Vermont State Tax Form 2022

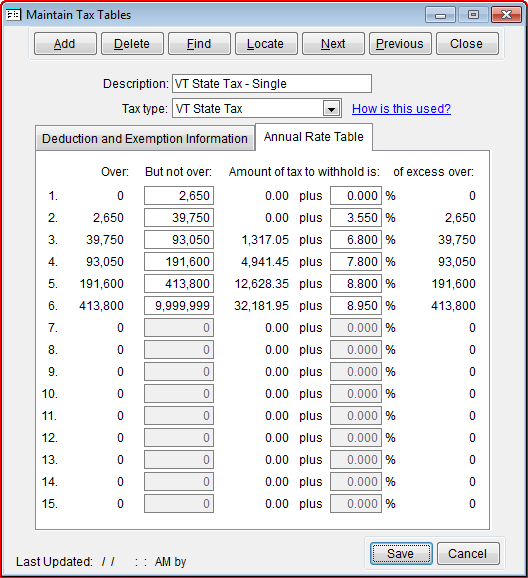

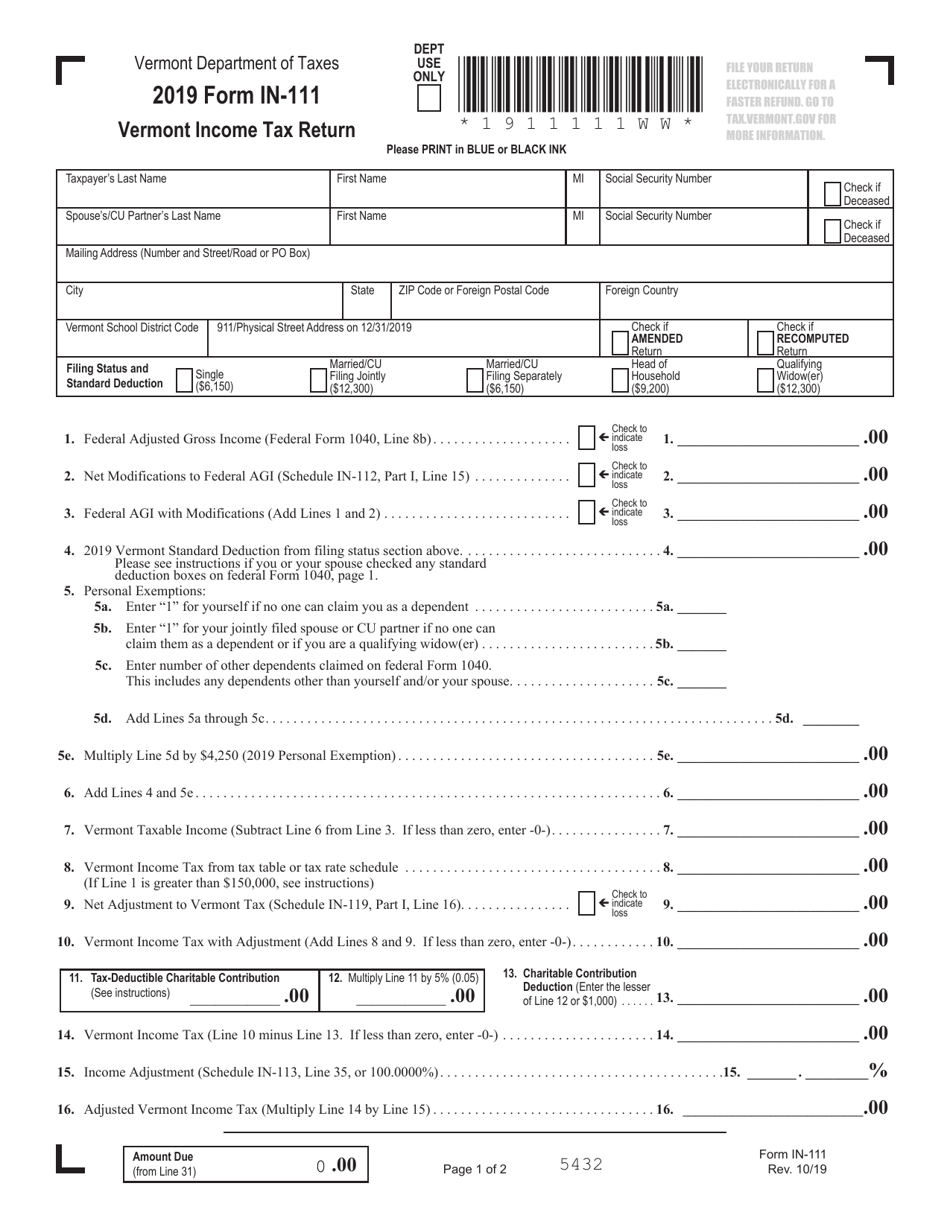

Vermont State Tax Form 2022 - Streamlined document workflows for any industry. Web december 1, 2022 commissioner of taxes releases fy2024 education tax rate letter october 3, 2022 vermont tax department reminds of final deadline for property tax. The vermont department of taxes offers several eservices for individual taxpayers and businesses through myvtax, the department's online portal. This booklet includes forms and instructions for: Most states will release updated tax forms between january and april. Complete, edit or print tax forms instantly. Web vermont state income tax return forms for tax year 2022 (jan. Residents must file state taxes using form. Animal licensure fillable pdf return form; Web vermont imposes state taxes in five income brackets with tax rates ranging from 3.55% to 8.95% depending on income and filing status.

Web instructions vermont income tax forms for current and previous tax years. Web forms by tax or type. This booklet includes forms and instructions for: Information on how to only file. 2022 vermont income tax return booklet. Complete, edit or print tax forms instantly. Animal licensure fillable pdf return form; Web find forms and documents from the treasurer's office listed by division: Web 25 rows vermont has a state income tax that ranges between 3.35% and 8.75% , which is administered by. Web the current tax year is 2022, with tax returns due in april 2023.

Find forms for your industry in minutes. Web the current tax year is 2022, with tax returns due in april 2023. Information on how to only file. Web december 1, 2022 commissioner of taxes releases fy2024 education tax rate letter october 3, 2022 vermont tax department reminds of final deadline for property tax. We last updated the vermont personal income. The vermont department of taxes offers several eservices for individual taxpayers and businesses through myvtax, the department's online portal. Animal licensure fillable pdf return form; 2021 vermont income tax return booklet. The 2023 property tax credit is based on 2022 household income and. 2022 vermont income tax return booklet.

PowerChurch Software Church Management Software for Today's Growing

Web instructions vermont income tax forms for current and previous tax years. Find forms for your industry in minutes. Web find forms and documents from the treasurer's office listed by division: Residents must file state taxes using form. Animal licensure fillable pdf return form;

Edgardo Byrnes

2021 vermont income tax return booklet. Corporate and business income taxes. This booklet includes forms and instructions for: Show entries showing 1 to 25 of 41. Web the current tax year is 2022, with tax returns due in april 2023.

