Peconic Bay Transfer Tax Form

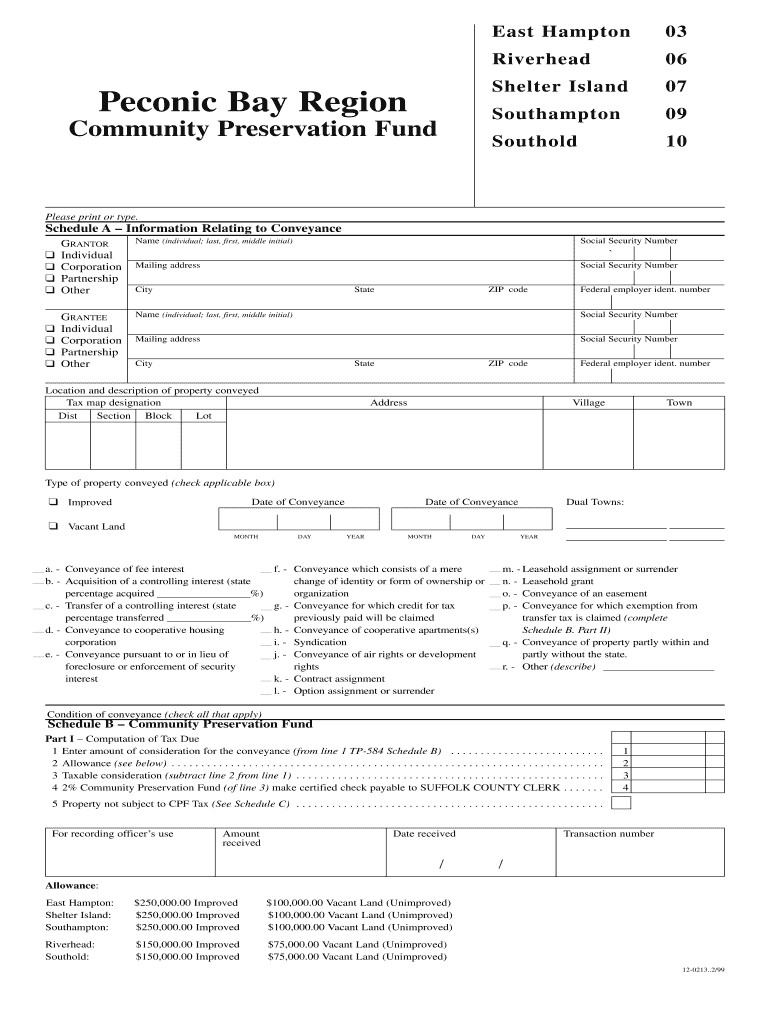

Peconic Bay Transfer Tax Form - East hampton riverhead shelter island southampton southold 03 06 07 09 10. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes. Cpf tax rate & allowance changes please find the attached updated peconic bay community preservation fund form to be used for recording deeds within east hampton, shelter island, southampton, riverhead and southold. Web peconic bay transfer tax form (contracts dated through march 31, 2023) **peconic bay transfer tax form (contracts dated april 1, 2023 to april 30, 2023) ***peconic bay transfer tax form (contracts dated may 1, 2023 and thereafter) Web this form is required for use on sale or transfer of real property by a nonresident after december 31, 2023, but before january 1, 2024. Peconic bay region fill in form beginning april 2023 and peconic bay region. With the exception of riverhead, all transfers in the peconic bay region on or after april 1, 2023, will be subject to an increased tax of.5%. Your use of the new form will depend on whether you will be using the old 2% rate or the new 2.5% rate. Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. Web effective april 1, 2023:

Web peconic bay region community preservation fund. Your use of the new form will depend on whether you will be using the old 2% rate or the new 2.5% rate. Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes. Web peconic bay region community preservation fund. East hampton riverhead shelter island southampton southold 03 06 07 09 10. Cpf tax rate & allowance changes please find the attached updated peconic bay community preservation fund form to be used for recording deeds within east hampton, shelter island, southampton, riverhead and southold. Web the cpf tax or the peconic bay region community preservation fund tax is a 2% transfer tax on all real property in the town of southampton. Web effective april 1, 2023: The first $100,000 of a vacant, unimproved parcel is exempt from the tax and the first $250,000 of an improved parcel is exempt from the tax.

