Requesting Form 712 From Insurance Company

Requesting Form 712 From Insurance Company - Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. If there were multiple policies in effect, the executor must. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. The life insurance company, upon request, should provide a copy of this tax form to the executor. Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran File a separate form 712 for each policy. The time needed to complete and file this form will vary depending on individual circumstances. What information does irs form 712 contain? Web ask the life insurance company what a form 712 is.

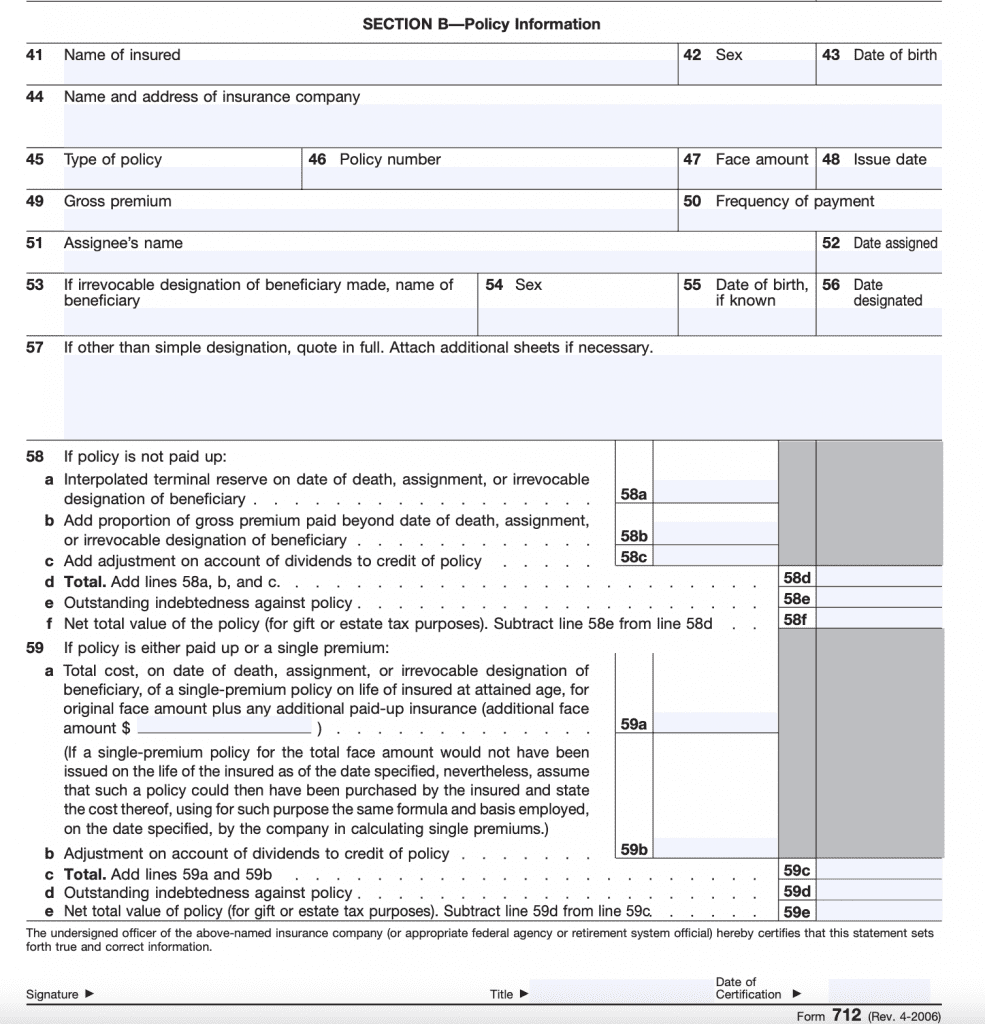

There are 2 parts to this tax form: Web life insurance company. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw The life insurance company, upon request, should provide a copy of this tax form to the executor. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. You should also ask the company, in writing, to pay the proceeds to you. This will allow the executor to complete the estate tax return. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. The time needed to complete and file this form will vary depending on individual circumstances. Web ask the life insurance company what a form 712 is.

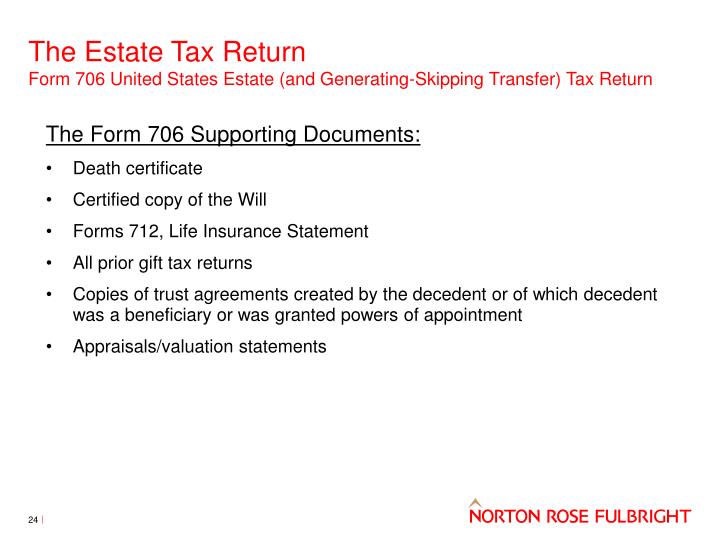

Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran There are 2 parts to this tax form: The time needed to complete and file this form will vary depending on individual circumstances. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw What information does irs form 712 contain? Report on line 13 the annual premium, not the Web form 712 plays a key role in establishing the value of a life insurance policy when filing gift tax and estate tax returns. Web life insurance company. There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. Web ask the life insurance company what a form 712 is.

