Tennessee Business License Application Form

Tennessee Business License Application Form - Download the tennessee business services business entity database. State of tennessee business license information, registration, support. Start date for location in jurisdiction 3. Web begin your registration process for your new business with tnbear. A business tax account and filing are not required with a minimum activity license. The state administered business tax is a tax based upon business gross receipts, which is due annually. Web forms and downloads. Business licenses are issued by the county clerk and city official (if the city imposes business tax) of the county and city in which the business is located. We make starting your business affordable, fast, and simple. Let us handle all the hard work for you.

The state administered business tax is a tax based upon business gross receipts, which is due annually. Ad new state sales tax registration. Search the business services database to determine if a business name is available. Web request, pay for, receive, and/or verify a certificate of existence online. Between $3,000 and $10,000 in gross sales. Type of ownership (choose only one box below): A business will renew directly with their local county clerk's office. Fiscal year end date 4. Web registration and licensing if you are subject to the business tax, you must register to pay the tax. Start your new business with swyft filings.

Start your new business with swyft filings. Start date for location in jurisdiction 3. Let us handle all the hard work for you. Between $3,000 and $10,000 in gross sales. Ad new state sales tax registration. Business licenses are issued by the county clerk and city official (if the city imposes business tax) of the county and city in which the business is located. The state administered business tax is a tax based upon business gross receipts, which is due annually. A business will renew directly with their local county clerk's office. Contractor revisions amendments/changes to existing license. Alternatively, this application can be mailed or delivered to any taxpayer services division office.

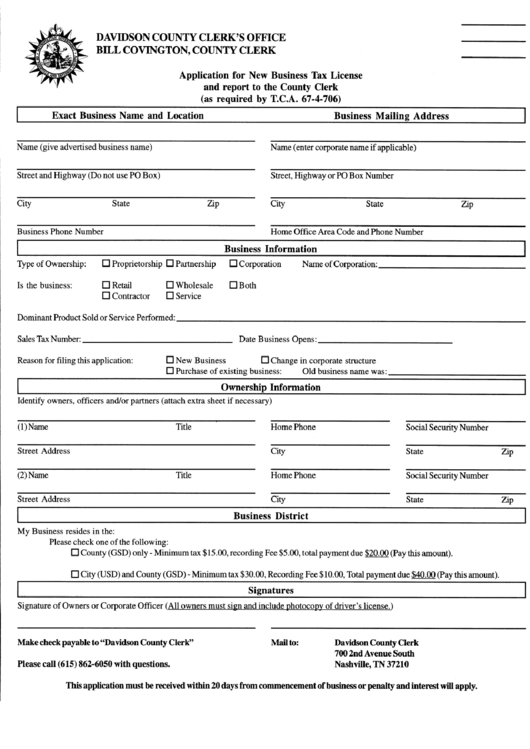

Application For New Business Tax License And Report To The County Clerk

Start your new business with swyft filings. A business tax account and filing are not required with a minimum activity license. Business licenses are issued by the county clerk and city official (if the city imposes business tax) of the county and city in which the business is located. Incomplete and unsigned applications will delay processing. Web business forms &.

