Other Deductions Form 1120

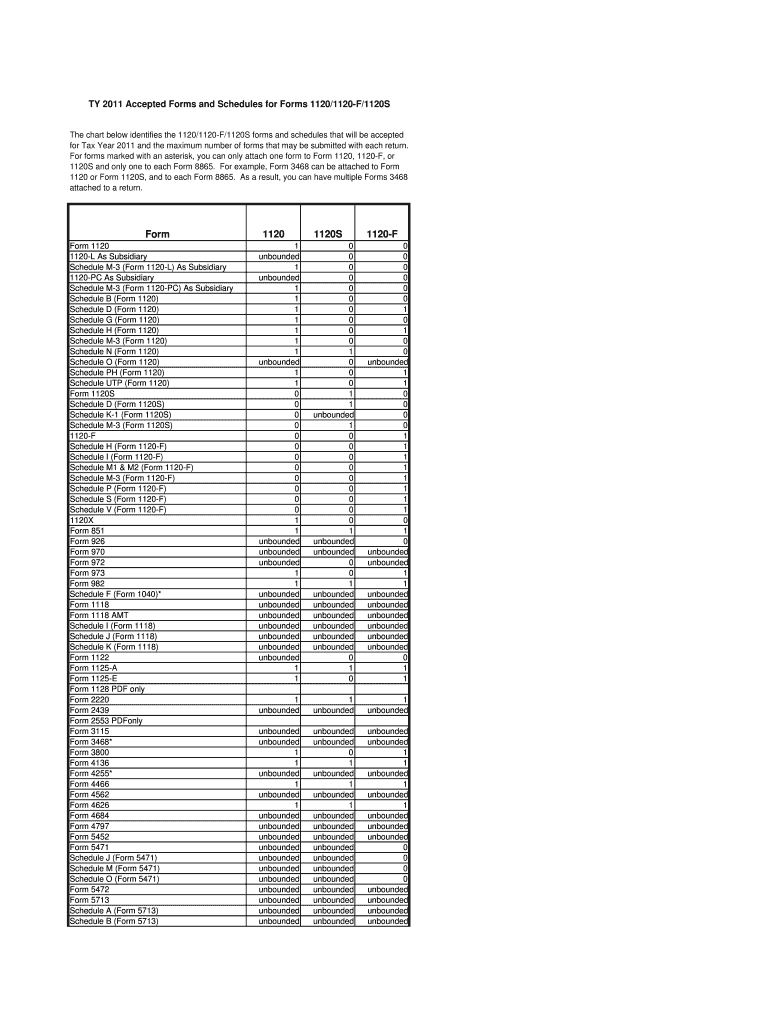

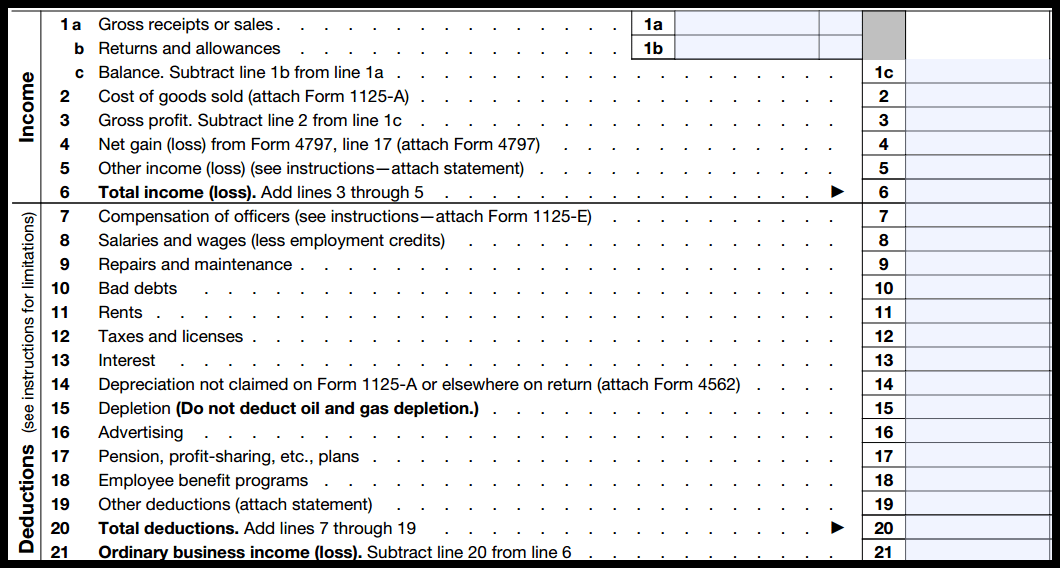

Other Deductions Form 1120 - As such, it is used by s corporations to report their income, profits, losses, tax credits, deductions, and other. If this is your first time filing taxes for a corporation or llc, or you simply. Web form 1120s department of the treasury internal revenue service u.s. Report their income, gains, losses, deductions,. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed. Repairs and maintenance, line 9. Uswsa$$1 accounting uniforms tools temporary help telephone supplies Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. The other deductions line on page 1 of the tax return history report is the sum of the following amounts on form 1120s, page 1. Web copyright form software only, 2008 universal tax systems, inc.

If this is your first time filing taxes for a corporation or llc, or you simply. Web form 1120, u.s. Repairs and maintenance, line 9. The other deductions line on page 1 of the tax return history report is the sum of the following amounts on form 1120s, page 1. Corporation income tax return domestic corporations use this form to: Uswsa$$1 accounting uniforms tools temporary help telephone supplies Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed. Then you’ll need to know about irs form 1120. Web what is an 1120 tax form? As such, it is used by s corporations to report their income, profits, losses, tax credits, deductions, and other.

Corporation income tax return domestic corporations use this form to: Uswsa$$1 accounting uniforms tools temporary help telephone supplies Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed. Repairs and maintenance, line 9. Web form 1120, u.s. Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. Web form 1120s department of the treasury internal revenue service u.s. The other deductions line on page 1 of the tax return history report is the sum of the following amounts on form 1120s, page 1. Web what is an 1120 tax form?

