Pa-1000 Form 2022

Pa-1000 Form 2022 - Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Save or instantly send your ready documents. Fill in form must be downloaded onto your computer prior to completing pa schedule a 2205410059 deceased claimant and/or. This form is for income earned in tax year 2022, with tax. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Easily fill out pdf blank, edit, and sign them. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Web one ticket in california matched all five numbers and the powerball. Enter the amount of your total property. Web make a payment where's my income tax refund?

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Npsd educational services center, 401 e. We will update this page with a new version of the form for 2024 as soon as it is made available. Web make a payment where's my income tax refund? Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Fill in form must be downloaded onto your computer prior to completing pa schedule a 2205410059 deceased claimant and/or. Enter the amount of your total property.

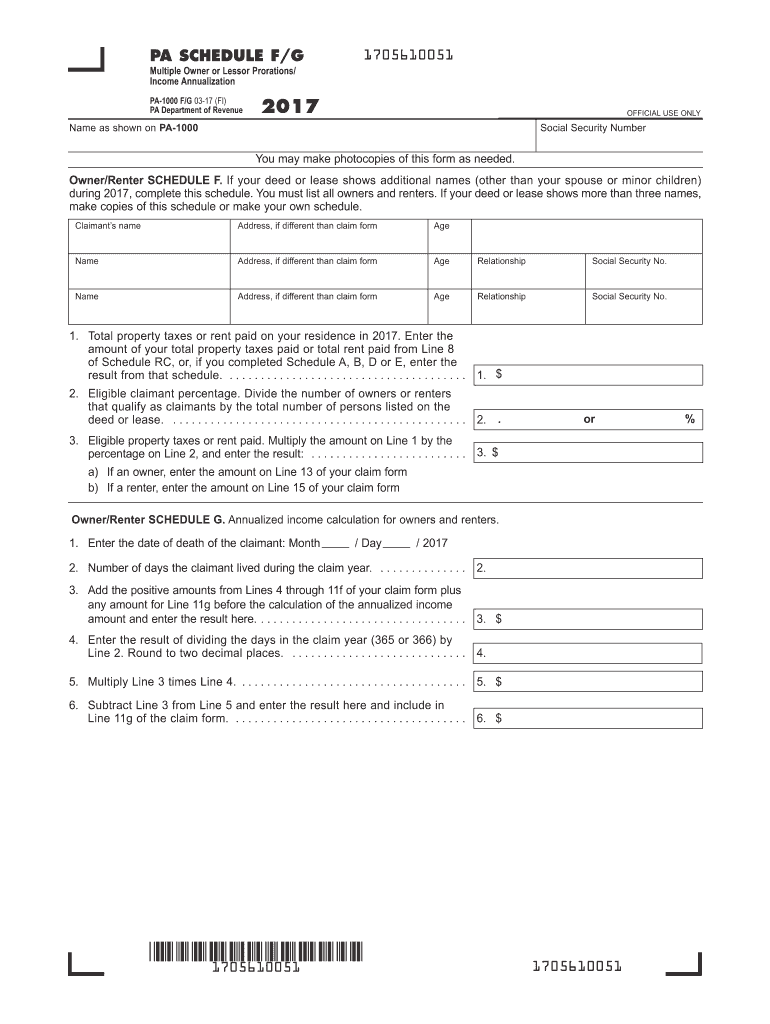

Npsd educational services center, 401 e. Easily fill out pdf blank, edit, and sign them. Web one ticket in california matched all five numbers and the powerball. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Total property taxes or rent paid on your residence in 2022. This form is for income earned in tax year 2022, with tax. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Enter the amount of your total property.

