Texas Tax Exempt Form For Churches

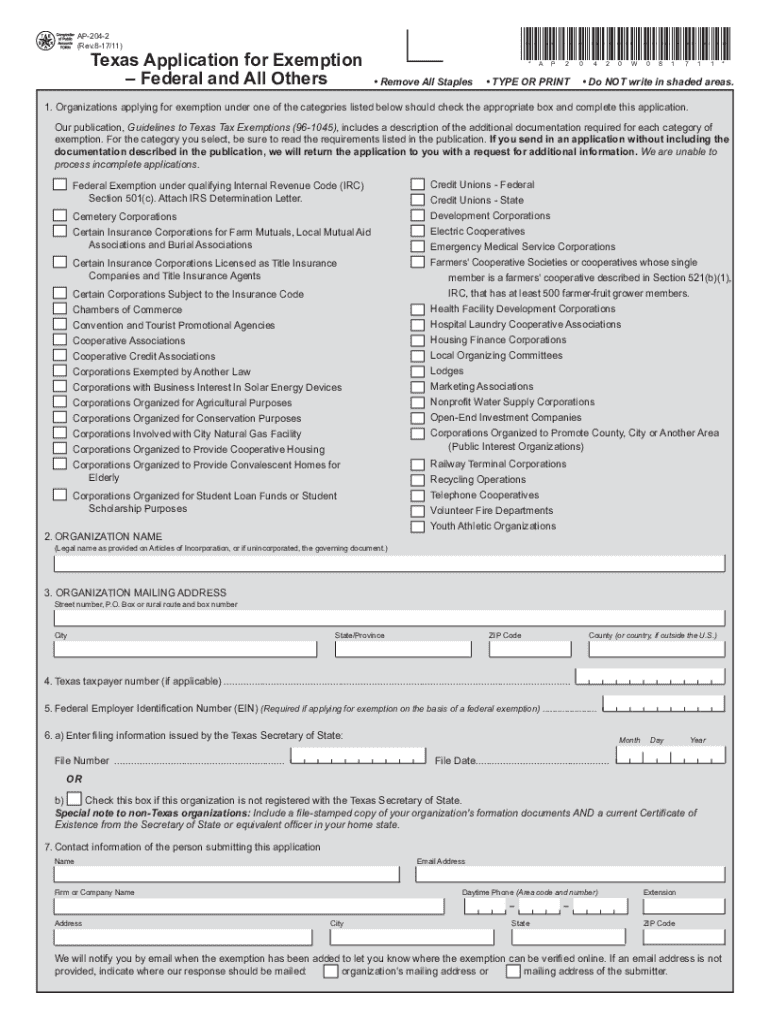

Texas Tax Exempt Form For Churches - Web an organization that qualifies as a religious organization as provided by subsection (c) is entitled to an exemption from taxation of: Web churches and religious organizations are still exempt. To apply the certificate, the buyer must first present the. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and use tax,. Web exempt organizations forms & instructions. Web religious, educational or charitable exemption provisions within the state statutes. Instructions for form 990 pdf. Form 990, return of organization exempt from income tax. Web certain nonprofit and government organizations are eligible for exemption from paying texas taxes on their purchases. The forms can be downloaded on this page.