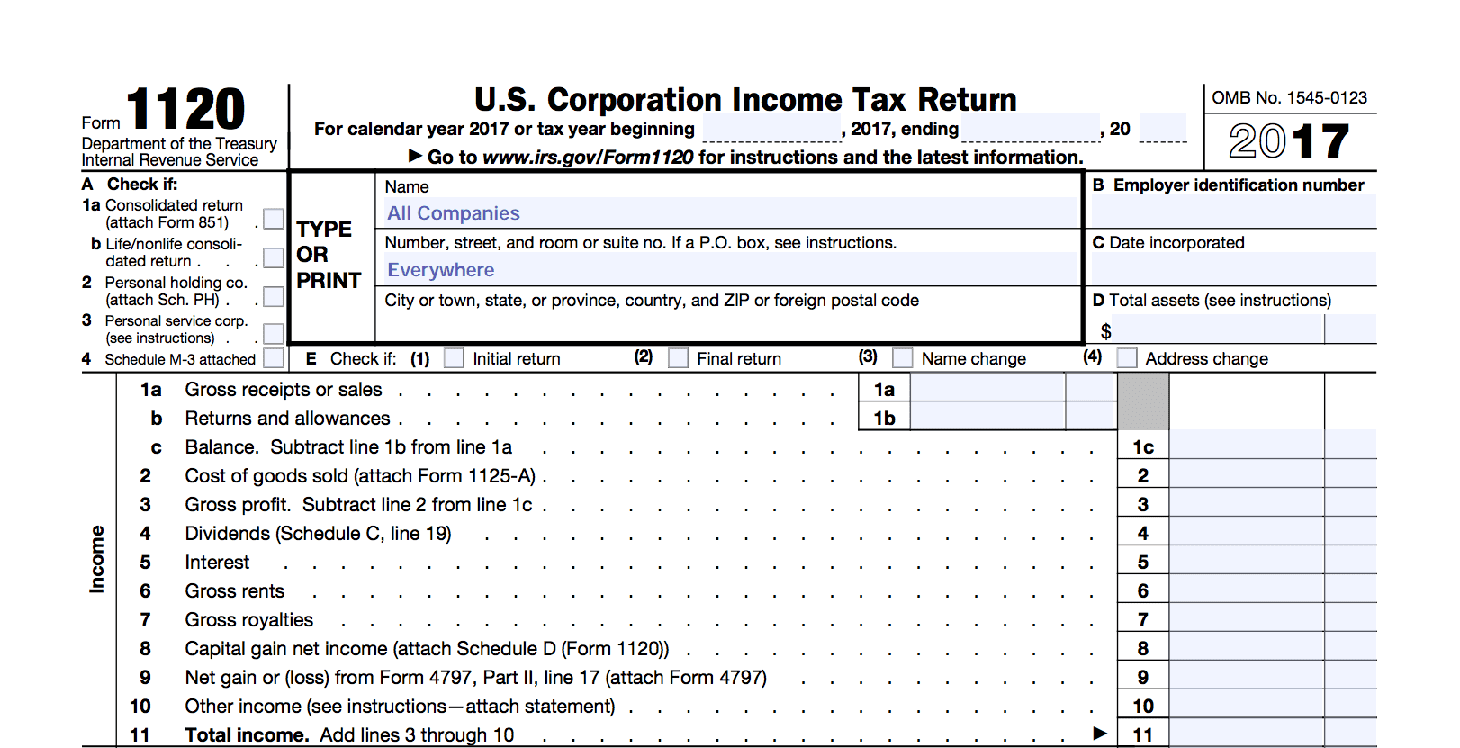

2017 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Repairs and maintenance, line 9. Report their income, gains, losses, deductions,. Web other dividends deduction for dividends paid on certain preferred stock of public utilities section 250 deduction (attach form 8993) total dividends and inclusions. Then you’ll need to know.

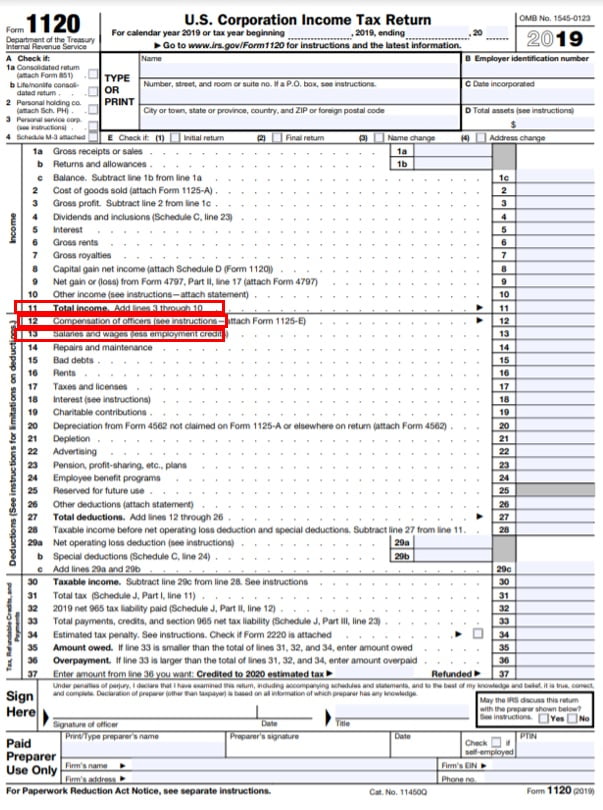

IRS Form 1120

Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. Corporation income tax return domestic corporations use this form to: Uswsa$$1 accounting uniforms tools temporary help telephone supplies Report their income, gains, losses, deductions,. Repairs and maintenance, line 9.

Calculating Earnings for Businesses Vetted Biz

Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed. Then you’ll need to know about irs form 1120. Web are you responsible for filing taxes for a corporation or llc? Web form 1120s department of the treasury internal revenue service u.s. According to the irs.

41 1120s other deductions worksheet Worksheet Works

If this is your first time filing taxes for a corporation or llc, or you simply. Web form 1120, u.s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible.

Form 1120 Line 26 Other Deductions Worksheet Fill Out and Sign

According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Then you’ll need to know about irs form 1120. Web copyright form software only, 2008 universal tax systems, inc. Web what is an 1120 tax form? Report their income, gains, losses, deductions,.

IRS Form 1120S (2020)

Report their income, gains, losses, deductions,. Web form 1120s department of the treasury internal revenue service u.s. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. Web other dividends deduction for dividends paid on certain preferred stock of public utilities section 250 deduction (attach form 8993) total dividends and inclusions. The.

IRS 1120H 2010 Fill out Tax Template Online US Legal Forms

Web form 1120s department of the treasury internal revenue service u.s. Then you’ll need to know about irs form 1120. Web form 1120, u.s. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in.

