Sales Of Business Property Form 4797

Sales Of Business Property Form 4797 - You can download or print current. Buyer and seller acknowledge and agree that the note and mortgage/deed of trust instruments provided for herein shall be fnma/fhlmc uniform. Web sold january 2, 2011 for $24,000 tangible real property based on year placed in service adr depreciation acrs depreciation macrs depreciation purchase price = $40,000. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. To enter the sale of business property in taxact so that it is reported on form 4797: Web form 4797 sales of business property reports the sale of business property. Web complete and file form 4797: Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions.

Web form 4797 sales of business property reports the sale of business property. You can download or print current. Get ready for tax season deadlines by completing any required tax forms today. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. To enter the sale of business property in taxact so that it is reported on form 4797: To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: • property used in trade or business • depreciable or amortizable property • oil, gas, geothermal or other mineral property •. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Web if you sold property that was your home and you also used it for business, you may need to use form 4797 to report the sale of the part used for business (or the sale of the. This may include your home that was converted into a rental.

Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. The form instructions contain specific. Web if you sold property that was your home and you also used it for business, you may need to use form 4797 to report the sale of the part used for business (or the sale of the. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. This may include your home that was converted into a rental. Web we last updated the sales of business property in december 2022, so this is the latest version of form 4797, fully updated for tax year 2022. Web depending on your tax situation, you may not need to use all parts of irs form 4797 to report sales of business property. • property used in trade or business • depreciable or amortizable property • oil, gas, geothermal or other mineral property •. Buyer and seller acknowledge and agree that the note and mortgage/deed of trust instruments provided for herein shall be fnma/fhlmc uniform.

Form 4797 Sales of Business Property (2014) Free Download

Complete, edit or print tax forms instantly. Rental property, like an apartment or a house the part of your home. This may include your home that was converted into a rental. • property used in trade or business • depreciable or amortizable property • oil, gas, geothermal or other mineral property •. Web form 4797 is strictly used to report.

Form 4797 Sales of Business Property Definition

Buyer and seller acknowledge and agree that the note and mortgage/deed of trust instruments provided for herein shall be fnma/fhlmc uniform. This may include your home that was converted into a rental. Generally, form 4797 is used to report the sale of a business. Web we last updated the sales of business property in december 2022, so this is the.

Form 4797 Sales of Business Property Definition

You can download or print current. Web form 4797 sales of business property reports the sale of business property. Web when form 4797 is used • sale or exchange of: To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: To enter the sale of business property in taxact so.

Form 4797 Sales of Business Property YouTube

• property used in trade or business • depreciable or amortizable property • oil, gas, geothermal or other mineral property •. Web form 4797 sales of business property reports the sale of business property. To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: Buyer and seller acknowledge and agree.

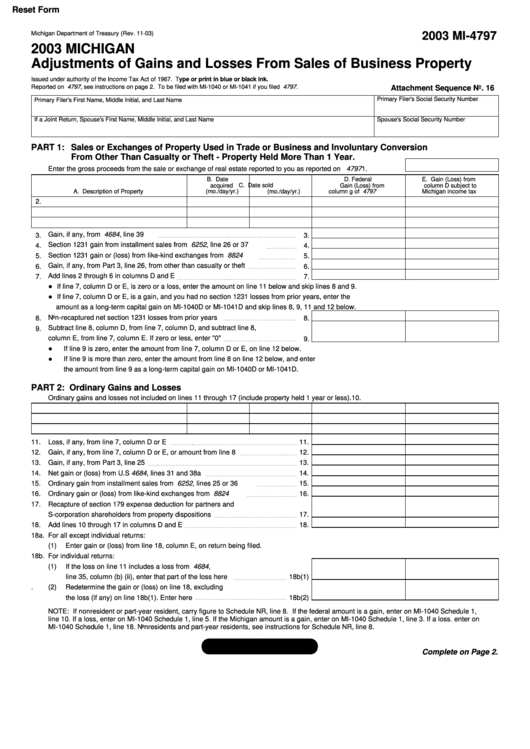

Form Mi4797 Michigan Adjustments Of Gains And Losses From Sales Of

Web form 4797 input for sales of business property solved•by intuit•14•updated july 14, 2022 sales of assets may be entered in either the income section, on the screen. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. The form instructions contain specific. To enter a loss for the sale of business property not.

