Payroll Summary Form

Payroll Summary Form - Summarize payroll data in excel; Web and credit you may be entitled to on irs form 940. Web complete parts d and e on back of form, if required. You aren’t required to have federal income tax withheld from sick pay paid by a third party. Payroll reports are generated each payroll period, quarterly, and annually. Payroll summary by tax tracking type; How to create a payroll report let’s go back to the basics now…so how, exactly, do you create a payroll report from scratch? Note that the dates in this report are by paycheck dates only, not pay period dates. Web employment tax forms: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.

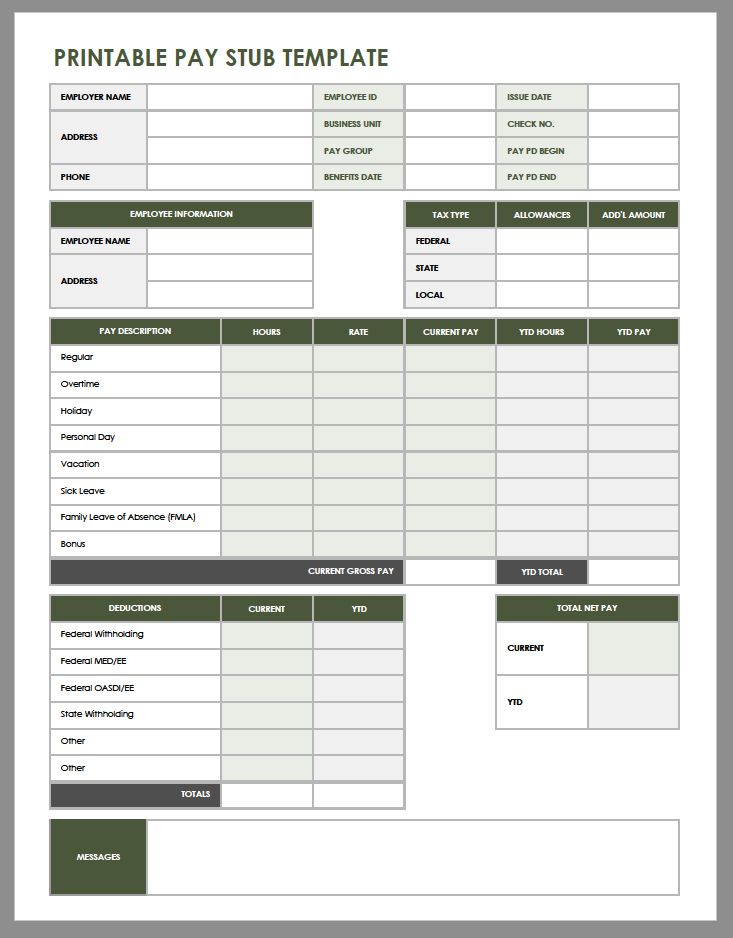

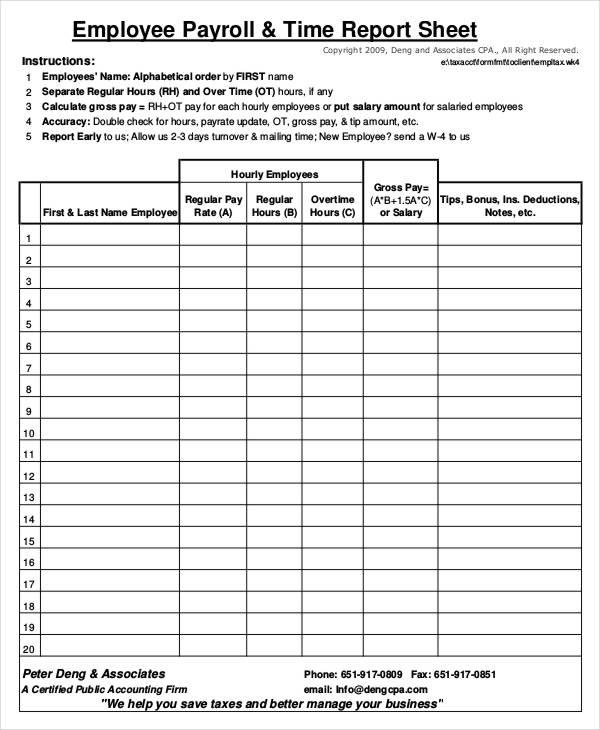

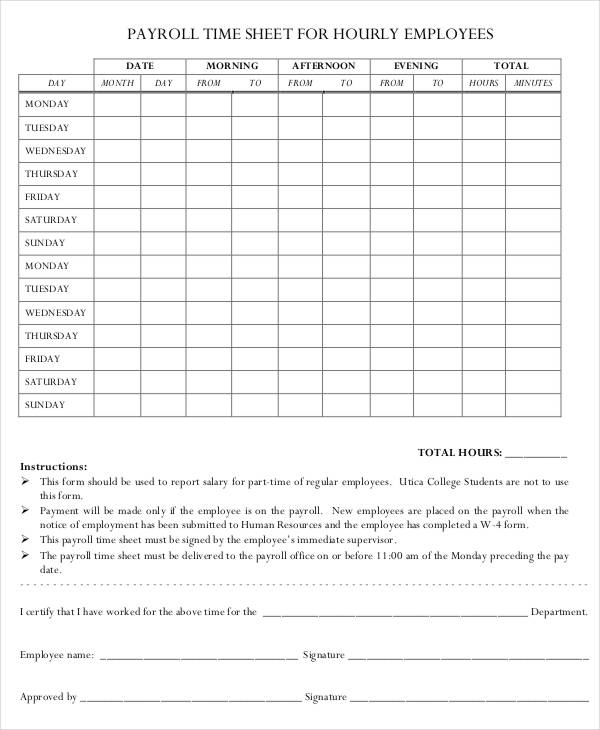

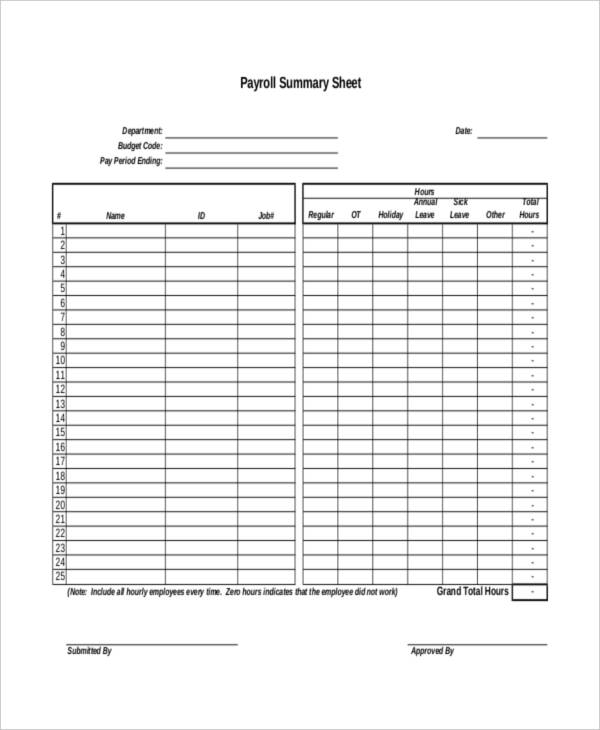

Payroll summary by tax tracking type; Easily create a salary grid, pay summary, check stub, or paycheck breakdown in daily, weekly, or monthly segments, depending on the agreed schedule, in a sheet or pdf document. Here's how to run a payroll summary report. Form 940, employer's annual federal unemployment tax return. Form 941, employer's quarterly federal tax return. Web download free payroll template. Web any employee’s income over $100,000 per year. Web pay your employees easily and on time with customizable payroll templates. For a comprehensive list of eligible costs, visit sba.gov. Tax agency information and ids

Web payroll summary 5 payroll summary this report displays a summary of all payroll funding, check counts, wages, taxes, hours, earnings, deductions, and memo calculations. Web a payroll summary report template is a template that contains detailed information about employees’ payments and deductions. Do not use negative numbers; 277 kb download uniform payroll deduction form airservcorp.com details file format pdf size: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. A payroll summary report provides a great overview of your payroll activity, including the total gross pay, adjusted gross pay, net pay, and all employer taxes and contributions. Web employment tax forms: 16 kb download employee payroll deduction form theeducationplan.com details file format pdf size: 187 kb download payroll remittance forms sample ira payroll remittance form fulfillment.lordabbett.com Web complete parts d and e on back of form, if required.

