Shopify 1099K Form

Shopify 1099K Form - You might need to register your business with your local or federal tax authority to handle your sales tax. Web shopify doesn’t file or remit your sales taxes for you. Retail and point of sale. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. When you receive this form, you need. You’ll also want to find an accounting. This form will detail the total revenue you brought in with. Web click on “view payouts” under shopify payments. After you know where you're liable for tax, you can configure your.

This form will show how much total revenue you. You’ll also want to find an accounting. You might need to register your business with your local or federal tax authority to handle your sales tax. Web click on “view payouts” under shopify payments. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. When you sell something using shopify, this gets recorded on your shopify. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. This form will detail the total revenue you brought in with. When you receive this form, you need. Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify.

Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. Web shopify translate & adapt. This form will show how much total revenue you. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. You might need to register your business with your local or federal tax authority to handle your sales tax. You’ll also want to find an accounting. After you know where you're liable for tax, you can configure your. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. When you sell something using shopify, this gets recorded on your shopify. Retail and point of sale.

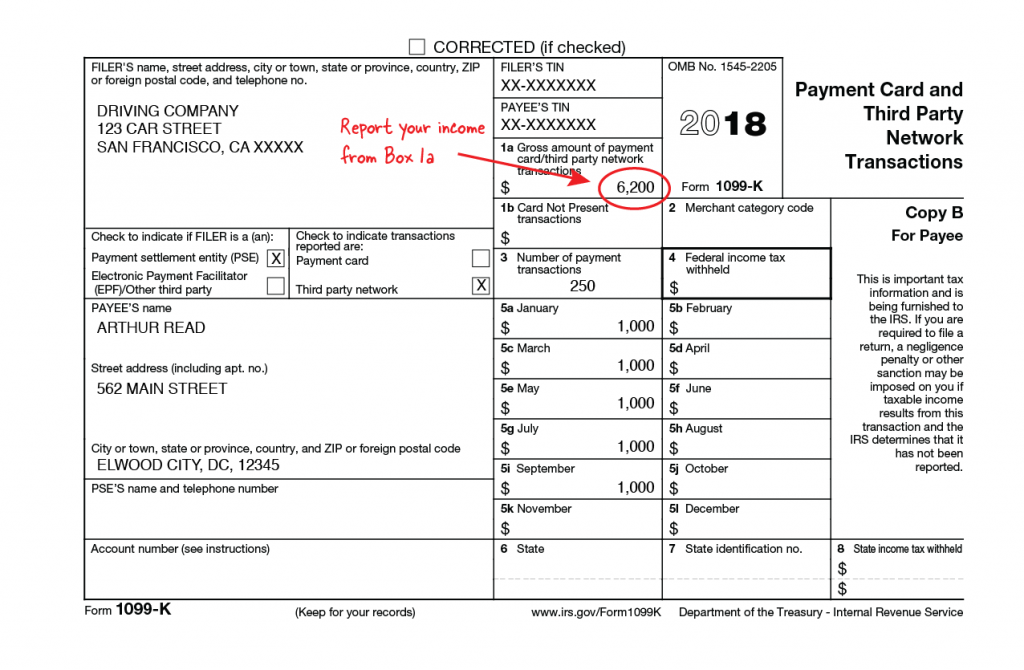

What Is A 1099K? — Stride Blog

After you know where you're liable for tax, you can configure your. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web shopify doesn’t file or remit your sales taxes for you. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. Web.

Finding And FilIng Your Shopify 1099K Made Easy

You’ll also want to find an accounting. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. For calendar years prior to (and. Retail and point of sale. You might need to register your business with your local or federal tax authority to handle your sales tax.

Understanding Your Form 1099K FAQs for Merchants Clearent

Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. Web shopify doesn’t file or remit your sales taxes for you. You’ll also want to find an accounting. This form will detail the total revenue you brought in with. After you know where you're liable for tax, you can configure your.