Insurance Policy Form 712

There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

File a separate form 712 for each policy. Web on behalf of the insurance company that issued the policy, by an officer of the company having access to the records of the company. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web life insurance company. Form—letter to life insurance.

IRS Form 712 A Guide to the Life Insurance Statement

Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. File a separate form 712 for each policy. There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. Web the irs federal form 712 reports the value of a.

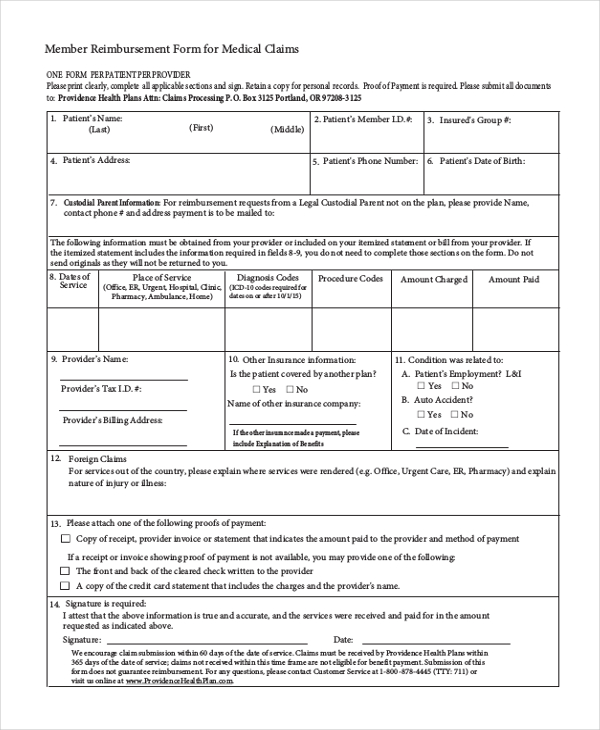

Sample Letter To Insurance Company Requesting Reimbursement For Your

Web life insurance company. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. What information does irs form 712 contain? There are 2 parts to this tax form: This will allow the executor to complete the estate tax return.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web form 712 plays a key role in establishing the value of a life insurance policy when filing gift tax and estate tax returns. This will allow the executor to complete the estate tax return. File a separate form 712 for each policy. The time needed to complete and file this form will vary depending on individual circumstances. Understanding irs.

Mumbai News Network Latest News Today's Insurance Alertss 712

If there were multiple policies in effect, the executor must. There are 2 parts to this tax form: This will allow the executor to complete the estate tax return. Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran What information does irs form 712 contain?

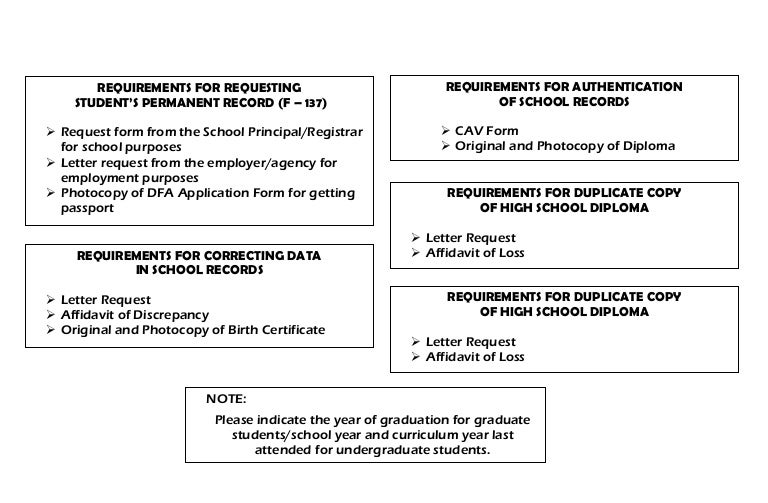

Requirements for requesting form 137

Report on line 13 the annual premium, not the The time needed to complete and file this form will vary depending on individual circumstances. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. There are 2 parts to this tax form: There may be a reason.

Sample Letter To Insurance Company Requesting Reimbursement For Your

There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw The time.

