Oregon Cat Tax Form 2022

Oregon Cat Tax Form 2022 - View all of the current year's forms and publications by popularity or program area. • use blue or black ink. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than. You must be registered for oregon corporate activity. Businesses with less than $1 million of taxable commercial activity will not have a. Web the oregon legislature made a change to the cat in the 2022 session. You must be registered for oregon corporate activity. Select a heading to view its forms, then u se the search. • print actual size (100%). Web oregon cat filing dates for 2022 have changed.

List the tax years for which federal waivers of the statute of limitations are in effect (yyyy) j. • changes return filing due date to the 15th day of the. Web current forms and publications. Web the oregon legislature made a change to the cat in the 2022 session. Web the corporate activity tax (cat) is a tax imposed on companies for the privilege of doing business in oregon. View all of the current year's forms and publications by popularity or program area. Web the cat is applied to taxable oregon commercial activity more than $1 million. Web law change affects cat filing in 2022 with the passage of senate bill 164 in the 2021 session, the oregon legislature removed the requirement for calendar year filing of. Select a heading to view its forms, then u se the search. • don’t submit photocopies or.

Download and save the form to your computer, then open it in adobe reader to complete and print. List the tax years your federal income attributable to. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than. Use codes from appendix a from the 2022. You must be registered for oregon corporate activity. • print actual size (100%). We don't recommend using your. Web legal name of designated corporate activity tax (cat) entity as shown on your oregon return (sole proprietor—complete the next line) last name social security number (ssn). Businesses with less than $1 million of taxable commercial activity will not have a. Web • short year returns for 2021 are due by april 15, 2022.

Cat tax 🐈⬛ raisedbyborderlines

• don’t submit photocopies or. You must be registered for oregon corporate activity. • print actual size (100%). List the tax years for which federal waivers of the statute of limitations are in effect (yyyy) j. Web oregon department of revenue i.

