Tax Form 8829

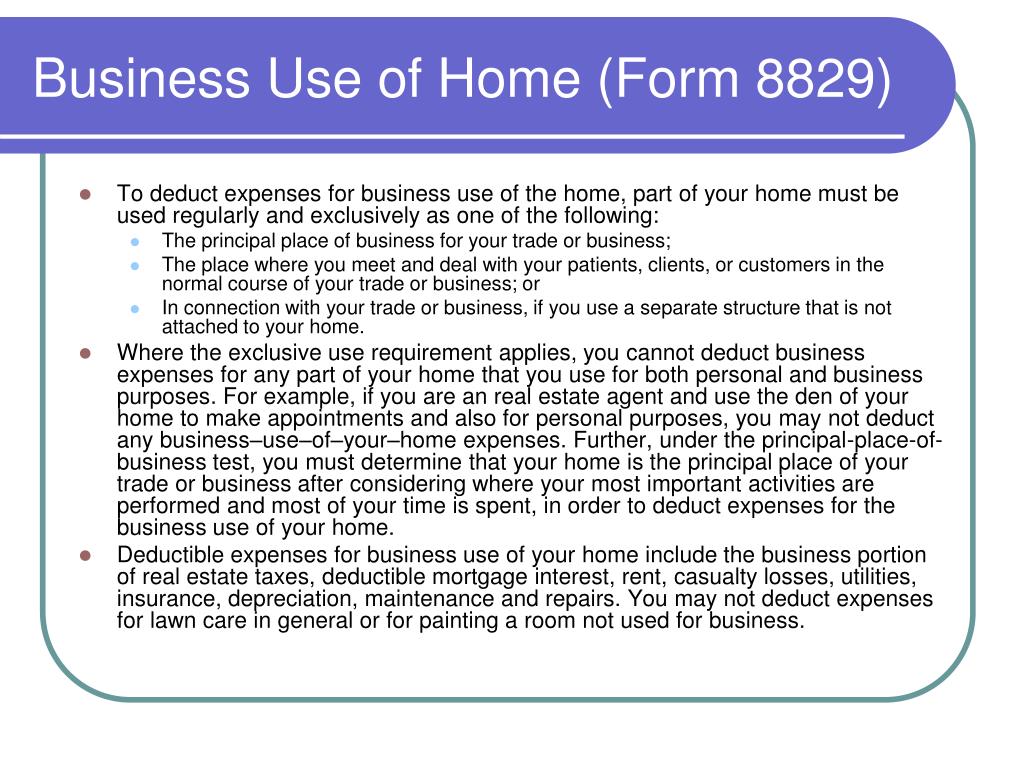

Tax Form 8829 - Web popular forms & instructions; Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web form 8829 is an irs tax form that sole proprietors can file with schedule c (form 1040) to claim a tax deduction on home office expenses. If line 26 is greater than line 15, you can carry that excess. Sign in to your account. Use a separate form 8829 for each. Luckily, you can deduct many of. Web what is irs form 8829 and why should you file it? Employers engaged in a trade or business who.

17 however, this is not happening. Get ready for tax season deadlines by completing any required tax forms today. For paperwork reduction act notice, see your tax return. Get ready for tax season deadlines by completing any required tax forms today. Web form 8829 is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Web form 8829 is an irs tax form that sole proprietors can file with schedule c (form 1040) to claim a tax deduction on home office expenses. Web how can we help you? Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web what is irs form 8829 and why should you file it? As a small business owner, your operating expenses can add up.

Statutorily, the irs should process these forms within 90 days. Sign in to your account. Complete, edit or print tax forms instantly. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. As a small business owner, your operating expenses can add up. Ad access irs tax forms. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Luckily, you can deduct many of. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Employee's withholding certificate form 941;

What Is Tax Form 8829 for Business Use of Home Expenses?

