Tax Exempt Form Virginia

Tax Exempt Form Virginia - Each filer is allowed one personal exemption. Address _____ number and street or rural route city, town, or post office state zip code. Purchases of prepared or catered meals and food are also covered by this exemption. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption Web apply for the exemption with virginia tax; You can find resale certificates for other states here. Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. You must file this form with your employer when your employment begins. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web virginia allows an exemption of $930* for each of the following:

Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Address _____ number and street or rural route city, town, or post office state zip code. Each filer is allowed one personal exemption. Web virginia allows an exemption of $930* for each of the following: For married couples, each spouse is entitled to an exemption. Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. Are issued a certificate of exemption by virginia tax. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption You can find resale certificates for other states here. Web apply for the exemption with virginia tax;

You must file this form with your employer when your employment begins. Each filer is allowed one personal exemption. Web apply for the exemption with virginia tax; Web exemptions you are allowed to claim. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. You can find resale certificates for other states here. Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. Web virginia allows an exemption of $930* for each of the following: Are issued a certificate of exemption by virginia tax. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption.

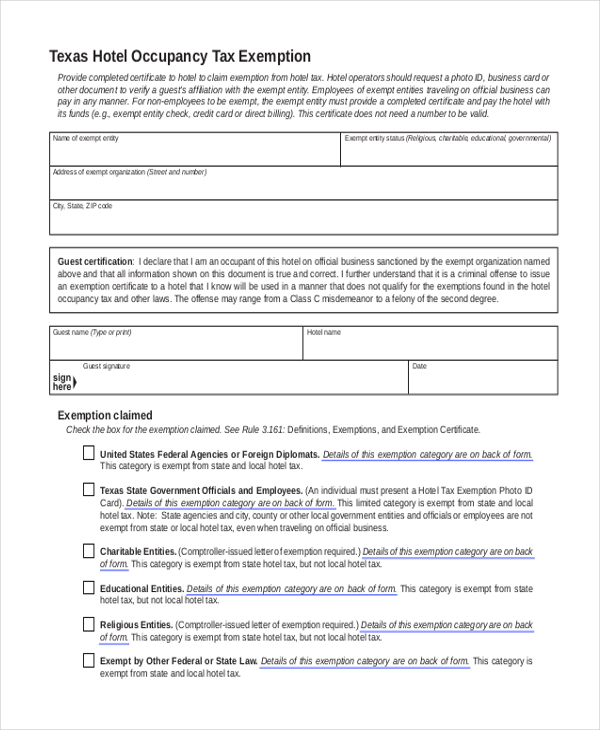

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. You must file this form with your employer when your employment begins. Are issued a certificate of exemption by virginia tax. Web apply for the exemption with virginia tax; Purchases of prepared or catered meals and food are also covered by this exemption.

