Shopify 1099 Form

Shopify 1099 Form - Although tax laws and regulations are complex and can. Web however, you will usually need the following forms: Web the 1099 form is used to report income from your shopify business to the irs. Ad customize your store with our website builder. Web the 1099 filing deadline is january 31 of the subsequent calendar year. No.1 ecommerce platform for all businesses. Ad customize your store with our website builder. As a seller, you might need to charge taxes on your sales, and then report and remit those taxes to your government. Yes, shopify does give you a 1099. In the shopify payments section, click manage.

No.1 ecommerce platform for all businesses. The minimum threshold implies that if any business entity has paid. Web the 1099 filing deadline is january 31 of the subsequent calendar year. As a seller, you might need to charge taxes on your sales, and then report and remit those taxes to your government. For calendar years prior to (and. Click the links in each step for more details. There are a few things to keep in mind when getting your 1099 form from shopify:. Ad customize your store with our website builder. Web you’ll also receive a copy of the shopify 1099, and you’ll need to hang on to this for tax filing. Web shopify blog get to know the 1099 tax form:

For calendar years prior to (and. Start, run + grow your business with shopify® Web you’ll also receive a copy of the shopify 1099, and you’ll need to hang on to this for tax filing. We’ll walk you through the 1099k 2022 process, including how to get tax info from. Although tax laws and regulations are complex and can. Web shopify blog get to know the 1099 tax form: Ad customize your store with our website builder. There isn't a formal list of steps to set up your taxes, but you can use the following process as a guide. Web prohibited businesses some types of businesses and services are not permitted to use shopify payments. As a seller, you might need to charge taxes on your sales, and then report and remit those taxes to your government.

How To File Form 1099NEC For Contractors You Employ VacationLord

On this page determine your tax liability register for taxes set up your. Submit your questions by april 23 for our ama with klaviyo: Click the links in each step for more details. Trusted by millions of businesses. Web you will receive form 1099 from shopify depending on whether you have carried your business via shopify.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Ad customize your store with our website builder. The minimum threshold implies that if any business entity has paid. Guidance for business owners by shopify. Web you will receive form 1099 from shopify depending on whether you have carried your business via shopify. 200 separate payments for goods or services in a calendar year, and.

