Partnership Form 1065

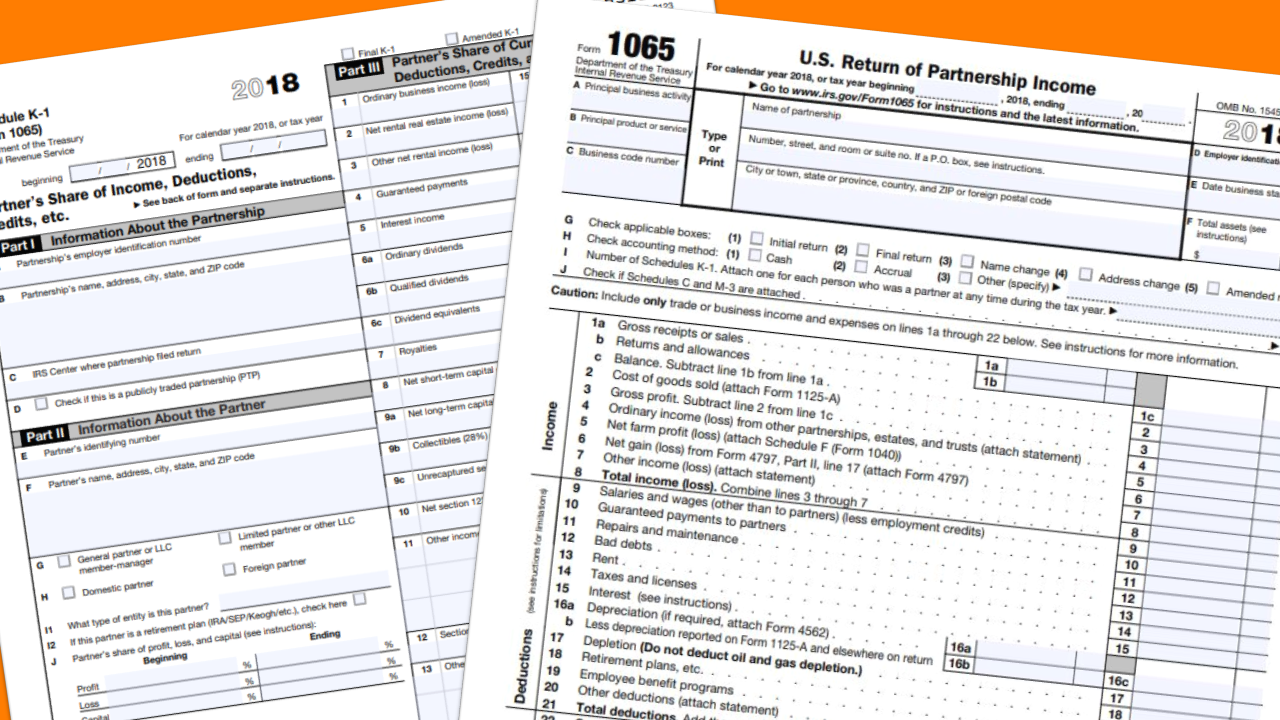

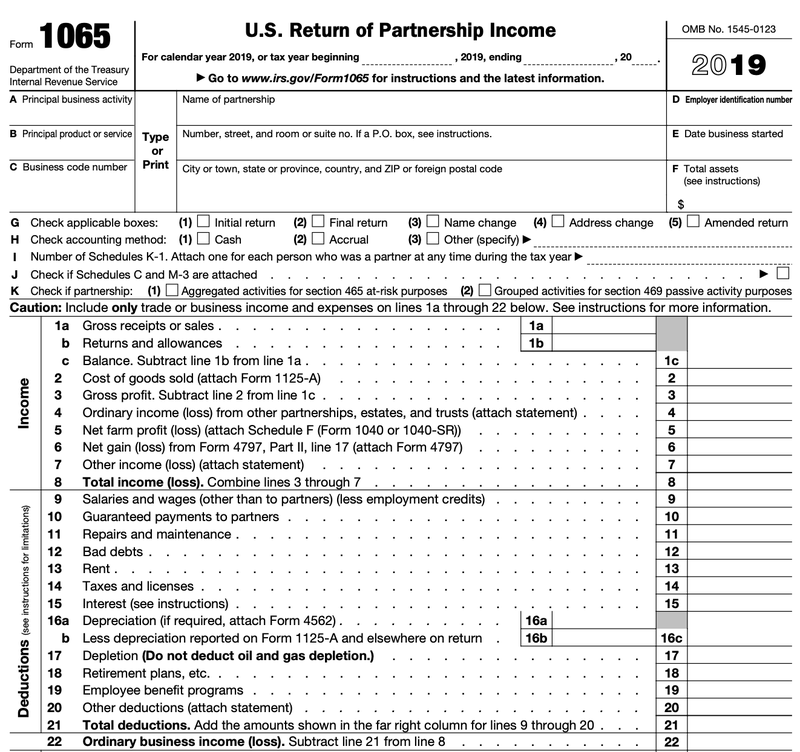

Partnership Form 1065 - If the partnership's principal business, office, or agency is located in: You can also reference these irs partnership instructions for additional information. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and credits of a business. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. And the total assets at the end of the tax year are: Ending / / partner’s share of income, deductions, credits, etc. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. Or getting income from u.s. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code.