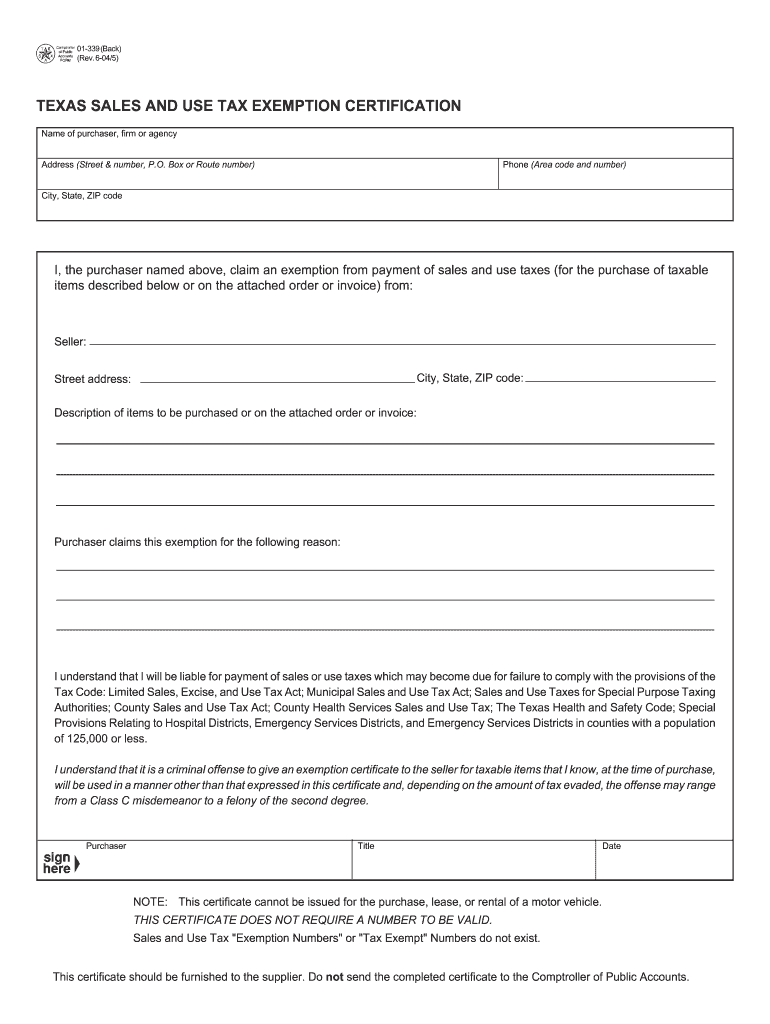

Web churches and religious organizations are still exempt. Form 990, return of organization exempt from income tax. Web attach one schedule ar form for each parcel of real property to be exempt. Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. Web the exemption certificate is utilized for the majority of tax exempt purchases. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and use tax,. (1) the real property that is. Instructions for form 990 pdf. Federal and texas government entities are. Web certain nonprofit and government organizations are eligible for exemption from paying texas taxes on their purchases.

Web exempt organizations forms & instructions. The forms can be downloaded on this page. Instructions for form 990 pdf. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and use tax,. Web we would like to show you a description here but the site won’t allow us. Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. Federal and texas government entities are. Web an organization that qualifies as a religious organization as provided by subsection (c) is entitled to an exemption from taxation of: Web attach one schedule ar form for each parcel of real property to be exempt. Web the legislature may, by general laws, exempt from taxation actual places of religious worship, clergy residences, property used by charitable institutions, and other.

Why are Ministries and Churches TaxExempt Institutions? 7575290000

Web certain nonprofit and government organizations are eligible for exemption from paying texas taxes on their purchases. Web religious, educational or charitable exemption provisions within the state statutes. Web the legislature may, by general laws, exempt from taxation actual places of religious worship, clergy residences, property used by charitable institutions, and other. The forms can be downloaded on this page..

Homestead Exemption Texas Form 2019 Splendora Tx Fill Out and Sign

Web attach one schedule ar form for each parcel of real property to be exempt. Attach one schedule br form listing all personal property to be exempt. For an organization to be exempt from these state taxes based on its. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and.

FREE 10+ Sample Tax Exemption Forms in PDF

Web the legislature may, by general laws, exempt from taxation actual places of religious worship, clergy residences, property used by charitable institutions, and other. Form 990, return of organization exempt from income tax. Instructions for form 990 pdf. (1) the real property that is. Search and obtain online verification of nonprofit and other types of organizations that hold state tax.

Fillableform 01 339 Fill Online, Printable, Fillable, Blank pdfFiller

Web exempt organizations forms & instructions. Web the exemption certificate is utilized for the majority of tax exempt purchases. Web an organization that qualifies as a religious organization as provided by subsection (c) is entitled to an exemption from taxation of: Web certain nonprofit and government organizations are eligible for exemption from paying texas taxes on their purchases. The forms.

Churches And Tax Exemption St. Peter's Church To The Church

Form 990, return of organization exempt from income tax. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and use tax,. Web religious, educational or charitable exemption provisions within the state statutes. Web exempt organizations forms & instructions. Web an organization that qualifies as a religious organization as provided by.

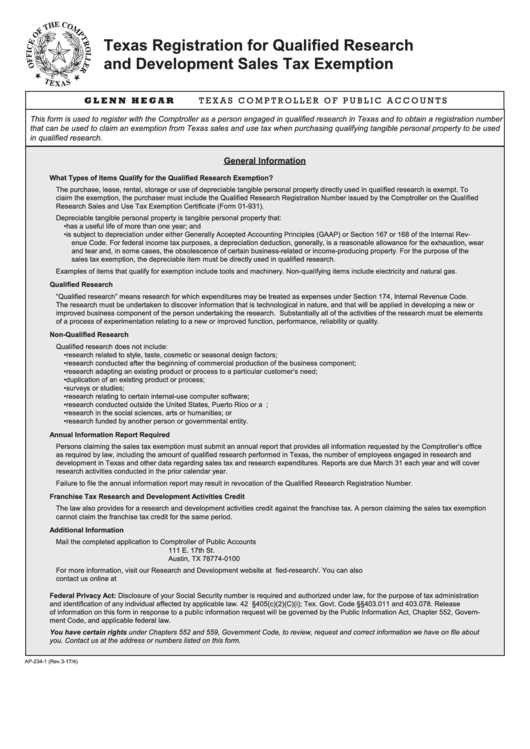

Fillable Form Ap234 Texas Registration For Qualified Research And

Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. Attach one schedule br form listing all personal property to be exempt. The forms can be downloaded on this page. Web religious, educational or charitable exemption provisions.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Web exempt organizations forms & instructions. Instructions for form 990 pdf. Form 990, return of organization exempt from income tax. Web religious, educational or charitable exemption provisions within the state statutes. Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group.

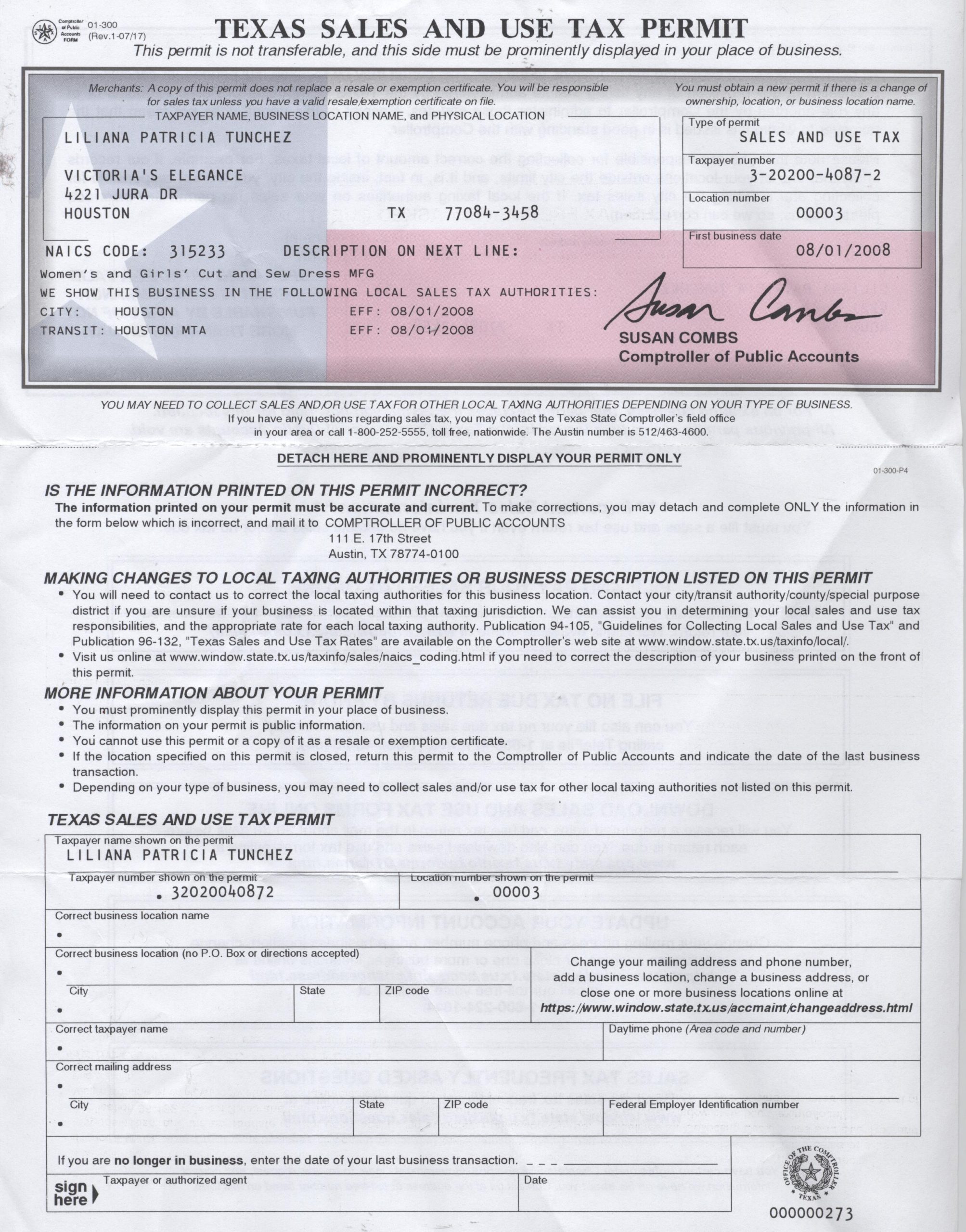

Texas Sales Tax Certificate.jpg Eva USA

To apply the certificate, the buyer must first present the. Web religious, educational or charitable exemption provisions within the state statutes. Federal and texas government entities are. Attach one schedule br form listing all personal property to be exempt. Web due to the differing definitions used by the state of texas and the irs, this is the form that is.

Texas Exemption Port Fill Online, Printable, Fillable, Blank pdfFiller

Form 990, return of organization exempt from income tax. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and use tax,. For an organization to be exempt from these state taxes based on its. Web an organization that qualifies as a religious organization as provided by subsection (c) is entitled.

Tax exempt status isn't just for churches. Let's not that

Web the legislature may, by general laws, exempt from taxation actual places of religious worship, clergy residences, property used by charitable institutions, and other. Instructions for form 990 pdf. (1) the real property that is. Web we would like to show you a description here but the site won’t allow us. Federal and texas government entities are.

Web An Organization That Qualifies As A Religious Organization As Provided By Subsection (C) Is Entitled To An Exemption From Taxation Of:

Form 990, return of organization exempt from income tax. (1) the real property that is. Web exempt organizations forms & instructions. Web churches and religious organizations are still exempt.

For An Organization To Be Exempt From These State Taxes Based On Its.

The forms can be downloaded on this page. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from sales and use tax,. Web religious, educational or charitable exemption provisions within the state statutes. Web the exemption certificate is utilized for the majority of tax exempt purchases.

Web Due To The Differing Definitions Used By The State Of Texas And The Irs, This Is The Form That Is Most Often Filed On Behalf Of Foundation Group Clients Seeking Texas Tax.

Web certain nonprofit and government organizations are eligible for exemption from paying texas taxes on their purchases. Web attach one schedule ar form for each parcel of real property to be exempt. Web we would like to show you a description here but the site won’t allow us. Instructions for form 990 pdf.

Web The Legislature May, By General Laws, Exempt From Taxation Actual Places Of Religious Worship, Clergy Residences, Property Used By Charitable Institutions, And Other.

Attach one schedule br form listing all personal property to be exempt. Federal and texas government entities are. To apply the certificate, the buyer must first present the.