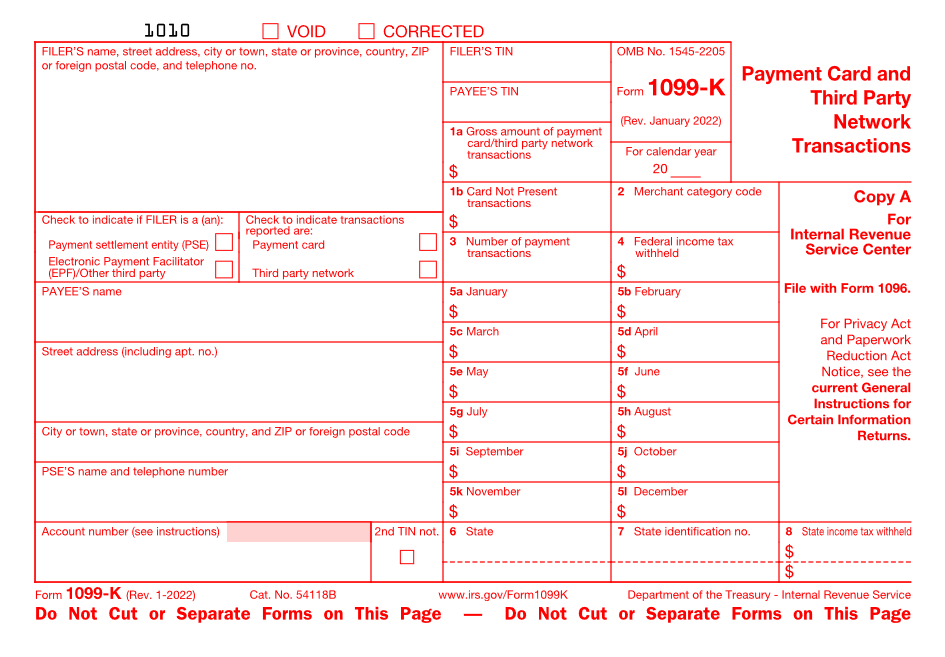

1099 K Form 2020 Blank Sample to Fill out Online in PDF

The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. This form will detail the total revenue you brought in with. You’ll also want to find an accounting. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. This.

Solved 1099k doesn’t include PayPal transactions Shopify Community

Web shopify translate & adapt. This form will show how much total revenue you. When you receive this form, you need. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. Web 1099 k forms.

Are You Ready for New 1099K Rules? CPA Practice Advisor

When you receive this form, you need. When you sell something using shopify, this gets recorded on your shopify. Web shopify doesn’t file or remit your sales taxes for you. Retail and point of sale. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,.

Formulario 1099K Definición de transacciones de red de terceros y

After you know where you're liable for tax, you can configure your. For calendar years prior to (and. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. Retail and point of sale. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using.

New Tax Reporting for Online Sales 1099K Inforest Communications

You might need to register your business with your local or federal tax authority to handle your sales tax. When you sell something using shopify, this gets recorded on your shopify. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. For calendar years prior to (and. Web 1099 k forms.

How To Get 1099 K From Coinbase Ethel Hernandez's Templates

Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. This form will show how much total revenue you. When you sell something using shopify, this gets recorded on your shopify. This form will detail the total revenue you brought in with. The shopfy issued 1099 k for 2018, as if.