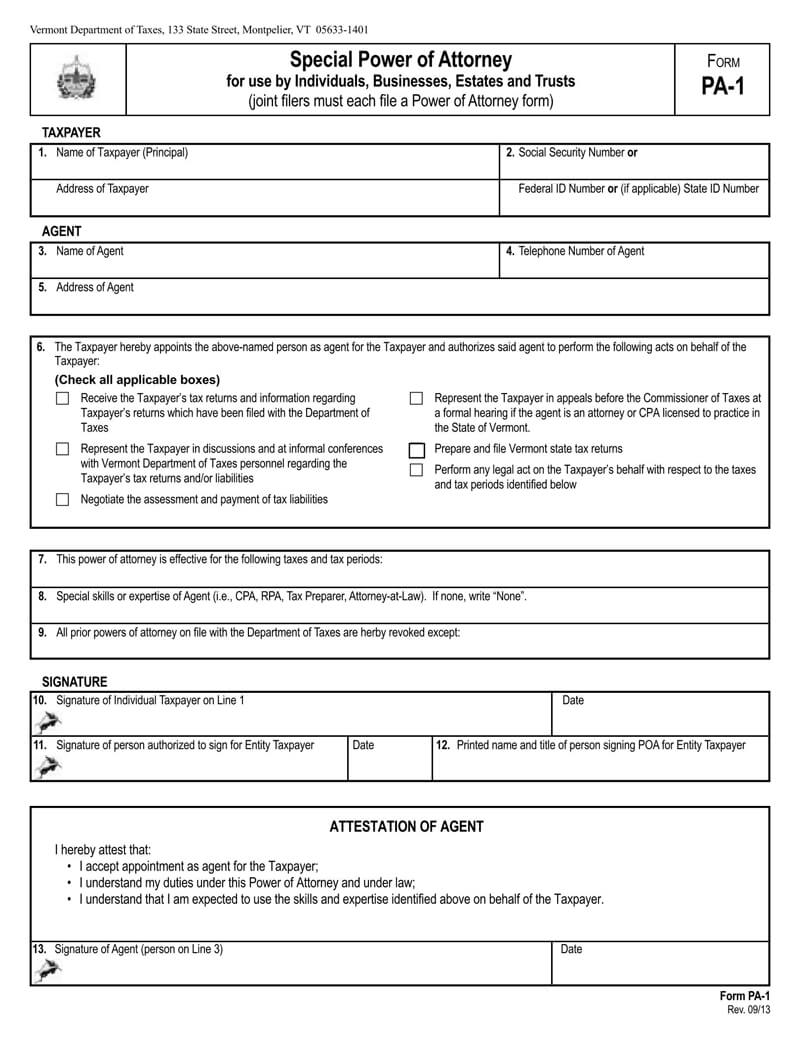

Free State Tax Power of Attorney Forms (by State) WordPDF

Web find forms and documents from the treasurer's office listed by division: Web the credit is applied to your property tax and the town issues a bill for any balance due. Web instructions vermont income tax forms for current and previous tax years. 2021 vermont income tax return booklet. Complete, edit or print tax forms instantly.

