Recoverable Draw

Recoverable Draw - These funds are typically deducted from future commission. The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. Web employers may cap recoverable draw payments and stop making draw payments until the employee earns sufficient commissions to reduce the amount of draw owed either to $0 or a specified amount. Sales representatives earn 10% commission per sale. Web a recoverable draw is a payout you make with an opportunity to gain back if an employee doesn't meet expected goals. At this rate, sam receives a $2,000 commission draw each pay period. Web a recoverable draw is a type of advance payment made by a company to a commissioned employee. It often acts as a loan for earning sales commissions, and if an employee earns less than what they received in a draw, they owe the difference back to the company. Web a recoverable draw is a reliable way to ensure your sales reps bring home enough variable pay every month, whether they’re just starting out or navigating a lull in the sales cycle. This is done so that the employee can cover for their basic expenses.

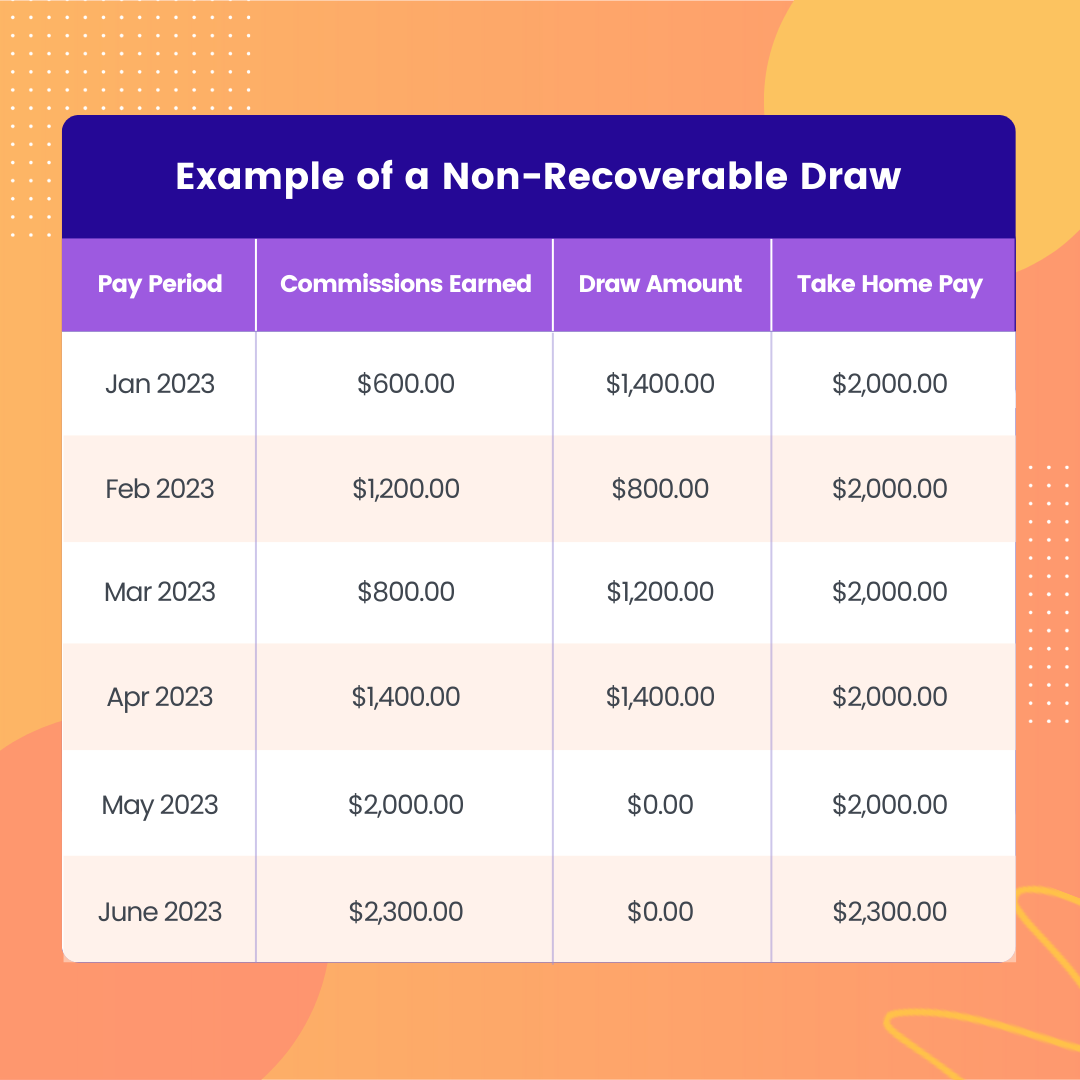

Commission earned, pay cheque amount and draw balance: It often acts as a loan for earning sales commissions, and if an employee earns less than what they received in a draw, they owe the difference back to the company. These funds are typically deducted from future commission. Web the draw activities are recorded in a spreadsheet under the categories: The salesperson gets to keep the draw amount. If there is a negative balance in the draw account at the end of the reconciliation period or on termination of employment, the draw deficit is owed to. The term recoverable refers to the fact that the. Web a recoverable draw is a reliable way to ensure your sales reps bring home enough variable pay every month, whether they’re just starting out or navigating a lull in the sales cycle. At this rate, sam receives a $2,000 commission draw each pay period. Web a recoverable draw is a payout you make with an opportunity to gain back if an employee doesn't meet expected goals.