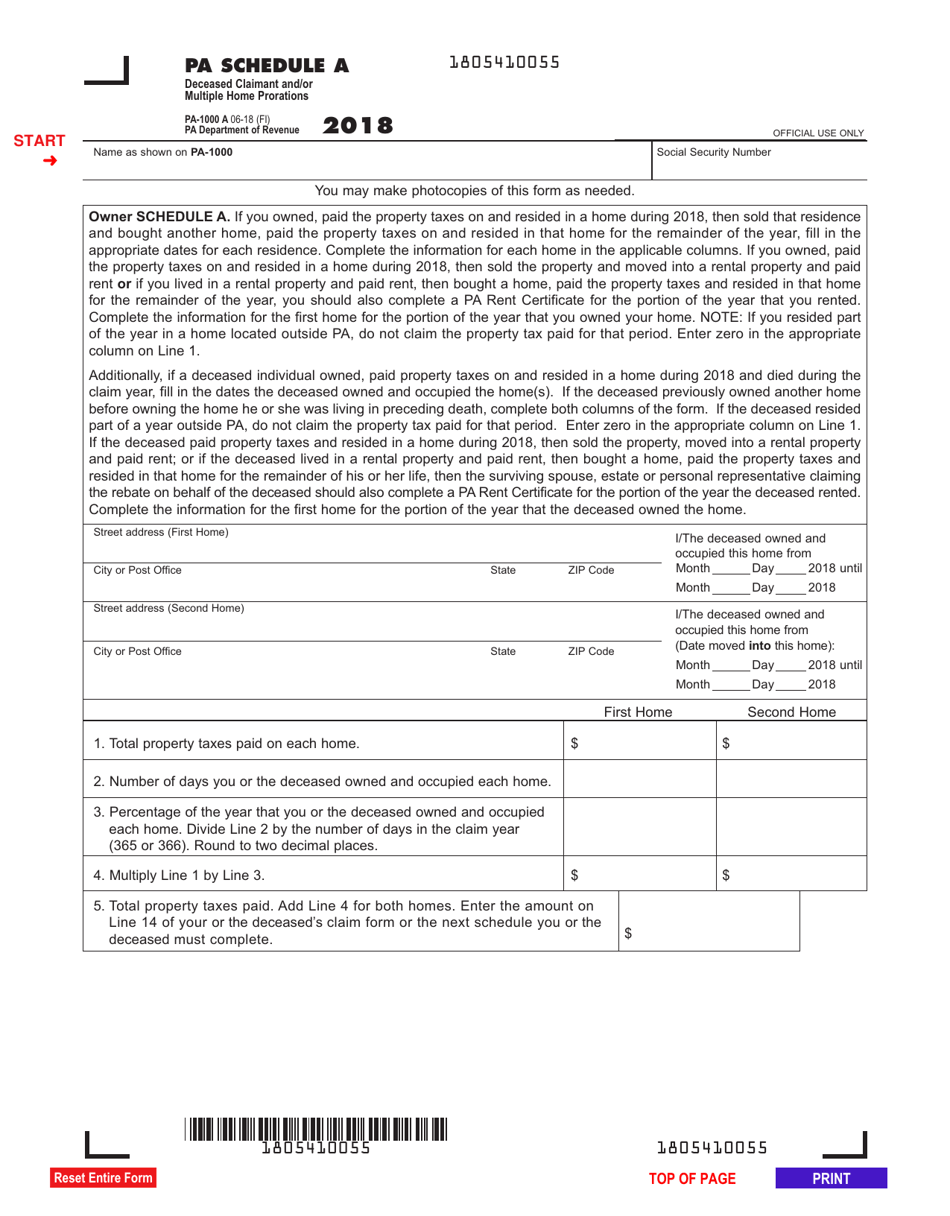

Form PA1000 A Schedule A Download Fillable PDF or Fill Online Deceased

Enter the amount of your total property. This form is for income earned in tax year 2022, with tax. We will update this page with a new version of the form for 2024 as soon as it is made available. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Total property taxes or rent paid.

20202022 Form PA PA40 C Fill Online, Printable, Fillable, Blank

Total property taxes or rent paid on your residence in 2022. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Web make a payment where's my income tax refund? Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax. Save or instantly send your ready documents. Fill in form must be downloaded onto your computer prior to completing pa schedule a 2205410059 deceased claimant and/or. Web one ticket in california matched all five numbers and the powerball. Web make a payment where's my income tax refund?

