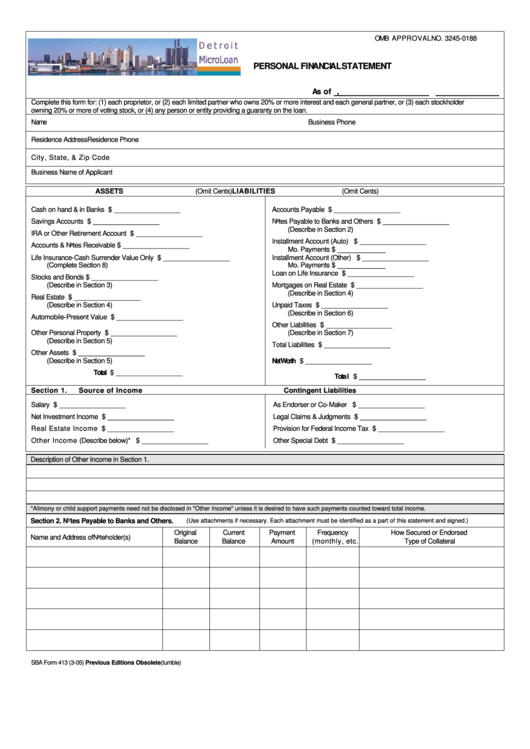

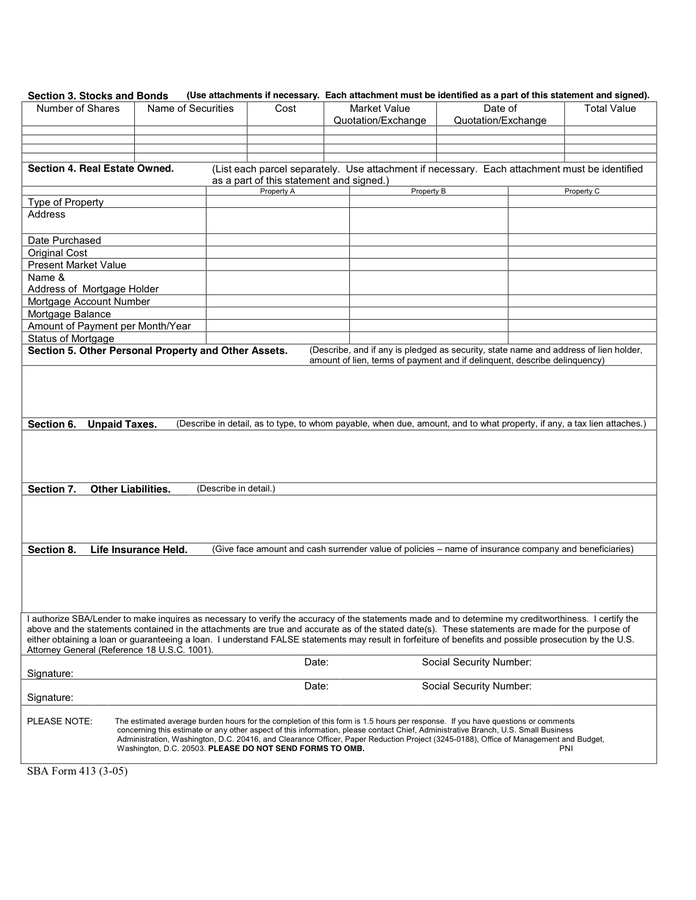

Sba Form 413 Personal Financial Statement

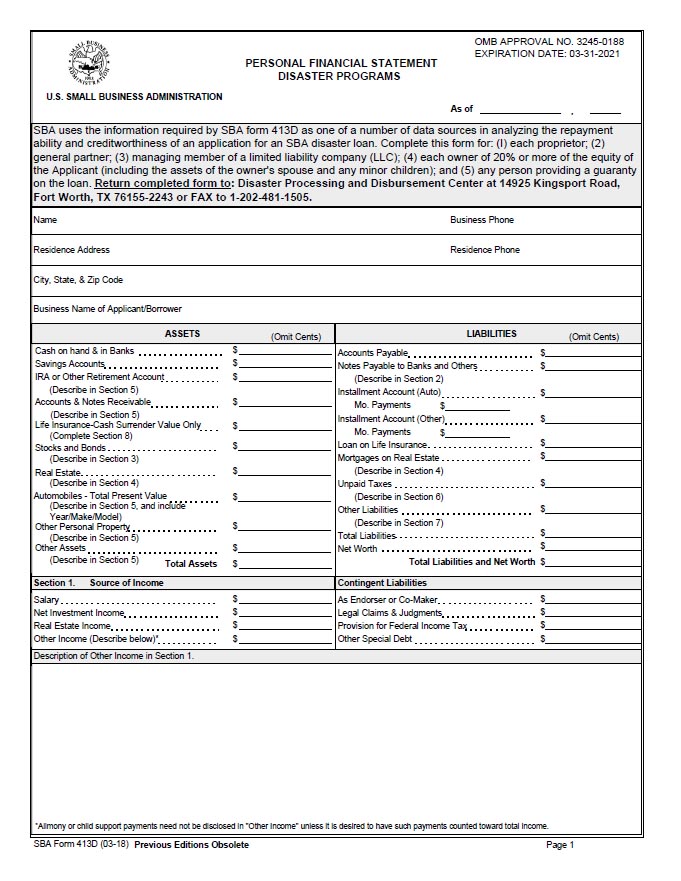

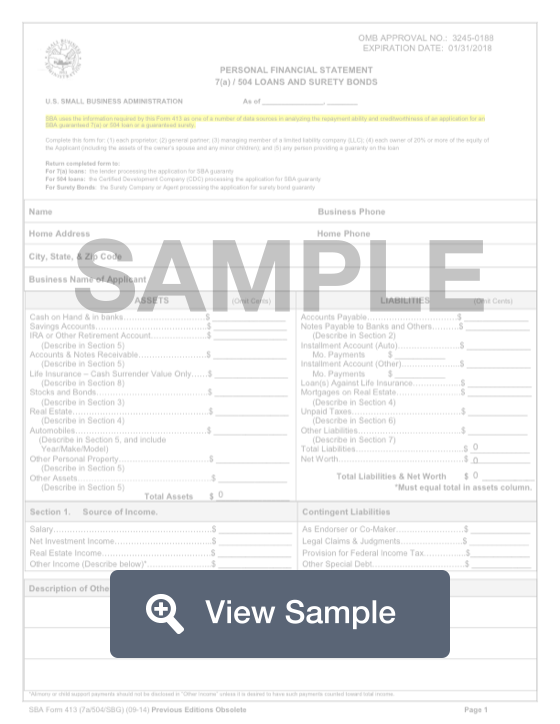

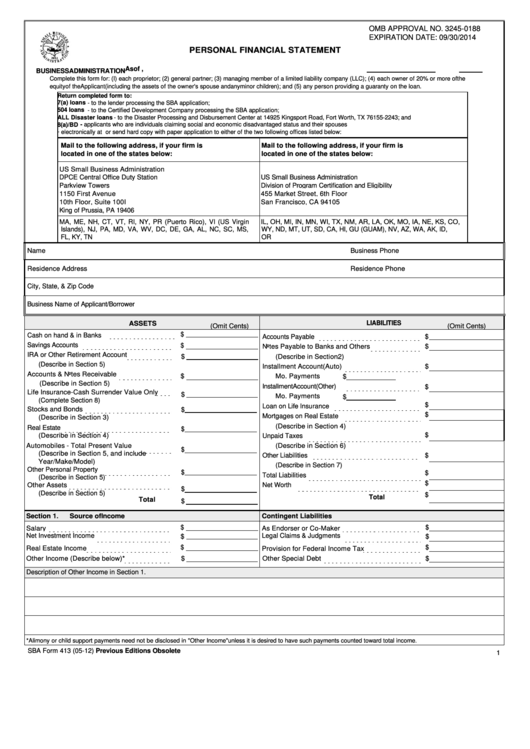

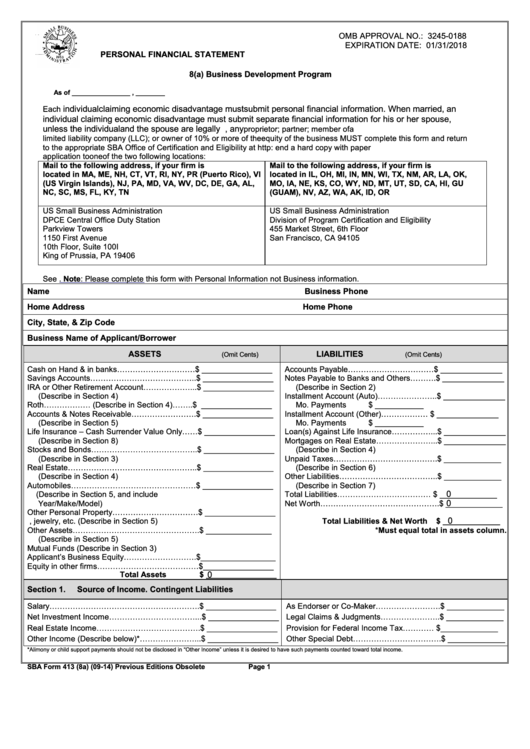

Sba Form 413 Personal Financial Statement - It is completed when a small business owner wants to apply for a loan or surety bond with the sba. Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Web also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. This form is used to assess repayment ability and creditworthiness of applicants for: Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the. It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. Web sba form 413 is a form used by the small business administration (sba).