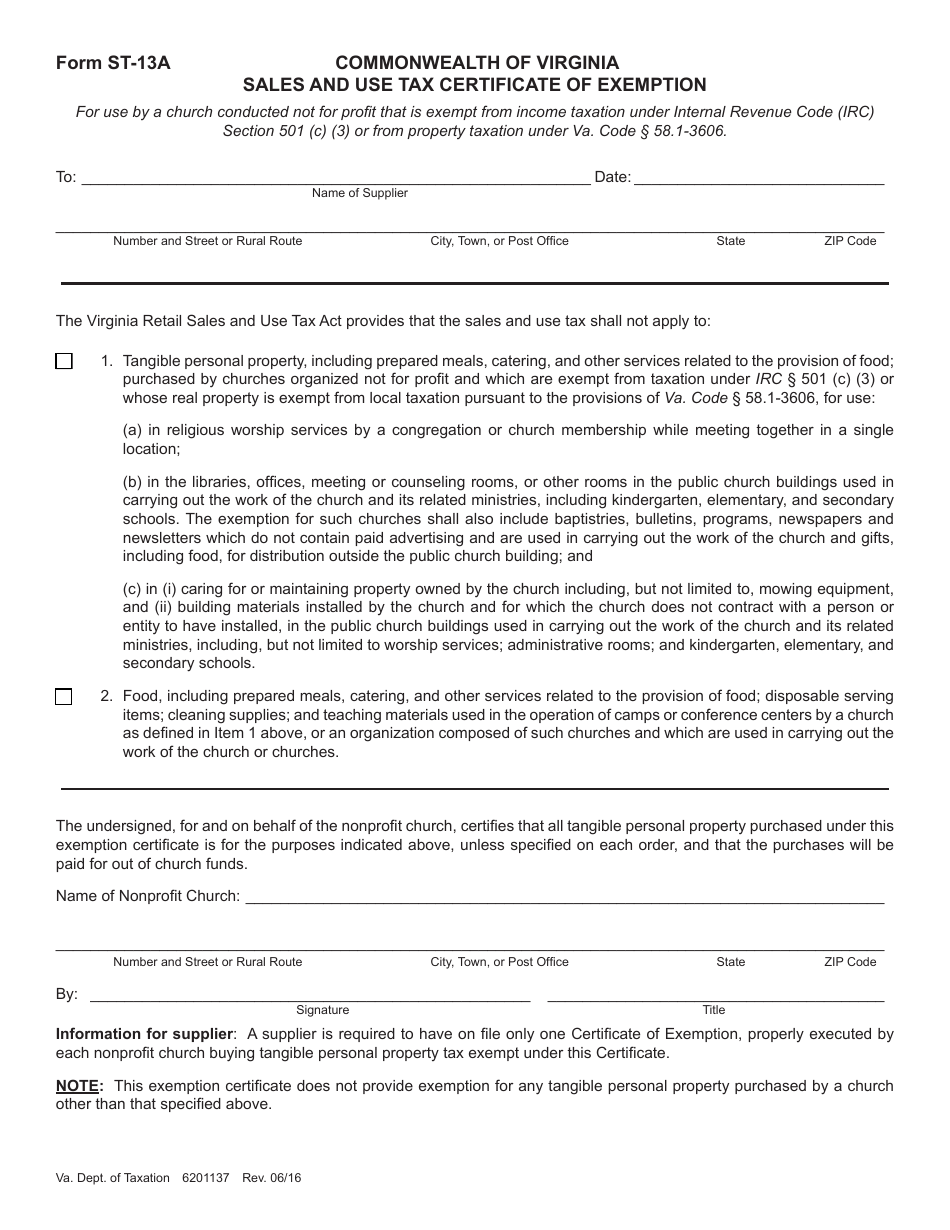

Form ST13A Download Fillable PDF or Fill Online Sales and Use Tax

Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption Web a dealer is required to have on file only one certificate of exemption,.