Web the cpf tax or the peconic bay region community preservation fund tax is a 2% transfer tax on all real property in the town of southampton. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes. East hampton riverhead shelter island southampton southold 03 06 07 09 10. Your use of the new form will depend on whether you will be using the old 2% rate or the new 2.5% rate. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes. East hampton, riverhead, shelter island, southampton and southold only peconic bay region community preservation form: Web effective april 1, 2023: Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. Uniform form certificate of acknowledgement: The first $100,000 of a vacant, unimproved parcel is exempt from the tax and the first $250,000 of an improved parcel is exempt from the tax.

community preservation fund Fill out & sign online DocHub

East hampton riverhead shelter island southampton southold 03 06 07 09 10. The first $100,000 of a vacant, unimproved parcel is exempt from the tax and the first $250,000 of an improved parcel is exempt from the tax. Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. Web peconic bay transfer tax form (contracts dated.

Canadian Certificate of Origin

Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. East hampton, riverhead, shelter island, southampton and southold only peconic bay region community preservation form: The cpf form will be amended and made available in. Uniform form certificate of acknowledgement: Web peconic bay region community preservation fund.

Fill Free fillable Federal Standard Abstract PDF forms

The first $100,000 of a vacant, unimproved parcel is exempt from the tax and the first $250,000 of an improved parcel is exempt from the tax. The cpf form will be amended and made available in. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and.

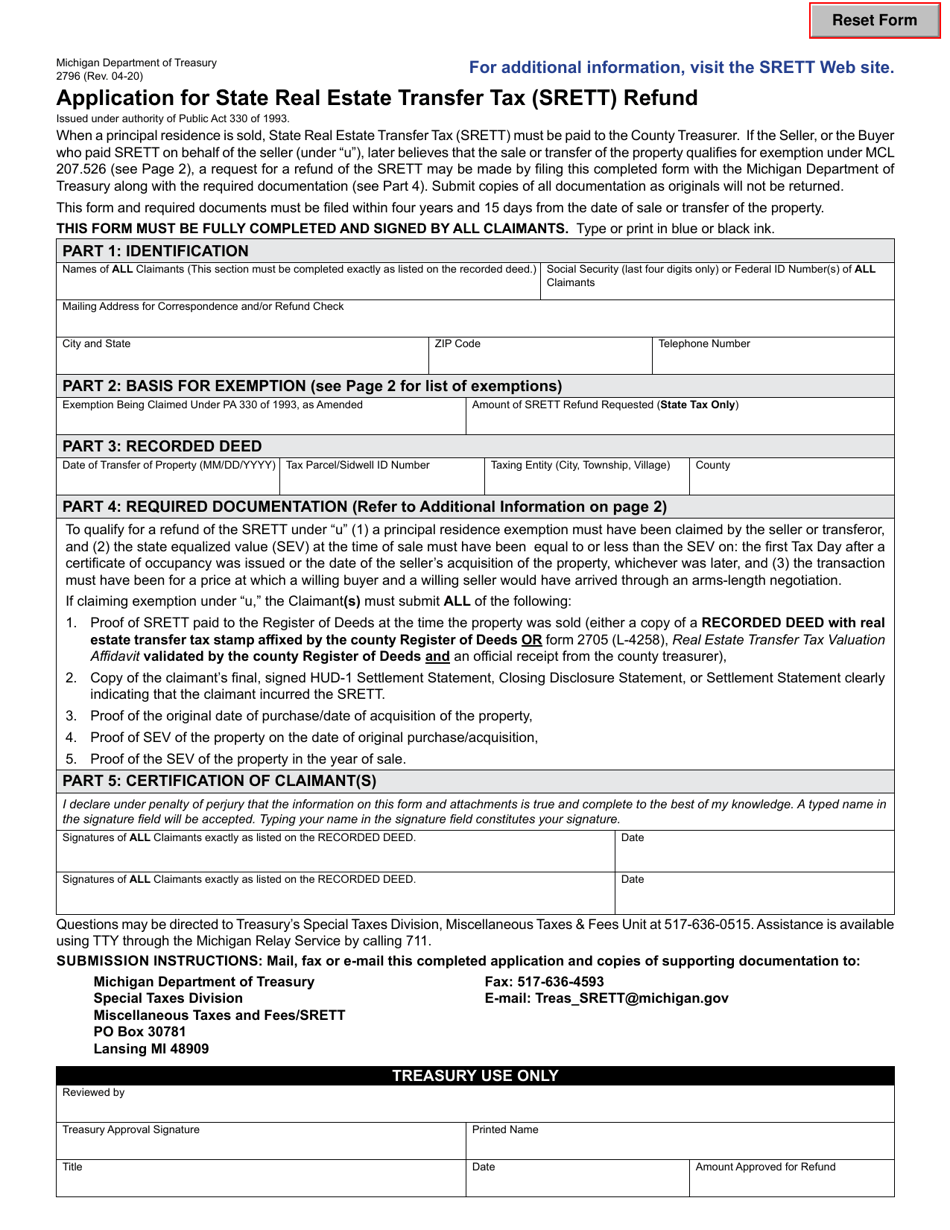

Form 2796 Download Fillable PDF or Fill Online Application for State

East hampton riverhead shelter island southampton southold 03 06 07 09 10. Peconic bay region fill in form beginning april 2023 and peconic bay region. Uniform form certificate of acknowledgement: The cpf form will be amended and made available in. Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only.

