Turbotax Disclosure Consent Form

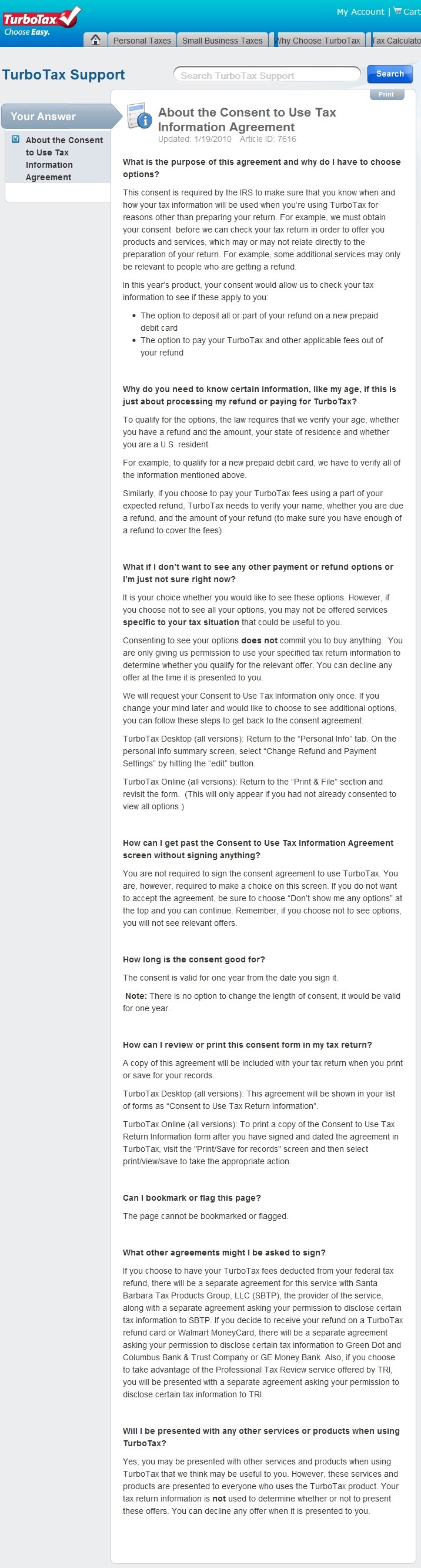

Turbotax Disclosure Consent Form - Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec. Clearly, it is not illegal for them to ask for our consent. Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. Web 1 best answer. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. 2.1k views 1 year ago. Each tax preparer should read regs.

Each tax preparer should read regs. But how they are asking is deceiving. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. Clearly, it is not illegal for them to ask for our consent. Web that q and a was very informative. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. Web 1 best answer. (a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. Web the commissioner, or his or her authorized delegate, may disclose company’s:

The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web that q and a was very informative. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time other items you may find useful all form 8275. Clearly, it is not illegal for them to ask for our consent. Each tax preparer should read regs. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Web the commissioner, or his or her authorized delegate, may disclose company’s: It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. Web the appropriate consent forms for one accounting firm may not be suitable for another firm.

form 2106 turbotax Fill Online, Printable, Fillable Blank

When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec. Web 1 best answer. But how they are asking.

Turbotax Consent To Disclosure Of Tax Return Information? The 6 Correct

Web the appropriate consent forms for one accounting firm may not be suitable for another firm. Web 1 best answer. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent.