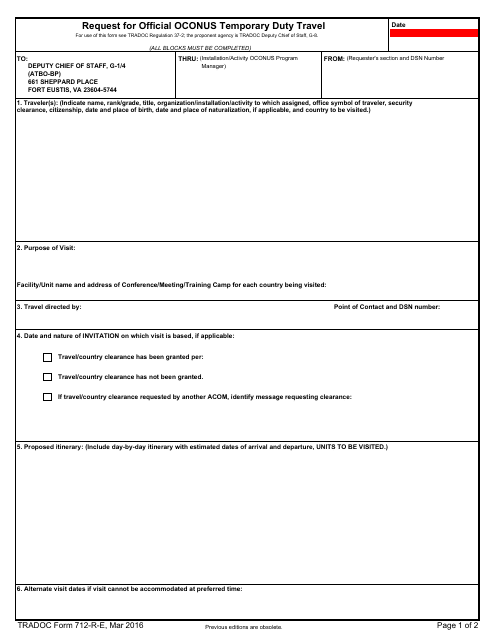

TRADOC Form 712RE Download Fillable PDF or Fill Online Request for

Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran There are 2 parts to this tax form: You should also ask the company, in writing, to pay the proceeds to you. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw.

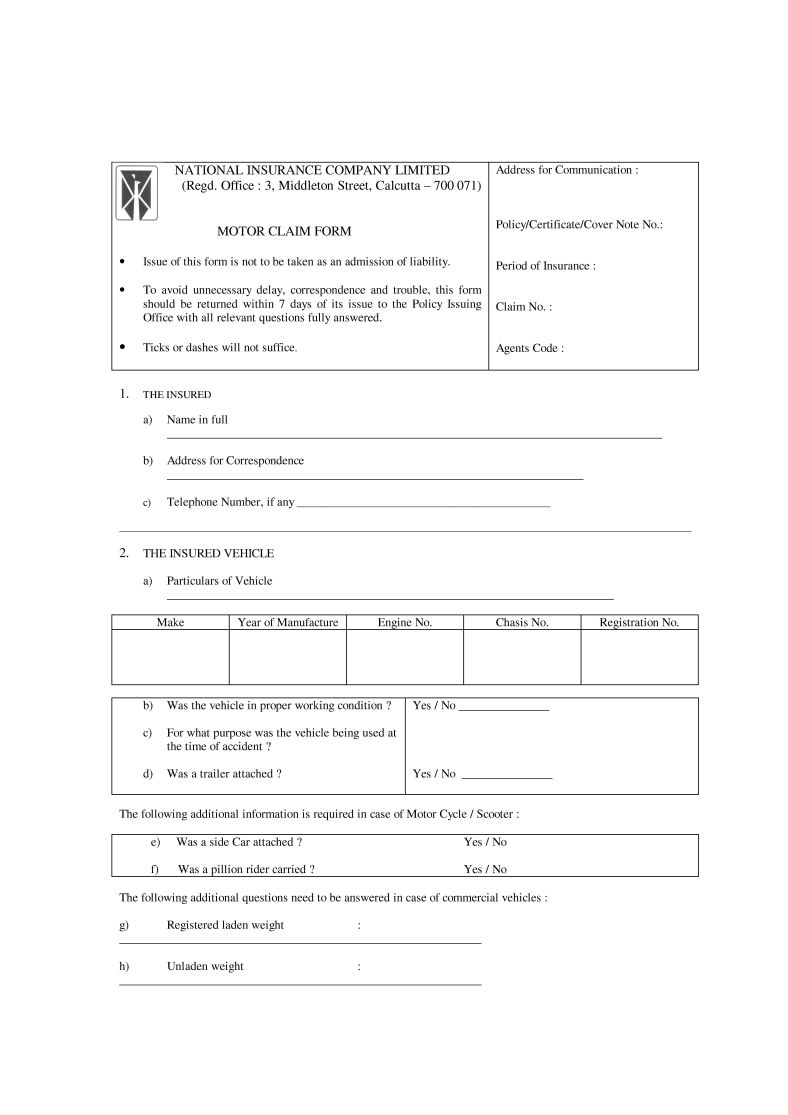

Claim Form National Insurance Company Download 2021 2022 Student Forum

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Report on line 13 the annual premium, not the What information does irs form 712 contain? Web life.

Web Form 712 Plays A Key Role In Establishing The Value Of A Life Insurance Policy When Filing Gift Tax And Estate Tax Returns.

File a separate form 712 for each policy. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Report on line 13 the annual premium, not the

What Information Does Irs Form 712 Contain?

The life insurance company, upon request, should provide a copy of this tax form to the executor. Web ask the life insurance company what a form 712 is. There are 2 parts to this tax form: The time needed to complete and file this form will vary depending on individual circumstances.

If There Were Multiple Policies In Effect, The Executor Must.

American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw Web life insurance company.

Understanding Irs Form 712 When Valuing Life Insurance On Gift Tax & Estate Tax Returns | Our Insights | Plante Moran

Web on behalf of the insurance company that issued the policy, by an officer of the company having access to the records of the company. This will allow the executor to complete the estate tax return. You should also ask the company, in writing, to pay the proceeds to you. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file.