S Corp Owner Draw

S Corp Owner Draw - Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. While a salary is compensation for services rendered by an employee, an owner’s draw is a distribution of profits to the business owner. Web posted 6 may 2024, updated 7 may 2024. For sole proprietors, an owner’s draw is the only option for payment. Web an owner can take up to 100 percent of the owner's equity as a draw, but the business's cash flow should be a consideration. Web trigger payroll taxes. An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. Can trigger penalties from the irs if your salary is considered unreasonable. Irs guidelines on paying yourself from a corporation. Web may 9, 2024.

Create a new account for the owner's draw and set it up as an owner's equity account. She has decided to give herself a salary of $50,000 out of her catering business. Business owners might use a draw for compensation versus paying themselves a salary. By salary, distributions or both. There is no fixed amount and no fixed interval for these payments. An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. A draw lowers the owner's equity in the business. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web with an s corp election, it is a tax election which allows any profit and loss to flow through to itd owner or owners (i.e.

Web if your s corp income and social security benefits exceeds a certain level of income, a portion of your social security oasdi benefits becomes taxable. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. Irs guidelines on paying yourself from a corporation. Pros:using the owner's draw method can help you, as an owner, keep funds in your. An owner of a c corporation may not. You can adjust it based on your cash flow, personal expenses, or how your company is performing. Web owner’s draws are flexible. However, this has become a hot button. Owner’s draw involves drawing discretionary amounts of money from your business to pay yourself.

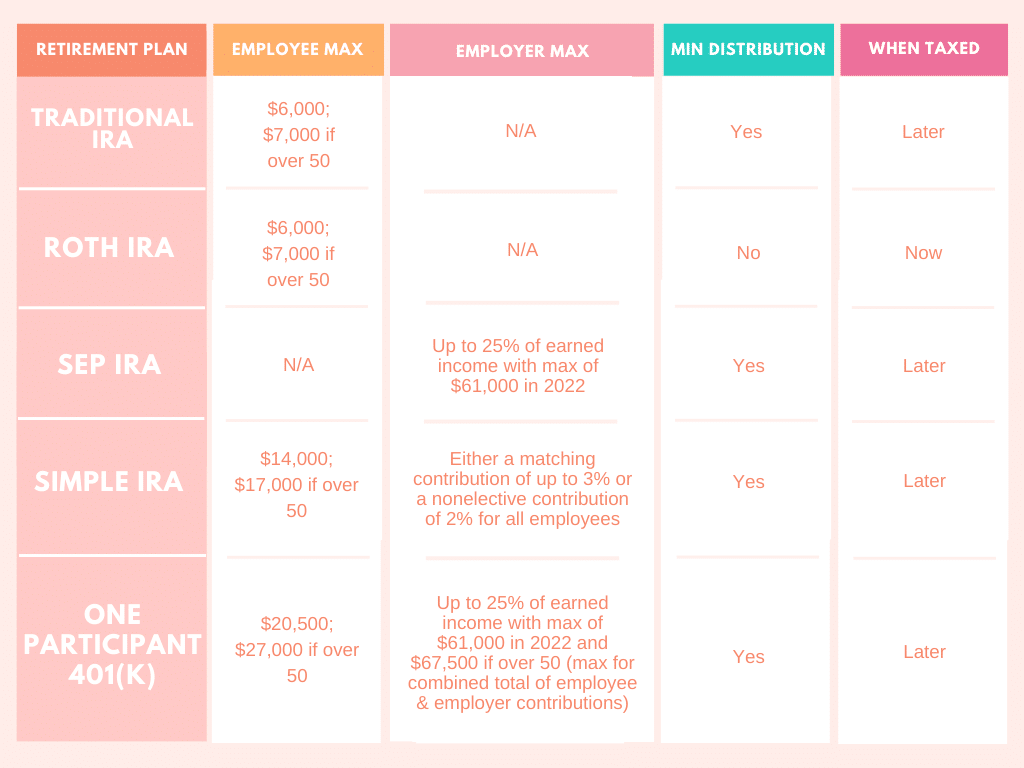

Retirement Account Options for the SCorp Owner

Shareholders of norfolk southern, the beleaguered freight railroad, on thursday voted down an attempt by an activist investment firm to remove the company’s chief executive and take. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web it is vital to note that an owner’s draw differs.