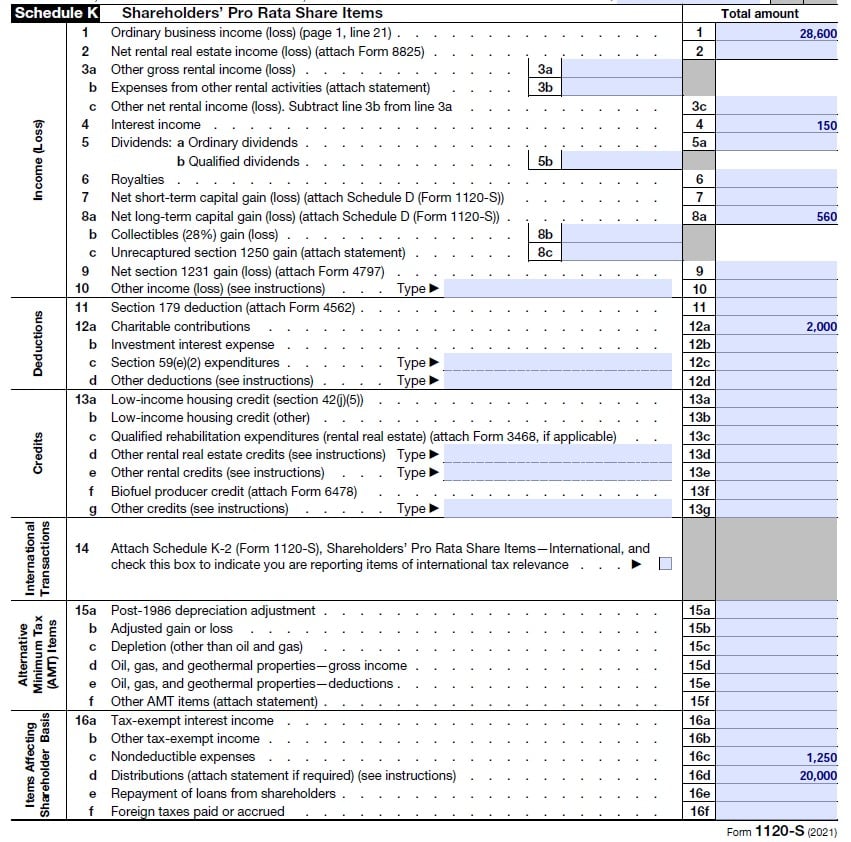

Form 1120S (Schedule K1) Shareholder's Share of Deductions

Repairs and maintenance, line 9. Web are you responsible for filing taxes for a corporation or llc? Web form 1120s department of the treasury internal revenue service u.s. Web copyright form software only, 2008 universal tax systems, inc. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.

1120s Other Deductions Worksheet Worksheet List

Report their income, gains, losses, deductions,. Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Uswsa$$1 accounting uniforms tools temporary help telephone supplies As such, it is used by.

IRS Form 1120S Definition, Download & Filing Instructions

Web other dividends deduction for dividends paid on certain preferred stock of public utilities section 250 deduction (attach form 8993) total dividends and inclusions. If this is your first time filing taxes for a corporation or llc, or you simply. As such, it is used by s corporations to report their income, profits, losses, tax credits, deductions, and other. Web.

Uswsa$$1 Accounting Uniforms Tools Temporary Help Telephone Supplies

As such, it is used by s corporations to report their income, profits, losses, tax credits, deductions, and other. Corporation income tax return domestic corporations use this form to: Web home forms and instructions about form 1120, u.s. Report their income, gains, losses, deductions,.

Web Copyright Form Software Only, 2008 Universal Tax Systems, Inc.

According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. If this is your first time filing taxes for a corporation or llc, or you simply. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Corporate income tax return, is the form corporations must use to report income, gains, losses, deductions, and credits.

Web Per Irs Instructions, Lacerte Generates A Statement For Form 1120, Line 26, Listing All Allowable Deductions That Aren't Deductible Elsewhere On The Form.

For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. Web what is an 1120 tax form? Then you’ll need to know about irs form 1120. Web other dividends deduction for dividends paid on certain preferred stock of public utilities section 250 deduction (attach form 8993) total dividends and inclusions.

Web Form 1120S Department Of The Treasury Internal Revenue Service U.s.

Repairs and maintenance, line 9. Web are you responsible for filing taxes for a corporation or llc? Web form 1120, u.s. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed.