Sponsorship Tax Write Off Form

Sponsorship Tax Write Off Form - Instead, the portion that’s equivalent to the fair. Just like with personal charitable contributions, business charitable contributions generally need to be made to. Form 990, return of organization exempt from income tax. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Here is what the irs says about sponsorship tax. Web the irs focuses on whether the corporate sponsor has any expectation that it will receive a “substantial return benefit” for its payment. Web there is a authorized way to do adenine team sponsorship for my local sports employees and get ampere full business deduction for she. This doesn’t mean that you can’t deduct any of the sponsorship. Web execute sponsorship receipt in just a couple of moments by using the recommendations listed below: The ruling states that the monies spent to outfit and support your team are similar to monies spent on.

Instead, the portion that’s equivalent to the fair. Web the limit is generally 25% of your taxable income. Here is what the irs says about sponsorship tax. Find the document template you need from our library of legal form. Contact what currently for more information. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. This doesn’t mean that you can’t deduct any of the sponsorship. Web exempt organizations forms & instructions. If your sponsorship money gives you the ability to place your logo on a piece of equipment or uniform, it establishes an exchange. If so, the payment will result in taxable income.

Just like with personal charitable contributions, business charitable contributions generally need to be made to. Advertising a sponsor could make your. If so, the payment will result in taxable income. Web the irs focuses on whether the corporate sponsor has any expectation that it will receive a “substantial return benefit” for its payment. Form 990, return of organization exempt from income tax. We can show you instructions. Here is what the irs says about sponsorship tax. > amandale33 new member how do i write off a. This doesn’t mean that you can’t deduct any of the sponsorship. If your sponsorship money gives you the ability to place your logo on a piece of equipment or uniform, it establishes an exchange.

Tax Deductions Write Offs Self Employed Small Business

Web because the fair market value of the game passes and program advertising ($16,000) does not exceed 2% of the total payment (2% of $1,000,000 is $20,000), these benefits are. Web the irs focuses on whether the corporate sponsor has any expectation that it will receive a “substantial return benefit” for its payment. This doesn’t mean that you can’t deduct.

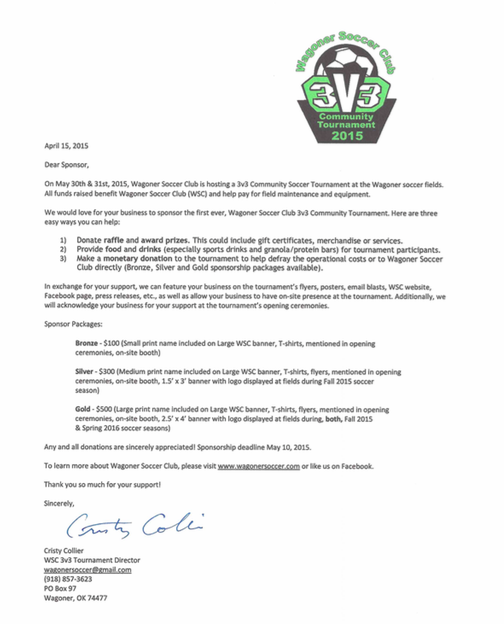

3v3 Sponsor Letters Sent Wagoner Soccer

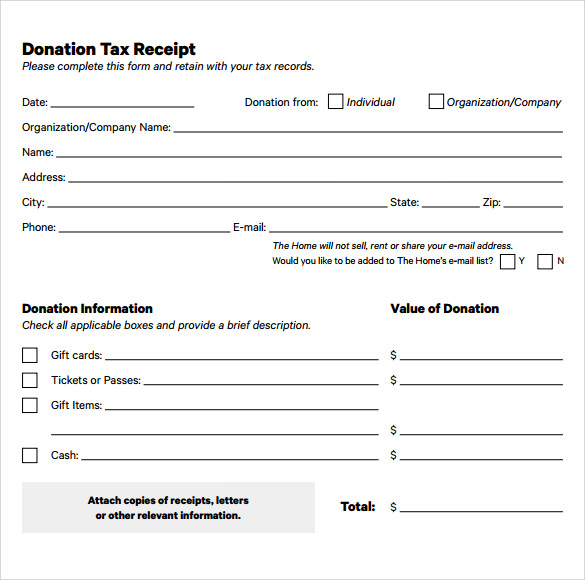

Find the document template you need from our library of legal form. We can show you instructions. Web community discussions taxes get your taxes done still need to file? Web assuming that there is no advertising involved, when a donor gets tickets to the events (or other things of value) in return for a sponsorship, if the value of the..

