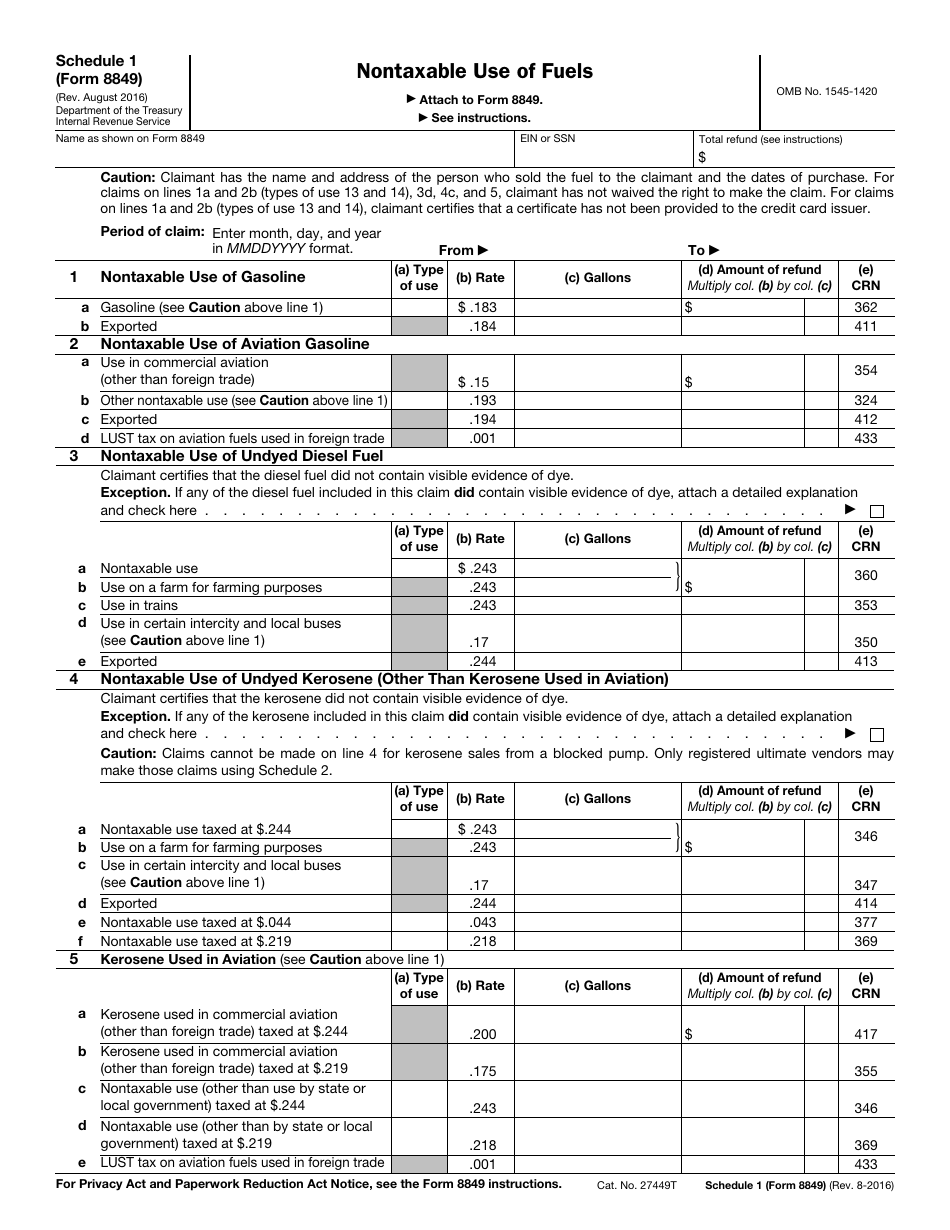

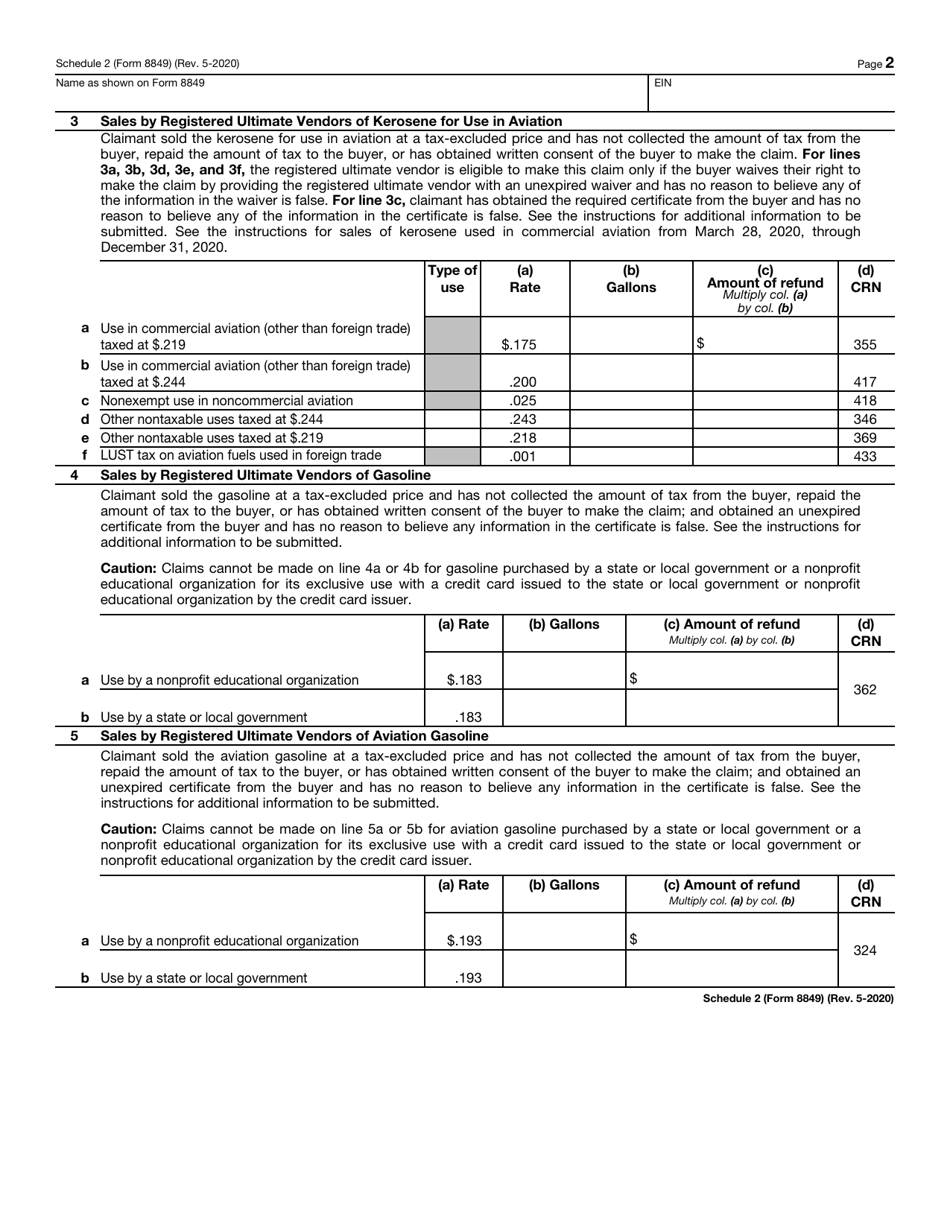

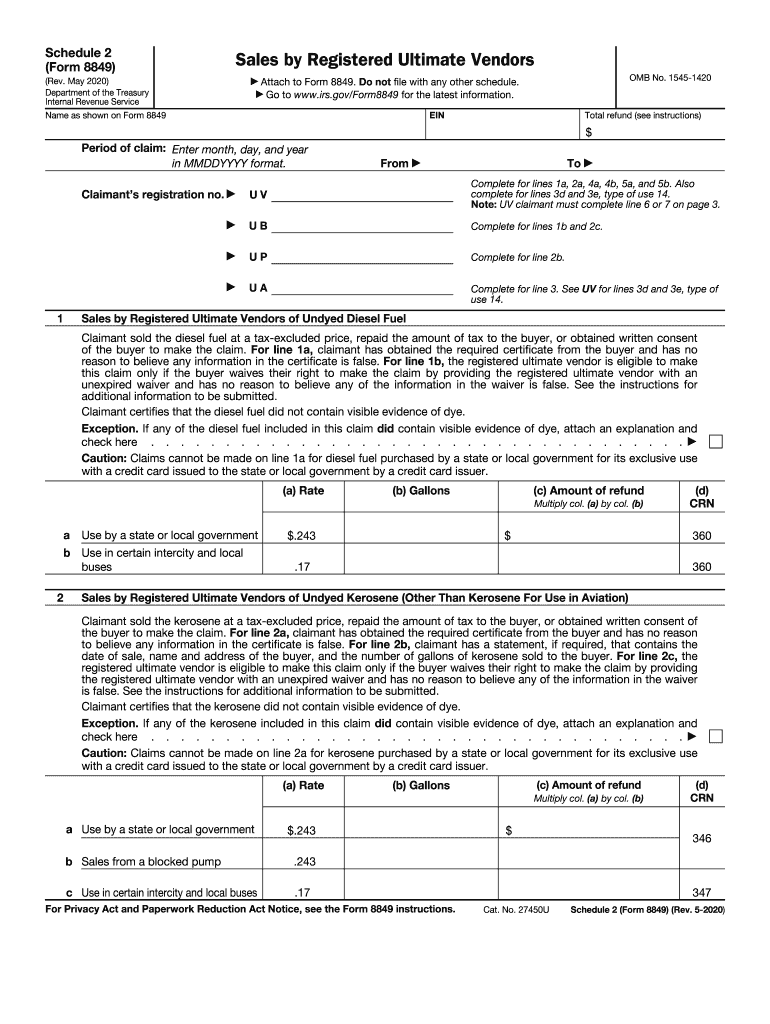

Schedule 2 Form 8849

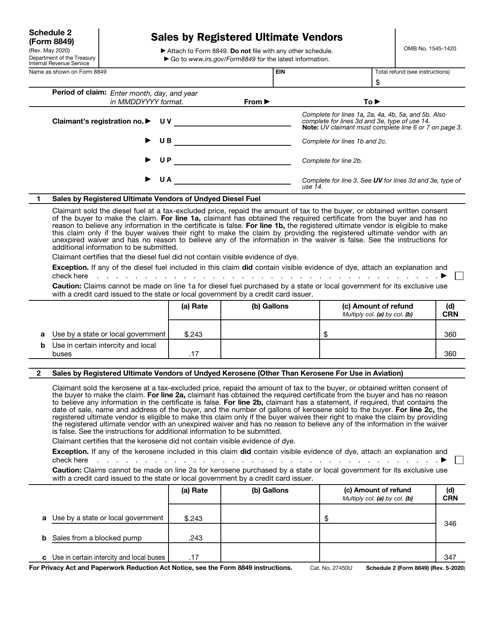

Schedule 2 Form 8849 - Web what are the different schedules of form 8849? Claimants are now allowed to file a claim for nontaxable use of fuels (schedule 1) for any quarter of their income tax year. Edit your form 8849 schedule 2 online. Web get your form 8849 (schedule 2) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately 1. Sales by registered ultimate vendors. Form 8849 schedule 3 certain fuel mixtures and the alternative fuel credit. December 2020) department of the treasury internal revenue service. All other form 8849 schedules. Web form 8849 schedule 2 is used for refunds by vendors, specifically ones that sell “undyed diesel fuel, undyed kerosene, kerosene sold for use in aviation, gasoline, or aviation. Web form 8849 schedule 2 sales by registered ultimate vendors.

Don’t file with any other. You can also download it, export it or print it out. Uv ub up ua 4321451598uv 4321451598ub 4321451598up. Web form 8849 schedule 2 is used for refunds by vendors, specifically ones that sell “undyed diesel fuel, undyed kerosene, kerosene sold for use in aviation, gasoline, or aviation. Web send form 8849 schedule 2 via email, link, or fax. To claim refunds on nontaxable use of fuels schedule 2: Save or instantly send your ready documents. May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. Web schedule 2 form 8849 use a form 8849 schedule 2 fillable template to make your document workflow more streamlined. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit.

