Ssa Withholding Form

Ssa Withholding Form - You can print other federal tax forms here. Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits. Use this form to ask payers to withhold federal income tax from certain government payments. Efile your federal tax return now Please answer the following questions as completely as you can. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. Web request to withhold taxes. Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses.

Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Follow the country’s practice for entering the postal code. Web application for a social security card. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Possessions, enter on line 3 the city, province or state, and name of the country. Authorization to disclose information to the social security administration. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. Please answer the following questions as completely as you can. Efile your federal tax return now If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits.

If your address is outside the united states or the u.s. In some areas, you may request a replacement social security card online. Possessions, enter on line 3 the city, province or state, and name of the country. See withholding income tax from your social security benefits for more information. Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses. You can print other federal tax forms here. Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Web request to withhold taxes. Please answer the following questions as completely as you can.

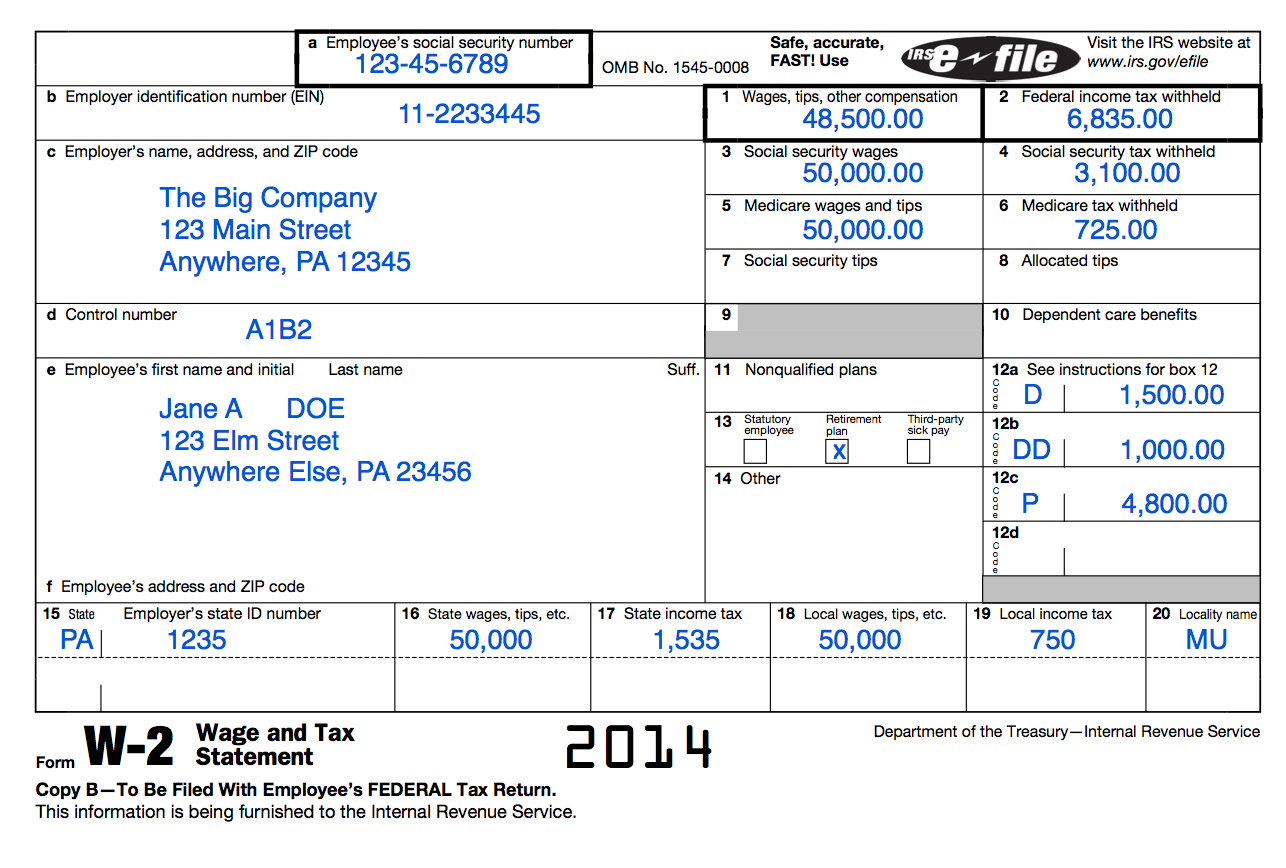

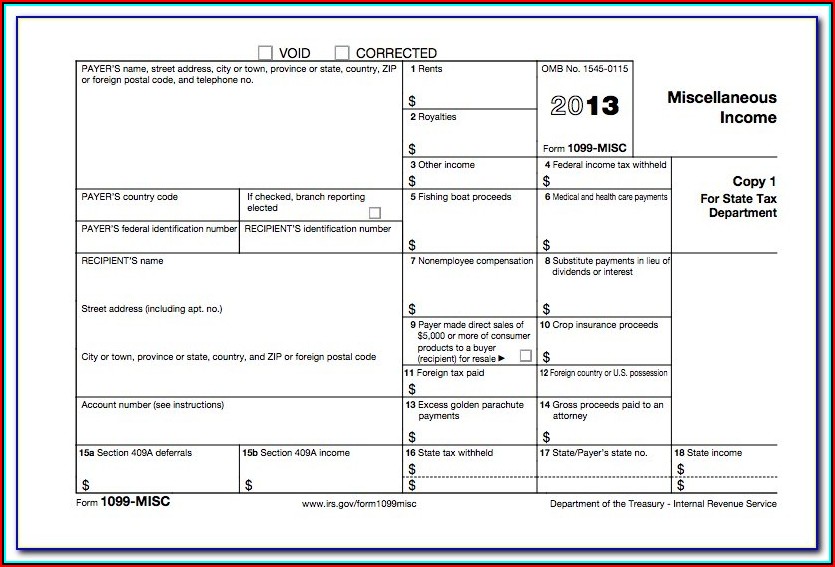

SSA POMS RM 01103.034 Form W4, "Employee's Withholding Allowance

See withholding income tax from your social security benefits for more information. Authorization to disclose information to the social security administration. We will use your answers to decide if we can reduce the amount you must pay us back each month. Web if you get social security, you can ask us to withhold funds from your benefit and we will.