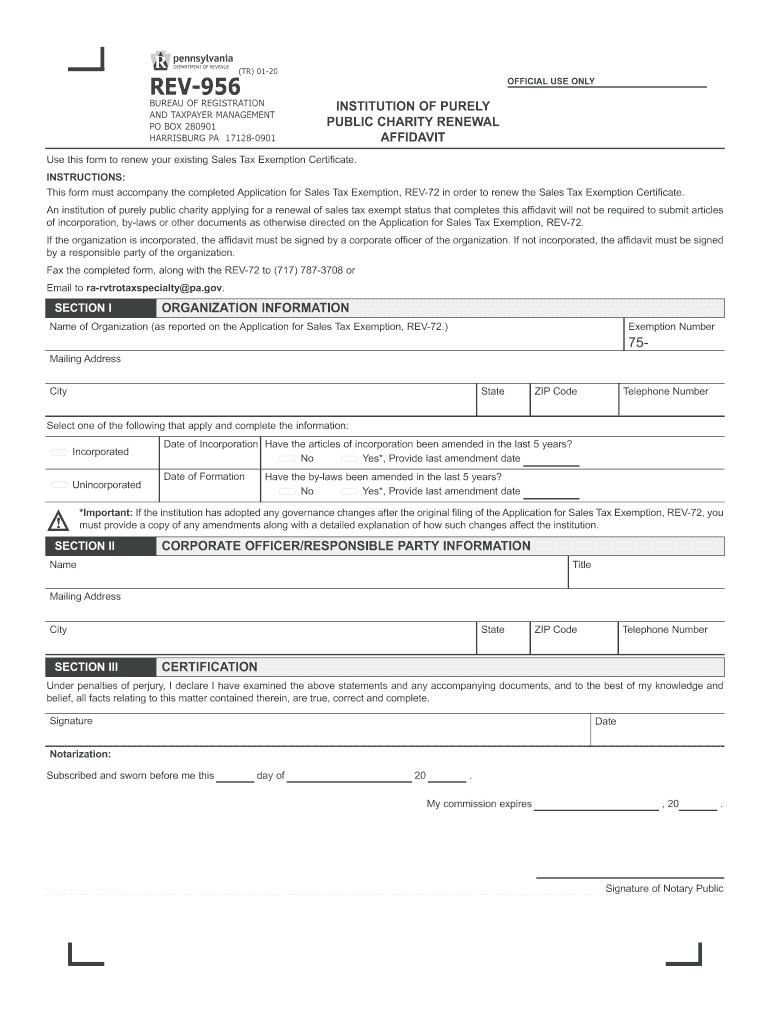

PA REV956 20202022 Fill out Tax Template Online US Legal Forms

Web one ticket in california matched all five numbers and the powerball. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Save or instantly send your ready.

