St Louis City Tax Form

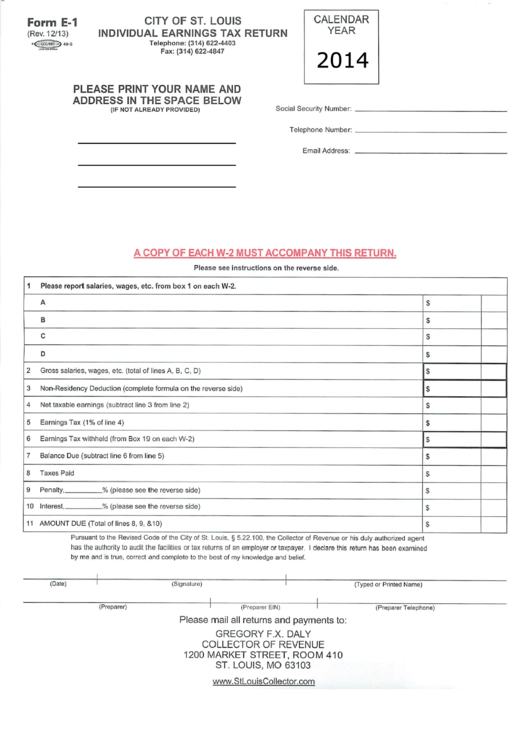

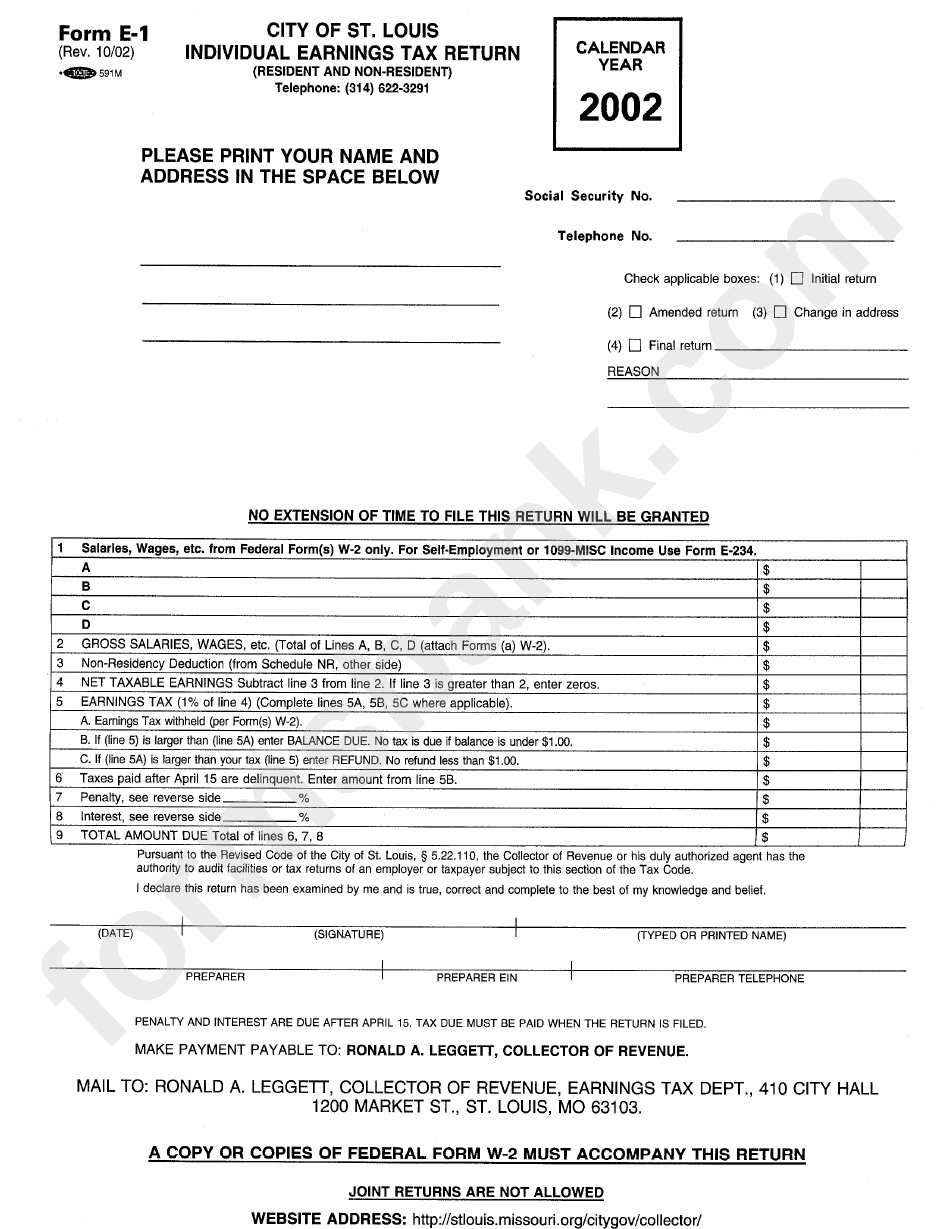

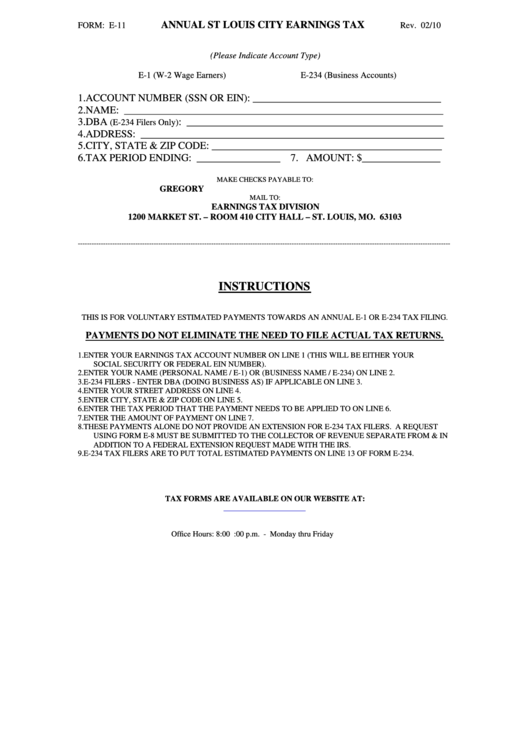

St Louis City Tax Form - Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need. Obtain a personal property tax receipt. Louis, mo 63103 instruction and information sheet for. Louis county cigarette tax statutes, rules, state constitution. Web account number or address: Web video instructions and help with filling out and completing st louis city form e 1rv. Use get form or simply click on the template preview to open it in the editor. Salaries, wages, commissions and other compensation earned by resident individuals of the city. Louis earnings tax return taxable year beginning and ending type of return: Louis to request a refund of tax withheld based on the fact that the employee had whole days.

©2023 washington university in st. Web video instructions and help with filling out and completing st louis city form e 1rv. To declare your personal property, declare online by april 1st or download the printable. Louis earnings & payroll tax division 1200 market street, room 410 st. Louis city earnings tax is a local tax and if you work within city limits, your pay is subject to st. Louis collects a 1% earnings tax on nonresidents for “work performed” or “services rendered” in the city. Web to obtain tax forms: Louis are required to pay the earnings. The tax is collected from all. Web account number or address:

Louis city earnings tax is a local tax and if you work within city limits, your pay is subject to st. Start completing the fillable fields and carefully. Use get form or simply click on the template preview to open it in the editor. Louis collects a 1% earnings tax on nonresidents for “work performed” or “services rendered” in the city. Will i receive interest on my refund from my missouri individual. The tax is collected from all. Web tax receipts and payment history for real estate tax and personal property tax are available online. How do i request a refund for a decedent? ©2023 washington university in st. Louis are required to pay the earnings.

Fillable Form E1 City Of St. Louis Individual Earnings Tax Return

Web account number or address: Louis county cigarette tax statutes, rules, state constitution. Obtain a personal property tax receipt. The tax is collected from all. Web to obtain tax forms:

St. Louis City Economic Incentives Report Final Draft and SLDC

Web tax receipts and payment history for real estate tax and personal property tax are available online. Web account number or address: Louis earnings & payroll tax division 1200 market street, room 410 st. Web as authorized by state and local laws, the city of st. Salaries, wages, commissions and other compensation earned by resident individuals of the city.

