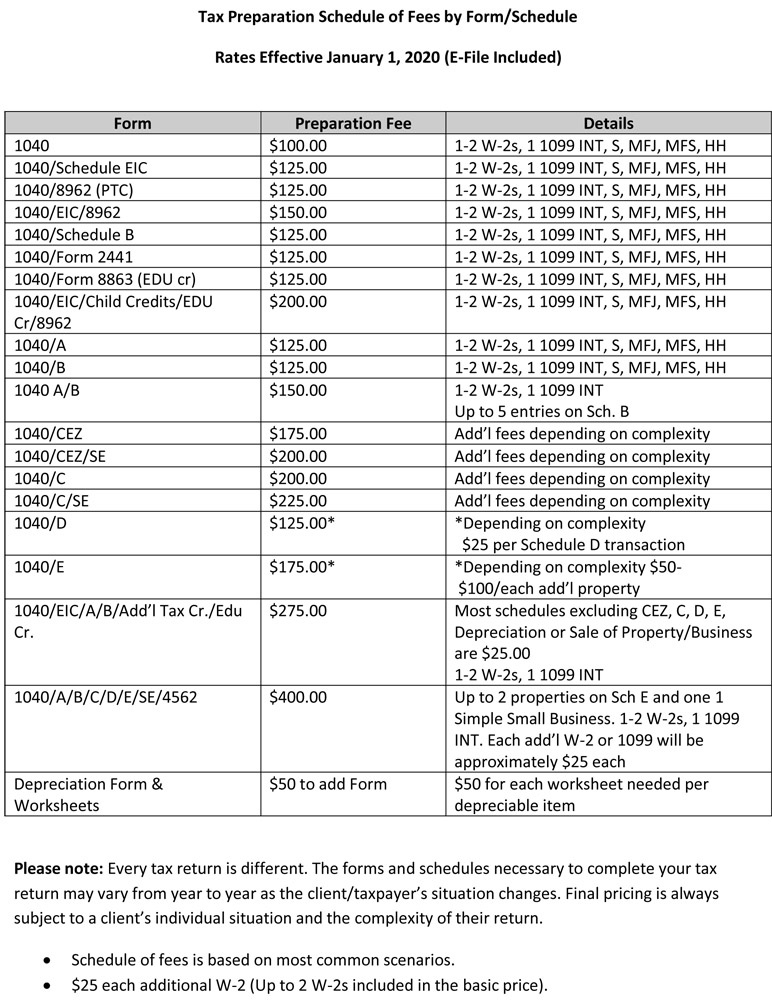

Tax Preparation Rates Per Form

Tax Preparation Rates Per Form - Web there are seven federal income tax rates in 2023: Web updated on february 28, 2023 reviewed by david kindness in this article view all pricing methods average preparation fees should you itemize? Web input your tax data into the online tax software. Ad compare your 2023 tax bracket vs. Web however, your taxable income is $90,000, which means only $925 will be taxed at 24%, which is $222. The same website urges citizens to. However, you don t need to wait to receive this form to file your return. Your 2022 tax bracket to see what's been adjusted. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web vita sites offer free tax help to people who need assistance in preparing their own tax returns, including:

Overall, your tax liability for the 2022 tax year will be. Ad a tax preparation service makes sure you get every deduction you've earned. Your 2022 tax bracket to see what's been adjusted. Your average tax rate is 11.67% and your marginal tax rate is. Web updated on february 28, 2023 reviewed by david kindness in this article view all pricing methods average preparation fees should you itemize? Web the average fees firms charged customers to prepare irs tax forms go as follows: Web according to the national society of accountants (nsa) in their recent survey report, the average hourly rate of cpas for filing federal/state tax returns was $180, and. Web form 709 (gift tax) $389. Form 940 (federal unemployment) $65. Web employer's quarterly federal tax return.

Web form 709 (gift tax) $389. Typically, if you expect a. People who generally make $60,000 or less. Tax on capital gain is payable. Web updated on february 28, 2023 reviewed by david kindness in this article view all pricing methods average preparation fees should you itemize? Overall, your tax liability for the 2022 tax year will be. Web the average fees firms charged customers to prepare irs tax forms go as follows: Web a tax preparation professional charges an average of $69.75 for this work. They help you get your taxes done right, save you time, and explain your unique situation. Ad a tax preparation service makes sure you get every deduction you've earned.

Key steps toward genuine tax reform in PH Inquirer Business

Web there are seven federal income tax rates in 2023: Web according to the national society of accountants (nsa) in their recent survey report, the average hourly rate of cpas for filing federal/state tax returns was $180, and. Form 941 (employer’s quarterly return) $92. Web in the new tax regime, the rates are as follows: Knowing the tax brackets for.

