Proof Of Loss Form For Insurance Claim

Proof Of Loss Form For Insurance Claim - The total amount of insurance held on the property at the time of the loss date issued/expires: 2.) abide by time requirements. Policyholders use this form to state the amount for an increased cost of compliance. Web once you’ve signed the form, you need to have a notary witness that signature and officiate it with a seal. So, don’t forget to do this one final thing, after filling out the form! Insurance policy number policy amt. Proof of loss is a legal document that explains what’s been damaged or stolen and how much money you’re claiming. With that final touch, your document becomes an official, sworn proof of loss; Homeowners, condo and renters insurance can typically help cover personal property. This form supports calculations to determine the amount of insurance benefits for mitigation activities.

Failure to fill out this form accurately can lead to underpayment,. Homeowners, condo and renters insurance can typically help cover personal property. Web follow these steps to fill out your proof of loss form policy number: 1.) fill out the form accurately and truthfully. The total amount of insurance held on the property at the time of the loss date issued/expires: Web what is a proof of loss? Insurance policy number policy amt. This form supports calculations to determine the amount of insurance benefits for mitigation activities. Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. Web total the total amount of insurance upon the property described by this policy was, at the time of the loss, $ _____, as more particularly specified in the apportionment attached, besides which there was no policy or other contract of insurance, written or.

Web total the total amount of insurance upon the property described by this policy was, at the time of the loss, $ _____, as more particularly specified in the apportionment attached, besides which there was no policy or other contract of insurance, written or. Proof of loss is a legal document that explains what’s been damaged or stolen and how much money you’re claiming. Web follow these steps to fill out your proof of loss form policy number: Failure to fill out this form accurately can lead to underpayment,. 2.) abide by time requirements. 1.) fill out the form accurately and truthfully. Web proof of loss is a formal, official, certified, and sworn statement of the claim an individual makes and submits it to the insurance company about the degree of property damage that occurred. Web a proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. Insurance policy number policy amt. This form supports calculations to determine the amount of insurance benefits for mitigation activities.

