Usaa Payable On Death Form

Usaa Payable On Death Form - Typing, drawing, or uploading one. Web life insurance, health insurance and annuity forms find the forms you need to help with your accounts. It's never easy losing a loved one. Web am under age 591/2 and wish to take a series of substantially equal periodic payments over my life expectancy or over the joint life expectancy of my designated beneficiary and i, in accordance with the provisions of the internal revenue code section 72(t). Web as we continue to honor your loved one's memory, we can help you manage and settle details of usaa accounts. Please attach any additional supporting information as necessary. If the field doesn’t apply enter “n/a.” Web with a payable on death account or paid on death account, you name a beneficiary who gets the account when you die—no probate, no hassle. You'll need the free adobe reader software to view the documents. Web make sure the info you fill in usaa payable on death form is updated and accurate.

If the field doesn’t apply enter “n/a.” Web retirement accounts like a tsp, 401(k) or iras can have a beneficiary assigned to them. Web suppliers who contract with usaa are typically required to review, complete and execute the following documents and forms. Simply download and print each form before completing it. Upload the usaa payable on death form checking account. Web am under age 591/2 and wish to take a series of substantially equal periodic payments over my life expectancy or over the joint life expectancy of my designated beneficiary and i, in accordance with the provisions of the internal revenue code section 72(t). Save your changes and share usaa pod form. Web life insurance, health insurance and annuity forms find the forms you need to help with your accounts. Check each and every area has been filled in properly. We can also provide contact information for survivor benefits that may apply.

You'll need the free adobe reader software to view the documents. Select the sign icon and make an electronic signature. Web with a payable on death account or paid on death account, you name a beneficiary who gets the account when you die—no probate, no hassle. Check each and every area has been filled in properly. Web make sure the info you fill in usaa payable on death form is updated and accurate. Our article covers the steps on how to close accounts and transfer ownership. Losing a loved one is a painful, devastating part of life. You can find 3 available options; We can also provide contact information for survivor benefits that may apply. Upload the usaa payable on death form checking account.

Payable on Death (POD) Account What is it and How to Add Beneficiary

Typing, drawing, or uploading one. Losing a loved one is a painful, devastating part of life. Web suppliers who contract with usaa are typically required to review, complete and execute the following documents and forms. If the field doesn’t apply enter “n/a.” Web with a payable on death account or paid on death account, you name a beneficiary who gets.

5 Reasons Not to Have a POD Account Northwest Legal Planning

Web retirement accounts like a tsp, 401(k) or iras can have a beneficiary assigned to them. Typing, drawing, or uploading one. Some nonretirement accounts are also titled in ways that allow immediate transfer to a beneficiary. Web am under age 591/2 and wish to take a series of substantially equal periodic payments over my life expectancy or over the joint.

CD NUEVO P.O.D. PAYABLE ON DEATH 075678367625 Libreria Atlas

You can find 3 available options; Web suppliers who contract with usaa are typically required to review, complete and execute the following documents and forms. Web am under age 591/2 and wish to take a series of substantially equal periodic payments over my life expectancy or over the joint life expectancy of my designated beneficiary and i, in accordance with.

Pros and cons of a ‘payable on death’ account

You can find 3 available options; Typing, drawing, or uploading one. Web retirement accounts like a tsp, 401(k) or iras can have a beneficiary assigned to them. Check each and every area has been filled in properly. Some nonretirement accounts are also titled in ways that allow immediate transfer to a beneficiary.

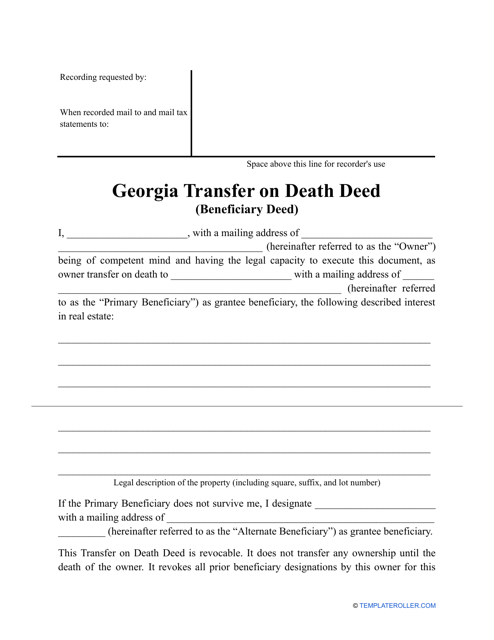

(United States) Transfer on Death Deed Form Download Printable

You'll need the free adobe reader software to view the documents. Typing, drawing, or uploading one. Web suppliers who contract with usaa are typically required to review, complete and execute the following documents and forms. You can find 3 available options; Simply download and print each form before completing it.

Payable on Death (POD) and Transfer on Death (TOD) Accounts

Save your changes and share usaa pod form. Web life insurance, health insurance and annuity forms find the forms you need to help with your accounts. Please attach any additional supporting information as necessary. We can also provide contact information for survivor benefits that may apply. Web make sure the info you fill in usaa payable on death form is.

Usaa Survivor Relations Fill Online, Printable, Fillable, Blank

Dealing with finances quickly after a loss can help you get your life back on track. Select the sign icon and make an electronic signature. Some nonretirement accounts are also titled in ways that allow immediate transfer to a beneficiary. Simply download and print each form before completing it. Web life insurance, health insurance and annuity forms find the forms.

