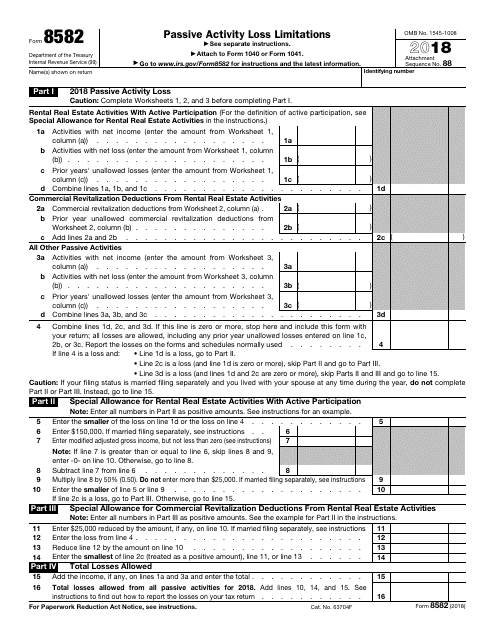

Tax Form 8582

Tax Form 8582 - Web how to fill in form 8582? Noncorporate taxpayers use form 8582 to: I have a passive activity unallowed loss from my prior year return form 8582 which i would like to carry forward. The maximum special allowance is: I cannot figure out how to do this and to include the carryforward on my 2015 form 8582 and schedule e. Web form 8582 is automatically generated by taxslayer pro based on information provided elsewhere in the return, and only a few lines can be directly edited. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Go to www.irs.gov/form8582 for instructions and the latest information. Is this an error for.

Figure the amount of any passive activity loss (pal) for the current tax year. Turbotax self employed online 0 10 10,677 reply 1 best answer view2 new member june 7,. It should be available soon. Is this an error for. I have a passive activity unallowed loss from my prior year return form 8582 which i would like to carry forward. Web how to fill in form 8582? Web form 8582 is automatically generated by taxslayer pro based on information provided elsewhere in the return, and only a few lines can be directly edited. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year.

A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. I cannot figure out how to do this and to include the carryforward on my 2015 form 8582 and schedule e. Web form 8582 is automatically generated by taxslayer pro based on information provided elsewhere in the return, and only a few lines can be directly edited. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. The maximum special allowance is: Activity description i keep getting the entry check error: It should be available soon. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals. I have a passive activity unallowed loss from my prior year return form 8582 which i would like to carry forward.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Go to www.irs.gov/form8582 for instructions and the latest information. Noncorporate taxpayers use form 8582 to: Turbotax self employed online 0 10 10,677 reply 1 best answer view2 new member june 7,. $25,000 for single individuals and married individuals filing a joint return for the tax year. Activity description i keep getting the entry check error:

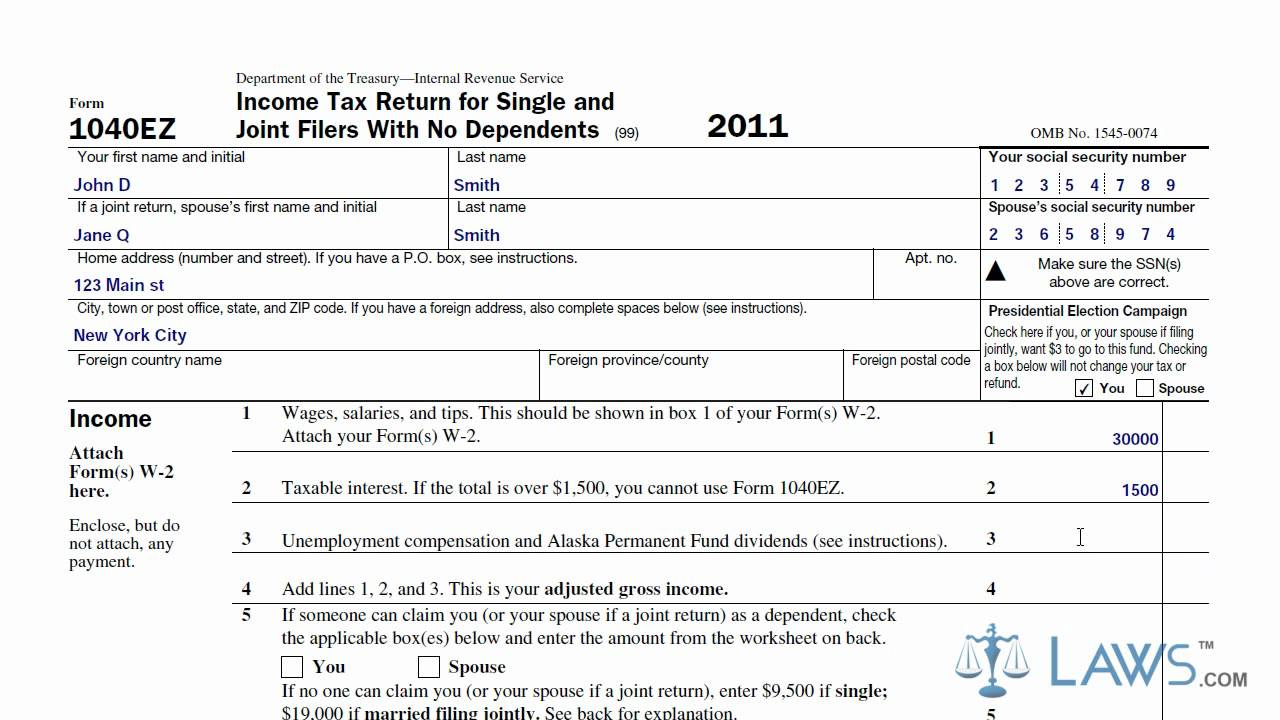

Learn How to Fill the Form 1040EZ Tax Return for Single and

The maximum special allowance is: Report the application of prior year unallowed pals. I cannot figure out how to do this and to include the carryforward on my 2015 form 8582 and schedule e. Go to www.irs.gov/form8582 for instructions and the latest information. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss.

Publication 925 Passive Activity and AtRisk Rules; Comprehensive Example

Is this an error for. I cannot figure out how to do this and to include the carryforward on my 2015 form 8582 and schedule e. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. This form also allows the taxpayer to report the application of previously disallowed passive activity.

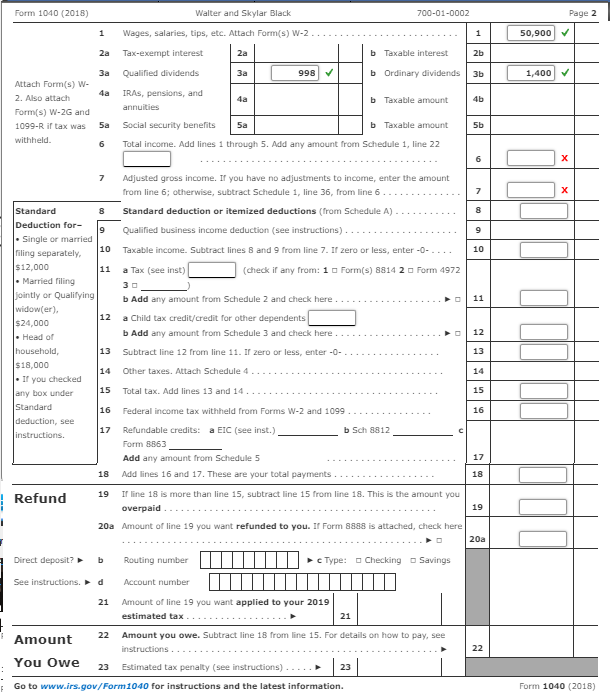

Comprehensive Problem 41 Skylar And Walter Black

Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. Go to www.irs.gov/form8582 for instructions and the latest information. The maximum special allowance is: Is this an error for. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions.

IRS Form 8582 Download Fillable PDF or Fill Online Passive Activity

This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Go to www.irs.gov/form8582 for instructions and the latest information. Web form 8582 department of.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Web about form 8582, passive activity loss limitations. The maximum special allowance is: A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Figure the amount of any.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8582 is automatically generated by taxslayer pro based on information provided elsewhere in the return, and only a few lines can be directly edited. Turbotax self employed online 0 10 10,677 reply 1 best answer view2 new member june 7,. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the.