It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business. It is also known as a personal financial statement. Why does the sba require form 413? Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Specifically, we’ll answer these questions and more: (1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g 20% or more of voting stock, or (4) any person. What is sba form 413? Web for personal finances, you must complete sba form 413 to apply for certain sba loans. Small business administration uses to assess the creditworthiness and repayment ability of its. Web sba form 413 is a form used by the small business administration (sba).

What is sba form 413? Web sba form 413, formally titled “personal financial statement,” is a document that the u.s. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. Web sba form 413 is a form used by the small business administration (sba). Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Web also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. It is completed when a small business owner wants to apply for a loan or surety bond with the sba. Small business administration uses to assess the creditworthiness and repayment ability of its.

SBA Loan Help Navajo Thaw Implementation Plan

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Web for personal.

SBA Form 413 Create & Download for Free PDF Word FormSwift

Web sba form 413 is a form used by the small business administration (sba). Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an.

Fill Free fillable SBA form 413 2014 PERSONAL FINANCIAL STATEMENT PDF

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. This form is used to assess repayment ability and creditworthiness of applicants for: Small business administration uses to assess the.

Sba Form 413 Personal Financial Statement printable pdf download

Web for personal finances, you must complete sba form 413 to apply for certain sba loans. Specifically, we’ll answer these questions and more: Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or,.

Sba 413 Balance Sheet Excel File Financial Statement Alayneabrahams

Specifically, we’ll answer these questions and more: What is sba form 413? It is also known as a personal financial statement. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond,.

SBA Form 413 Instructions YouTube

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. Web sba form 413, formally titled “personal financial statement,” is a document that the u.s. (1) each proprietor, or (2).

Fillable Sba Form 413 Personal Financial Statement U.s. Small

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Web sba form.

Sba Form 413 Personal Financial Statement printable pdf download

(1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g 20% or more of voting stock, or (4) any person. Web sba form 413, formally titled “personal financial statement,” is a document that the u.s. Sba lenders and surety companies/surety agents must begin to utilize.

Article

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the. (1) each proprietor, or (2) each limited partner who ow ns 20%.

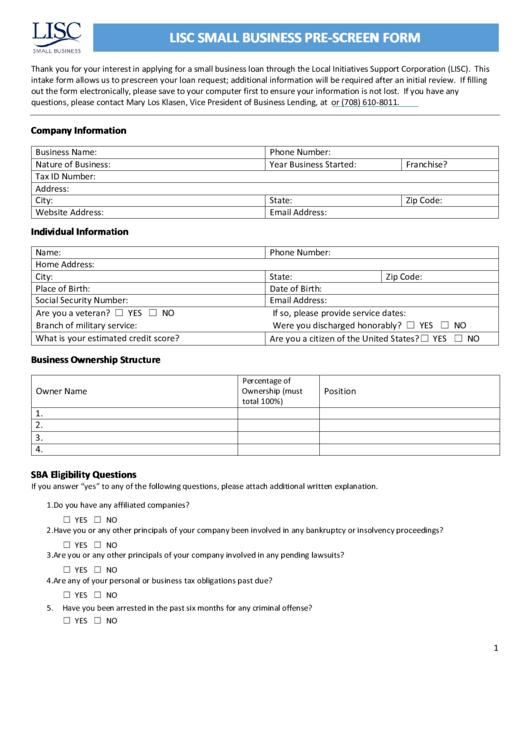

Sba Form 413 Personal Financial Statement, Lisc Small Business Pre

Web also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. This form is used to assess repayment ability and creditworthiness of applicants for: It is also known as a personal financial statement. Web sba uses the information required by this form 413 as one of a number of.

What Is Sba Form 413?

Web also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. Specifically, we’ll answer these questions and more: Small business administration uses to assess the creditworthiness and repayment ability of its. It is also known as a personal financial statement.

Web Sba Uses The Information Required By This Form 413 As One Of A Number Of Data Sources In Analyzing The Repayment Ability And Creditworthiness Of An Application For An Sba Guaranteed 7(A) Or 504 Loan Or, With Respect To A Surety Bond, To Assist In Recovery In The Event That The Contractor Defaults On The Contract.

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. Why does the sba require form 413? Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Web sba form 413, formally titled “personal financial statement,” is a document that the u.s.

Web For Personal Finances, You Must Complete Sba Form 413 To Apply For Certain Sba Loans.

(1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g 20% or more of voting stock, or (4) any person. Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the. It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business.

This Form Is Used To Assess Repayment Ability And Creditworthiness Of Applicants For:

Web sba form 413 is a form used by the small business administration (sba). It is completed when a small business owner wants to apply for a loan or surety bond with the sba.