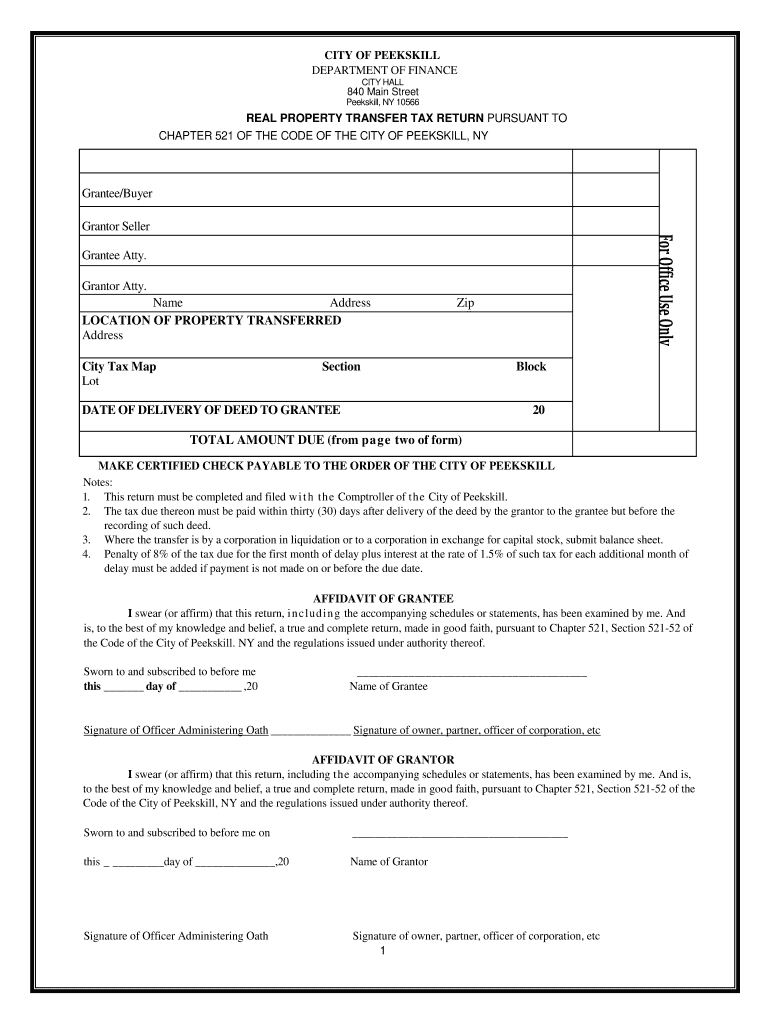

Peekskill Transfer Tax Form Fill Online, Printable, Fillable, Blank

Uniform form certificate of acknowledgement: The cpf form will be amended and made available in. Web effective april 1, 2023: Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes. Peconic bay region fill in form beginning april 2023.

What Is The Peconic Tax? Northshore Properties Realty

Web this form is required for use on sale or transfer of real property by a nonresident after december 31, 2023, but before january 1, 2024. Cpf tax rate & allowance changes please find the attached updated peconic bay community preservation fund form to be used for recording deeds within east hampton, shelter island, southampton, riverhead and southold. Your use.