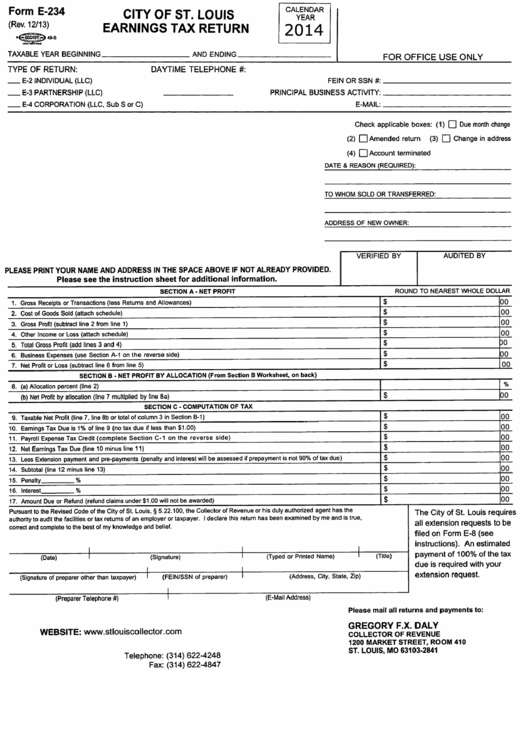

Fillable Form E234 City Of St. Louis Earnings Tax Return 2014

How do i request a refund for a decedent? Web what filing options and forms are available to file my income tax return? Obtain a personal property tax receipt. Louis city earnings tax is a local tax and if you work within city limits, your pay is subject to st. Louis earnings & payroll tax division 1200 market street, room.

Form E1 Individual Earnings Tax Return City Of St. Louis 2002

Account number number 700280 ; Obtain a personal property tax receipt. If you need to obtain a federal form , you. Use get form or simply click on the template preview to open it in the editor. Will i receive interest on my refund from my missouri individual.

Fillable Form E11 Annual St Louis City Earnings Tax printable pdf

Louis earnings & payroll tax division 1200 market street, room 410 st. Web tax receipts and payment history for real estate tax and personal property tax are available online. Louis earnings tax return taxable year beginning and ending type of return: Start completing the fillable fields and carefully. Louis city earnings tax is a local tax and if you work.

100 St. Louis City Properties Slated for Tax Sale Auction NextSTL

Louis earnings & payroll tax division 1200 market street, room 410 st. Web account number or address: Louis county cigarette tax statutes, rules, state constitution. Start completing the fillable fields and carefully. Web tax receipts and payment history for real estate tax and personal property tax are available online.