P.O.D. Payable On Death (2003, CD) Discogs

All fields are required to be filled in, unless noted otherwise. If the field doesn’t apply enter “n/a.” Web suppliers who contract with usaa are typically required to review, complete and execute the following documents and forms. Web life insurance, health insurance and annuity forms find the forms you need to help with your accounts. Web am under age 591/2.

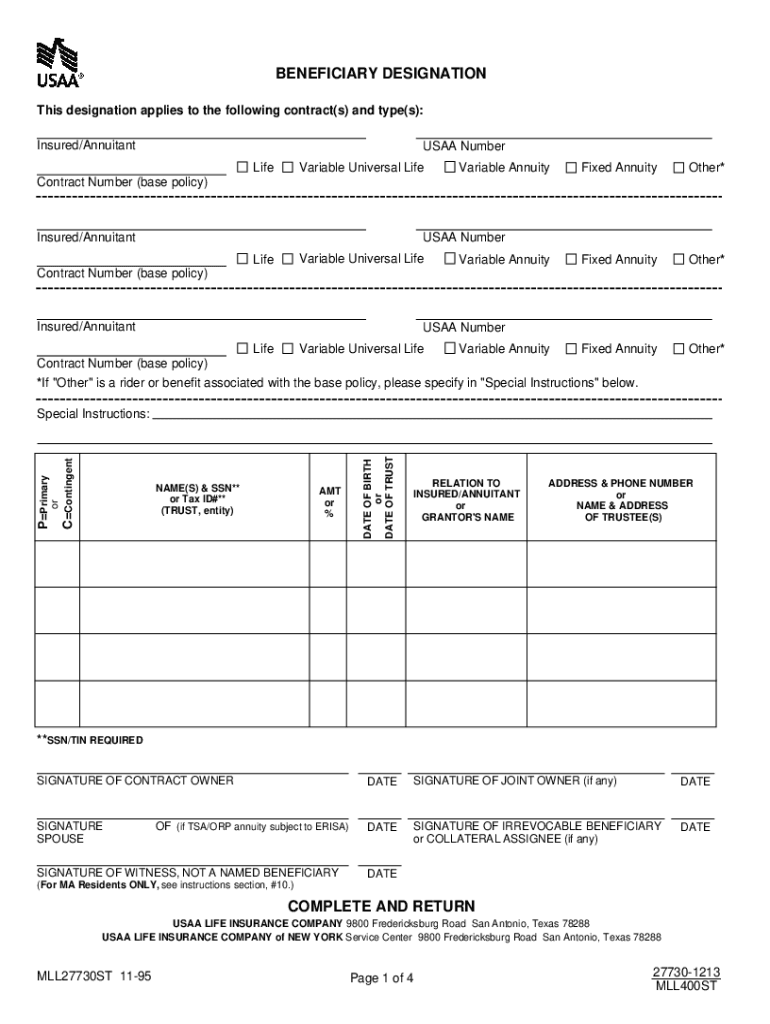

Usaa Pod Form Fill Online, Printable, Fillable, Blank pdfFiller

Losing a loved one is a painful, devastating part of life. Edit & sign usaa payable on death beneficiary from anywhere. Dealing with finances quickly after a loss can help you get your life back on track. Simply download and print each form before completing it. Web life insurance, health insurance and annuity forms find the forms you need to.

Change Payable Death Designation Form Editable template online

Please attach any additional supporting information as necessary. Some nonretirement accounts are also titled in ways that allow immediate transfer to a beneficiary. Edit & sign usaa payable on death beneficiary from anywhere. If the field doesn’t apply enter “n/a.” Select the sign icon and make an electronic signature.

We Can Also Provide Contact Information For Survivor Benefits That May Apply.

Web with a payable on death account or paid on death account, you name a beneficiary who gets the account when you die—no probate, no hassle. You can find 3 available options; Some nonretirement accounts are also titled in ways that allow immediate transfer to a beneficiary. Web as we continue to honor your loved one's memory, we can help you manage and settle details of usaa accounts.

Dealing With Finances Quickly After A Loss Can Help You Get Your Life Back On Track.

Web life insurance, health insurance and annuity forms find the forms you need to help with your accounts. If the field doesn’t apply enter “n/a.” Save your changes and share usaa pod form. Edit & sign usaa payable on death beneficiary from anywhere.

It's Never Easy Losing A Loved One.

Losing a loved one is a painful, devastating part of life. Please attach any additional supporting information as necessary. Web suppliers who contract with usaa are typically required to review, complete and execute the following documents and forms. All fields are required to be filled in, unless noted otherwise.

Web Retirement Accounts Like A Tsp, 401(K) Or Iras Can Have A Beneficiary Assigned To Them.

You'll need the free adobe reader software to view the documents. Our article covers the steps on how to close accounts and transfer ownership. Web am under age 591/2 and wish to take a series of substantially equal periodic payments over my life expectancy or over the joint life expectancy of my designated beneficiary and i, in accordance with the provisions of the internal revenue code section 72(t). Add the date to the template with the date option.

:format(jpeg):mode_rgb():quality(90)/discogs-images/R-2253518-1537419957-5931.jpeg.jpg)