Tax Year Vs Calendar Year

Tax Year Vs Calendar Year - It is also used for financial reporting by businesses and other organizations. A fiscal year is also known as a budget year or financial year, is a period of time used in government accounting that varies between countries, and for budget purposes. Web relevant for all individuals, including sole traders, partnerships and those who work for a company, the tax year, also known as the fiscal year, runs from 6th april. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. In this article, we define a fiscal and calendar year, list the. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. Web generally, taxpayers filing a version of form 1040 use the calendar year. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the.

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web tax year vs fiscal year. It is also used for financial reporting by businesses and other organizations. This may be convenient for entities that pass income through. Find out how to adopt, change, or retain a tax year and when to file a short tax year return. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. What is the fiscal year? Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes.

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. Learn when you should use each. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web generally, taxpayers filing a version of form 1040 use the calendar year. Find out how to adopt, change, or retain a tax year and when to file a short tax year return. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web tax year vs fiscal year. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year.

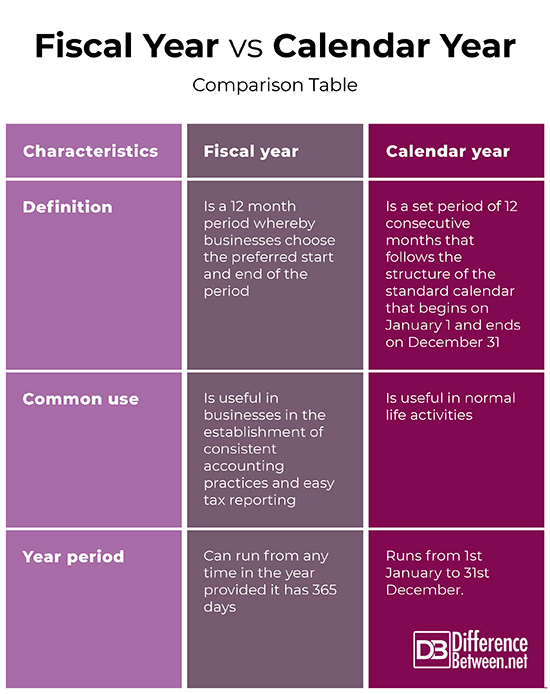

Fiscal Year vs Calendar Year Difference and Comparison

Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web generally, taxpayers filing a version of form 1040 use the calendar year. Learn when you should use each. Web tax year vs fiscal.

Fiscal Year Vs Calendar Andy Maegan

A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Your business's tax return deadline typically corresponds with. Web choosing to use a calendar year or a fiscal.

What is the Difference Between Fiscal Year and Calendar Year

This may be convenient for entities that pass income through. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. In this article, we define a fiscal and calendar year, list the. A business's tax year is 12 months used for financial accounting, budgeting, and.

Tax Year Vs Calendar Year Glad Penelope

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. A fiscal year is also known as a budget year or financial year, is a period of time used in government accounting that varies between countries, and for budget purposes. It.

Tax Year Vs Calendar Year Glad Penelope

In this article, we define a fiscal and calendar year, list the. Find out how to adopt, change, or retain a tax year and when to file a short tax year return. Web calendar year ends are simple — and they coincide with the tax filing deadlines for individuals. Web the fiscal year, a period of 12 months ending on.

Fiscal Year vs Calendar Year Difference and Comparison

Web relevant for all individuals, including sole traders, partnerships and those who work for a company, the tax year, also known as the fiscal year, runs from 6th april. Web calendar year ends are simple — and they coincide with the tax filing deadlines for individuals. Your business's tax return deadline typically corresponds with. A business's tax year is 12.

Difference Between Fiscal Year and Calendar Year Difference Between

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web the fiscal year, a period.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization.

Difference Between Fiscal Year and Calendar Year Difference Between

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial. A business's tax year is 12 months used for financial accounting,.

What is a Fiscal Year? Your GoTo Guide

Your business's tax return deadline typically corresponds with. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month except. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than.

Web Tax Year Vs Fiscal Year.

Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Web calendar year ends are simple — and they coincide with the tax filing deadlines for individuals. Web generally, taxpayers filing a version of form 1040 use the calendar year. What is the fiscal year?

Learn When You Should Use Each.

In this article, we define a fiscal and calendar year, list the. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. It is also used for financial reporting by businesses and other organizations.

Web The Irs Distinguishes A Fiscal Year As Separate From The Calendar Year, Defining It As Either 12 Consecutive Months Ending On The Last Day Of Any Month Except.

Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. A fiscal year is also known as a budget year or financial year, is a period of time used in government accounting that varies between countries, and for budget purposes. Web between a fiscal vs calendar year significantly impacts how and when your company pays its taxes, so building a plan is beneficial.

Web Fiscal Years Can Differ From A Calendar Year And Are An Important Concern For Accounting Purposes Because They Are Involved In Federal Tax Filings, Budgeting, And.

Your business's tax return deadline typically corresponds with. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. Web relevant for all individuals, including sole traders, partnerships and those who work for a company, the tax year, also known as the fiscal year, runs from 6th april. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two.

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)