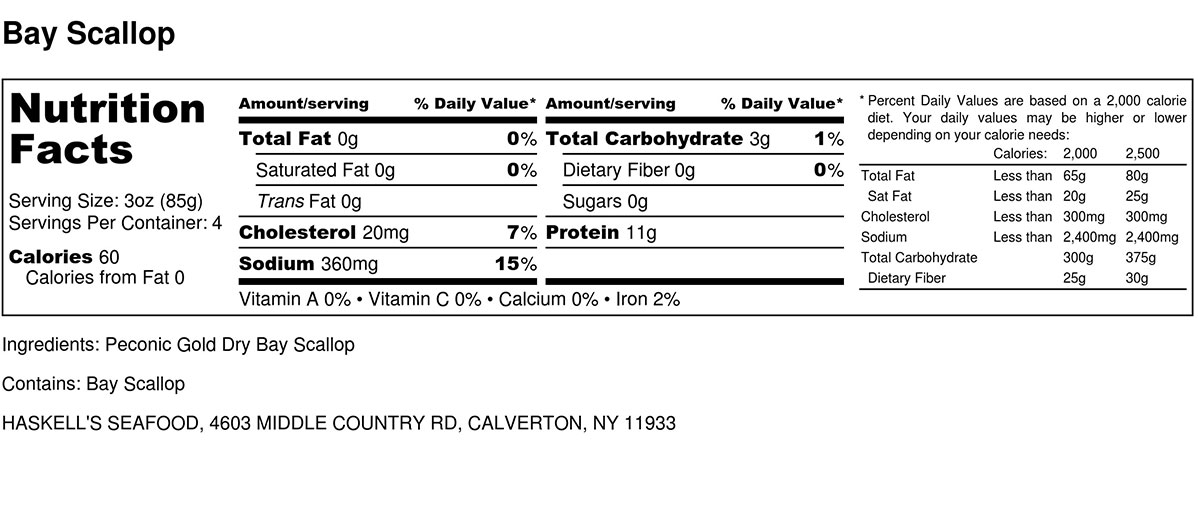

Peconic Gold Bay Scallops Haskell's Seafood

Peconic bay region fill in form beginning april 2023 and peconic bay region. The cpf form will be amended and made available in. East hampton riverhead shelter island southampton southold 03 06 07 09 10. Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. Web effective april 1, 2023:

Peconic Bay Region Form Instructions Fill Out and Sign Printable PDF

Web the cpf tax or the peconic bay region community preservation fund tax is a 2% transfer tax on all real property in the town of southampton. The first $100,000 of a vacant, unimproved parcel is exempt from the tax and the first $250,000 of an improved parcel is exempt from the tax. With the exception of riverhead, all transfers.

Fix Peconic Bay Transfer Tax Form Instructions

Web this form is required for use on sale or transfer of real property by a nonresident after december 31, 2023, but before january 1, 2024. East hampton riverhead shelter island southampton southold 03 06 07 09 10. Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. With the exception of riverhead, all transfers in.

All Shore Abstract Ltd. Forms

Cpf tax rate & allowance changes please find the attached updated peconic bay community preservation fund form to be used for recording deeds within east hampton, shelter island, southampton, riverhead and southold. With the exception of riverhead, all transfers in the peconic bay region on or after april 1, 2023, will be subject to an increased tax of.5%. Proceeds of.

The Cpf Form Will Be Amended And Made Available In.

Web effective april 1, 2023: The first $100,000 of a vacant, unimproved parcel is exempt from the tax and the first $250,000 of an improved parcel is exempt from the tax. Your use of the new form will depend on whether you will be using the old 2% rate or the new 2.5% rate. Web peconic bay region community preservation fund.

Web Peconic Bay Transfer Tax Form (Contracts Dated Through March 31, 2023) **Peconic Bay Transfer Tax Form (Contracts Dated April 1, 2023 To April 30, 2023) ***Peconic Bay Transfer Tax Form (Contracts Dated May 1, 2023 And Thereafter)

Web this form is required for use on sale or transfer of real property by a nonresident after december 31, 2020, but before january 1, 2022. Web this form is required for use on sale or transfer of real property by a nonresident after december 31, 2023, but before january 1, 2024. Web the cpf tax or the peconic bay region community preservation fund tax is a 2% transfer tax on all real property in the town of southampton. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes.

Cpf Tax Rate & Allowance Changes Please Find The Attached Updated Peconic Bay Community Preservation Fund Form To Be Used For Recording Deeds Within East Hampton, Shelter Island, Southampton, Riverhead And Southold.

Uniform form certificate of acknowledgement east hampton, riverhead, shelter island, southampton and southold only. Uniform form certificate of acknowledgement: East hampton, riverhead, shelter island, southampton and southold only peconic bay region community preservation form: Peconic bay region fill in form beginning april 2023 and peconic bay region.

East Hampton Riverhead Shelter Island Southampton Southold 03 06 07 09 10.

Web peconic bay region community preservation fund. East hampton riverhead shelter island southampton southold 03 06 07 09 10. With the exception of riverhead, all transfers in the peconic bay region on or after april 1, 2023, will be subject to an increased tax of.5%. Proceeds of this transfer tax are disbursed to the townships in which the transaction takes place for its acquisition of land, development rights, and other interests in property for conservation purposes.