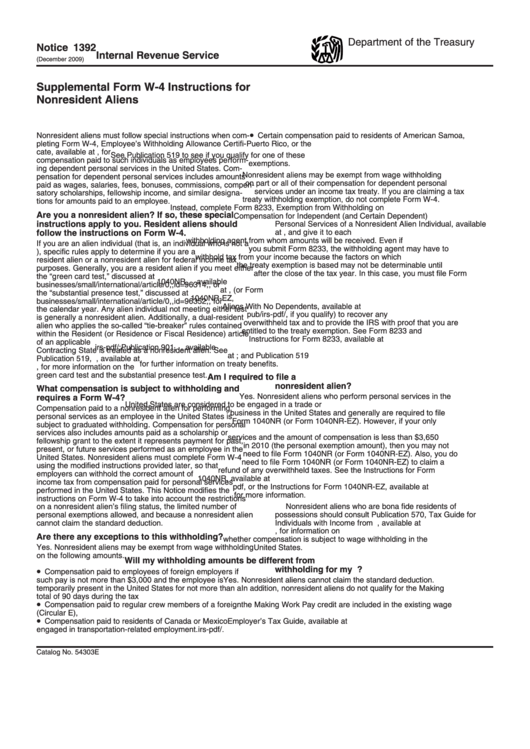

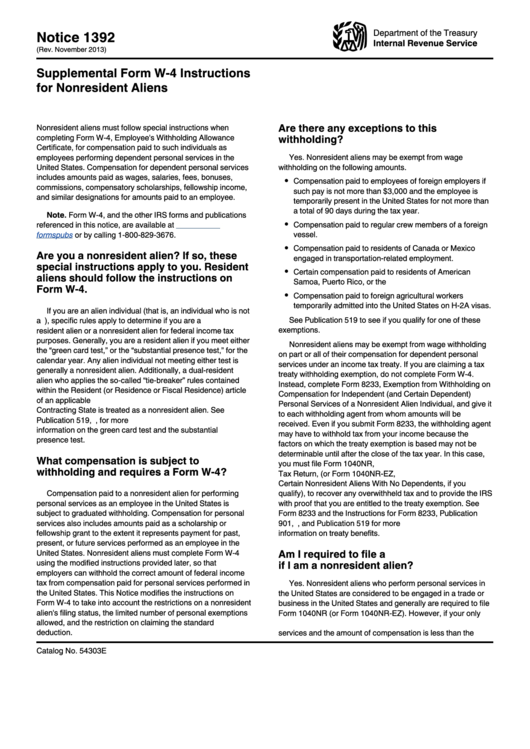

Supplemental Form W 4 Instructions For Nonresident Aliens

Supplemental Form W 4 Instructions For Nonresident Aliens - Here are some details on the changes. Using the modified instructions provided later, so. This is because of the restrictions on a nonresident alien’s filing status, the. Enter name, address and social security. Web in the united states. Web nonresident aliens with a u.s. Resident aliens are considered u.s. Step 1 (a) and (b): Web irs tax withholding estimator.

Enter name, address and social security. Here are some details on the changes. Web nonresident aliens with a u.s. Web irs tax withholding estimator. Web in the united states. This is because of the restrictions on a nonresident alien’s filing status, the. Step 1 (a) and (b): Using the modified instructions provided later, so. Resident aliens are considered u.s.

Resident aliens are considered u.s. Step 1 (a) and (b): Here are some details on the changes. Using the modified instructions provided later, so. This is because of the restrictions on a nonresident alien’s filing status, the. Web in the united states. Enter name, address and social security. Web irs tax withholding estimator. Web nonresident aliens with a u.s.

Irs 2022 tax calculator AnnmarieHaris

Web in the united states. Here are some details on the changes. Step 1 (a) and (b): Web nonresident aliens with a u.s. Resident aliens are considered u.s.

Irs withholding estimator ConnahMahid

Resident aliens are considered u.s. Here are some details on the changes. Using the modified instructions provided later, so. Web nonresident aliens with a u.s. This is because of the restrictions on a nonresident alien’s filing status, the.

