Oregon Highway Use Tax Bond Form

Oregon Highway Use Tax Bond Form - Web $2,000 oregon highway use tax bonds usually cost $100 and can go up to $200 in some cases. Web the state of oregon highway use tax starts at $100 plus shipping costs and fees. Web do i need oregon operating authority? An indemnity agreement will be emailed to you. $2,000 (plus $750 for each additional. Varies, click below to choose. Apply, pay, print your bond. (1) to pay the usual. Web information requested concerning any transaction with the undersigned. Or click here to download a pdf version of the application.

Web an oregon highway make tax bond is a type of surety bond this promises you desire pay your highway taxes. Here's totality you need to perceive. Web the base rate for the oregon highway use tax bond averages around 2% of the required bond amount with a minimum charge of $100 for a 1 year bond term. The bond must be posted to your account by the. Oregon highway use tax bonds are required by the oregon department of. Web whenever a motor carrier enrolls a vehicle (or multiple vehicles) in oregon’s weight mile tax program, they have to file an oregon highway use tax bond, a cash deposit, or some. Web oregon highway use tax bond costs start at $100 annually. Bonds express offers an oregon highway use tax surety bond with a 100% approval rate. Web total bond amounts for carriers who no longer classify as “new carriers” are as follows: Web different requirements exist for private carriers, farmers and vehicles using gasoline for which oregon state fuel tax is paid.

Web click for a no obligation quote. Or (e) direct correspondence and plates to another address. Plus $125 for each additional vehicle above. Your exact premium will depend on your required bond amount, which is determined based on the number of vehicles you. Web oregon highway use tax bond costs start at $100 annually. Should the company execute said bond(s), the undersigned agree as follows: Varies, click below to choose. An indemnity agreement will be emailed to you. $2,000 between 2 and 5 vehicles: Fill out the form to buy your bond instantly!

State of Oregon Highway Use Tax Bond EZ Surety Bonds

(1) to pay the usual. Fill out the form to buy your bond instantly! Web the base rate for the oregon highway use tax bond averages around 2% of the required bond amount with a minimum charge of $100 for a 1 year bond term. Web different requirements exist for private carriers, farmers and vehicles using gasoline for which oregon.

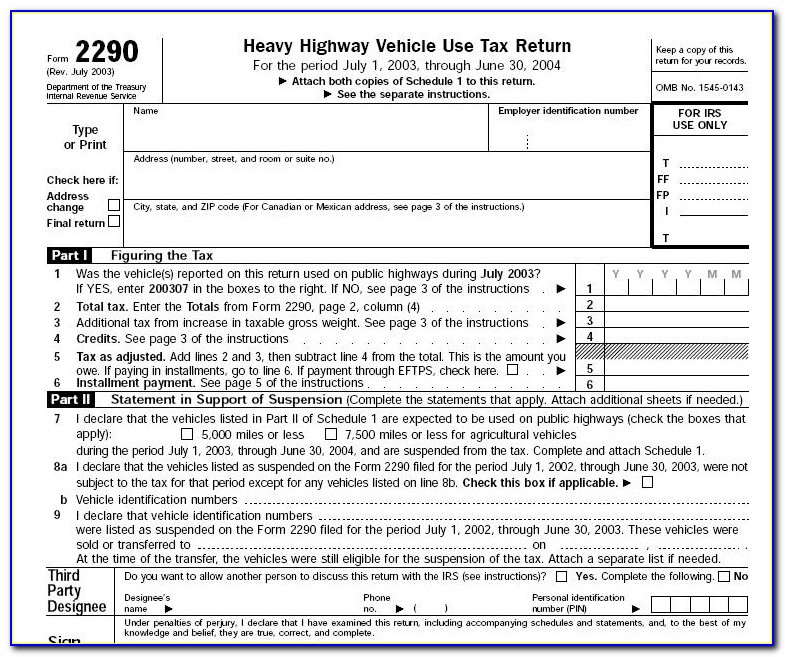

How to file your own IRS 2290 highway use tax. Step by step

Varies, click below to choose. Web get your or highway use tax bond in minutes, not days. Should the company execute said bond(s), the undersigned agree as follows: Apply, pay, print your bond. Fill out the form to buy your bond instantly!