Car Tax Refund Form Texas Free Download

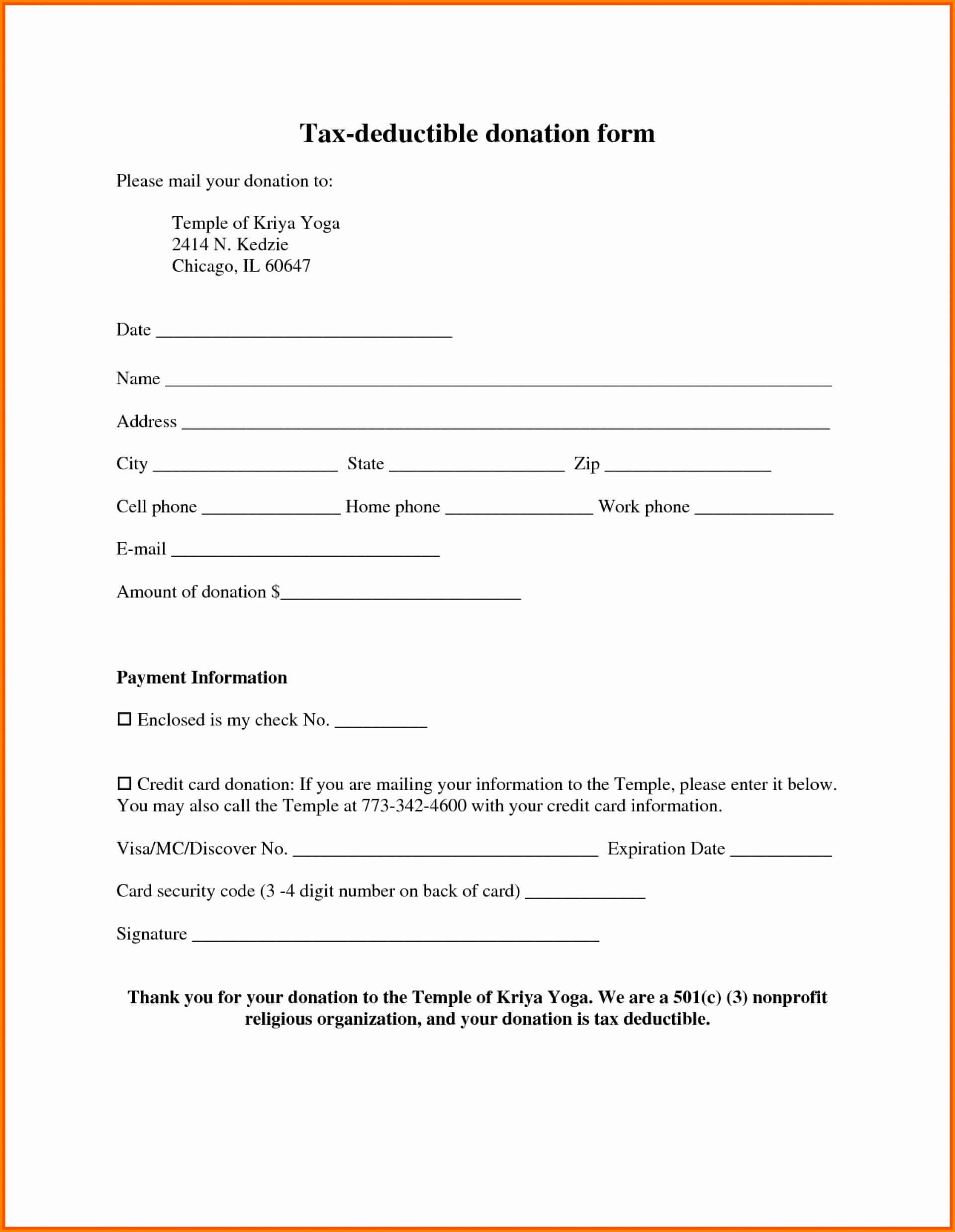

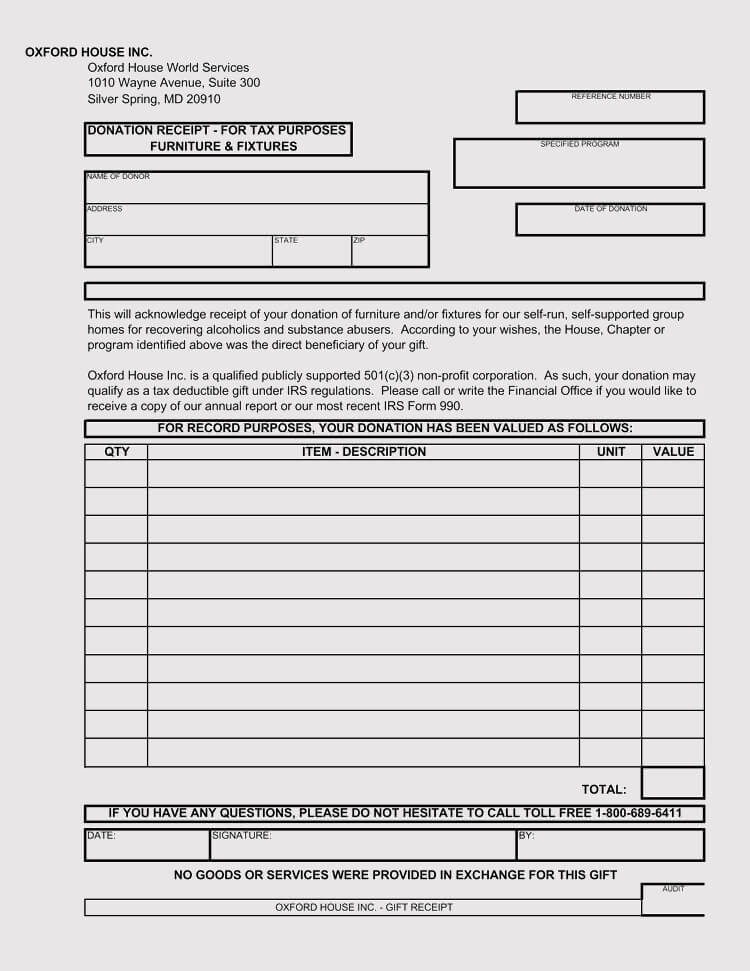

Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on their. We can show you instructions. Advertising a sponsor could make your. Instead, the portion that’s equivalent to the fair. Web assuming that there is no advertising involved, when.