Owner Draw Quickbooks Scorp DRAWING IDEAS

In 2023, the fosterville gold mine produced 277,994 ounces of gold at fosterville at a price of. Shareholders of norfolk southern, the beleaguered freight railroad, on thursday voted down an attempt by an activist investment firm to remove the company’s chief executive and take. Web posted 6 may 2024, updated 7 may 2024. Web repayment of loan was simply a.

What Is An S Corp?

You can adjust it based on your cash flow, personal expenses, or how your company is performing. If the shareholder received or had the right to receive cash or property,. When taking an owner's draw, the business cuts a check to the owner for the full amount of the draw. Shareholders of norfolk southern, the beleaguered freight railroad, on thursday.

owner draw quickbooks scorp Arlinda Lundberg

Types of business where you can take an owner’s draw: The right choice depends largely on how you contribute to the company and the company. The business’s profits and losses are passed through to the owner). Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. Shareholders of norfolk.

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

C corp owners typically do not take draws. Types of business where you can take an owner’s draw: Web repayment of loan was simply a paper transaction in which outstanding loan balance was credited against undistributed income and rental payments owed by the corporation to the shareholder. Business owners might use a draw for compensation versus paying themselves a salary..

Reasonable salaries What every S corp owner needs to know Finaloop

Many small business owners use s corporations. Types of business where you can take an owner’s draw: Web if your s corp income and social security benefits exceeds a certain level of income, a portion of your social security oasdi benefits becomes taxable. Web an owner's draw is an amount of money an owner takes out of a business, usually.

I own an SCorp, how do I get paid? ClearPath Advisors

Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web you are able to take an owner’s draw from your business if your business is part of: However, this has become a hot button. There is no fixed amount and no fixed interval for these payments. Pros:using.

owner draw quickbooks scorp Anton Mintz

Web it is vital to note that an owner’s draw differs from a salary. As of publication, part of your social. The right choice depends largely on how you contribute to the company and the company. Web owner’s draws are flexible. For example, maybe instead of being a sole proprietor, patty set up riverside catering as an s corp.

Owner Draw Quickbooks Scorp DRAWING IDEAS

One of the biggest reasons is that an s corporation can save a business owner social security and medicare taxes. Payroll software can help you distribute salaries to s corp owners and employees. The selling of the stock may result in capital gains. The business’s profits and losses are passed through to the owner). Owner’s draw involves drawing discretionary amounts.