FREE 31+ Payroll Samples & Templates in MS Word MS Excel Pages

A payroll summary report provides a great overview of your payroll activity, including the total gross pay, adjusted gross pay, net pay, and all employer taxes and contributions. Many businesses use payroll software to generate tax forms for payroll reports. For each employee, it includes details on wage earnings, tax withholdings, benefit deductions and taxes owed by the employer. Creating.

Free Forms Payroll Record Fill and Sign Printable Template Online

Web a payroll report is a document created every pay period that displays specific financial information such as pay rates, hours worked and taxes withheld for the specific pay run. The employer’s share of certain payroll taxes contractor and vendor payments. For a comprehensive list of eligible costs, visit sba.gov. Compensation for employees who live outside the u.s. Here's how.

Payroll Summary Report Template Templates2 Resume Examples

Web payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. For each employee, it includes details on wage earnings, tax withholdings, benefit deductions and taxes owed by the employer. Tax agency information and ids Creating a ppp payroll report using payroll or accounting. For a comprehensive list of eligible costs, visit sba.gov.

Payroll Discrepancy Form Template PDF Template

Tax agency information and ids Web a payroll report is a document created every pay period that displays specific financial information such as pay rates, hours worked and taxes withheld for the specific pay run. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web pay your employees easily and on time with customizable payroll templates. Timesheet.

Pin on Resume Template

Form 941, employer's quarterly federal tax return. Web the payroll statement template summarizes employee hours, gross pay, deductions, and net pay for a single employee. Payroll reports are generated each payroll period, quarterly, and annually. Template.net’s free payroll templates help your business track, calculate, and organize payroll data for your employees. This page offers a wide variety of free payroll.

6 Payroll Summary Template SampleTemplatess SampleTemplatess

Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings statements. Web pay your employees easily and on time with customizable payroll templates. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Creating a ppp payroll report using payroll or accounting. Share your.

FREE 31+ Payroll Samples & Templates in MS Word MS Excel Pages

Share your form with others Web and credit you may be entitled to on irs form 940. Form 940, employer's annual federal unemployment tax return. Web employment tax forms: Timesheet template this timesheet template is a summary of employee hours worked and total pay.

11+ Payroll Sheet Templates Free Sample, Example Format Download

Web payroll summary reports. This page offers a wide variety of free payroll templates that. Gross pay is the amount of money an employee earns for hours worked for a specific date range before you subtract the appropriate amount of taxes or any other necessary deductions. Web download free payroll template. A payroll summary report provides a great overview of.

Payroll Summary Template HQ Printable Documents

Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings statements. Web a payroll summary report, also known as a payroll activity summary report, shows an overview of your payroll activity, including employee details like: For each employee, it includes details on wage earnings, tax withholdings, benefit deductions and taxes owed.

Payroll Summary Template merrychristmaswishes.info

Do not use negative numbers; It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Web a payroll summary report, also known as a payroll activity summary report, shows an overview of your payroll activity, including employee details like: Web complete parts d and e on back of form, if required. Sign it.

Creating A Ppp Payroll Report Using Payroll Or Accounting.

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. 08/01/23)” to comply with their employment eligibility verification responsibilities. Here's how to run a payroll summary report. Web any employee’s income over $100,000 per year.

277 Kb Download Uniform Payroll Deduction Form Airservcorp.com Details File Format Pdf Size:

Web download free payroll template. Many businesses use payroll software to generate tax forms for payroll reports. Web details file format pdf size: Web payroll summary reports.

Web Payroll Reports Document Employee Time Worked, Wages Paid, Federal Taxes Withheld, State Taxes Withheld, And Other Withholdings.

Summarize payroll data in excel; Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings statements. Form 941, employer's quarterly federal tax return. Note that the dates in this report are by paycheck dates only, not pay period dates.

Web Complete Parts D And E On Back Of Form, If Required.

Web employment tax forms: It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Web payroll summary 5 payroll summary this report displays a summary of all payroll funding, check counts, wages, taxes, hours, earnings, deductions, and memo calculations. This page offers a wide variety of free payroll templates that.