Dean and Ellen Price are married and have a

Web when form 4797 is used • sale or exchange of: Rental property, like an apartment or a house the part of your home. Web sold january 2, 2011 for $24,000 tangible real property based on year placed in service adr depreciation acrs depreciation macrs depreciation purchase price = $40,000. You can download or print current. The form instructions contain.

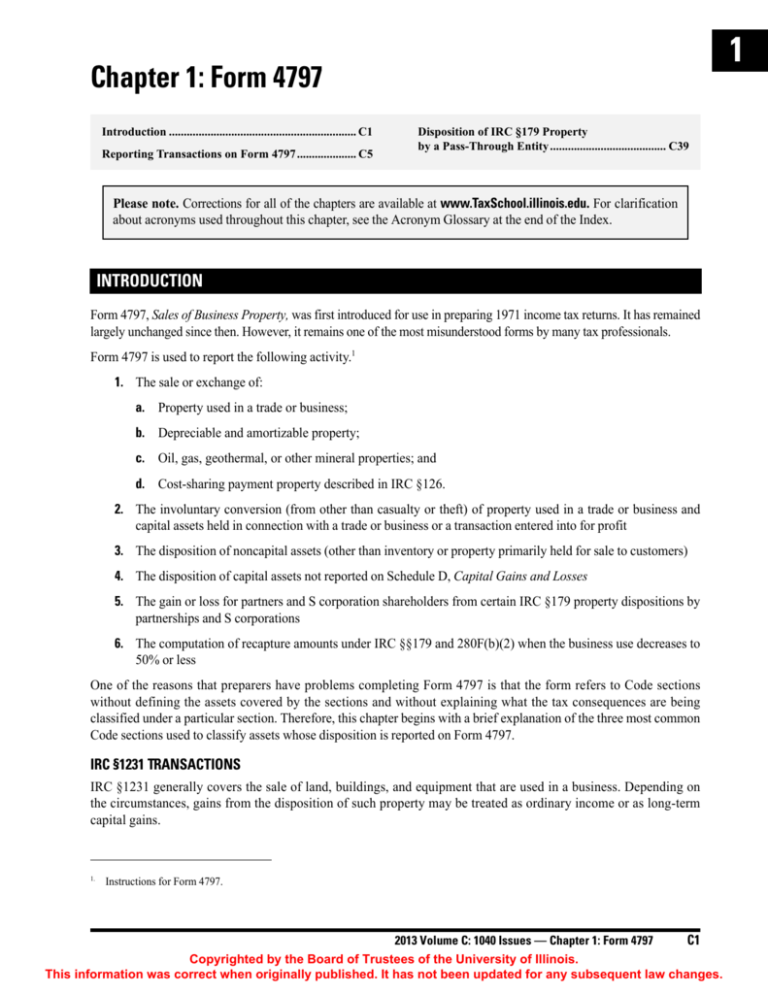

Chapter 1 Form 4797 University of Illinois Tax School

Complete, edit or print tax forms instantly. From within your taxact return ( online or desktop), click federal (on smaller devices, click in. Web form 4797 input for sales of business property solved•by intuit•14•updated july 14, 2022 sales of assets may be entered in either the income section, on the screen. Generally, form 4797 is used to report the sale.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from.