Oregon Highway Use Tax Bond Jet Insurance Company

Web the base rate for the oregon highway use tax bond averages around 2% of the required bond amount with a minimum charge of $100 for a 1 year bond term. An indemnity agreement will be emailed to you. Web different requirements exist for private carriers, farmers and vehicles using gasoline for which oregon state fuel tax is paid. Web.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

Fill out the form to buy your bond instantly! An indemnity agreement will be emailed to you. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. For larger bond amounts, you can expect your premium to be between 1% and. Web whenever a motor carrier enrolls a vehicle (or multiple vehicles) in oregon’s weight mile tax.

Highway Use Tax Federal Heavy Use Tax IRS Form Download Digital Art by

Apply, pay, print your bond. Web the base rate for the oregon highway use tax bond averages around 2% of the required bond amount with a minimum charge of $100 for a 1 year bond term. Bonds under $25,000 are instant issue, no waiting! Your exact premium will depend on your required bond amount, which is determined based on the.

Oregon Highway Use Tax Bond Oregon, Bond

Varies, click below to choose. You may request a form from mctd for this purpose. Web whenever a motor carrier enrolls a vehicle (or multiple vehicles) in oregon’s weight mile tax program, they have to file an oregon highway use tax bond, a cash deposit, or some. Web total bond amounts for carriers who no longer classify as “new carriers”.

Kentucky Highway Use Tax Bond South Coast Surety

Apply, pay, print your bond. Your exact premium will depend on your required bond amount, which is determined based on the number of vehicles you. Oregon highway use tax bonds are required by the oregon department of. Bonds under $25,000 are instant issue, no waiting! Web different requirements exist for private carriers, farmers and vehicles using gasoline for which oregon.

Oregon Highway Use Tax Bond Surety Bond Authority

Web whenever a motor carrier enrolls a vehicle (or multiple vehicles) in oregon’s weight mile tax program, they have to file an oregon highway use tax bond, a cash deposit, or some. Web oregon highway use tax bond costs start at $100 annually. Web get your or highway use tax bond in minutes, not days. Here's totality you need to.

What You Need to Know About the Oregon Highway Use Tax Bond Absolute

Apply, pay, print your bond. Fill out the form to buy your bond instantly! Plus $125 for each additional vehicle above. Web the base rate for the oregon highway use tax bond averages around 2% of the required bond amount with a minimum charge of $100 for a 1 year bond term. Or (e) direct correspondence and plates to another.

How To Get An Oregon Highway Use Tax Bond Surety Solutions, A

Varies, click below to choose. Fill out the form to buy your bond instantly! For larger bond amounts, you can expect your premium to be between 1% and. Web get your or highway use tax bond in minutes, not days. Web oregon highway use tax bond costs start at $100 annually.

Fill Out The Form To Buy Your Bond Instantly!

Apply, pay, print your bond. Plus $125 for each additional vehicle above. Web whenever a motor carrier enrolls a vehicle (or multiple vehicles) in oregon’s weight mile tax program, they have to file an oregon highway use tax bond, a cash deposit, or some. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds.

Oregon Highway Use Tax Bonds Are Required By The Oregon Department Of.

Or click here to download a pdf version of the application. Web the state of oregon highway use tax starts at $100 plus shipping costs and fees. Or (e) direct correspondence and plates to another address. Varies, click below to choose.

Web An Oregon Highway Make Tax Bond Is A Type Of Surety Bond This Promises You Desire Pay Your Highway Taxes.

The bond must be posted to your account by the. Web get your or highway use tax bond in minutes, not days. You may request a form from mctd for this purpose. Web the base rate for the oregon highway use tax bond averages around 2% of the required bond amount with a minimum charge of $100 for a 1 year bond term.

An Indemnity Agreement Will Be Emailed To You.

$2,000 between 2 and 5 vehicles: Web total bond amounts for carriers who no longer classify as “new carriers” are as follows: Your exact premium will depend on your required bond amount, which is determined based on the number of vehicles you. For larger bond amounts, you can expect your premium to be between 1% and.