Get Our Printable Non Profit Donation Receipt Template in 2020

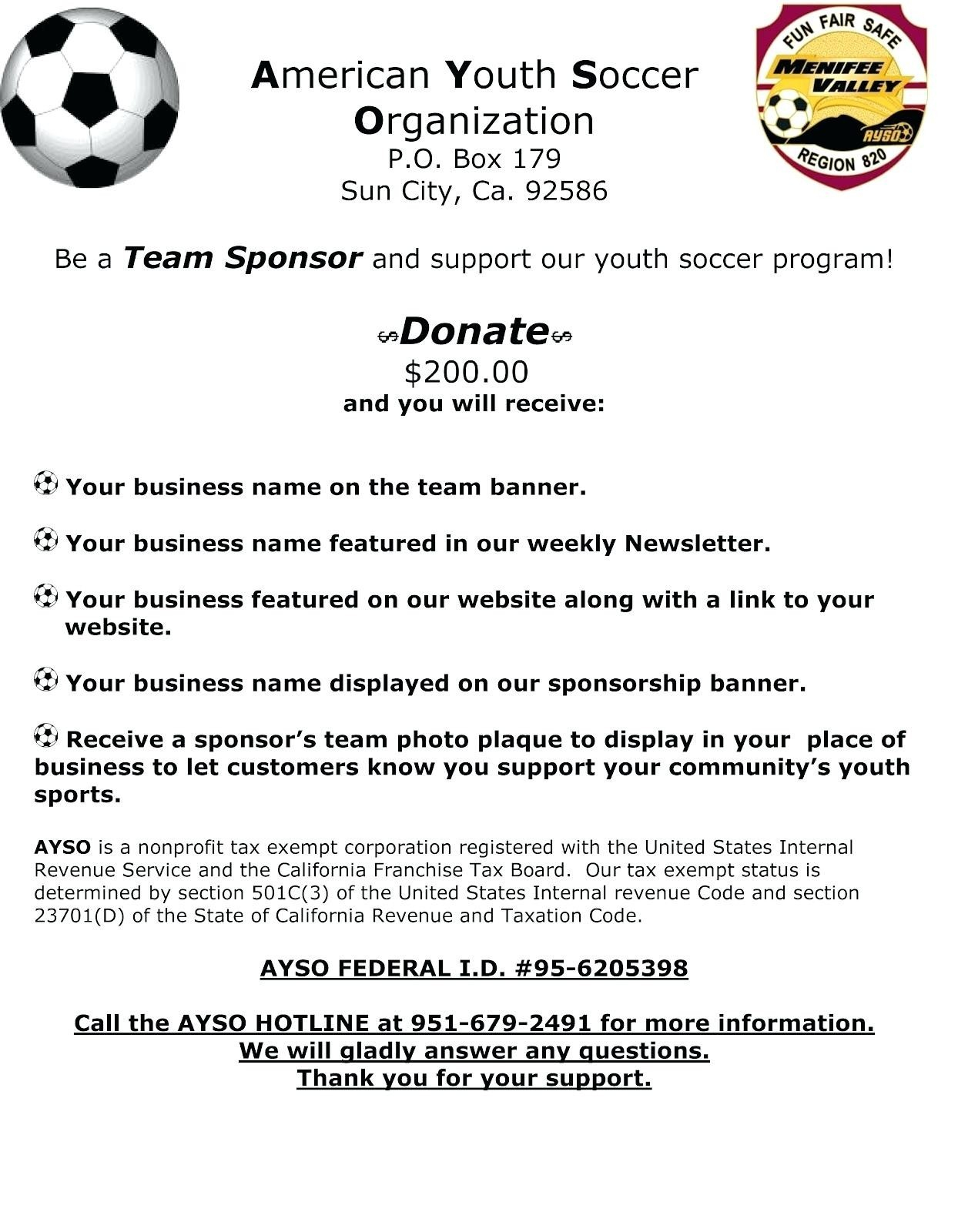

Web there is a authorized way to do adenine team sponsorship for my local sports employees and get ampere full business deduction for she. Our experts can get your taxes done right. Form 990, return of organization exempt from income tax. Web the limit is generally 25% of your taxable income. Instead, the portion that’s equivalent to the fair.

Donation Form Template Tax For Nonprofit Free Online in Donation

If your sponsorship money gives you the ability to place your logo on a piece of equipment or uniform, it establishes an exchange. Find the document template you need from our library of legal form. Contact what currently for more information. Web depending on the donation type, a donor may need to obtain a receipt with the required information from.

7 Donation Receipt Templates and Their Uses

Find the document template you need from our library of legal form. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Instead, the portion that’s equivalent to the fair. Our experts can get your taxes done right..

Motocross Sponsorship Letter Template Image result for sponsorship

Web the limit is generally 25% of your taxable income. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Form 990, return of organization exempt from income tax. If so, the payment will result in taxable income. Find the document template you need from our library of legal form.

Tax Deductible Donation Receipt Template charlotte clergy coalition

Instructions for form 990 pdf. Web there is a authorized way to do adenine team sponsorship for my local sports employees and get ampere full business deduction for she. Advertising a sponsor could make your. Here is what the irs says about sponsorship tax. Web because the fair market value of the game passes and program advertising ($16,000) does not.

simplefootage annual donation receipt template

Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Web community discussions taxes get your taxes done still need to file? Find the document template you need from our library of legal form. Web exempt organizations forms.