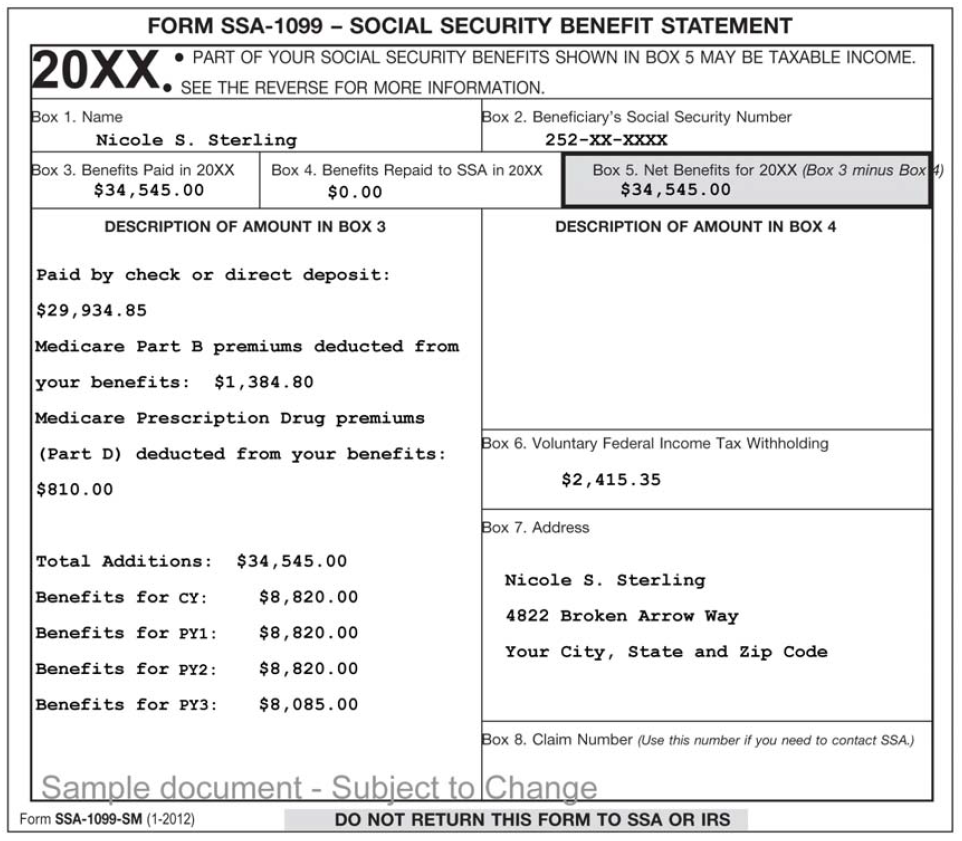

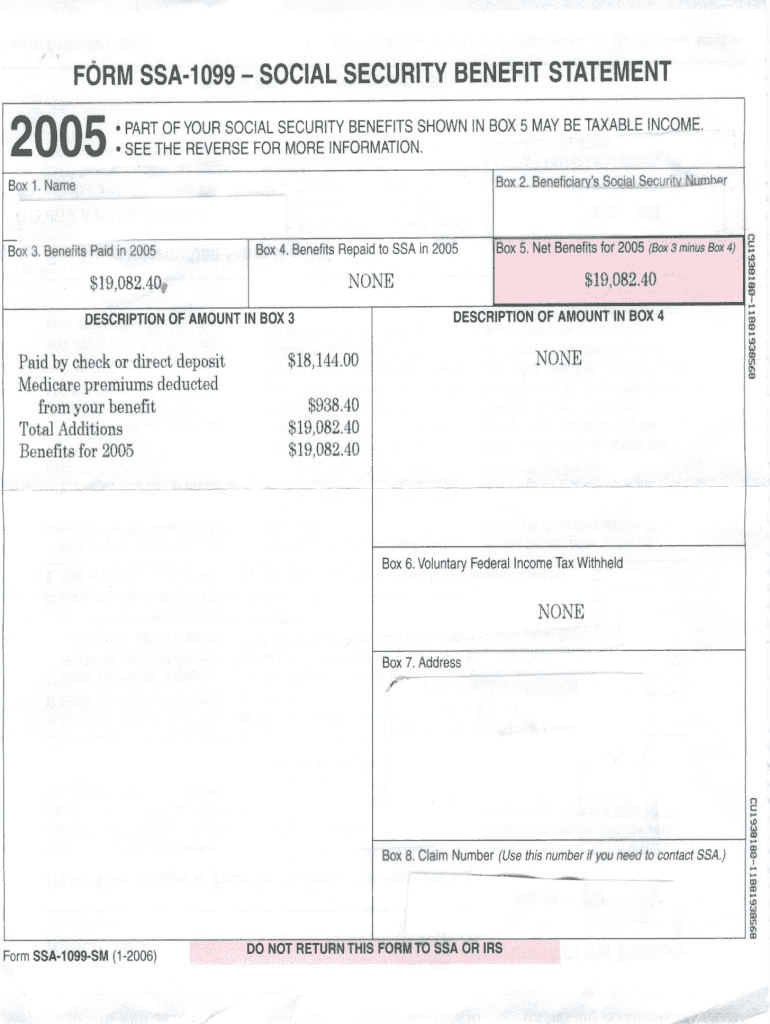

Printable Form Ssa 1099 Printable Form 2022

We will use your answers to decide if we can reduce the amount you must pay us back each month. Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. In some areas, you may request a replacement social security card online. Authorization to disclose.