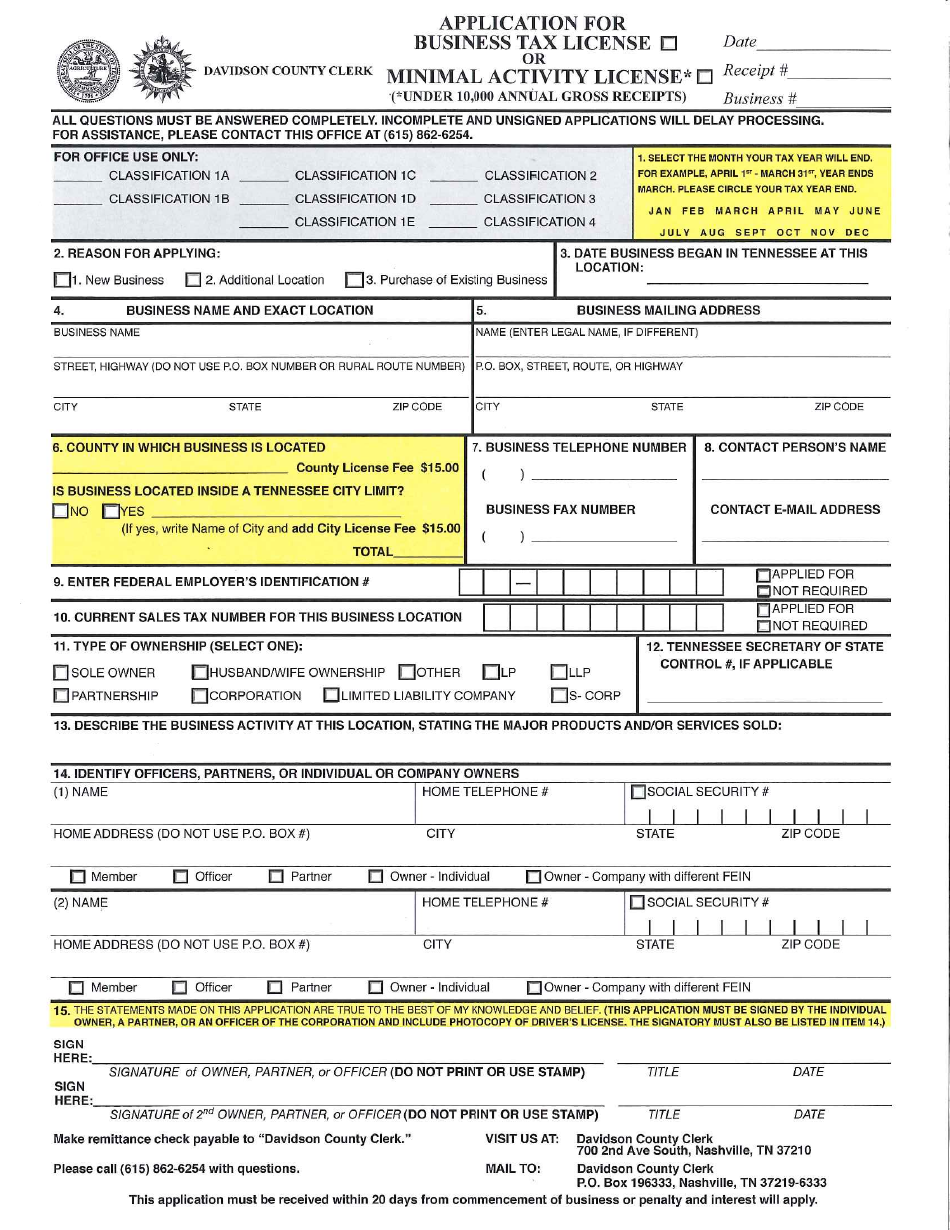

Davidson county, Tennessee Application for Business Tax License or

Download the tennessee business services business entity database. We'll determine what licenses, permits, and tax registrations your business requires. Contractor revisions amendments/changes to existing license. Ad new state sales tax registration. Web forms and downloads.

State of Tennessee Employment Application Free Download

Ad file your paperwork for free in 3 easy steps! Web begin your registration process for your new business with tnbear. Alternatively, this application can be mailed or delivered to any taxpayer services division office. A business tax account and filing are not required with a minimum activity license. Type of ownership (choose only one box below):

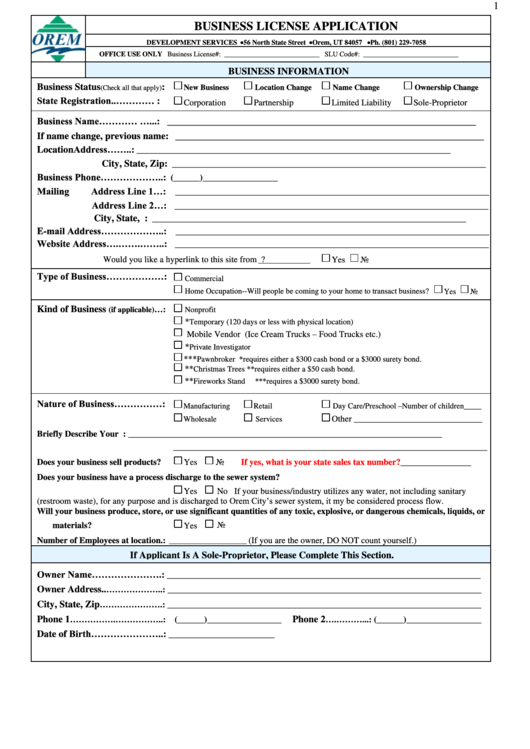

Business License Application Form Utah printable pdf download

Ad business license applications $149 plus state fees. Except for business tax, you will receive the. We make starting your business affordable, fast, and simple. Web begin your registration process for your new business with tnbear. Let us handle all the hard work for you.

How To Apply For A Business License In Memphis Tn Leah Beachum's Template

We'll determine what licenses, permits, and tax registrations your business requires. Let us handle all the hard work for you. Between $3,000 and $10,000 in gross sales. Start your new business with swyft filings. Ad file your paperwork for free in 3 easy steps!