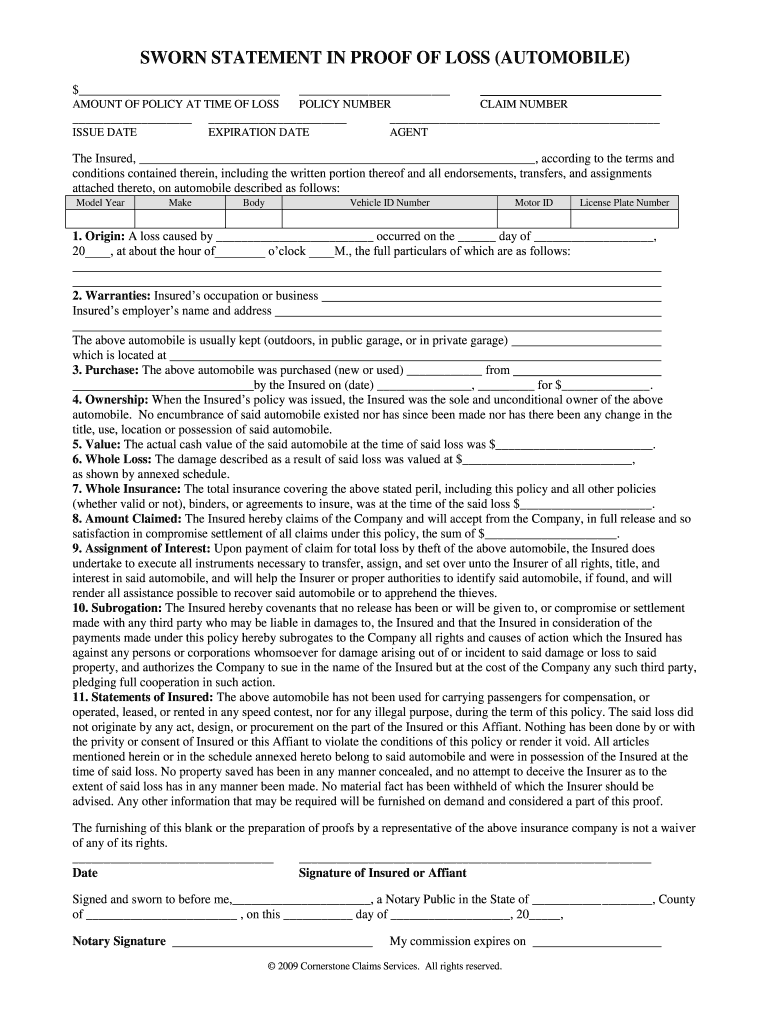

Taking a Look at a Common Proof of Loss Form Property Insurance

This helps to document the circumstances, as you have told it, to the insurance company and will be used as part of the overall record for your total insurance claim. Homeowners, condo and renters insurance can typically help cover personal property. Failure to fill out this form accurately can lead to underpayment,. Proof of loss is a legal document that.

Proof of Loss Form Fill Out and Sign Printable PDF Template signNow

Homeowners, condo and renters insurance can typically help cover personal property. Web follow these steps to fill out your proof of loss form policy number: The total amount of insurance held on the property at the time of the loss date issued/expires: Failure to fill out this form accurately can lead to underpayment,. The insurance company then investigates the claim.

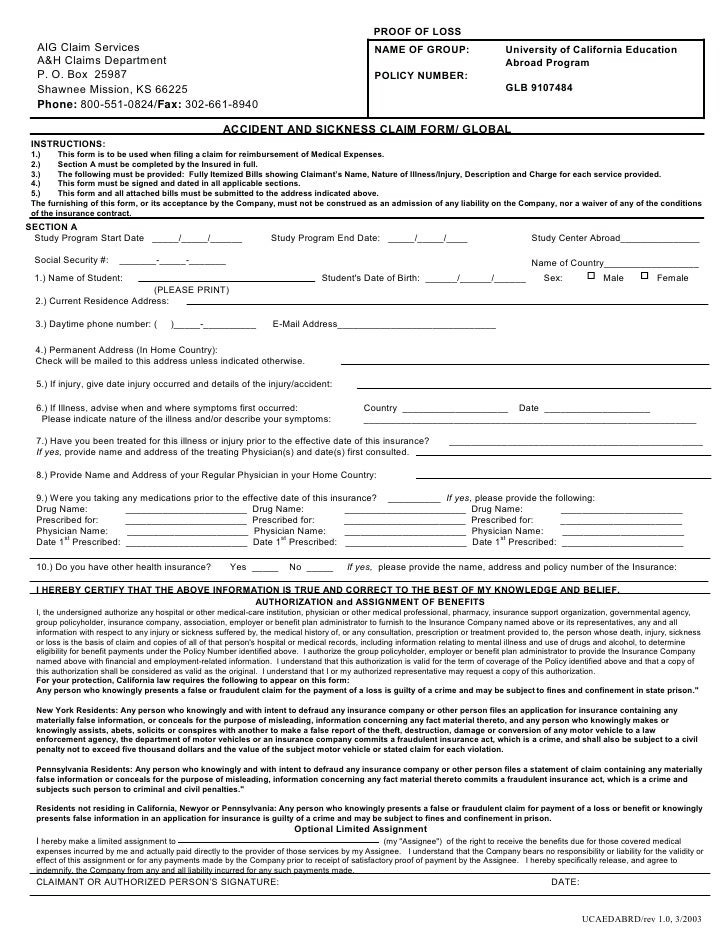

Proof Of Loss Aig Claim Services A H Claims Department

Web follow these steps to fill out your proof of loss form policy number: This form supports calculations to determine the amount of insurance benefits for mitigation activities. Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. Proof of loss is a legal document that explains.

Health Insurance Claim Form Royalty Free Stock Photos Image 31502088

Web once you’ve signed the form, you need to have a notary witness that signature and officiate it with a seal. Policyholders use this form to state the amount for an increased cost of compliance. With that final touch, your document becomes an official, sworn proof of loss; Web proof of loss is a formal, official, certified, and sworn statement.