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Department of the treasury internal revenue service. Or getting income from u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. You can also reference these irs partnership instructions for additional information. The partners of the partnership or one of the members of the joint venture or. Ending / / partner’s share of income, deductions, credits, etc. And the total assets at the end of the tax year are:

If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code. Any member or partner, regardless of position, may sign the return. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Department of the treasury internal revenue service. Part i information about the partnership. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. You can also reference these irs partnership instructions for additional information. To obtain information and missouri tax forms, access our web site at:.

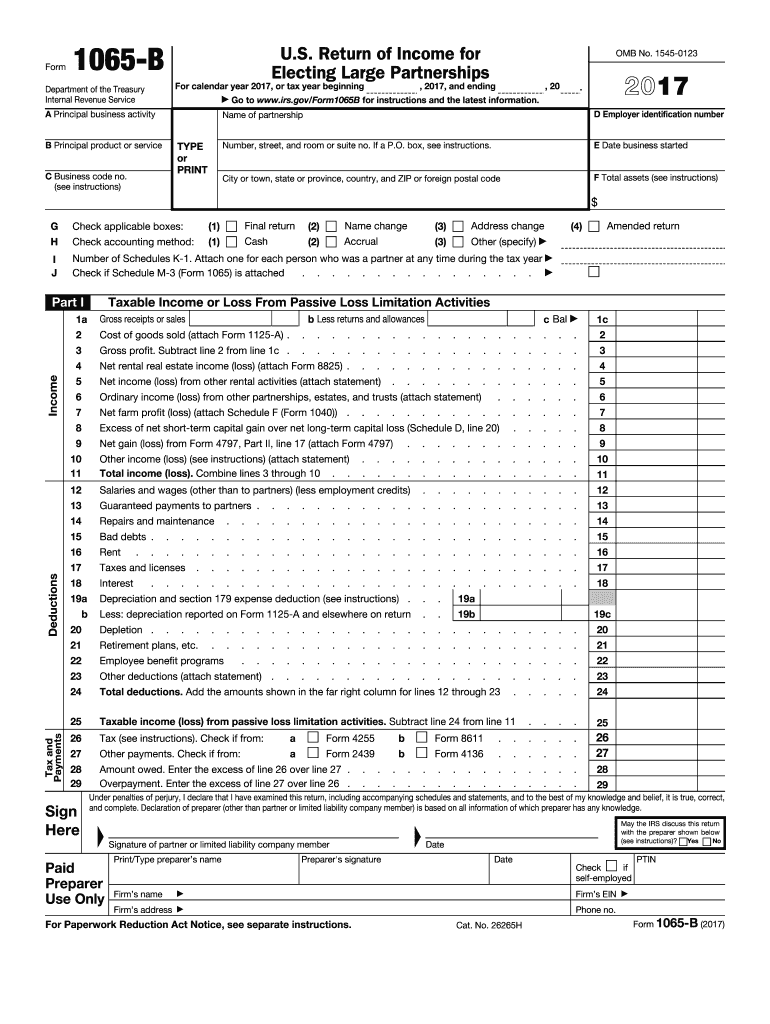

1065 B Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. The partners of the partnership or one of the members of the joint venture or. Ending / / partner’s share of income, deductions, credits, etc. Use the following internal revenue service center address: If the partnership reports unrelated business taxable income to an ira partner on line 20,.

Form 1065 Us Return Of Partnership United States Tax Forms

The partners of the partnership or one of the members of the joint venture or. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code. To obtain information and missouri tax forms, access our web site at:. Report the amount as it.

Form 1065 U.S. Return of Partnership (2014) Free Download

For calendar year 2022, or tax year beginning / / 2022. Box 1 ordinary business income (loss): Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. To obtain information and missouri tax forms, access our web.

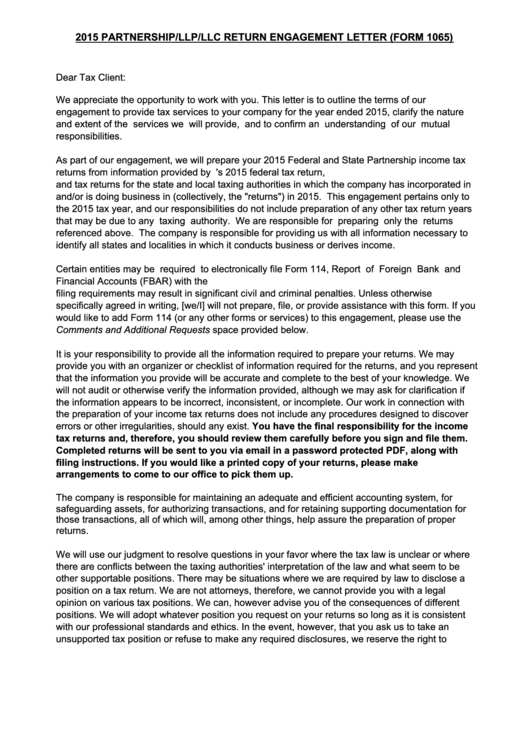

Form 1065 Partnership/llp/llc Return Engagement Letter 2015

You can also reference these irs partnership instructions for additional information. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Box 1 ordinary business income (loss): The partners of the partnership or one of the members of the joint venture or. Return of partnership income is a tax document issued by the internal revenue service.