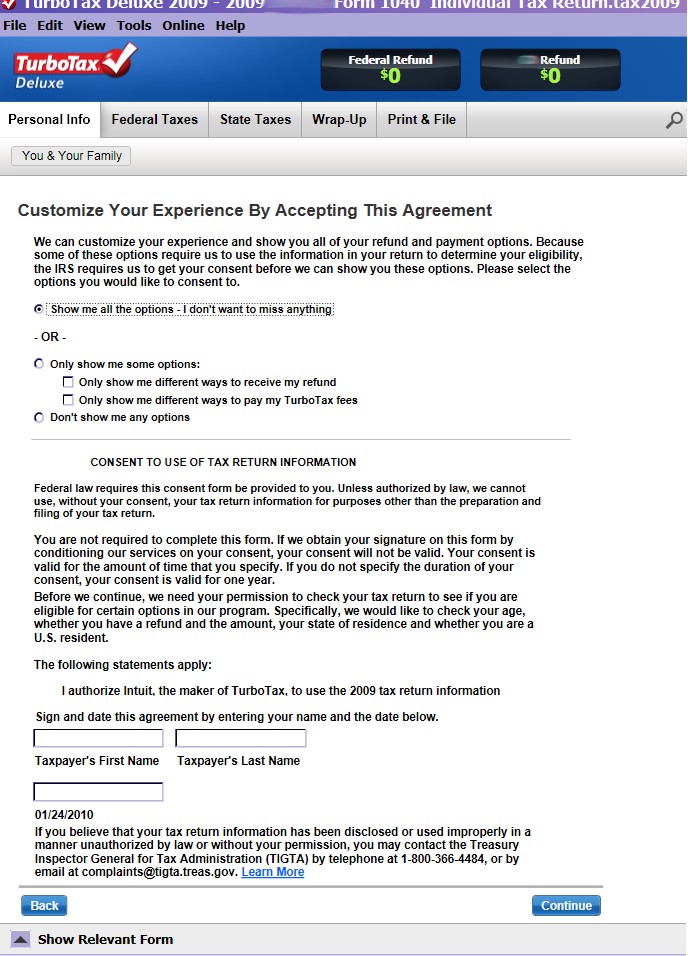

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

2.1k views 1 year ago. Web that q and a was very informative. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time other items you may find useful all form 8275. Web this year's scam is a bogus consent form at the start of the process that looks as if.

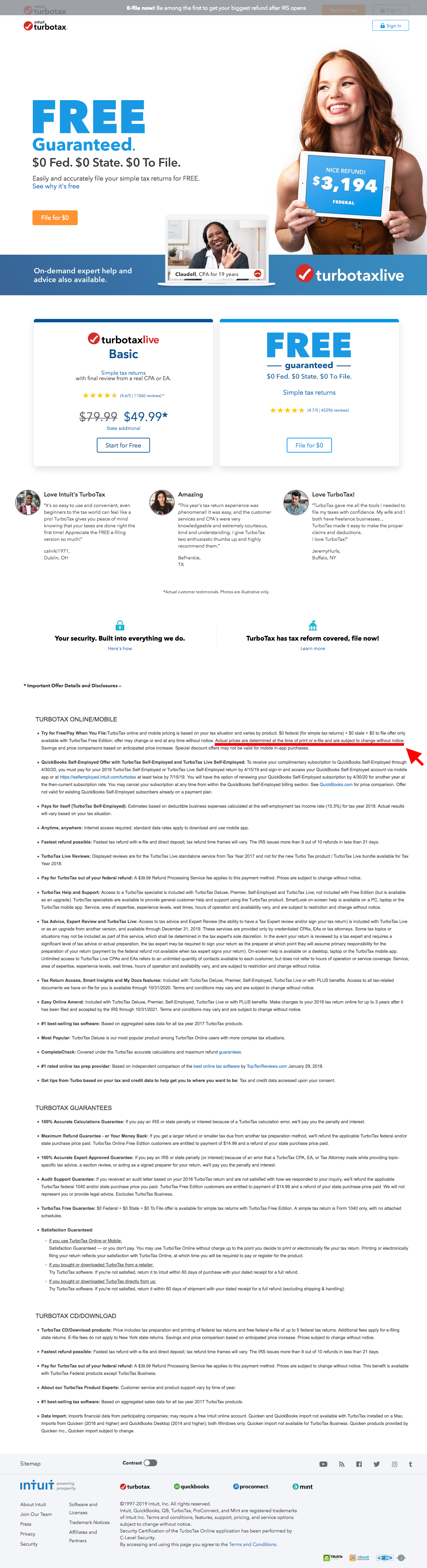

How TurboTax turns a dreadful user experience into a delightful one

Web 1 best answer. It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. Web this year's scam.

Example Of Informed Consent For Therapy slide share

This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec. (a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the.

Adoptive Child Worksheet Turbotax Worksheet Resume Examples

Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. Clearly, it is not illegal for them to ask for.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Web the commissioner, or his or her authorized delegate, may disclose company’s: Web that q and a was very informative. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are.

TurboTax Free Truth In Advertising

Web that q and a was very informative. 2.1k views 1 year ago. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time.

TurboTax Review 2022 Is It Really That Easy?

2.1k views 1 year ago. But how they are asking is deceiving. Each tax preparer should read regs. Web the commissioner, or his or her authorized delegate, may disclose company’s: Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Disclosure, Consent, Acknowledgment and Agreement Doc Template pdfFiller

Web the commissioner, or his or her authorized delegate, may disclose company’s: Clearly, it is not illegal for them to ask for our consent. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. When you go through the screens, it looks like you are just providing a signature early for your tax form.

It May Seem Silly, But Turbotax Can't Offer You Those Services Unless You Officially Give It Permission To Know About Your Tax Refund Status.

When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Clearly, it is not illegal for them to ask for our consent.

But How They Are Asking Is Deceiving.

(a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time other items you may find useful all form 8275. Web that q and a was very informative. 2.1k views 1 year ago.

Each Tax Preparer Should Read Regs.

Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. Web the commissioner, or his or her authorized delegate, may disclose company’s: This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec.