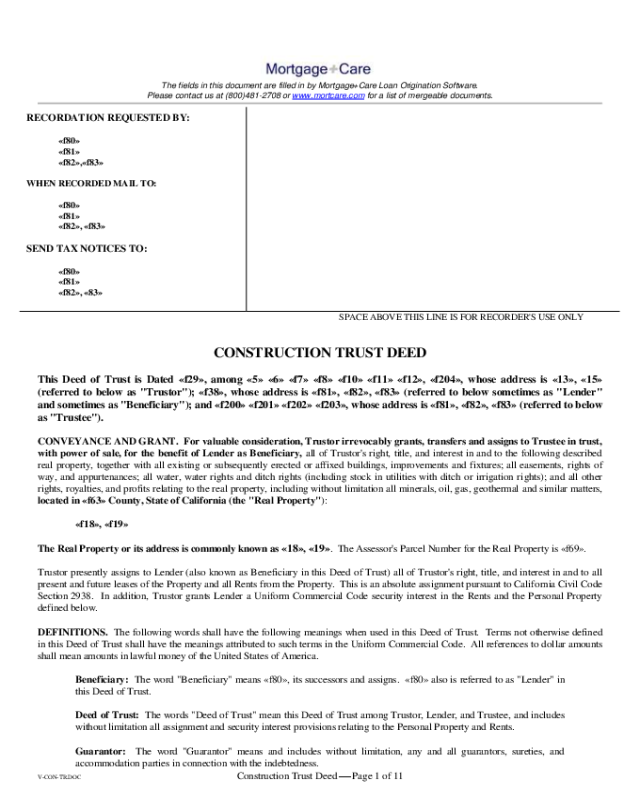

Trust Transfer Deed California Form

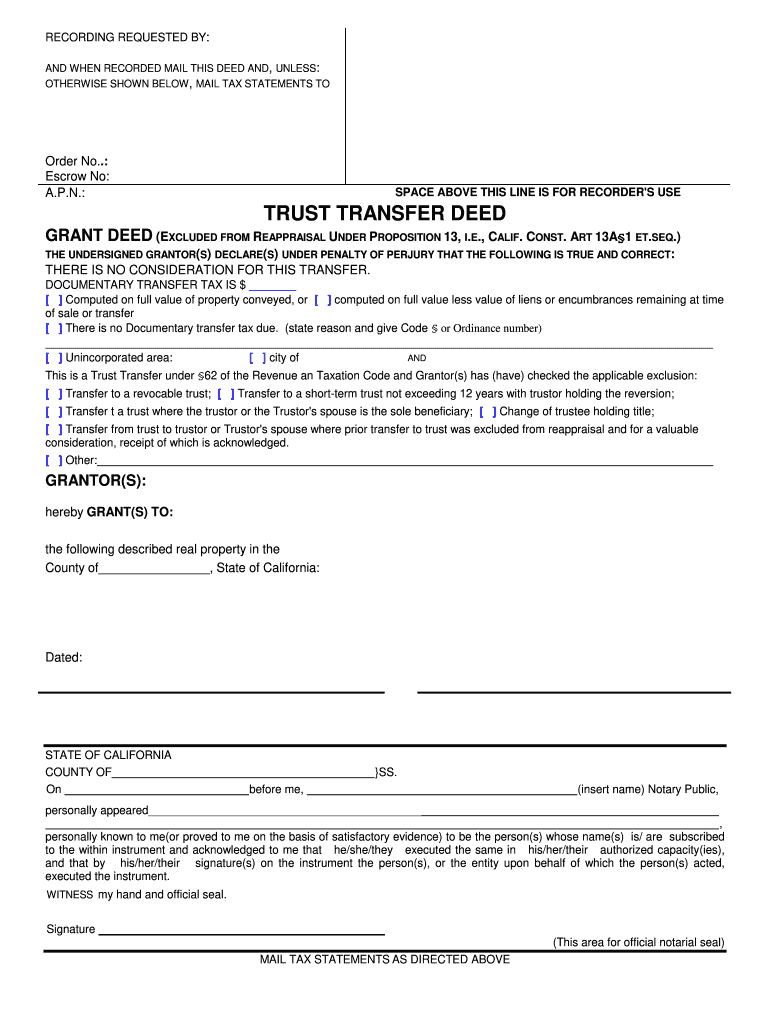

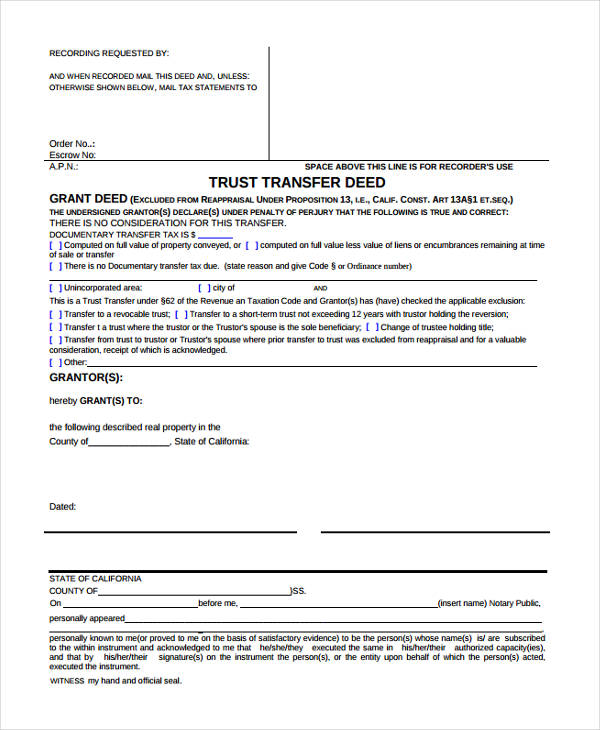

Trust Transfer Deed California Form - Transfer to a revocable trust; Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: Web california deed of trust a california property deed also includes the california deed of trust. Trust transfer deed grant deed, excluded from reassessment under proposition 13, california constitution article 13 a §1 et seq. California deed forms allow for the transfer of real property from a seller (“grantor”) to a buyer (“grantee”). It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. There is no consideration for this transfer. City of _____________________________________________________ and this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: Very broadly, real property may be owned in the following ways:

Computed on full value of property conveyed, or computed on full value less value of liens orencumbrances remaining at time of sale or transfer. The documents vary due to the different scenarios that surround the conveyance. City of _____________________________________________________ and this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: Web if you create a trust with california trusts online, california trusts online will need a copy of your quitclaim deed, grant deed, interspousal deed or trust transfer deed in order to prepare your new trust transfer deed. California deed forms allow for the transfer of real property from a seller (“grantor”) to a buyer (“grantee”). Web the form of ownership is usually selected based on the needs of the owner or owners. Web california deed of trust form. Web updated june 07, 2023. Or, see government code sections 27201, 27201.5, 27287, and 27288. Very broadly, real property may be owned in the following ways:

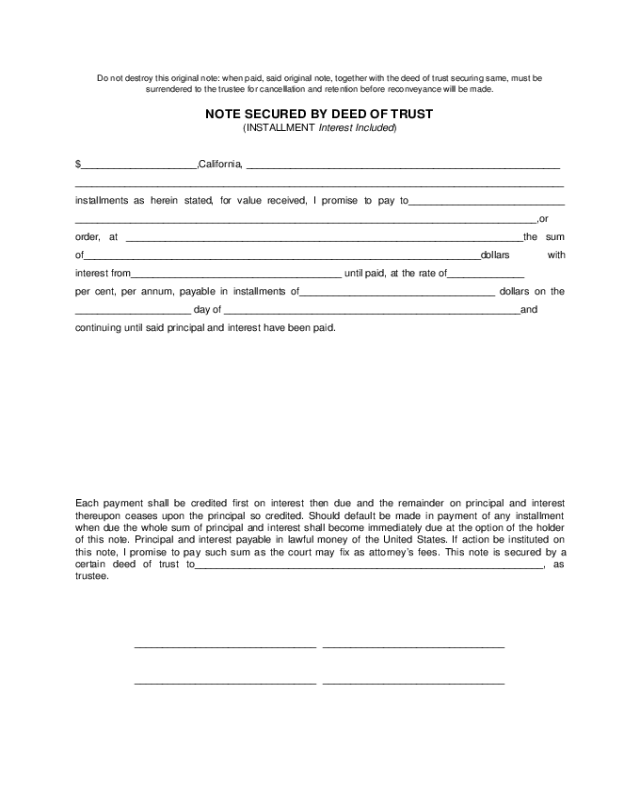

Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; There is no consideration for this transfer. The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: Transfer to a revocable trust; Computed on full value of property conveyed, or computed on full value less value of liens orencumbrances remaining at time of sale or transfer. This form develops a security interest in property where the legal title gets transferred to a trustee who holds it as security as a loan between the. It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. Joint, common, or community ownership; Web trust transfer grant deed the undersigned grantor(s) declare(s):documentary transfer tax is $ __________________. What is a trust deed?

2023 Deed of Trust Form Fillable, Printable PDF & Forms Handypdf

Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; Or, see government code sections 27201, 27201.5, 27287, and 27288. The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. Computed on full value of property conveyed, or.

California Deed Of Trust Release Form Form Resume Examples ko8LNGeK9J

Or, see government code sections 27201, 27201.5, 27287, and 27288. The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: Transfer to a revocable trust; Transfer to a revocable trust; This form develops a security interest in property where the legal title gets transferred to a trustee who holds it as security as a loan.

Trust Transfer Deed PDF Form Fill Out and Sign Printable PDF Template

Very broadly, real property may be owned in the following ways: Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: California deed forms allow for the transfer of real property from a seller (“grantor”) to a buyer (“grantee”). Computed on full value of property conveyed, or computed.

2022 Deed of Trust Form Fillable, Printable PDF & Forms Handypdf

Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: Web the form of ownership is usually selected based on the needs of the owner or owners. There is no consideration for this transfer. It is the deed that shows that the lender has an interest in the.

California Deed Of Trust Release Form Form Resume Examples ko8LNGeK9J

It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. This form develops a security interest in property where the legal title gets transferred to a trustee who holds it as security as a loan between the. The undersigned grantor(s) declare(s) under penalty of perjury that the following.

interspousal transfer deed california Fill Online, Printable

Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: Web updated june 07, 2023. Very broadly, real property may be owned in the following ways: Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; Web trust transfer grant deed the undersigned.

FREE 23+ Deed Forms in PDF

Joint, common, or community ownership; Web trust transfer grant deed the undersigned grantor(s) declare(s):documentary transfer tax is $ __________________. A california deed of trust is a deed used in connection with a mortgage loan. The documents vary due to the different scenarios that surround the conveyance. There is no consideration for this transfer.

Grant Deed Form Sacramento County Universal Network

Trust transfer deed grant deed, excluded from reassessment under proposition 13, california constitution article 13 a §1 et seq. The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: Web california deed of trust a california property deed also includes the california deed of trust. Or, see government code sections 27201, 27201.5, 27287, and 27288..

Free Fillable California Grant Deed Form Form Resume Examples

Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes. California trusts online does not need a copy of your trust deed. Web updated june 07, 2023. Transfer to a revocable trust; Web if you create a trust with california trusts online, california trusts online will need a.

Nfa Trust Document Universal Network

What is a trust deed? California deed forms allow for the transfer of real property from a seller (“grantor”) to a buyer (“grantee”). The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. Transfer to a revocable trust; The undersigned grantor(s) declare(s) under.

Web California Deed Of Trust Form.

Transfer to a revocable trust; Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; The documents vary due to the different scenarios that surround the conveyance. Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes.

This Form Develops A Security Interest In Property Where The Legal Title Gets Transferred To A Trustee Who Holds It As Security As A Loan Between The.

Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. Joint, common, or community ownership; There is no consideration for this transfer.

Web If You Create A Trust With California Trusts Online, California Trusts Online Will Need A Copy Of Your Quitclaim Deed, Grant Deed, Interspousal Deed Or Trust Transfer Deed In Order To Prepare Your New Trust Transfer Deed.

The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: City of _____________________________________________________ and this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicable exclusion: The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. Web california deed of trust a california property deed also includes the california deed of trust.

Transfer To A Revocable Trust;

Trust transfer deed grant deed, excluded from reassessment under proposition 13, california constitution article 13 a §1 et seq. Computed on full value of property conveyed, or computed on full value less value of liens orencumbrances remaining at time of sale or transfer. Web trust transfer grant deed the undersigned grantor(s) declare(s):documentary transfer tax is $ __________________. A california deed of trust is a deed used in connection with a mortgage loan.