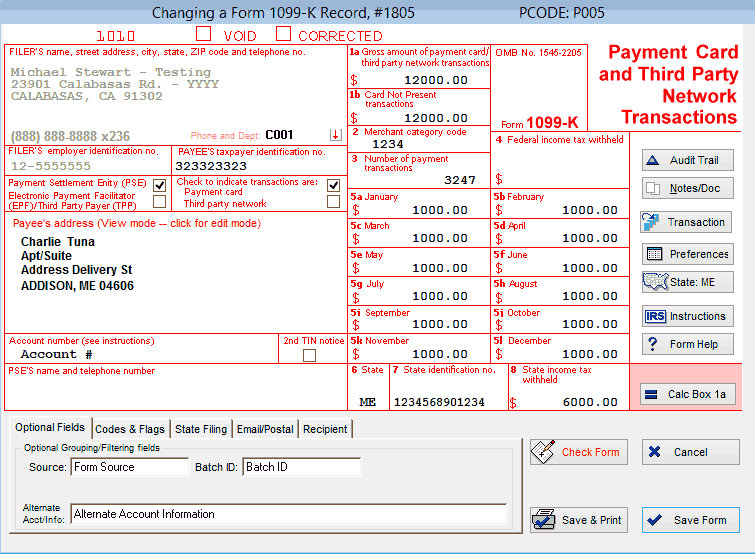

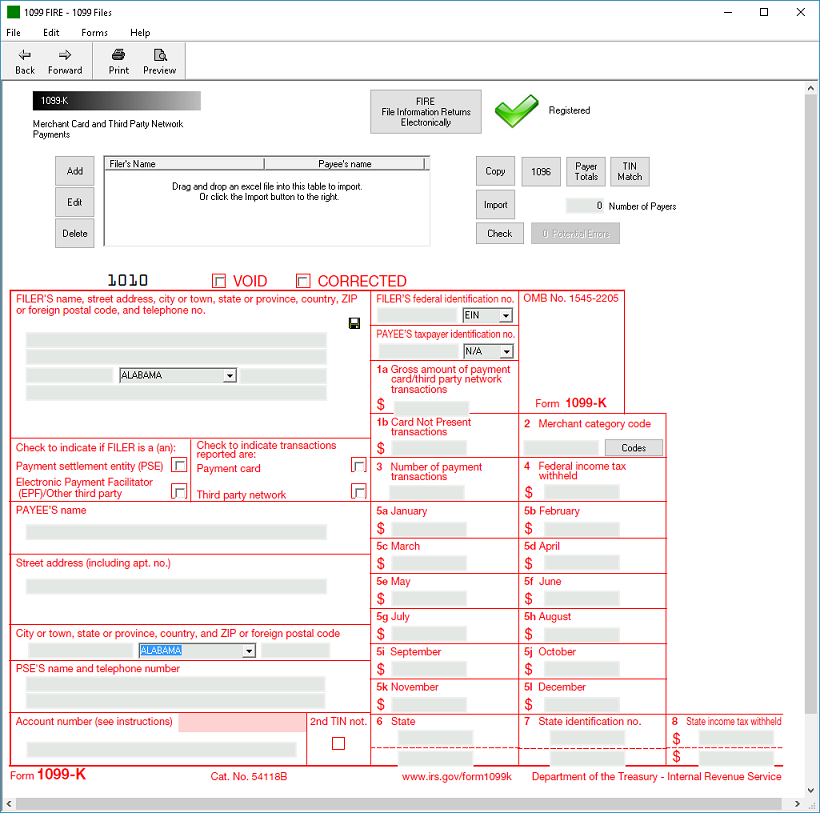

IRS Form 1099K Software 79 print, 289 eFile 1099K Software

You might need to register your business with your local or federal tax authority to handle your sales tax. After you know where you're liable for tax, you can configure your. Web shopify doesn’t file or remit your sales taxes for you. When you sell something using shopify, this gets recorded on your shopify. When you receive this form, you.

This Form Will Detail The Total Revenue You Brought In With.

When you receive this form, you need. Web 1099 k forms. Web shopify doesn’t file or remit your sales taxes for you. 200 separate payments for goods or services in a calendar year, and $20,000 usd in.

Retail And Point Of Sale.

Web shopify translate & adapt. You might need to register your business with your local or federal tax authority to handle your sales tax. After you know where you're liable for tax, you can configure your. When you sell something using shopify, this gets recorded on your shopify.

For Calendar Years Prior To (And.

This form will show how much total revenue you. You’ll also want to find an accounting. Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes.

Web Click On “View Payouts” Under Shopify Payments.

The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,.