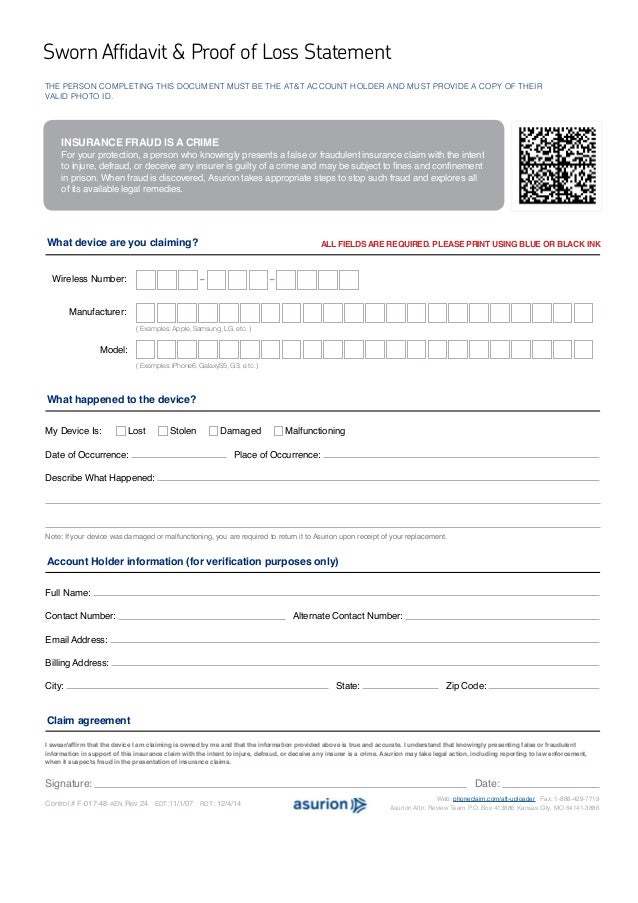

Understanding Proof of Loss Declarations Avner Gat Public Adjusters

This form supports calculations to determine the amount of insurance benefits for mitigation activities. The insurance company then investigates the claim and allows the individual to protect its interests. Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. Failure to fill out this form accurately can.

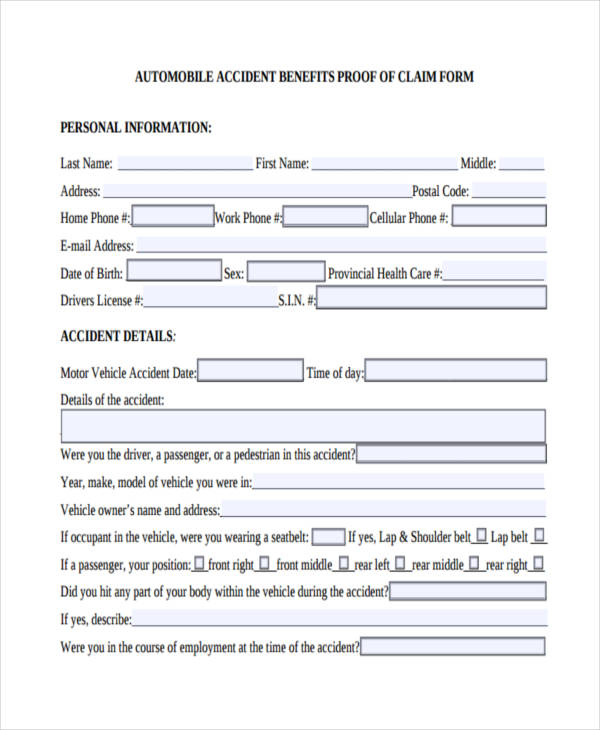

Car Accident Notice of Claim and Proof of Loss Form (Form NS1) NOVA

Insurance policy number policy amt. So, don’t forget to do this one final thing, after filling out the form! Your insurer may have you fill one out, depending on the loss. Web proof of loss is a formal, official, certified, and sworn statement of the claim an individual makes and submits it to the insurance company about the degree of.

38514158

Homeowners, condo and renters insurance can typically help cover personal property. Not knowing your policy requirements your policy may be the perfect blend of boring and confusing, but reading it takes some of the mystery out of the claim handling process. Web proof of loss is a formal, official, certified, and sworn statement of the claim an individual makes and.

Health Insurance Claim Form Sample Free Download

This helps to document the circumstances, as you have told it, to the insurance company and will be used as part of the overall record for your total insurance claim. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property. 1.) fill out the form accurately and.

FREE 37+ Sample Claim Forms in PDF Excel MS Word

Policyholders use this form to state the amount for an increased cost of compliance. Web follow these steps to fill out your proof of loss form policy number: Web proof of loss is a formal, official, certified, and sworn statement of the claim an individual makes and submits it to the insurance company about the degree of property damage that.