Federal And State Tax Calculator

Resident aliens are considered u.s. This is because of the restrictions on a nonresident alien’s filing status, the. Web irs tax withholding estimator. Web in the united states. Step 1 (a) and (b):

Form W4 Employee'S Withholding Allowance Certificate printable pdf

Resident aliens are considered u.s. Web in the united states. This is because of the restrictions on a nonresident alien’s filing status, the. Web nonresident aliens with a u.s. Using the modified instructions provided later, so.

Oregon W4 2021 With Instructions 2022 W4 Form

Using the modified instructions provided later, so. Web irs tax withholding estimator. This is because of the restrictions on a nonresident alien’s filing status, the. Web nonresident aliens with a u.s. Enter name, address and social security.

Form W4 Employee'S Withholding Allowance Certificate 2014, Notice

Web irs tax withholding estimator. Step 1 (a) and (b): Web nonresident aliens with a u.s. Here are some details on the changes. This is because of the restrictions on a nonresident alien’s filing status, the.

Instructions for 1040nr 2016 Canada Guid Cognitive Guide

This is because of the restrictions on a nonresident alien’s filing status, the. Enter name, address and social security. Resident aliens are considered u.s. Web in the united states. Using the modified instructions provided later, so.

IRS Form W4 Follow the Instructions to Fill it

Here are some details on the changes. Enter name, address and social security. Using the modified instructions provided later, so. This is because of the restrictions on a nonresident alien’s filing status, the. Web nonresident aliens with a u.s.

Irs tax refund calculator 2022 SadhiaElys

Here are some details on the changes. Resident aliens are considered u.s. Web in the united states. Using the modified instructions provided later, so. Enter name, address and social security.

Resident Aliens Are Considered U.s.

Web in the united states. Web irs tax withholding estimator. This is because of the restrictions on a nonresident alien’s filing status, the. Web nonresident aliens with a u.s.

Enter Name, Address And Social Security.

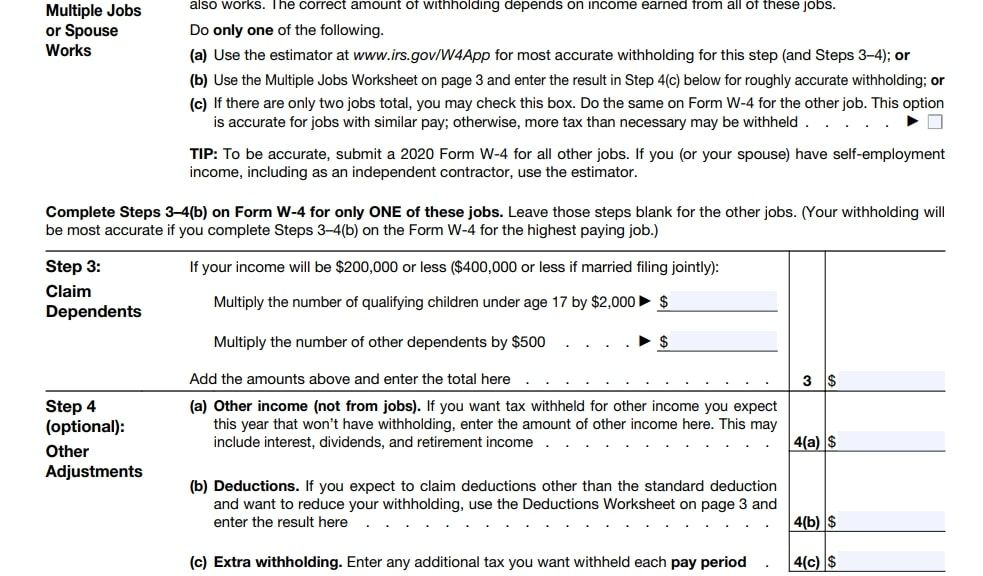

Using the modified instructions provided later, so. Here are some details on the changes. Step 1 (a) and (b):