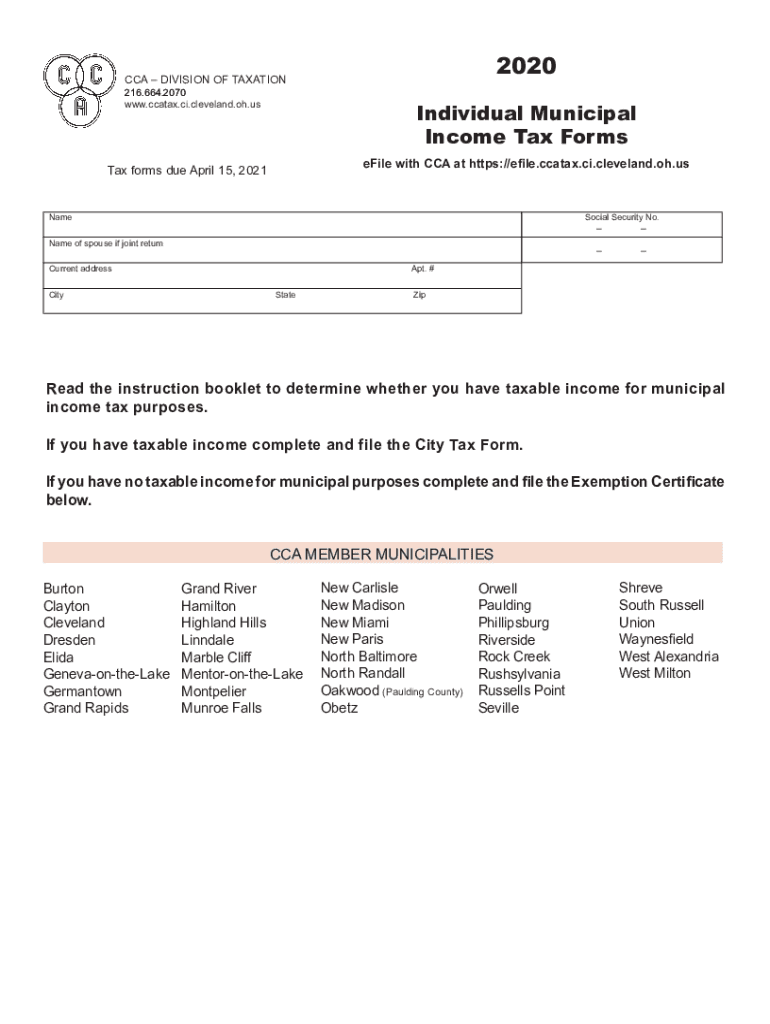

Cca Form Tax Fill Out and Sign Printable PDF Template signNow

©2023 washington university in st. To declare your personal property, declare online by april 1st or download the printable. Louis to request a refund of tax withheld based on the fact that the employee had whole days. Web as authorized by state and local laws, the city of st. Web tax receipts and payment history for real estate tax and.

St Louis City Tax Sale Kneelpost

Louis imposes an earnings tax of 1% on the following: Louis, mo 63103 instruction and information sheet for. Use get form or simply click on the template preview to open it in the editor. Louis collects a 1% earnings tax on nonresidents for “work performed” or “services rendered” in the city. Instructions for how to find city of st.

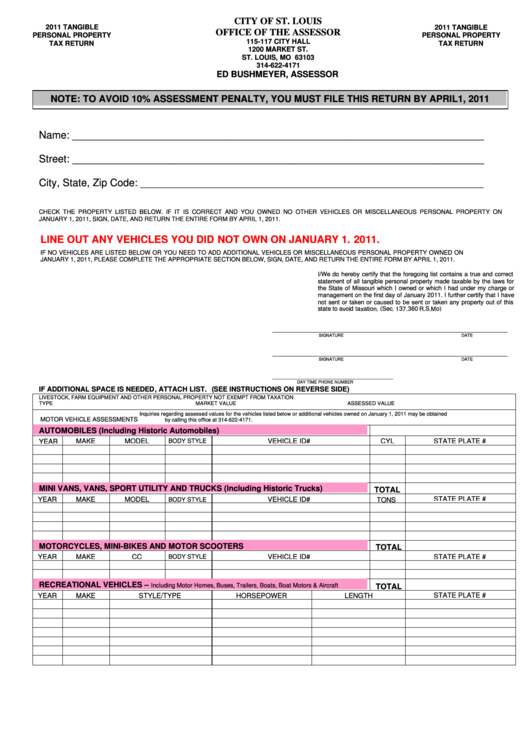

Tangible Personal Property Tax Return Form City Of St. Louis 2011

The tax is collected from all. Louis are required to pay the earnings. Louis imposes an earnings tax of 1% on the following: Louis city earnings tax is a local tax and if you work within city limits, your pay is subject to st. Louis county cigarette tax statutes, rules, state constitution.

The NonProfit Paradox. 40 of Real Estate in St. Louis is Government

If you need to obtain a federal form , you. Louis to request a refund of tax withheld based on the fact that the employee had whole days. Louis collects a 1% earnings tax on nonresidents for “work performed” or “services rendered” in the city. Web account number or address: Web to obtain tax forms:

Visit The Tax Forms Section Of The Website, To Download Forms, Fill In And Print, Or Just Print The Forms You Need.

Will i receive interest on my refund from my missouri individual. Salaries, wages, commissions and other compensation earned by resident individuals of the city. Louis imposes an earnings tax of 1% on the following: Web account number or address:

Louis To File And Pay The.

Louis collects a 1% earnings tax on nonresidents for “work performed” or “services rendered” in the city. Louis county cigarette tax statutes, rules, state constitution. Web tax receipts and payment history for real estate tax and personal property tax are available online. ©2023 washington university in st.

Louis Earnings & Payroll Tax Division 1200 Market Street, Room 410 St.

Web comptroller's office tax verification form. Louis earnings tax return taxable year beginning and ending type of return: Web what filing options and forms are available to file my income tax return? Obtain a personal property tax receipt.

Web To Obtain Tax Forms:

The tax is collected from all. Louis are required to pay the earnings. Use get form or simply click on the template preview to open it in the editor. Web video instructions and help with filling out and completing st louis city form e 1rv.