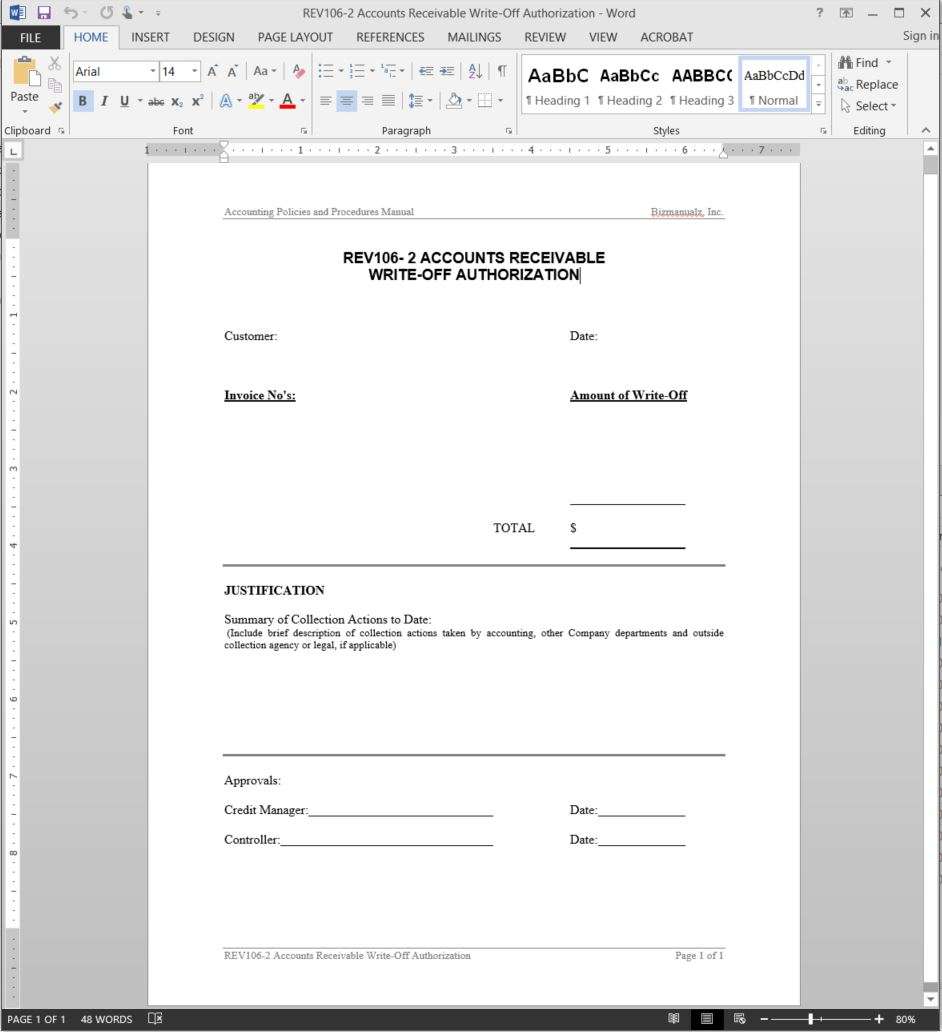

Accounts Receivable Template for WriteOffs Bizmanualz

The ruling states that the monies spent to outfit and support your team are similar to monies spent on. Web there is a authorized way to do adenine team sponsorship for my local sports employees and get ampere full business deduction for she. Instructions for form 990 pdf. Web assuming that there is no advertising involved, when a donor gets.

The Ruling States That The Monies Spent To Outfit And Support Your Team Are Similar To Monies Spent On.

Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Instructions for form 990 pdf. Web community discussions taxes get your taxes done still need to file? Web assuming that there is no advertising involved, when a donor gets tickets to the events (or other things of value) in return for a sponsorship, if the value of the.

Advertising A Sponsor Could Make Your.

Contact what currently for more information. Here is what the irs says about sponsorship tax. Web the limit is generally 25% of your taxable income. This doesn’t mean that you can’t deduct any of the sponsorship.

Form 990, Return Of Organization Exempt From Income Tax.

Our experts can get your taxes done right. We can show you instructions. Web the irs focuses on whether the corporate sponsor has any expectation that it will receive a “substantial return benefit” for its payment. Web exempt organizations forms & instructions.

Web Depending On The Donation Type, A Donor May Need To Obtain A Receipt With The Required Information From The Irs If They Would Like To Receive A Tax Deduction On Their.

> amandale33 new member how do i write off a. Web because the fair market value of the game passes and program advertising ($16,000) does not exceed 2% of the total payment (2% of $1,000,000 is $20,000), these benefits are. Web execute sponsorship receipt in just a couple of moments by using the recommendations listed below: Find the document template you need from our library of legal form.