You can also download it, export it or print it out. Sales by registered ultimate vendors. May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. Save or instantly send your ready. Easily fill out pdf blank, edit, and sign them. Web schedule 1 (form 8849) (rev. Web schedule 2 (form 8849) (rev. Web schedule 2 form 8849 use a form 8849 schedule 2 fillable template to make your document workflow more streamlined. To claim refunds on nontaxable use of fuels schedule 2: Web about schedule 2 (form 8849), sales by registered ultimate.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Don’t file with any other. Easily fill out pdf blank, edit, and sign them. Web send form 8849 schedule 2 via email, link, or fax. Easily fill out pdf blank, edit, and sign them. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and.

Fill Free fillable FOrm 8849 schedule 1 Nontaxable Use of Fuels 2016

Save or instantly send your ready. For amending sales by registered. Save or instantly send your ready documents. Don’t file with any other. Easily fill out pdf blank, edit, and sign them.

IRS Form 8849 Schedule 1 Download Fillable PDF or Fill Online

Web where to file • for schedules 1 and 6, send form 8849 to: May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. To claim refunds on nontaxable use of fuels schedule 2: Sales by registered ultimate vendors. Dec 9, 2020 — information about schedule 2 (form 8849), sales by registered ultimate.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Uv ub up ua 4321451598uv 4321451598ub 4321451598up. Web schedule 2 (form 8849), sales by registered ultimate vendors (rev. Save or instantly send your ready. Type text, add images, blackout. To claim refunds on nontaxable use of fuels schedule 2:

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web schedule 1 (form 8849) (rev. Web send form 8849 schedule 2 via email, link, or fax. Save or instantly send your ready. Web schedule 2 (form 8849), sales by registered ultimate vendors (rev. For amending sales by registered.