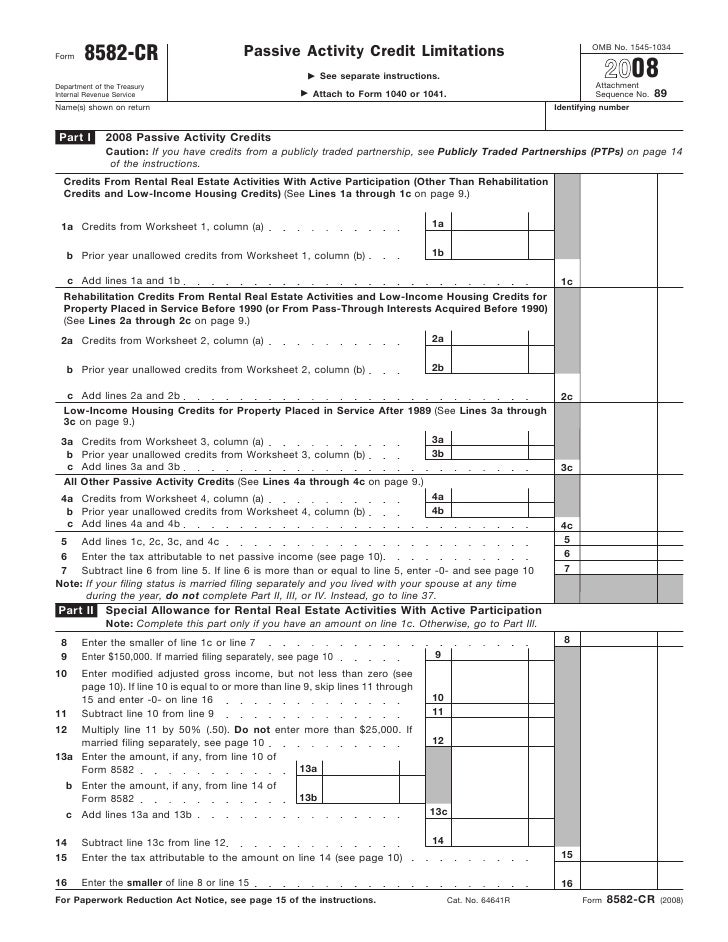

Form 8582CR Passive Activity Credit Limitations

Go to www.irs.gov/form8582 for instructions and the latest information. Report the application of prior year unallowed pals. Web how to fill in form 8582? $25,000 for single individuals and married individuals filing a joint return for the tax year. Noncorporate taxpayers use form 8582 to:

Tax Form 8332 Printable Master of Documents

Go to www.irs.gov/form8582 for instructions and the latest information. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income. Noncorporate taxpayers use form 8582 to: $25,000 for single individuals and married individuals filing a joint return for the tax year. Web form 8582 department of the treasury internal revenue.

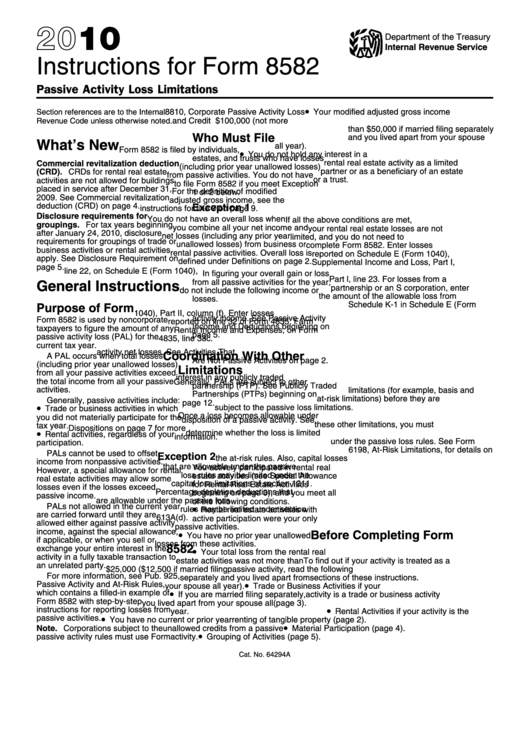

Instructions For Form 8582 2010 printable pdf download

Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. It should be available soon. The maximum special allowance is: Go to www.irs.gov/form8582 for instructions and the latest information. Noncorporate taxpayers use form 8582 to:

Noncorporate Taxpayers Use Form 8582 To:

Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. It should be available soon. I cannot figure out how to do this and to include the carryforward on my 2015 form 8582 and schedule e. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed pals.

Go To Www.irs.gov/Form8582 For Instructions And The Latest Information.

I have a passive activity unallowed loss from my prior year return form 8582 which i would like to carry forward. Web form 8582 is automatically generated by taxslayer pro based on information provided elsewhere in the return, and only a few lines can be directly edited. Activity description i keep getting the entry check error: Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year.

Turbotax Self Employed Online 0 10 10,677 Reply 1 Best Answer View2 New Member June 7,.

$25,000 for single individuals and married individuals filing a joint return for the tax year. Web form 8582 department of the treasury internal revenue service passive activity loss limitations see separate instructions. Is this an error for. The maximum special allowance is:

Report The Application Of Prior Year Unallowed Pals.

Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. A pal occurs when total losses (including prior year unallowed losses) from all your passive activities exceed the total income from all your passive activities. Figure the amount of any passive activity loss (pal) for the current tax year. Web about form 8582, passive activity loss limitations.