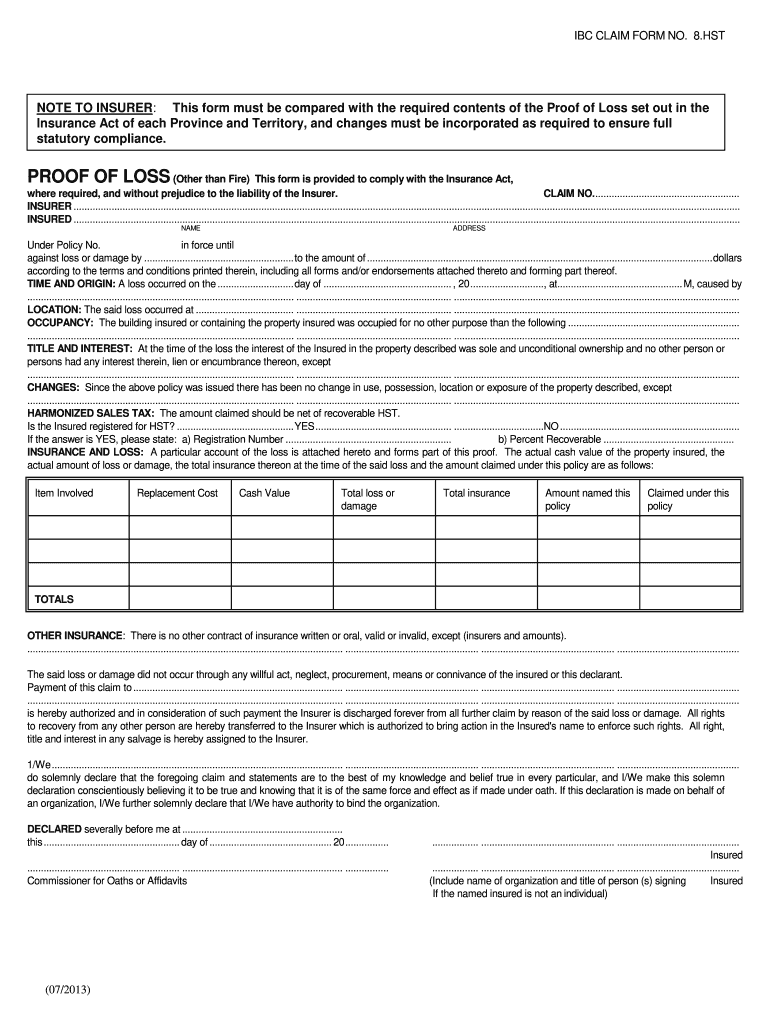

Ibc Claim Form No 8 Fill Out and Sign Printable PDF Template signNow

The insurance company then investigates the claim and allows the individual to protect its interests. Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. Web what is a proof of loss? Web proof of loss is a formal, official, certified, and sworn statement of the claim.

Policyholders Use This Form To State The Amount For An Increased Cost Of Compliance.

This form supports calculations to determine the amount of insurance benefits for mitigation activities. In the insurance policy, under the. Failure to fill out this form accurately can lead to underpayment,. This helps to document the circumstances, as you have told it, to the insurance company and will be used as part of the overall record for your total insurance claim.

Web Once You’ve Signed The Form, You Need To Have A Notary Witness That Signature And Officiate It With A Seal.

Web three important items to remember when filling out a proof of loss form: Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. Web what is a proof of loss? Proof of loss is a legal document that explains what’s been damaged or stolen and how much money you’re claiming.

Web Proof Of Loss Is A Formal, Official, Certified, And Sworn Statement Of The Claim An Individual Makes And Submits It To The Insurance Company About The Degree Of Property Damage That Occurred.

Web a proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. The total amount of insurance held on the property at the time of the loss date issued/expires: With that final touch, your document becomes an official, sworn proof of loss; The kind your policy requires.

The Insurance Company Then Investigates The Claim And Allows The Individual To Protect Its Interests.

Your insurer may have you fill one out, depending on the loss. So, don’t forget to do this one final thing, after filling out the form! Insurance policy number policy amt. 1.) fill out the form accurately and truthfully.