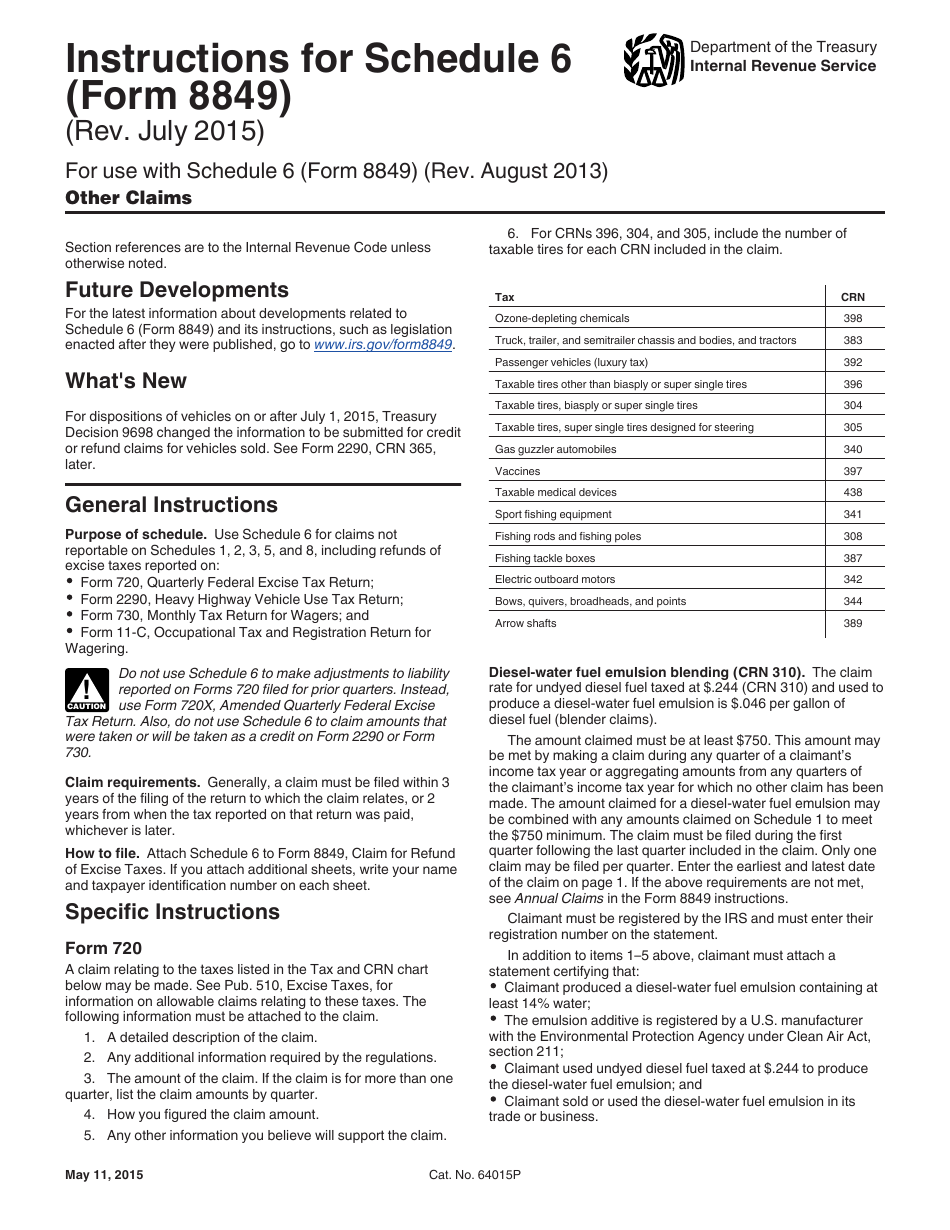

Download Instructions for IRS Form 8849 Schedule 6 Other Claims PDF

Sales by registered ultimate vendors. Web schedule 2 (form 8849) (rev. Web schedule 1 (form 8849) (rev. Web where to file • for schedules 1 and 6, send form 8849 to: Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel.

8849 Schedule 2 Form Fill Out and Sign Printable PDF Template signNow

December 2020) department of the treasury internal revenue service. Web schedule 2 form 8849 use a form 8849 schedule 2 fillable template to make your document workflow more streamlined. Edit your form 8849 schedule 2 online. Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate schedule form. All other.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

To claim refunds on nontaxable use of fuels schedule 2: Easily fill out pdf blank, edit, and sign them. Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. Web complete 8849 schedule 2 form online with us legal forms. Web schedule 2 (form 8849) (rev.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Save or instantly send your ready. Uv ub up ua 4321451598uv 4321451598ub 4321451598up. Type text, add images, blackout. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit. Web schedule 2 form 8849 use a form 8849 schedule 2 fillable.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Easily fill out pdf blank, edit, and sign them. Web schedule 2 form 8849 use a form 8849 schedule 2 fillable template to make your document workflow more streamlined. Web schedule 2 (form 8849) (rev. Form 8849 schedule 3 certain fuel mixtures and the alternative fuel credit. Save or instantly send your ready.

December 2020) Department Of The Treasury Internal Revenue Service.

The fillable 8849 form allows you. Don’t file with any other. Dec 9, 2020 — information about schedule 2 (form 8849), sales by registered ultimate vendors, including recent. Web about schedule 2 (form 8849), sales by registered ultimate.

Web Schedule 1 (Form 8849) (Rev.

Uv ub up ua 4321451598uv 4321451598ub 4321451598up. Form 8849 schedule 3 certain fuel mixtures and the alternative fuel credit. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit. Web we last updated the sales by registered ultimate vendors in february 2023, so this is the latest version of 8849 (schedule 2), fully updated for tax year 2022.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web form 8849 schedule 2 is used for refunds by vendors, specifically ones that sell “undyed diesel fuel, undyed kerosene, kerosene sold for use in aviation, gasoline, or aviation. May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. To claim refunds on nontaxable use of fuels schedule 2: Claimants are now allowed to file a claim for nontaxable use of fuels (schedule 1) for any quarter of their income tax year.

Type Text, Add Images, Blackout.

Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate schedule form. You can also download it, export it or print it out. Web schedule 2 (form 8849) (rev. Form 8849 schedule 5 section.