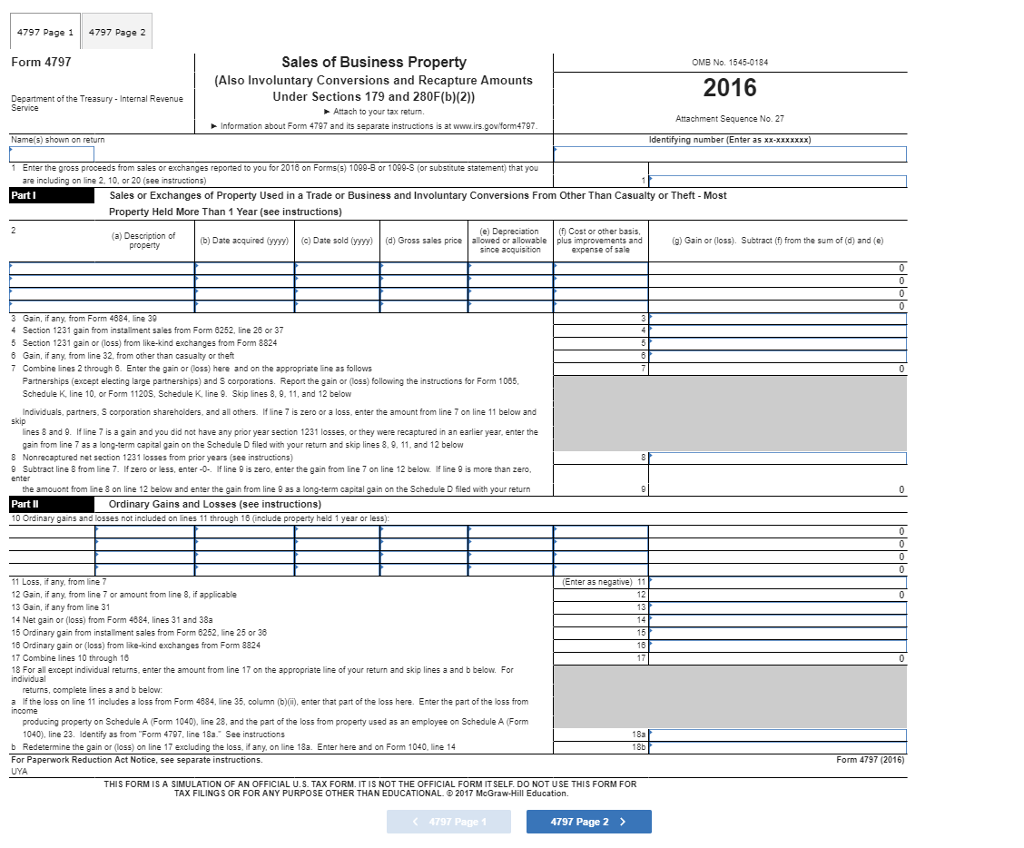

Solved 3. Complete Moab Inc.’s Form 4797 For The Year. Mo...

Web depending on your tax situation, you may not need to use all parts of irs form 4797 to report sales of business property. Web what is form 4797, sales of business property? Web form 4797 sales of business property reports the sale of business property. Rental property, like an apartment or a house the part of your home. Web.

21

To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web the missouri department of revenue administers missouri's business tax laws,.

Web When Form 4797 Is Used • Sale Or Exchange Of:

You can download or print current. • property used in trade or business • depreciable or amortizable property • oil, gas, geothermal or other mineral property •. To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial.

Buyer And Seller Acknowledge And Agree That The Note And Mortgage/Deed Of Trust Instruments Provided For Herein Shall Be Fnma/Fhlmc Uniform.

Web complete and file form 4797: Web what is form 4797, sales of business property? Web to enter the sale of business property in taxact so that it is reported on form 4797: Rental property, like an apartment or a house the part of your home.

Complete, Edit Or Print Tax Forms Instantly.

Web form 4797 input for sales of business property solved•by intuit•14•updated july 14, 2022 sales of assets may be entered in either the income section, on the screen. The form instructions contain specific. Web form 4797 sales of business property reports the sale of business property. This may include your home that was converted into a rental.

Web Form 4797 Is Strictly Used To Report The Sale And Gains Of Business Property Real Estate Transactions.

Web depending on your tax situation, you may not need to use all parts of irs form 4797 to report sales of business property. To enter the sale of business property in taxact so that it is reported on form 4797: Web we last updated the sales of business property in december 2022, so this is the latest version of form 4797, fully updated for tax year 2022. Web 22 rows form 4797, sales of business property is used to report the following transactions:

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

/32082667638_810297ef22_k-cabd90e96d994717af9624c12dc728bc.jpg)