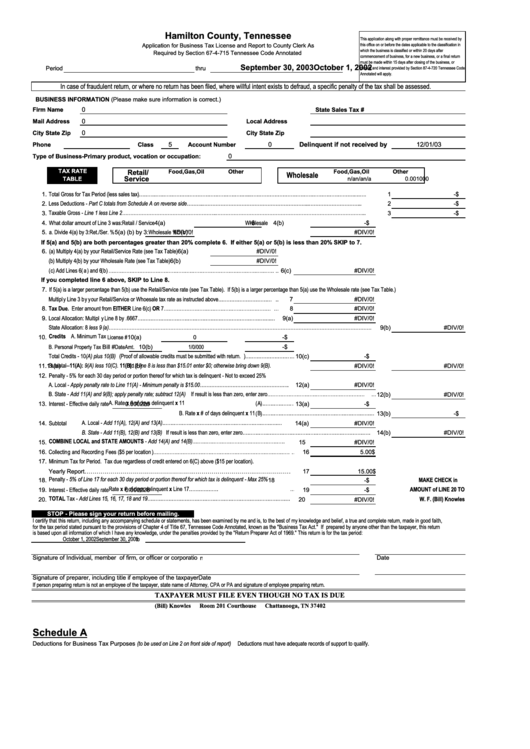

Application For Business Tax License And Report Form Hamilton County

Ad business license applications $149 plus state fees. Except for business tax, you will receive the. We'll determine what licenses, permits, and tax registrations your business requires. Incomplete and unsigned applications will delay processing. Web file new businesses online search businesses file & search uccs order copies & certificates file & search athlete agents apostille & authentication guide apply for.

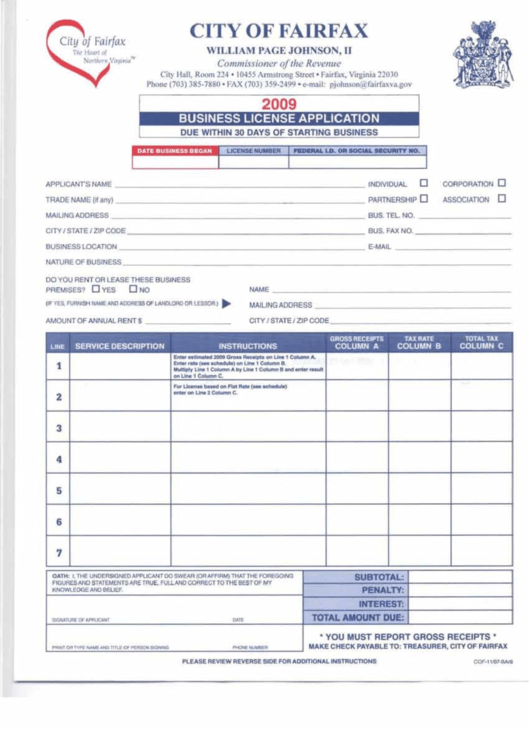

Business License Application Form City Of Fairfax, Virginia 2009

Download the tennessee business services business entity database. Let us handle all the hard work for you. Start your new business with swyft filings. Web forms and downloads. Incomplete and unsigned applications will delay processing.

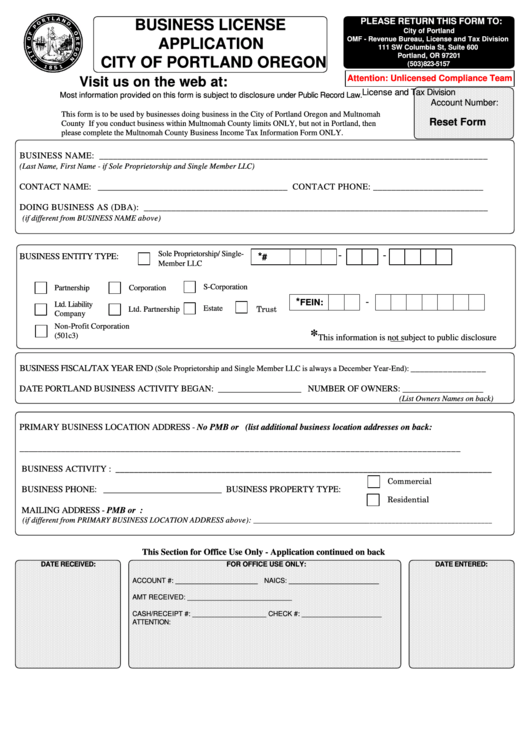

Fillable Business License Application Form City Of Portland, Oregon

State of tennessee business license information, registration, support. Contractor revisions amendments/changes to existing license. Web registration and licensing if you are subject to the business tax, you must register to pay the tax. Ad follow simple instructions to create a legally binding business plan online. Web begin your registration process for your new business with tnbear.