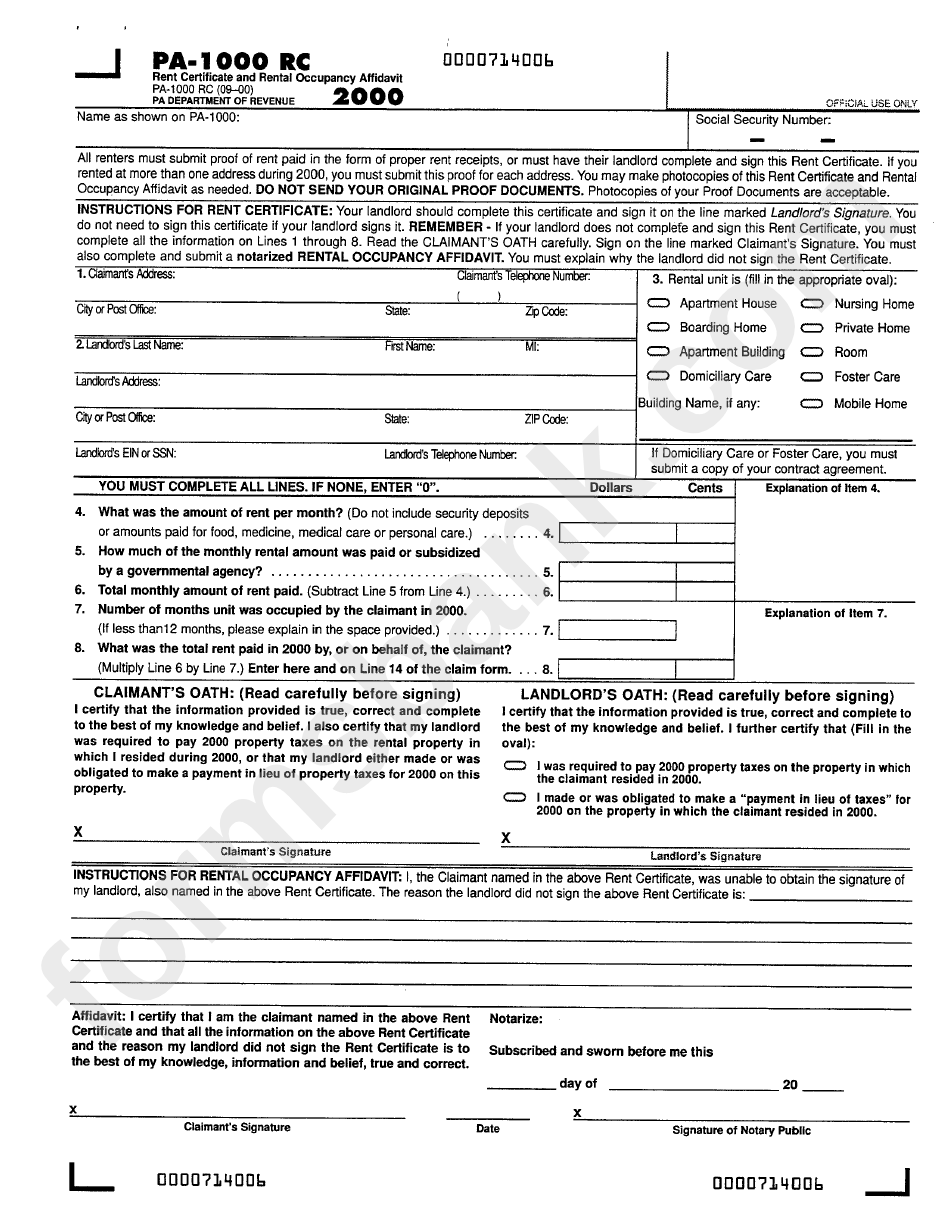

Pa 1000 rc 2018 Fill out & sign online DocHub

We will update this page with a new version of the form for 2024 as soon as it is made available. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits,.

PA PA1000 20212022 Fill and Sign Printable Template Online US

Npsd educational services center, 401 e. Save or instantly send your ready documents. Fill in form must be downloaded onto your computer prior to completing pa schedule a 2205410059 deceased claimant and/or. We will update this page with a new version of the form for 2024 as soon as it is made available. This form is for income earned in.

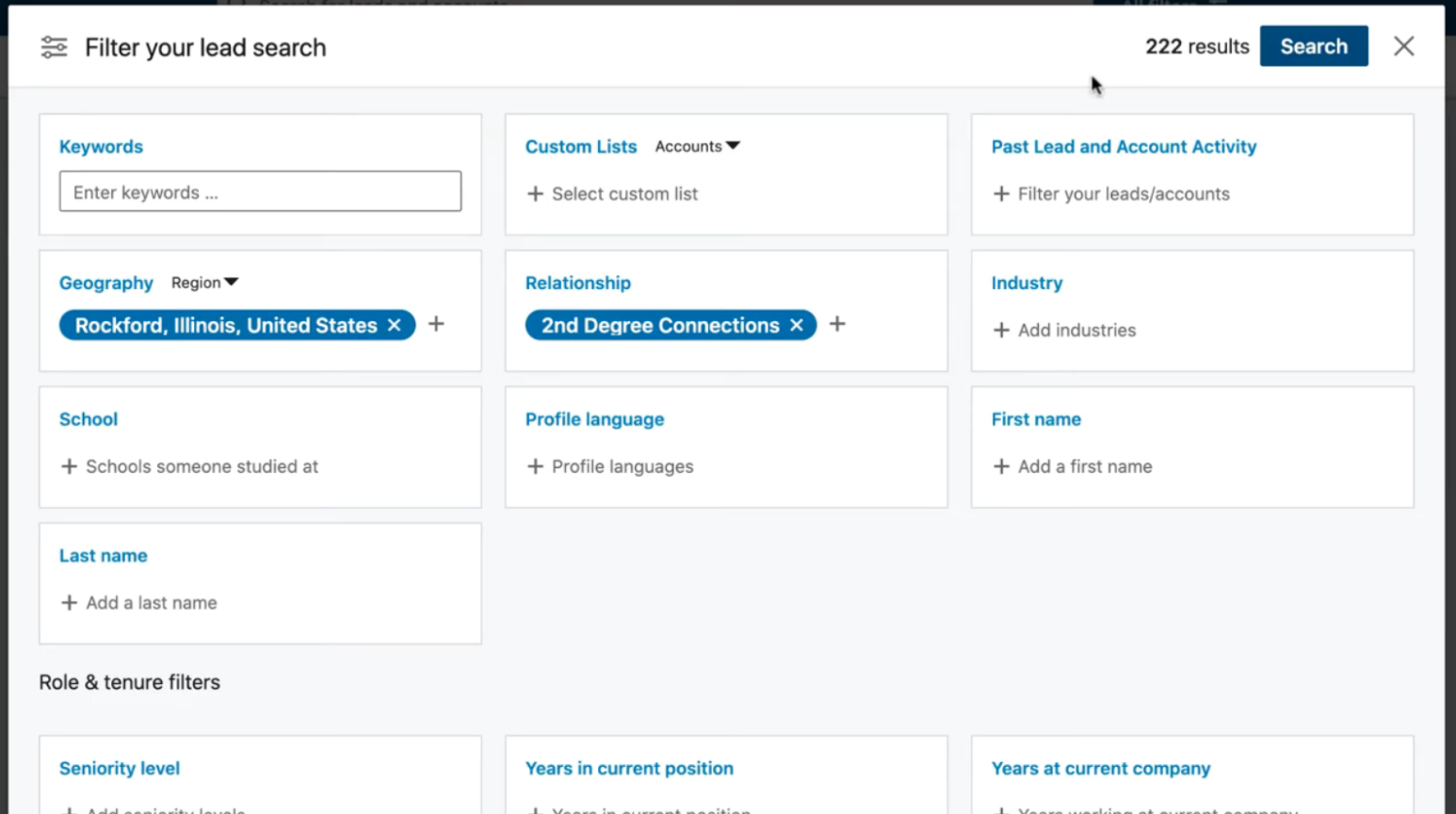

LinkedIn search results financial advisors Skyline Social

Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax. Easily fill out pdf blank, edit, and sign them. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least.

Pa1000 Form Pdf Fill Out and Sign Printable PDF Template signNow

Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria. Enter the amount of your total property. Save or instantly send your ready documents. Web make a payment where's my income tax refund? Property tax/rent rebate status pennsylvania department of revenue >.

20202022 Form PA DoR REV1220 AS Fill Online, Printable, Fillable

Total property taxes or rent paid on your residence in 2022. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who.

Form Pa1000 Rc Rent Certificate And Rental Occupancy Affidavit

Fill in form must be downloaded onto your computer prior to completing pa schedule a 2205410059 deceased claimant and/or. Web make a payment where's my income tax refund? Enter the amount of your total property. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property. Npsd educational services center, 401 e.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Fill in form must be downloaded onto your computer prior to completing pa schedule a 2205410059 deceased claimant and/or. Save or instantly send your ready documents. Total property taxes or rent paid on your residence in 2022. Npsd educational services center, 401 e.

Web This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Easily fill out pdf blank, edit, and sign them. Web make a payment where's my income tax refund? We will update this page with a new version of the form for 2024 as soon as it is made available. Property tax/rent rebate status pennsylvania department of revenue > incentives, credits, programs > property.

Enter The Amount Of Your Total Property.

Web one ticket in california matched all five numbers and the powerball. Web spouses, personal representatives or estates may file rebate claims on behalf of claimants who lived at least one day in 2022 and meet all other eligibility criteria.