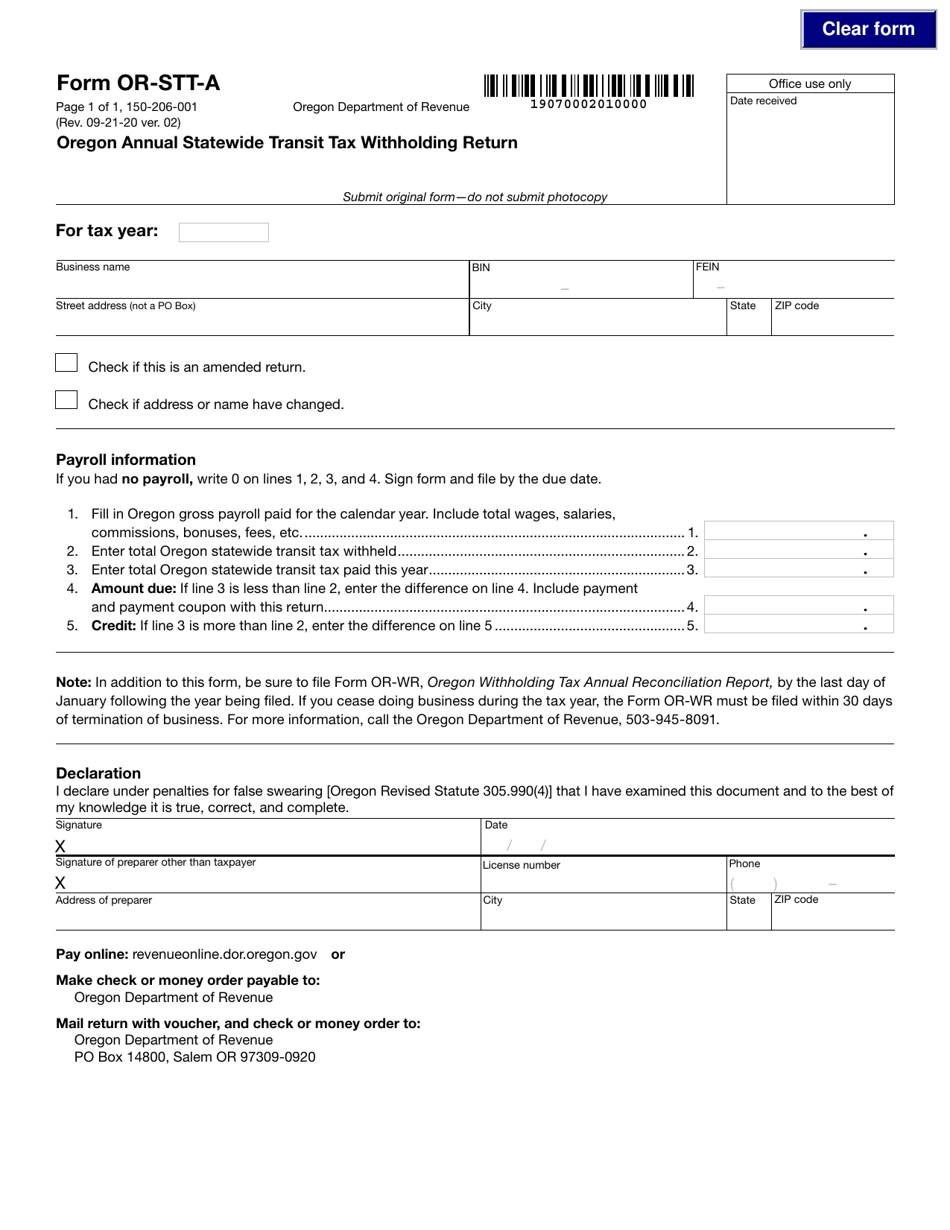

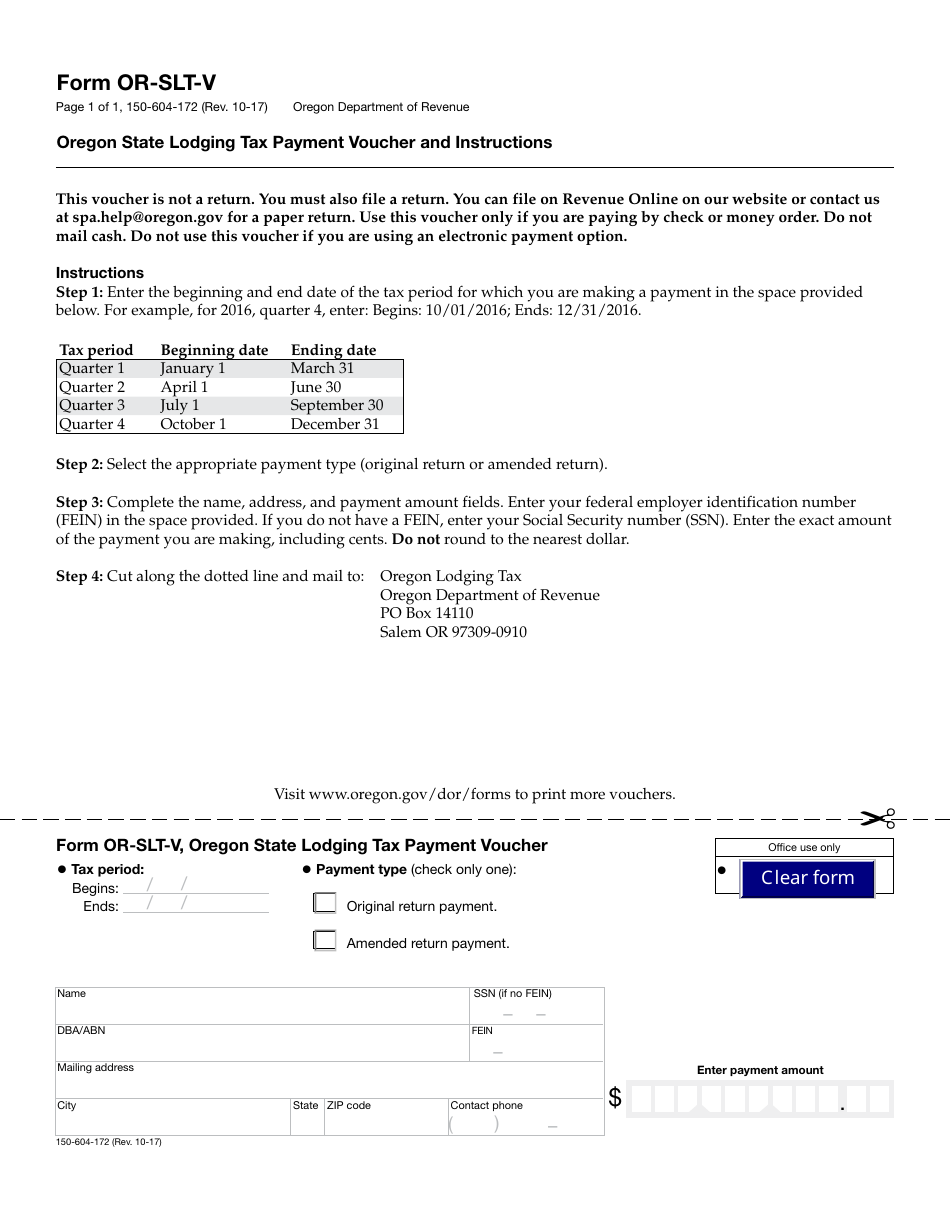

Form ORSTTA (150206001) Download Fillable PDF or Fill Online Oregon

Web forms for oregon’s corporate activity tax are now available on the department of revenue website. Web • short year returns for 2021 are due by april 15, 2022. Web oregon cat filing dates for 2022 have changed. Web legal name of designated corporate activity tax (cat) entity as shown on your oregon return (sole proprietor—complete the next line) last.

The Corporate Activity Tax (CAT) Southern Oregon Business Journal

Web legal name of designated corporate activity tax (cat) entity as shown on your oregon return (sole proprietor—complete the next line) last name social security number (ssn). Taxpayers using a fiscal calendar for income tax purposes (and whose calendar year began during 2021) are. Web the cat is applied to taxable oregon commercial activity more than $1 million. List the.

Oregon Corporate Activities Tax Update Aldrich CPAs + Advisors

Web the tax rate for the cat is 0.57% of taxable commercial activity over $1 million plus $250. View all of the current year's forms and publications by popularity or program area. Go to the revenue forms page and scroll down to. We don't recommend using your. Businesses with less than $1 million of taxable commercial activity will not have.

2014 Form OR DoR 40 Fill Online, Printable, Fillable, Blank PDFfiller

List all affiliates with commercial activity in oregon that are part of the. Web oregon cat filing dates for 2022 have changed. Web law change affects cat filing in 2022 with the passage of senate bill 164 in the 2021 session, the oregon legislature removed the requirement for calendar year filing of. Web current forms and publications. Web the cat.

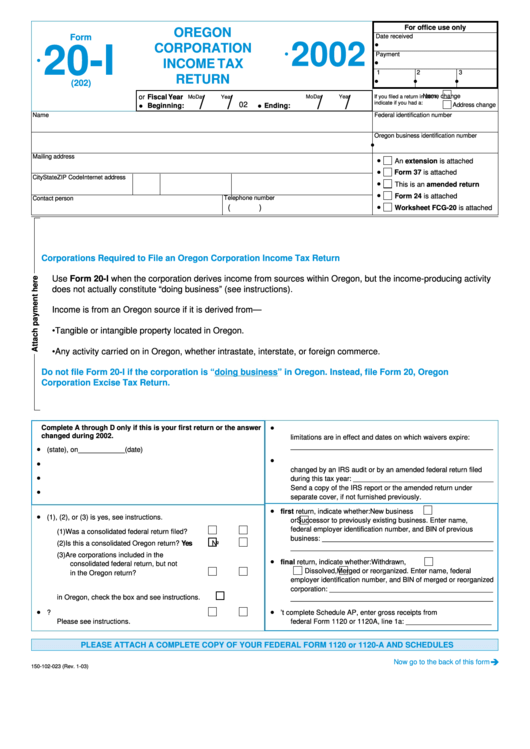

Form 20I Oregon Corporation Tax Return 2002 printable pdf

List all affiliates with commercial activity in oregon that are part of the. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than. Web law change affects cat filing in 2022 with the passage of senate bill 164 in the 2021 session, the oregon legislature removed the requirement for calendar year filing of..