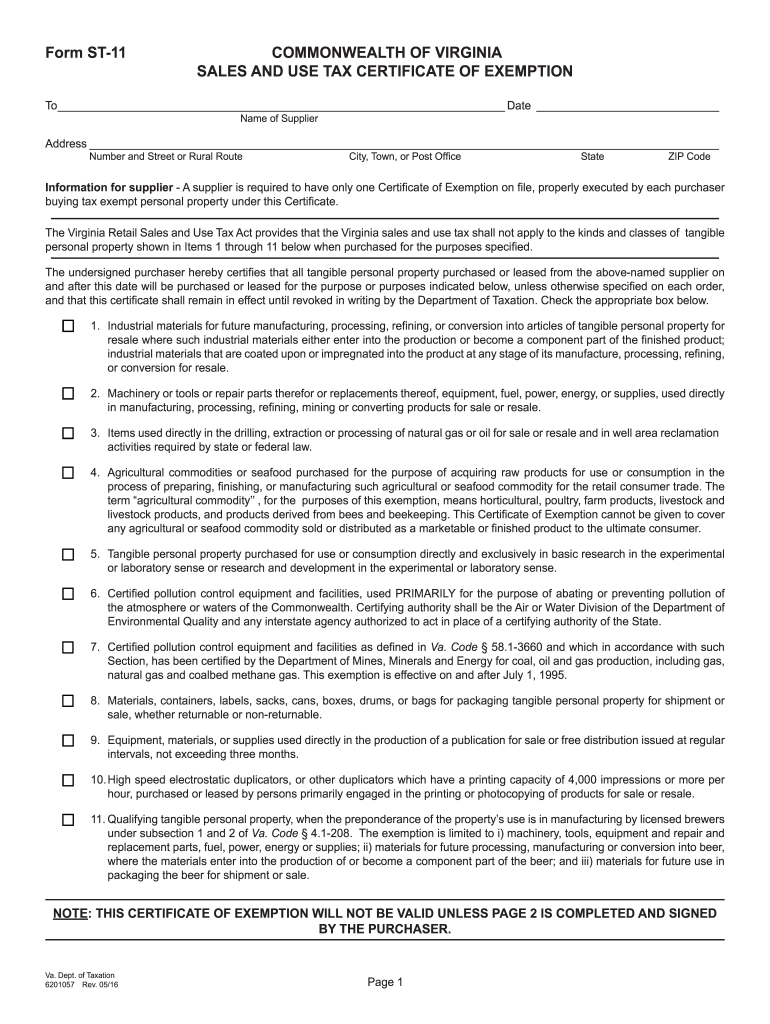

Virginia Sales Tax Exemption Form St 11 Fill Out and Sign Printable

You must file this form with your employer when your employment begins. You can find resale certificates for other states here. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing.

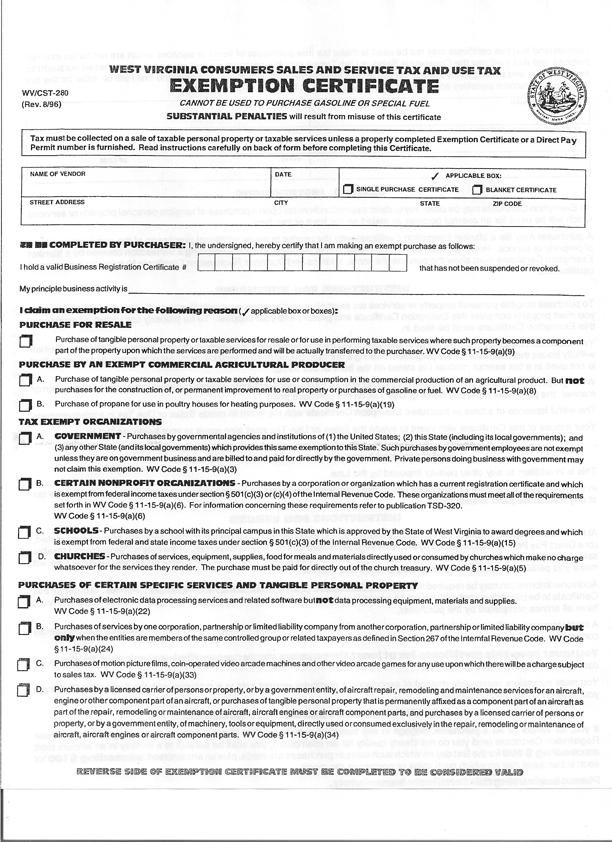

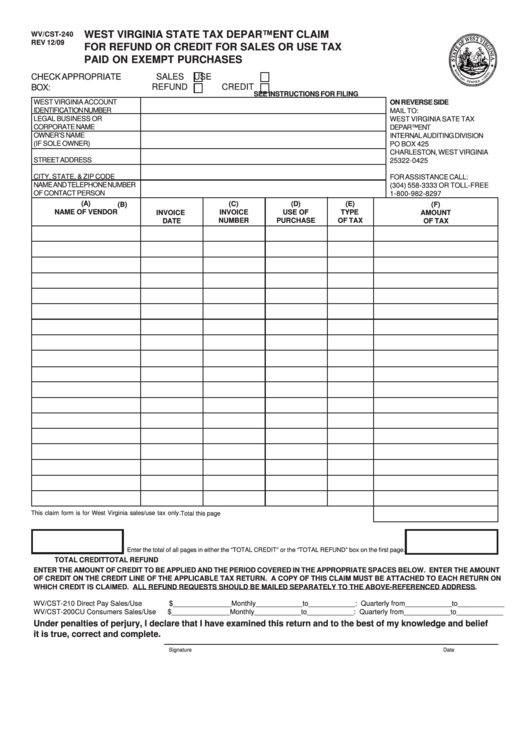

West Virginia Tax Exempt

Web exemptions you are allowed to claim. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption Address _____ number and street or rural.