53 best Tax Preparer images on Pinterest Tax preparation, Info

Web 20 hours agosay the irs notifies abe that he owes $1 million in taxes. Tax on capital gain is payable. Web form 709 (gift tax) $389. Web however, your taxable income is $90,000, which means only $925 will be taxed at 24%, which is $222. However, this is just the national.

Les bases de la fiscalité au Canada

The fee is 30% of any tax. Ad reliably fast and accurate payroll tax service by adp®. Your 2022 tax bracket to see what's been adjusted. Web form 709 (gift tax) $389. They help you get your taxes done right, save you time, and explain your unique situation.

Tax Preparation Individual Orlando

Web vita sites offer free tax help to people who need assistance in preparing their own tax returns, including: Typically, if you expect a. Web updated on february 28, 2023 reviewed by david kindness in this article view all pricing methods average preparation fees should you itemize? Web in the new tax regime, the rates are as follows: Ad a.

Sunnyside WA Tax Preparation Services White & Company, PC

They help you get your taxes done right, save you time, and explain your unique situation. Ad reliably fast and accurate payroll tax service by adp®. Just answer three quick questions, and you'll. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web forbes advisor's capital gains tax calculator helps estimate.

tax — what's it all about?

Your 2022 tax bracket to see what's been adjusted. Web 20 hours agosay the irs notifies abe that he owes $1 million in taxes. Web figuring out what to charge for your services can be a huge challenge. Abe hires a lawyer or accountant to negotiate an offer in compromise for him. Web catch the top stories of the day.

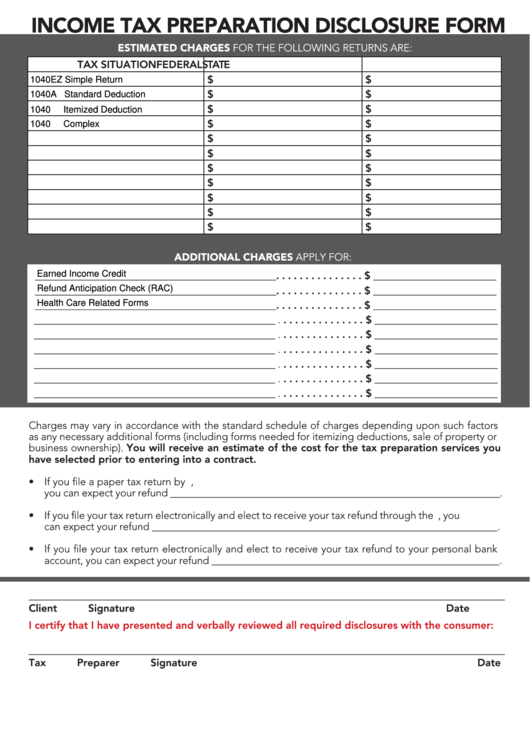

Fillable Tax Preparation Disclosure Form printable pdf download

Talk with adp® sales today. Typically, if you expect a. Web in the new tax regime, the rates are as follows: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web form 709 (gift tax) $389.

Free taxpreparation services available in Eastern Kentucky

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web the average fees firms charged customers to prepare irs tax forms go as follows: Ad compare your 2023 tax bracket vs. However, this is just the national. Web however, your taxable income is $90,000, which means only $925 will be taxed at 24%, which.

Tax Preparation Livable Solutions Livable Solutions

But this tax fee wizard will help you skip the guesswork. You may rely on other information received from. However, this is just the national. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Typically, if you expect a.

Is It Possible to a Tax Preparer Online? Yes, Here's How

Web however, your taxable income is $90,000, which means only $925 will be taxed at 24%, which is $222. Web in the new tax regime, the rates are as follows: Knowing the tax brackets for 2023 can help you implement smart tax strategies. Typically, if you expect a. Web there are seven federal income tax rates in 2023:

Web The Average Fees Firms Charged Customers To Prepare Irs Tax Forms Go As Follows:

Ad compare your 2023 tax bracket vs. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web however, your taxable income is $90,000, which means only $925 will be taxed at 24%, which is $222. But this tax fee wizard will help you skip the guesswork.

Overall, Your Tax Liability For The 2022 Tax Year Will Be.

Abe hires a lawyer or accountant to negotiate an offer in compromise for him. Talk with adp® sales today. Ad reliably fast and accurate payroll tax service by adp®. Just answer three quick questions, and you'll.

Web According To A National Society Of Accountants Survey, The Average Cost For Preparing A 1040 (Schedule C) Tax Form Is $218.

The same website urges citizens to. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web there are seven federal income tax rates in 2023: Ad a tax preparation service makes sure you get every deduction you've earned.

Your 2022 Tax Bracket To See What's Been Adjusted.

Form 943 (employer’s quarterly return for. Web a tax preparation professional charges an average of $69.75 for this work. However, you don t need to wait to receive this form to file your return. If you make $70,000 a year living in california you will be taxed $11,221.