Web the draw activities are recorded in a spreadsheet under the categories: This is done so that the employee can cover for their basic expenses. Web a recoverable draw is a payout you make with an opportunity to gain back if an employee doesn't meet expected goals. Commission earned, pay cheque amount and draw balance: At this rate, sam receives a $2,000 commission draw each pay period. The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. Web a recoverable draw is a reliable way to ensure your sales reps bring home enough variable pay every month, whether they’re just starting out or navigating a lull in the sales cycle. It often acts as a loan for earning sales commissions, and if an employee earns less than what they received in a draw, they owe the difference back to the company. The term recoverable refers to the fact that the. If there is a negative balance in the draw account at the end of the reconciliation period or on termination of employment, the draw deficit is owed to.

What is Draw against Commission in Sales?

The salesperson gets to keep the draw amount. When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. Web a recoverable draw is a payout you make with an opportunity to gain.

what is recoverable draw Alesia Carder

If there is a negative balance in the draw account at the end of the reconciliation period or on termination of employment, the draw deficit is owed to. This is done so that the employee can cover for their basic expenses. Web new heights operates with a recoverable draw against commission, expecting each sales representative to meet or exceed their.

Outside Sales Offer Letter with Recoverable Draw CleanTech Docs

Web a recoverable draw is a reliable way to ensure your sales reps bring home enough variable pay every month, whether they’re just starting out or navigating a lull in the sales cycle. Sales representatives earn 10% commission per sale. This is done so that the employee can cover for their basic expenses. When reps receive a draw that must.

FAQ What Are The Pros and Cons of Straight Commission Plans?

At this rate, sam receives a $2,000 commission draw each pay period. These funds are typically deducted from future commission. Web a recoverable draw is a type of advance payment made by a company to a commissioned employee. The amount of the draw is based on the expected earnings of the employee during a given period, such as a month.

Recoverable Draw Spiff

These funds are typically deducted from future commission. The term recoverable refers to the fact that the. Commission earned, pay cheque amount and draw balance: If there is a negative balance in the draw account at the end of the reconciliation period or on termination of employment, the draw deficit is owed to. When reps receive a draw that must.

Recoverable and NonRecoverable Draws » Forma.ai

This is done so that the employee can cover for their basic expenses. Web the draw activities are recorded in a spreadsheet under the categories: At this rate, sam receives a $2,000 commission draw each pay period. These funds are typically deducted from future commission. It often acts as a loan for earning sales commissions, and if an employee earns.

what is recoverable draw Alesia Carder

The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of.

Recoverable Draw Spiff

Web a recoverable draw is a reliable way to ensure your sales reps bring home enough variable pay every month, whether they’re just starting out or navigating a lull in the sales cycle. Web the draw activities are recorded in a spreadsheet under the categories: Web employers may cap recoverable draw payments and stop making draw payments until the employee.

Effective AND Fair Sales Compensation Plan Blueprints [With Examples

If there is a negative balance in the draw account at the end of the reconciliation period or on termination of employment, the draw deficit is owed to. This is done so that the employee can cover for their basic expenses. Web a recoverable draw is a type of advance payment made by a company to a commissioned employee. Web.

NonRecoverable Draw Spiff

At this rate, sam receives a $2,000 commission draw each pay period. When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. Web employers may cap recoverable draw payments and stop making.

The Term Recoverable Refers To The Fact That The.

When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. These funds are typically deducted from future commission. Commission earned, pay cheque amount and draw balance: Web a recoverable draw is a type of advance payment made by a company to a commissioned employee.

Web Employers May Cap Recoverable Draw Payments And Stop Making Draw Payments Until The Employee Earns Sufficient Commissions To Reduce The Amount Of Draw Owed Either To $0 Or A Specified Amount.

It often acts as a loan for earning sales commissions, and if an employee earns less than what they received in a draw, they owe the difference back to the company. Web new heights operates with a recoverable draw against commission, expecting each sales representative to meet or exceed their sales quota. This is done so that the employee can cover for their basic expenses. Web the draw activities are recorded in a spreadsheet under the categories:

Web A Recoverable Draw Is A Payout You Make With An Opportunity To Gain Back If An Employee Doesn't Meet Expected Goals.

If there is a negative balance in the draw account at the end of the reconciliation period or on termination of employment, the draw deficit is owed to. At this rate, sam receives a $2,000 commission draw each pay period. Sales representatives earn 10% commission per sale. The salesperson gets to keep the draw amount.

The Amount Of The Draw Is Based On The Expected Earnings Of The Employee During A Given Period, Such As A Month Or A Quarter.

Web a recoverable draw is a reliable way to ensure your sales reps bring home enough variable pay every month, whether they’re just starting out or navigating a lull in the sales cycle.