Eligible Partnerships Granted Extension to File Form 1065 and Schedules K1

Part i information about the partnership. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Or getting income from u.s. Use the following internal revenue service center address: Department of the treasury internal revenue service.

Where do i mail my 1065 tax form exoticvsera

Part i information about the partnership. And the total assets at the end of the tax year are: You can also reference these irs partnership instructions for additional information. If the partnership's principal business, office, or agency is located in: Web where to file your taxes for form 1065.

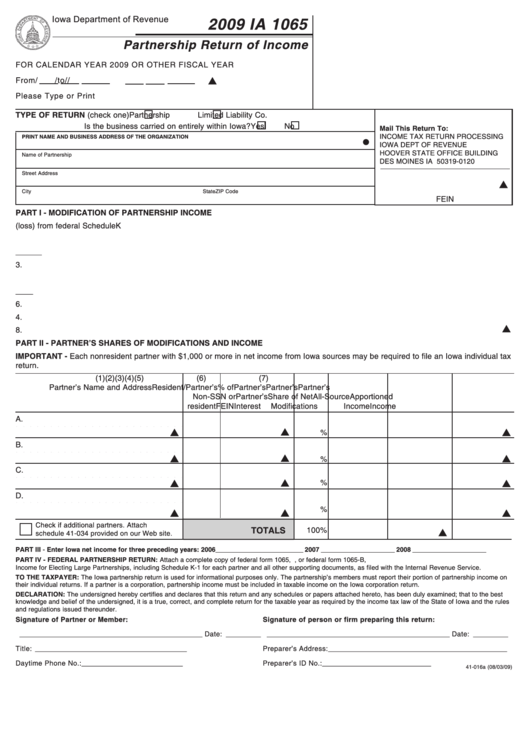

Form Ia 1065 Partnership Return Of 2009 printable pdf download

For calendar year 2022, or tax year beginning / / 2022. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Part i information about the partnership. Ending / / partner’s share of income, deductions, credits, etc. And the total assets at the end of the tax year are:

Partnership Tax (Form 1065) / AvaxHome

If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code. Or getting income from u.s. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income is.

Form 10 Attachment Sequence 10 Things To Avoid In Form 10 Attachment

Any member or partner, regardless of position, may sign the return. The partners of the partnership or one of the members of the joint venture or. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. And the total assets at the end of the tax year are:.

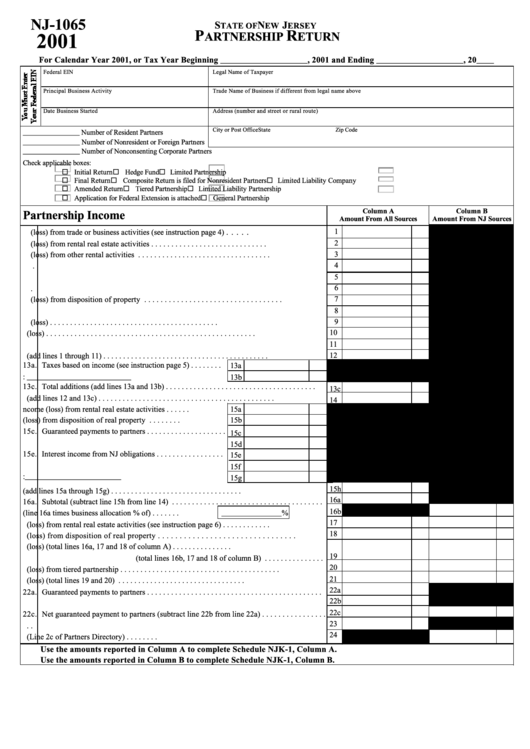

Form Nj1065 New Jersey Partnership Return 2001 printable pdf download

And the total assets at the end of the tax year are: Web where to file your taxes for form 1065. Box 1 ordinary business income (loss): Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland,.

Return Of Partnership Income Is A Tax Document Issued By The Internal Revenue Service (Irs) Used To Declare The Profits, Losses, Deductions, And Credits Of A Business.

The partners of the partnership or one of the members of the joint venture or. Ending / / partner’s share of income, deductions, credits, etc. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts.

Department Of The Treasury Internal Revenue Service.

Use the following internal revenue service center address: For calendar year 2022, or tax year beginning / / 2022. If the partnership's principal business, office, or agency is located in: Box 1 ordinary business income (loss):

Report The Amount As It Is Reported To You.

Part i information about the partnership. Any member or partner, regardless of position, may sign the return. To obtain information and missouri tax forms, access our web site at:. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s.

Web Where To File Your Taxes For Form 1065.

And the total assets at the end of the tax year are: Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. Or getting income from u.s. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code.