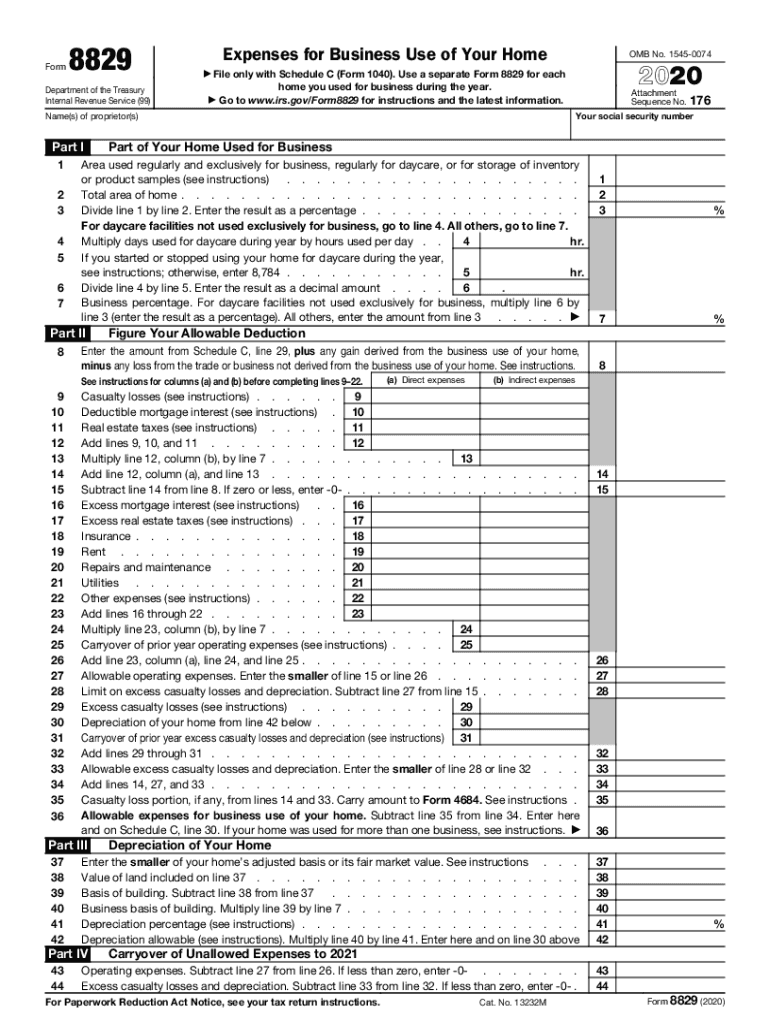

Web what is irs form 8829 and why should you file it? And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for. Ad access irs tax forms. Web how can we help you? Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040).

Home Office Tax Deductions for Small Business and Homeowner

Web general instructions purpose ofform use form 8829 to figure the allowable expenses forbusiness use of your home on schedule c (form 1040)and any carryover to 2011 of. Use a separate form 8829 for each. Employers engaged in a trade or business who. Individual tax return form 1040 instructions; Web irs form 8829 is used by small business owners to.

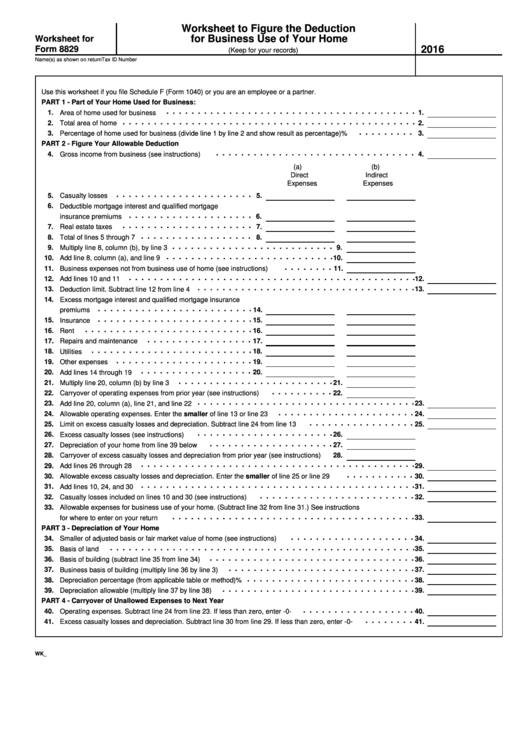

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Complete, edit or print tax forms instantly. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. If line 26.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. If line 26 is greater than line 15, you can carry that excess. For paperwork reduction act notice, see your tax return. Complete, edit or print tax forms instantly. Employee's withholding certificate form 941;

PPT Tax Tips for Real Estate Agents PowerPoint Presentation, free

Web there are four steps you should take to correctly fill out form 8829: As a small business owner, your operating expenses can add up. Web form 8829 is an irs tax form that sole proprietors can file with schedule c (form 1040) to claim a tax deduction on home office expenses. 17 however, this is not happening. Individual tax.

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

Tax advice form 8829, expenses for business. Use a separate form 8829 for each. Complete, edit or print tax forms instantly. Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Employee's withholding certificate form 941;

Business Use Of Home (Form 8829) Organizer 2014 printable pdf download

Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service. Web form 8829 is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). As a small business owner, your operating expenses can add up. Individual tax return form 1040 instructions; Ad.

2020 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

Web there are four steps you should take to correctly fill out form 8829: Web popular forms & instructions; For paperwork reduction act notice, see your tax return. Individual tax return form 1040 instructions; Web form 8829 is an irs tax form that sole proprietors can file with schedule c (form 1040) to claim a tax deduction on home office.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Web general instructions purpose ofform use form 8829 to figure the allowable expenses forbusiness use of your home on schedule c (form 1040)and any carryover to 2011 of. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Individual tax return form 1040 instructions; 17 however, this is not happening. Calculate the part of your home used for business part i of form 8829 helps you figure. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service. Use a separate form 8829 for each.

Use A Separate Form 8829 For Each.

For paperwork reduction act notice, see your tax return. Web popular forms & instructions; Web general instructions purpose ofform use form 8829 to figure the allowable expenses forbusiness use of your home on schedule c (form 1040)and any carryover to 2011 of. Web there are four steps you should take to correctly fill out form 8829:

Ad Access Irs Tax Forms.

Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service. Web irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Web Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To 2023 Of Amounts Not Deductible In 2022.

Web form 8829 is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Individual tax return form 1040 instructions; Web how can we help you?

If Line 26 Is Greater Than Line 15, You Can Carry That Excess.

Employee's withholding certificate form 941; 17 however, this is not happening. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for. Statutorily, the irs should process these forms within 90 days.

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)