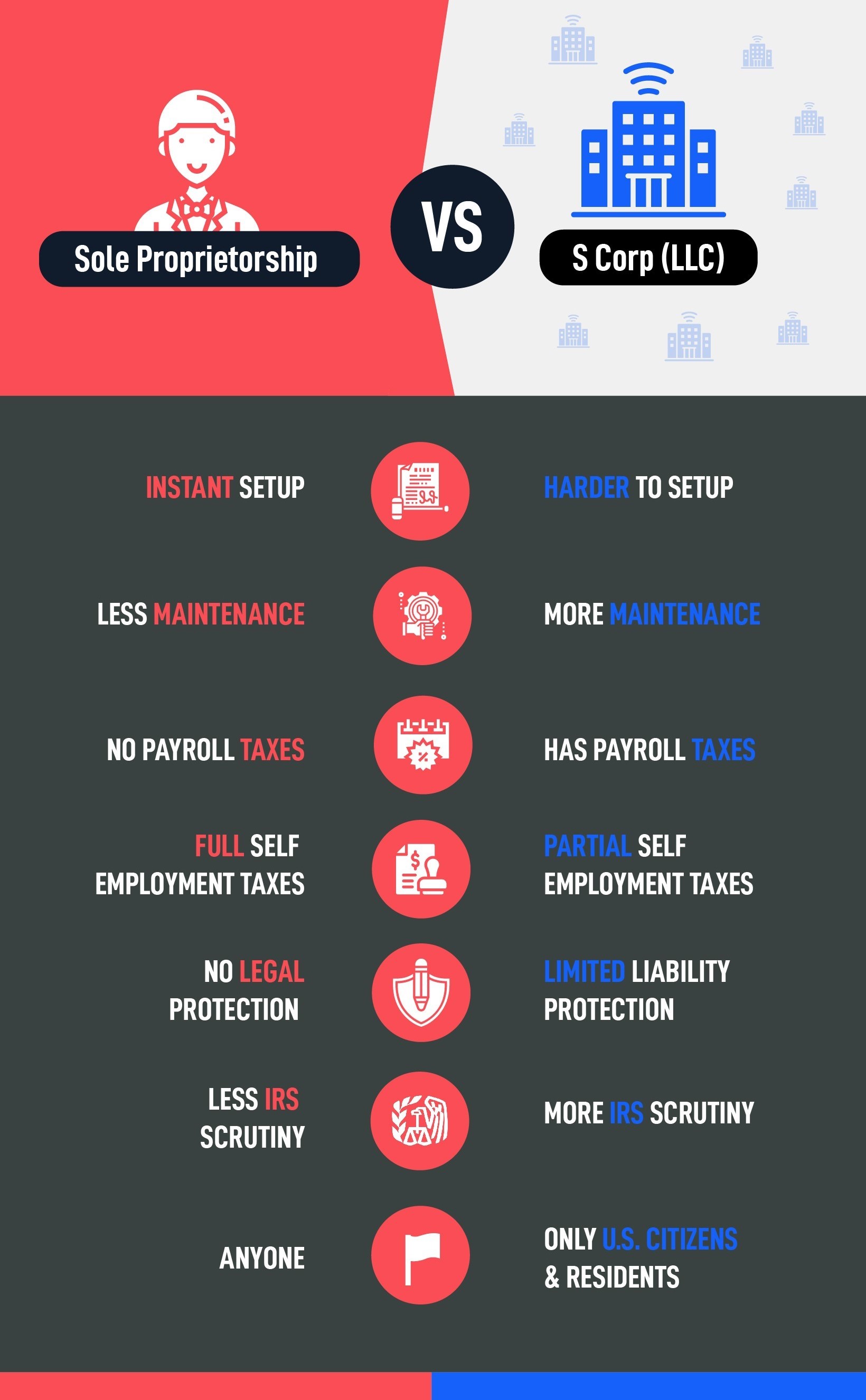

S Corp vs Sole Proprietorship Pros & Cons (Infographic 🆚)

You can adjust it based on your cash flow, personal expenses, or how your company is performing. The selling of the stock may result in capital gains. Inactivate the compensation of officers account if necessary. The more an owner takes, the fewer funds the business has to operate. This method of payment is common across various business structures such as.

An Owner Of A C Corporation May Not.

Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. The right choice depends largely on how you contribute to the company and the company. For sole proprietors, an owner’s draw is the only option for payment. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use.

Owner’s Draw Involves Drawing Discretionary Amounts Of Money From Your Business To Pay Yourself.

C corp owners typically do not take draws. Instead, shareholders can take both a salary and a dividend distribution. Many small business owners use s corporations. One of the biggest reasons is that an s corporation can save a business owner social security and medicare taxes.

Irs Guidelines On Paying Yourself From A Corporation.

Create a new account for the owner's draw and set it up as an owner's equity account. An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Business owners might use a draw for compensation versus paying themselves a salary. Types of business where you can take an owner’s draw:

Understanding The Concept Of Owner’s Draws.

If the shareholder received or had the right to receive cash or property,. From there, she could do the math to determine what her. Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. Web with an s corp election, it is a tax election which allows any profit and loss to flow through to itd owner or owners (i.e.

.png)