CA Business License Application City of Ridgecrest 20112021 Fill

Web registration and licensing if you are subject to the business tax, you must register to pay the tax. A business tax account and filing are not required with a minimum activity license. The state administered business tax is a tax based upon business gross receipts, which is due annually. File or prepare an annual report for a business entity.

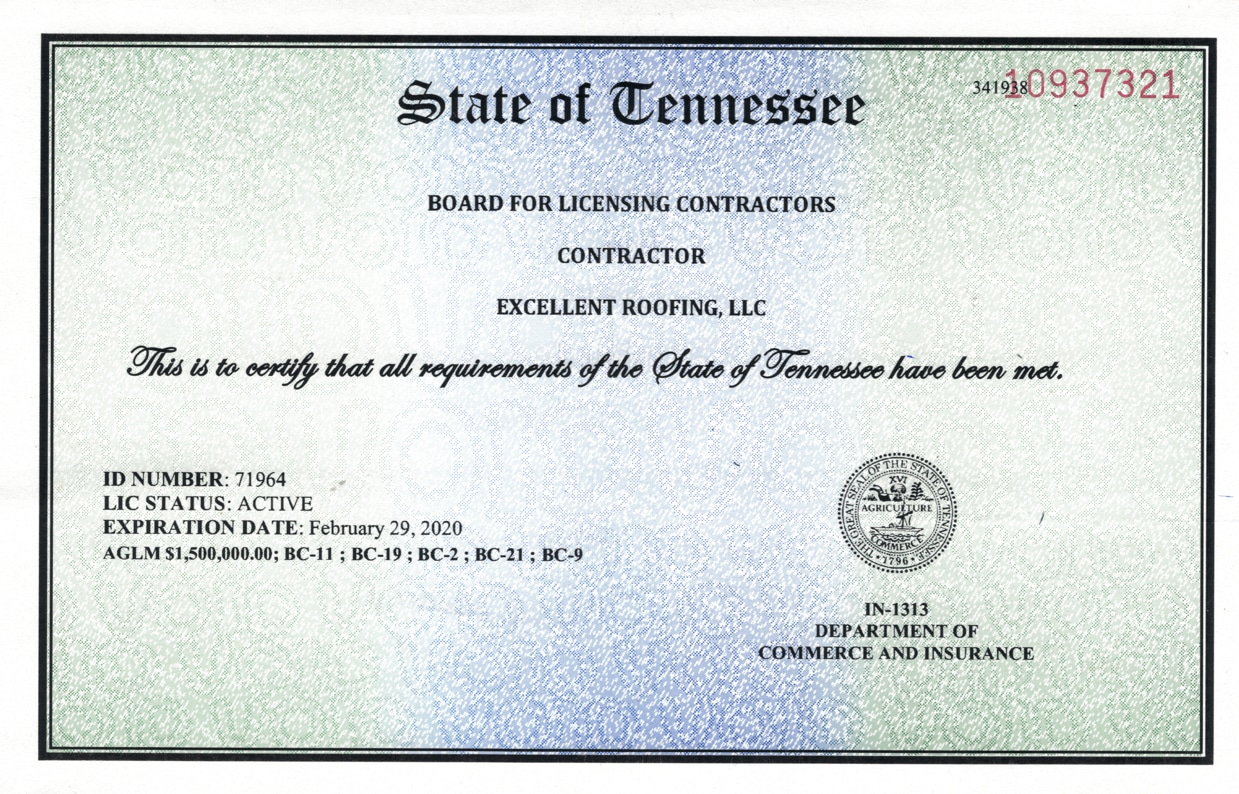

License and Insurance Excellent Roofing

Type of ownership (choose only one box below): Web forms and downloads. You must complete one application for each business location that you own. Start date for location in jurisdiction 3. File or prepare an annual report for a business entity registered in the state of tennessee.

Web Registration And Licensing If You Are Subject To The Business Tax, You Must Register To Pay The Tax.

Business licenses are issued by the county clerk and city official (if the city imposes business tax) of the county and city in which the business is located. Business fein or ssn (required) 2. Web begin your registration process for your new business with tnbear. State of tennessee business license information, registration, support.

Search The Business Services Database To Determine If A Business Name Is Available.

Type of ownership (choose only one box below): Web forms and downloads. A business will renew directly with their local county clerk's office. Alternatively, this application can be mailed or delivered to any taxpayer services division office.

Ad New State Sales Tax Registration.

Between $3,000 and $10,000 in gross sales. We make starting your business affordable, fast, and simple. Download the tennessee business services business entity database. We'll determine what licenses, permits, and tax registrations your business requires.

Ad Business License Applications $149 Plus State Fees.

Except for business tax, you will receive the. Start your new business with swyft filings. Start date for location in jurisdiction 3. File or prepare an annual report for a business entity registered in the state of tennessee.