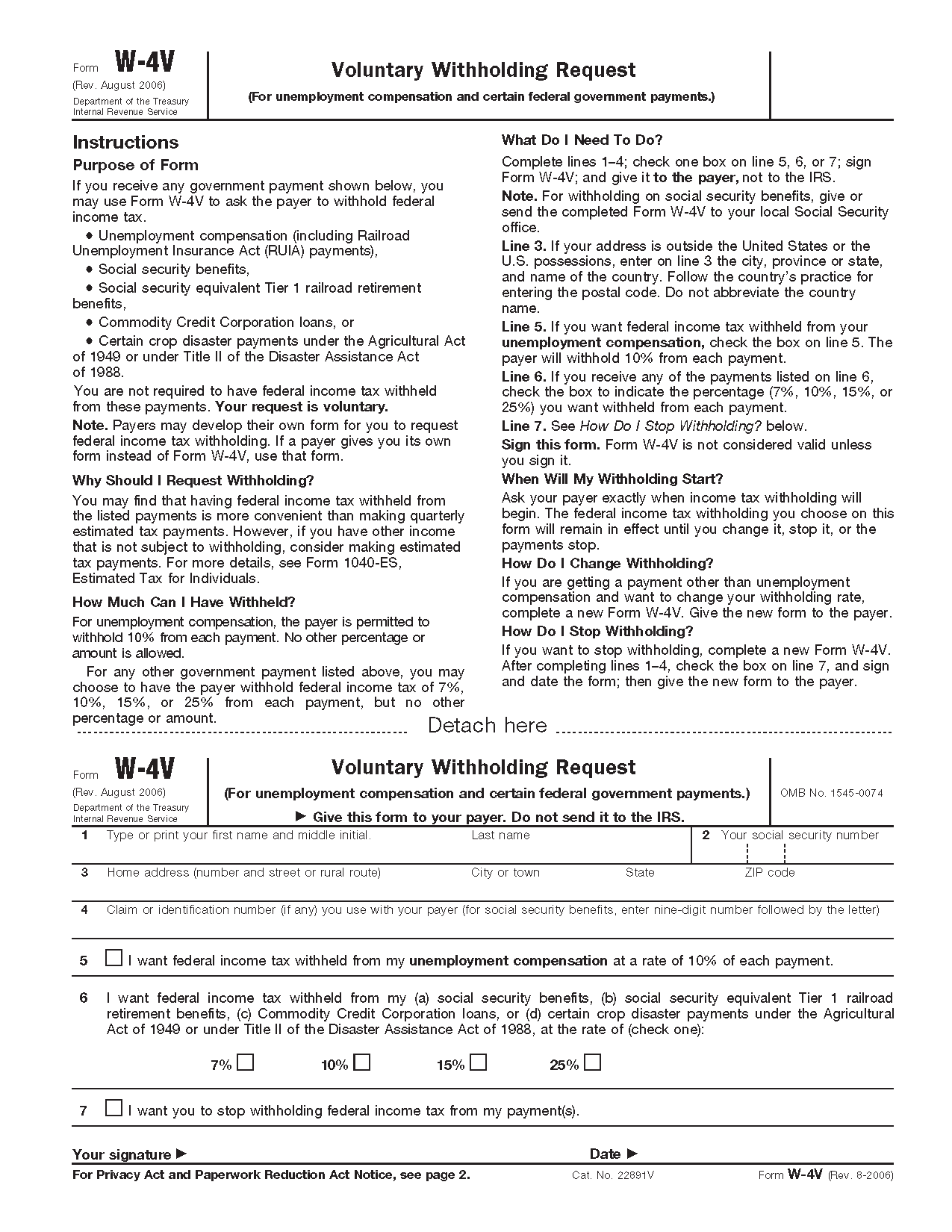

Ssa Voluntary Tax Withholding Form

You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. Please answer the following questions as completely as you can. In some areas, you may request a replacement social security card online. Web application for a social security card. You can.

Ssa 3288 Fillable / 17 Printable ssa 3288 Forms and Templates

Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses. Follow the country’s practice for entering the postal code. Please answer the following questions as completely as you can. You will pay federal income taxes on your benefits if your.

W 4V Form SSA Printable 2022 W4 Form

Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Web application for a social security card. You can print other federal tax forms here. We will use your answers to decide if we can reduce the amount you must pay us back.

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

If your address is outside the united states or the u.s. Efile your federal tax return now Web application for a social security card. Please answer the following questions as completely as you can. You can print other federal tax forms here.

Social Security Medicare Form Cms 1763 Form Resume Examples jl10DJW012

Web request to withhold taxes. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. Authorization to disclose information to the social security administration. Follow the country’s practice for entering the postal code. Web application for a social security card.

Irs Form W4V Printable where do i mail my w 4v form for social

Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses. You can print other federal tax forms here. Follow the country’s practice for entering the postal code. Please answer the following questions as completely as you can. If you do.

Printable Form Ssa 1099 Printable Form 2022

Authorization to disclose information to the social security administration. Efile your federal tax return now Web application for a social security card. Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If your address is outside the united states or the u.s.

Ssa Voluntary Tax Withholding Form

Web application for a social security card. If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits. Follow the country’s practice for entering the postal code. Authorization to disclose information to the social security administration. Possessions, enter on.

Possessions, Enter On Line 3 The City, Province Or State, And Name Of The Country.

If your address is outside the united states or the u.s. Web request to withhold taxes. Please answer the following questions as completely as you can. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

Web Complete This Form If You Are Requesting That We Adjust The Current Rate Of Withholding To Recover Your Overpayment Because You Are Unable To Meet Your Necessary Living Expenses.

We will use your answers to decide if we can reduce the amount you must pay us back each month. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Use this form to ask payers to withhold federal income tax from certain government payments. In some areas, you may request a replacement social security card online.

Follow The Country’s Practice For Entering The Postal Code.

You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits. See withholding income tax from your social security benefits for more information. Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf.

Authorization To Disclose Information To The Social Security Administration.

Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. You can print other federal tax forms here. Web application for a social security card. Efile your federal tax return now