Formulario 1099K Definición de transacciones de red de terceros y

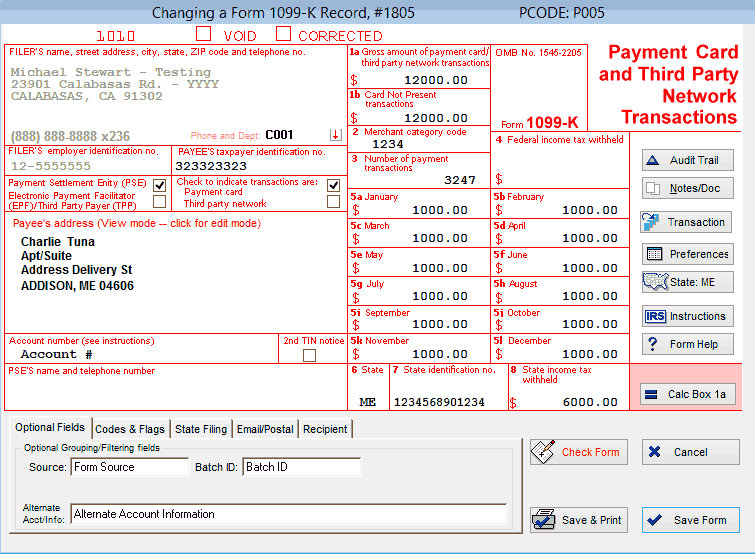

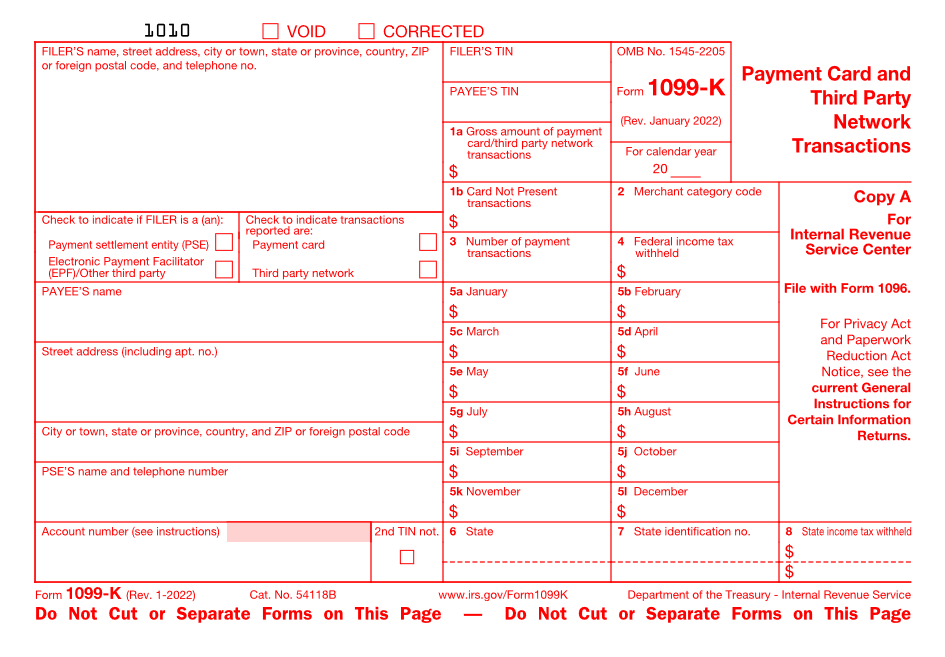

Web the 1099 filing deadline is january 31 of the subsequent calendar year. Desktop iphone android from your shopify admin, go to settings > payments. We’ll walk you through the 1099k 2022 process, including how to get tax info from. Web you’ll also receive a copy of the shopify 1099, and you’ll need to hang on to this for tax.

How I had my first QUARTER MILLION Dollar Year! Follow

Although tax laws and regulations are complex and can. Form 1040 for income tax returns schedule c if you are a sole proprietor and have income or losses to report. Ad customize your store with our website builder. Start, run + grow your business with shopify® Under payout schedule in the payout.

Finding And FilIng Your Shopify 1099K Made Easy

As a seller, you might need to charge taxes on your sales, and then report and remit those taxes to your government. Web the 1099 form is used to report income from your shopify business to the irs. Under payout schedule in the payout. The minimum threshold implies that if any business entity has paid. Yes, shopify does give you.

What Is an IRS 1099 Form? Purpose and How To File (2023)

In the shopify payments section, click manage. No.1 ecommerce platform for all businesses. Web shopify blog get to know the 1099 tax form: Yes, shopify does give you a 1099. Ad customize your store with our website builder.

Do You Need A Business License to Sell on Shopify?

Income earned in 2022, for instance, is reported on a 1099 due on january 31, 2023. Click the links in each step for more details. Ad customize your store with our website builder. Trusted by millions of businesses. There isn't a formal list of steps to set up your taxes, but you can use the following process as a guide.

New Tax Reporting for Online Sales 1099K Inforest Communications

Although tax laws and regulations are complex and can. 200 separate payments for goods or services in a calendar year, and. For calendar years prior to (and. Start, run + grow your business with shopify® Web you’ll also receive a copy of the shopify 1099, and you’ll need to hang on to this for tax filing.

Are You Ready for New 1099K Rules? CPA Practice Advisor

Form 1040 for income tax returns schedule c if you are a sole proprietor and have income or losses to report. There isn't a formal list of steps to set up your taxes, but you can use the following process as a guide. For calendar years prior to (and. Trusted by millions of businesses. 200 separate payments for goods or.

How To Get My 1099 Form From Postmates Paul Johnson's Templates

Trusted by millions of businesses. 200 separate payments for goods or services in a calendar year, and. We’ll walk you through the 1099k 2022 process, including how to get tax info from. If you are seeking your 1099 on shopify, you should be. Web prohibited businesses some types of businesses and services are not permitted to use shopify payments.

Ad Customize Your Store With Our Website Builder.

As a seller, you might need to charge taxes on your sales, and then report and remit those taxes to your government. Under payout schedule in the payout. We’ll walk you through the 1099k 2022 process, including how to get tax info from. If you are seeking your 1099 on shopify, you should be.

Start, Run + Grow Your Business With Shopify®

Desktop iphone android from your shopify admin, go to settings > payments. The minimum threshold implies that if any business entity has paid. Start, run + grow your business with shopify® Web you will receive form 1099 from shopify depending on whether you have carried your business via shopify.

Web Prohibited Businesses Some Types Of Businesses And Services Are Not Permitted To Use Shopify Payments.

Click the links in each step for more details. To see whether you can use shopify payments, check the list of. There are a few things to keep in mind when getting your 1099 form from shopify:. No.1 ecommerce platform for all businesses.

In The Shopify Payments Section, Click Manage.

Income earned in 2022, for instance, is reported on a 1099 due on january 31, 2023. Trusted by millions of businesses. For calendar years prior to (and. Submit your questions by april 23 for our ama with klaviyo:

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)