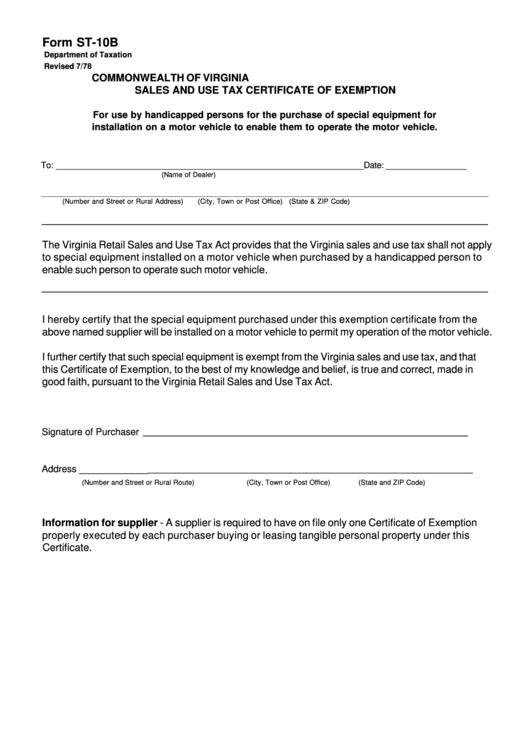

Form St10b Sales And Use Tax Certificate Of Exemption Commonwealth

Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Purchases of prepared or catered meals and food are also covered by this exemption. Each filer is allowed one personal exemption. Web we have five virginia sales tax exemption.

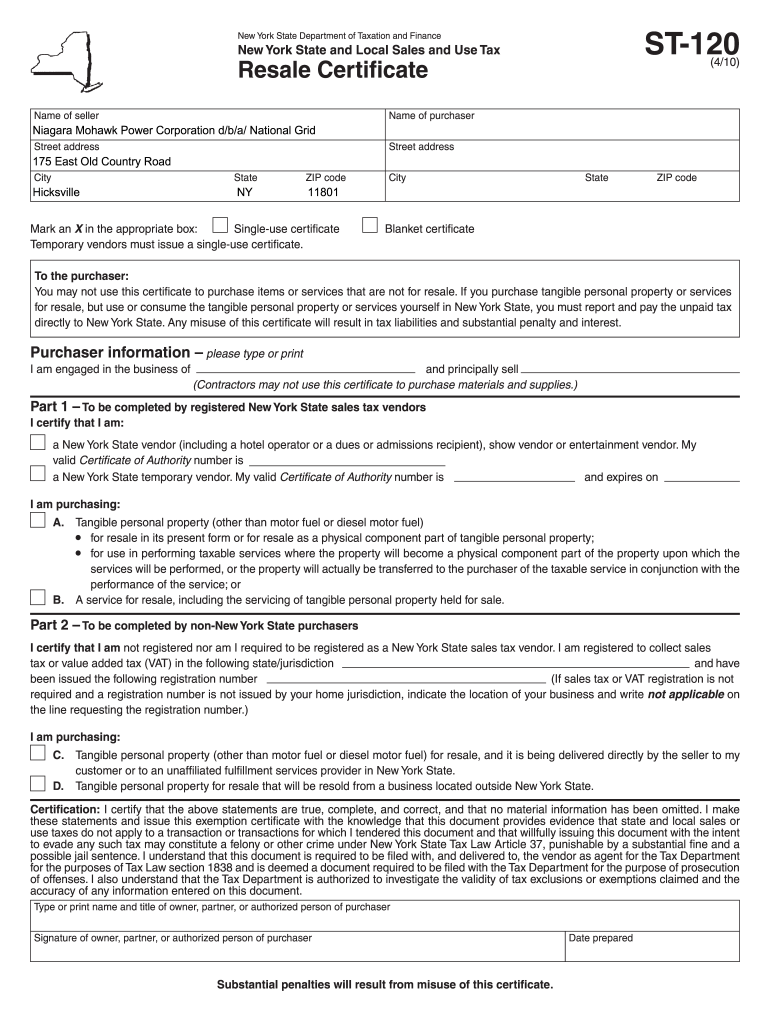

Tax Exempt Form Ny Fill and Sign Printable Template Online US Legal

Purchases of prepared or catered meals and food are also covered by this exemption. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Each filer is allowed one personal exemption. Web apply for the exemption with virginia tax; You can find resale certificates for other states here.