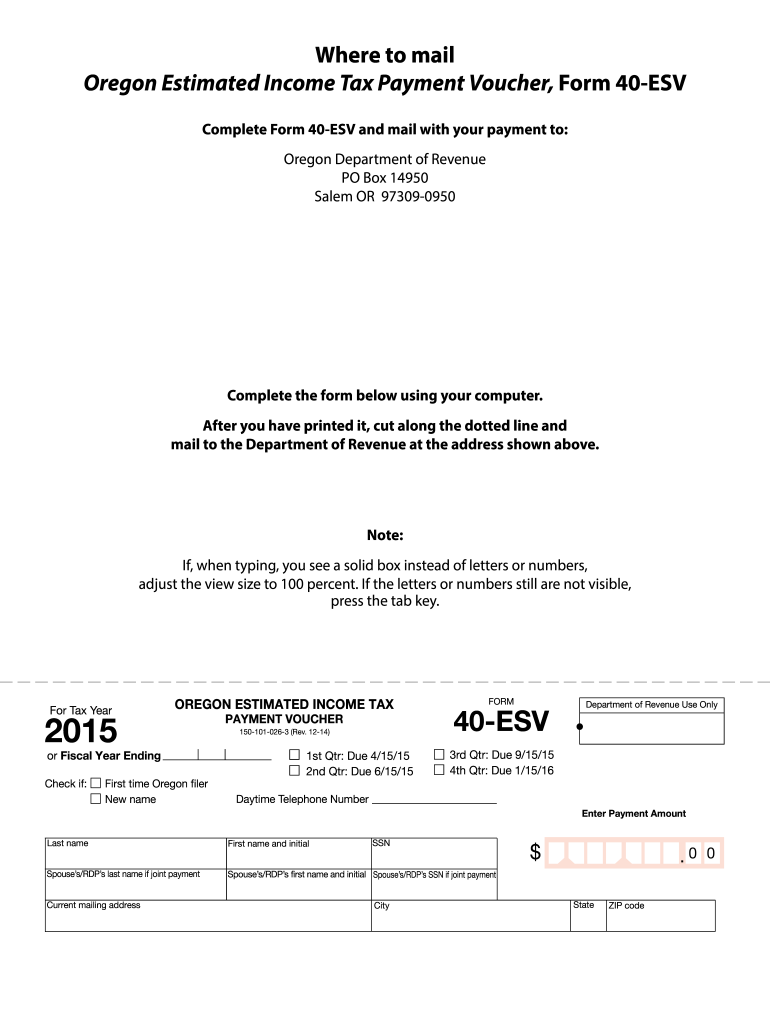

Oregon Estimated Tax Payment Voucher 2022 Fill Out and Sign Printable

Taxpayers using a fiscal calendar for income tax purposes (and whose calendar year began during 2021) are. List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this. Go to the revenue forms page and scroll down to. The tax is computed as $250.

What You Need to Know About the New Oregon CAT Tax in 2020

Web forms for oregon’s corporate activity tax are now available on the department of revenue website. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than. Taxpayers using a fiscal calendar for income tax purposes (and whose calendar year began during 2021) are. List all affiliates with commercial activity in oregon that are.

How To Calculate Oregon Cat Tax trendskami

Select a heading to view its forms, then u se the search. Web brief overview of the cat. • don’t submit photocopies or. • changes return filing due date to the 15th day of the. • print actual size (100%).

Cat Tax Oregon Form Cat Meme Stock Pictures and Photos

List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this. Web the oregon legislature made a change to the cat in the 2022 session. Businesses with less than $1 million of taxable commercial activity will not have a. • don’t submit photocopies or..

• Use Blue Or Black Ink.

List the tax years for which federal waivers of the statute of limitations are in effect (yyyy) j. You must be registered for oregon corporate activity. Web current forms and publications. Select a heading to view its forms, then u se the search.

List All Affiliates With Commercial Activity In Oregon That Are Part Of The.

We don't recommend using your. Go to the revenue forms page and scroll down to. Download and save the form to your computer, then open it in adobe reader to complete and print. Web legal name of designated corporate activity tax (cat) entity as shown on your oregon return (sole proprietor—complete the next line) last name social security number (ssn).

Web The Tax Rate For The Cat Is 0.57% Of Taxable Commercial Activity Over $1 Million Plus $250.

Web oregon department of revenue i. Senate bill 1524 adds that amounts received by an eligible pharmacy for the sale of prescription drugs are. Businesses with less than $1 million of taxable commercial activity will not have a. • changes return filing due date to the 15th day of the.

You Must Be Registered For Oregon Corporate Activity.

The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than. Use codes from appendix a from the 2022. It will ask for your name, the name of your business, a few other bits of information and your email. Web the oregon legislature made a change to the cat in the 2022 session.