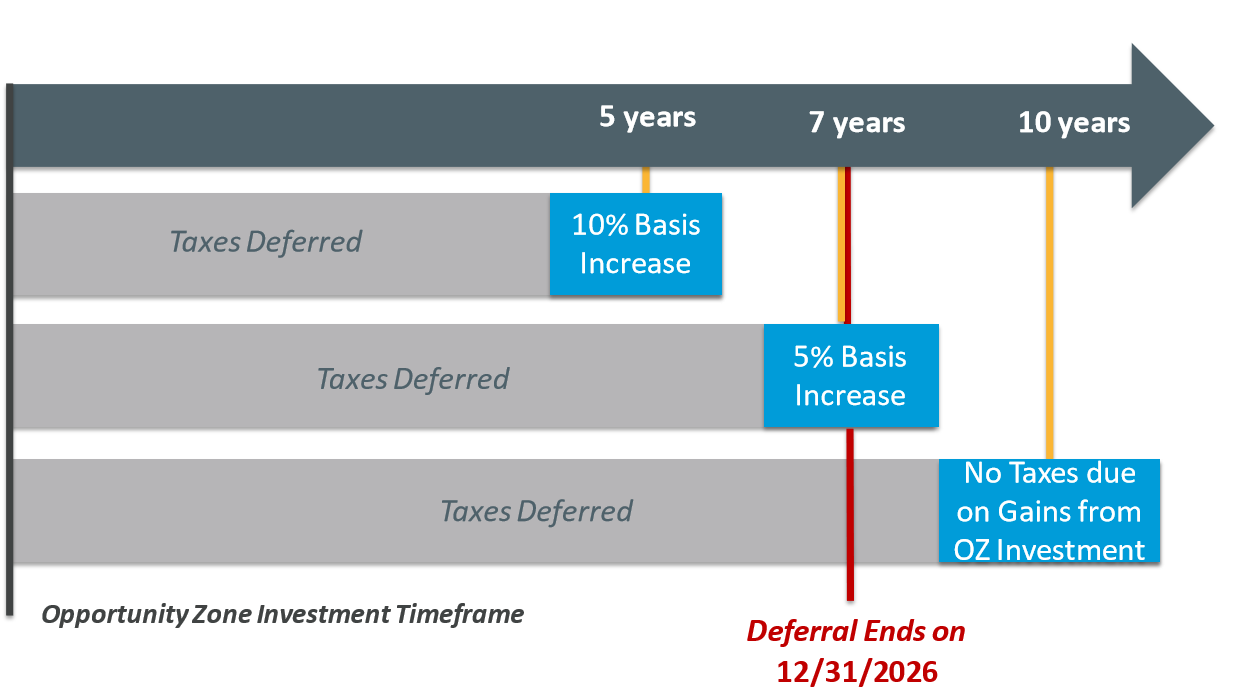

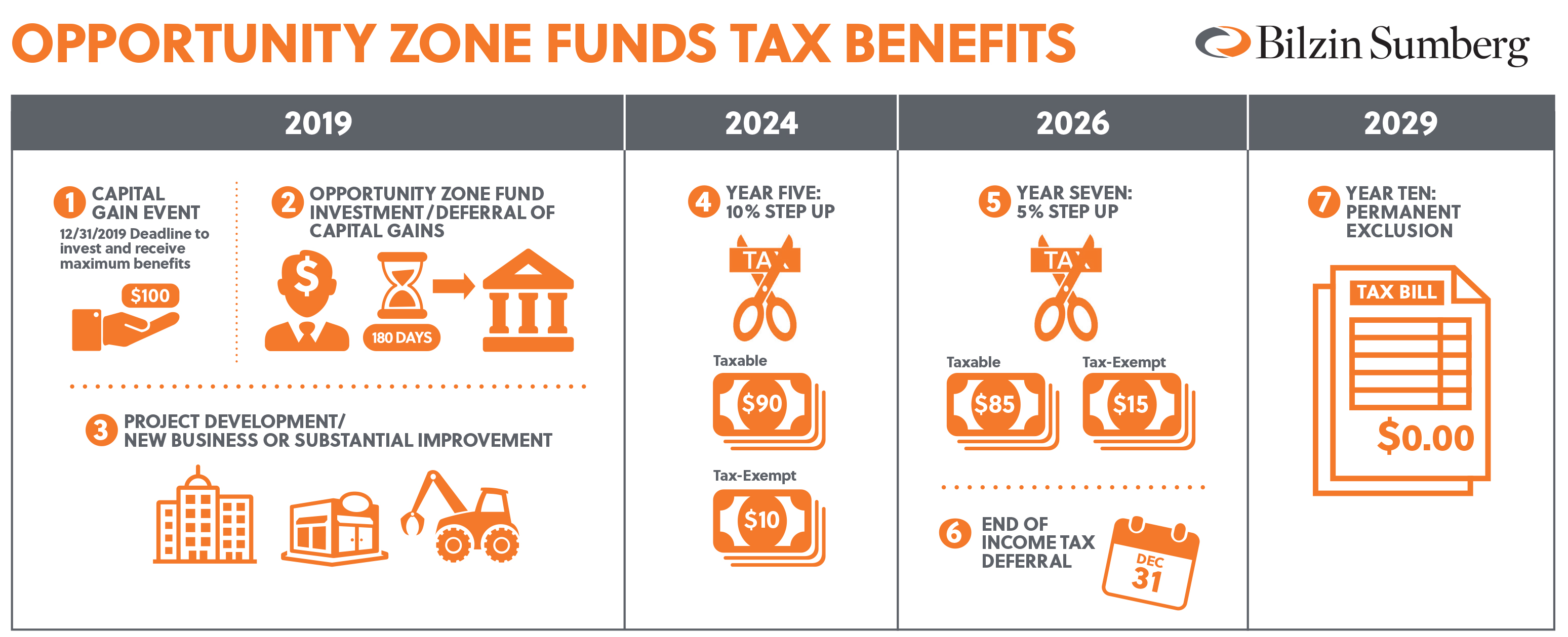

Opportunity Zone Tax Form - Territories are designated as qualified opportunity zones. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Get answers to commonly asked questions. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Do not file this form with your tax return.

Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Web report the deferral of the eligible gain in part ii and on form 8949. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Get answers to commonly asked questions. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs.

Web report the deferral of the eligible gain in part ii and on form 8949. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Territories are designated as qualified opportunity zones. Get answers to commonly asked questions. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Do not file this form with your tax return. Web 8996 2 is the taxpayer organized for the purpose of investing in qualified opportunity zone (qoz) property (other than another qualified opportunity fund (qof))?

Qualified Opportunity Zones and Tax Credit Incentives under the Tax

Do not file this form with your tax return. Territories are designated as qualified opportunity zones. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Additionally, localities can qualify as opportunity zones if they have.

Opportunity Zone Program Bexar County, TX Official Website

Get answers to commonly asked questions. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Territories are designated as qualified opportunity zones. Web report the deferral of the eligible gain in part ii and on form 8949. Web form a and form b can be accessed on the first page of.

The IRS Regulations on Qualified Opportunity Zone Funds Crowdfunding

Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. A.

NAR Releases Qualified Opportunities Zone Toolkit Vermont Association

Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal.

Opportunity Zones City of Eau Claire Economic Development Division

Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Do not file this form with your tax return. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Get answers to commonly asked questions. Web an opportunity zone is an economically distressed urban or.

Opportunity Zones a 100 billion investment for the clean economy

Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Get.

Bilzin Sumberg

Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Do not file this form.

What is an Opportunity Zone? Tax Benefits & More Explained [Free Guide]

Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no. Web report the deferral of the eligible gain in part ii and on form 8949. Web form a and form b can be.

Opportunity Zones New Tax Deferral Opportunity

Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Territories are designated.

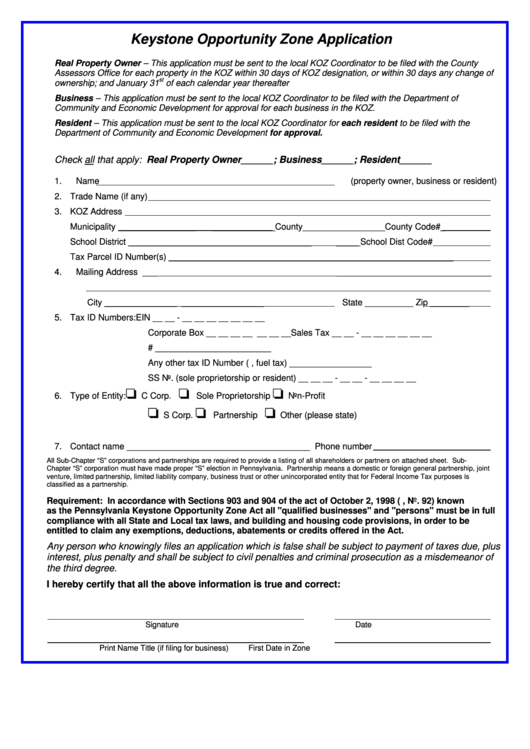

Keystone Opportunity Zone Application Form printable pdf download

A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Web form a and form b can be accessed.

Web 8996 2 Is The Taxpayer Organized For The Purpose Of Investing In Qualified Opportunity Zone (Qoz) Property (Other Than Another Qualified Opportunity Fund (Qof))?

Do not file this form with your tax return. Territories are designated as qualified opportunity zones. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Web report the deferral of the eligible gain in part ii and on form 8949.

Additionally, Localities Can Qualify As Opportunity Zones If They Have Been Previously Nominated For The Designation By The State.

The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. Get answers to commonly asked questions. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax.

A Qof Must Hold At Least 90% Of Its Assets, Measured On Two Annual Testing Dates, In Qualified Opportunity Zone Property, Or Pay A Monthly Penalty For Every Month It Is Out Of Compliance.

Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no.

![What is an Opportunity Zone? Tax Benefits & More Explained [Free Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/1mvtqLvt-What-is-an-Opportunity-Zone-Tax-Benefits-and-More-Explained-1024x536.png)