Tax Exempt Form 2022 IRS Forms

To _____ date _____ name of supplier. You can find resale certificates for other states here. Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Are issued a certificate of exemption by virginia tax. Web exemptions you are.

2015 Form VA DoT ST11 Fill Online, Printable, Fillable, Blank pdfFiller

If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web exemptions you are allowed to claim. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials.

Form WvCst240 West Virginia State Tax Department Claim For Refund

Are issued a certificate of exemption by virginia tax. Web virginia allows an exemption of $930* for each of the following: Web apply for the exemption with virginia tax; Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate..

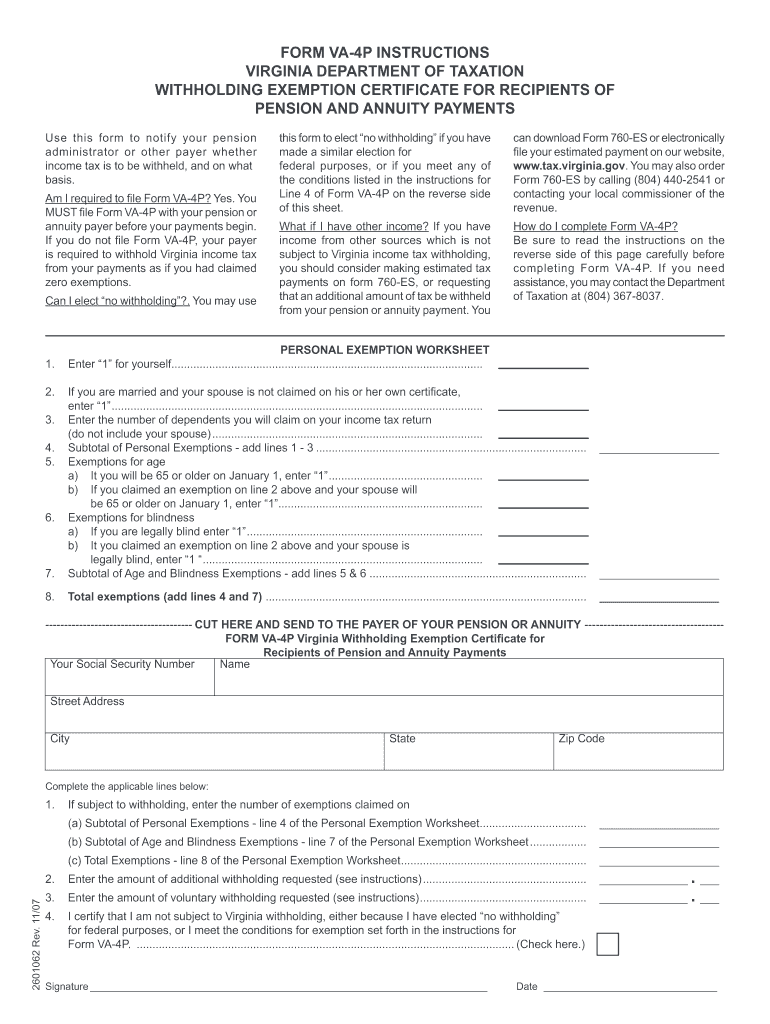

State Of Virginia Withholding Form Fill Out and Sign Printable PDF

You can find resale certificates for other states here. Web apply for the exemption with virginia tax; Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. If any of these links are broken, or you can't find the form you need, please let us know. Each filer is allowed.

If You Do Not File This Form, Your Employer Must Withhold Virginia Income Tax As If You Had No Exemptions.

Each filer is allowed one personal exemption. Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Are issued a certificate of exemption by virginia tax. For married couples, each spouse is entitled to an exemption.

When Using The Spouse Tax Adjustment, Each Spouse Must Claim His Or Her Own Personal Exemption.

To _____ date _____ name of supplier. You must file this form with your employer when your employment begins. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption Web exemptions you are allowed to claim.

Learn How To Issue Virginia Resale Certificates In.

If any of these links are broken, or you can't find the form you need, please let us know. You can find resale certificates for other states here. Address _____ number and street or rural route city, town, or post office state zip code. Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file.

Web Virginia Allows An Exemption Of $930* For Each Of The Following:

Web apply for the exemption with virginia tax; Purchases of prepared or catered meals and food are also covered by this exemption.