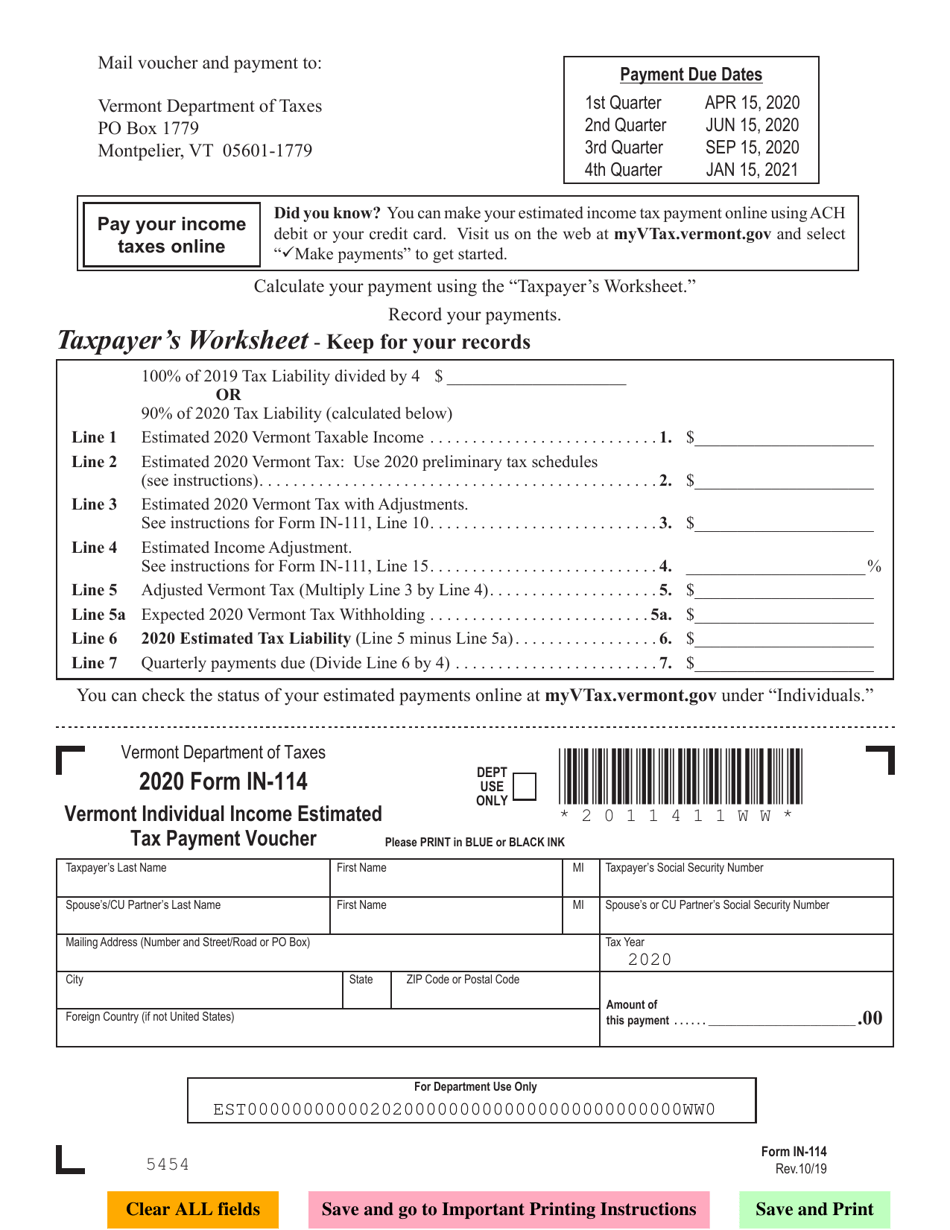

Form IN114 Download Fillable PDF or Fill Online Vermont Individual

Web vermont imposes state taxes in five income brackets with tax rates ranging from 3.55% to 8.95% depending on income and filing status. 2021 vermont income tax return booklet. Streamlined document workflows for any industry. The 2023 property tax credit is based on 2022 household income and. Corporate and business income taxes.

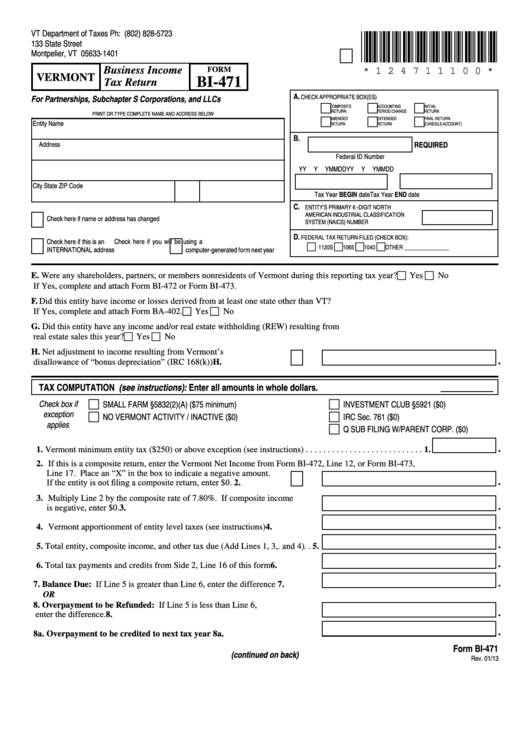

Fillable Form Bi471 Vermont Business Tax Return printable pdf

We last updated the vermont personal income. Web find forms and documents from the treasurer's office listed by division: 2022 vermont income tax return booklet. Complete, edit or print tax forms instantly. This booklet includes forms and instructions for:

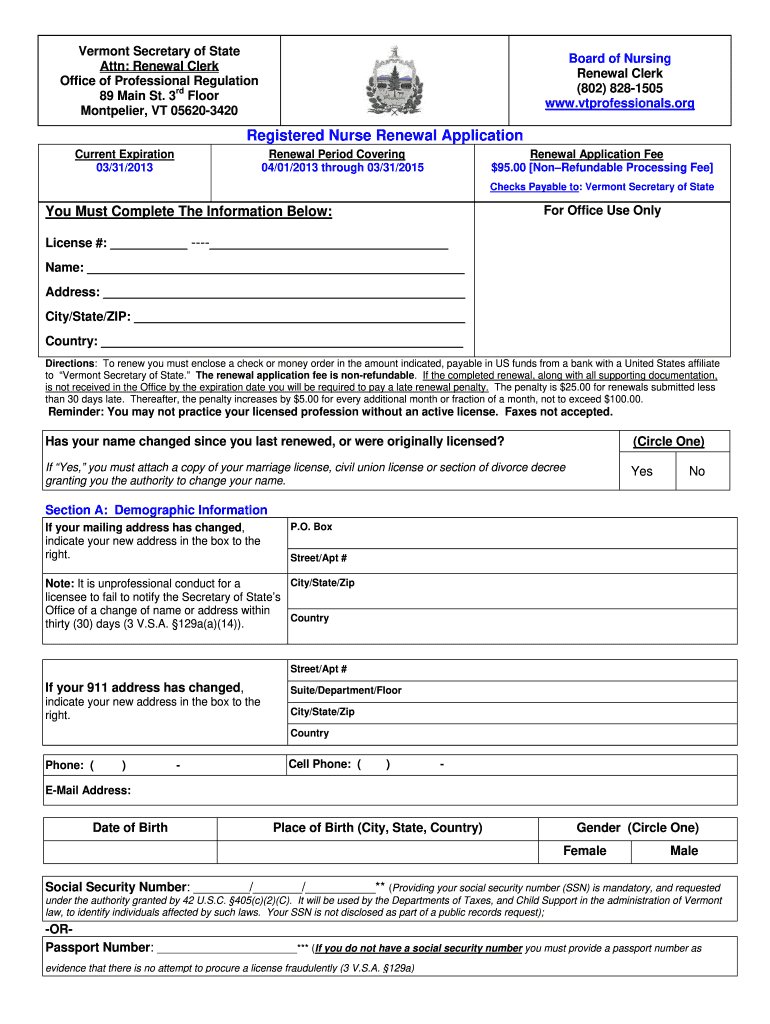

20132022 Form VT RN Renewal Application Fill Online, Printable

Streamlined document workflows for any industry. Most states will release updated tax forms between january and april. The vermont department of taxes offers several eservices for individual taxpayers and businesses through myvtax, the department's online portal. 2022 vermont income tax return booklet. Residents must file state taxes using form.

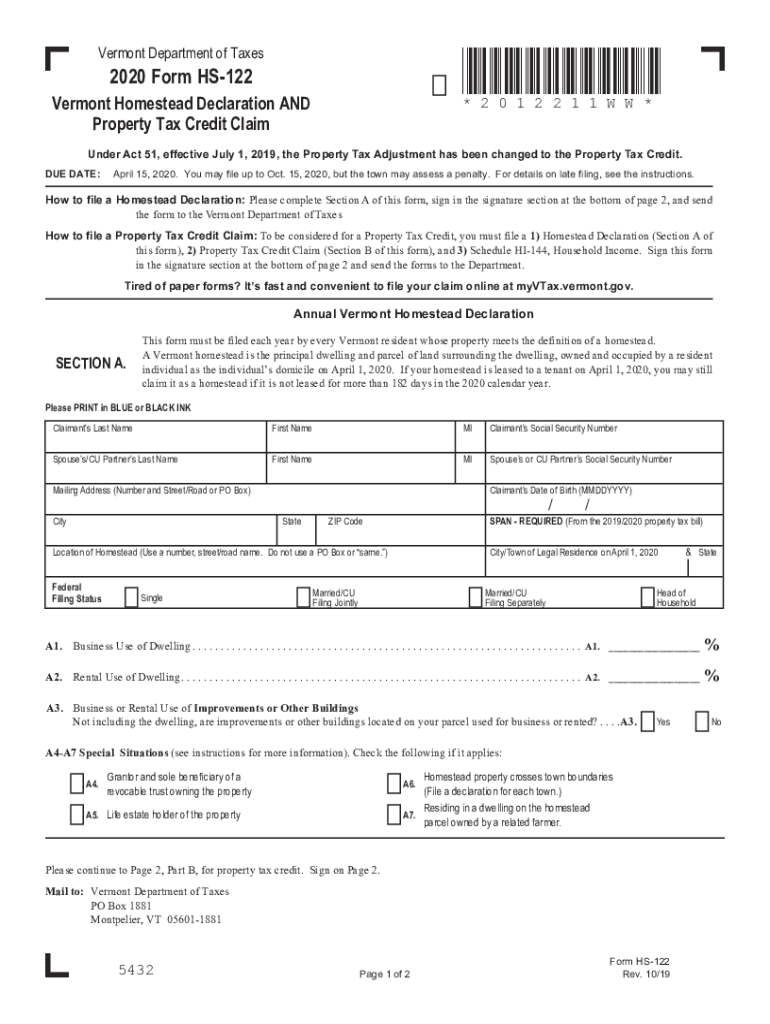

Vermont State Tax Form Fill Out and Sign Printable PDF Template signNow

Animal licensure fillable pdf return form; Corporate and business income taxes. Be sure to verify that the form you are downloading is for the correct year. Web december 1, 2022 commissioner of taxes releases fy2024 education tax rate letter october 3, 2022 vermont tax department reminds of final deadline for property tax. Web find forms and documents from the treasurer's.

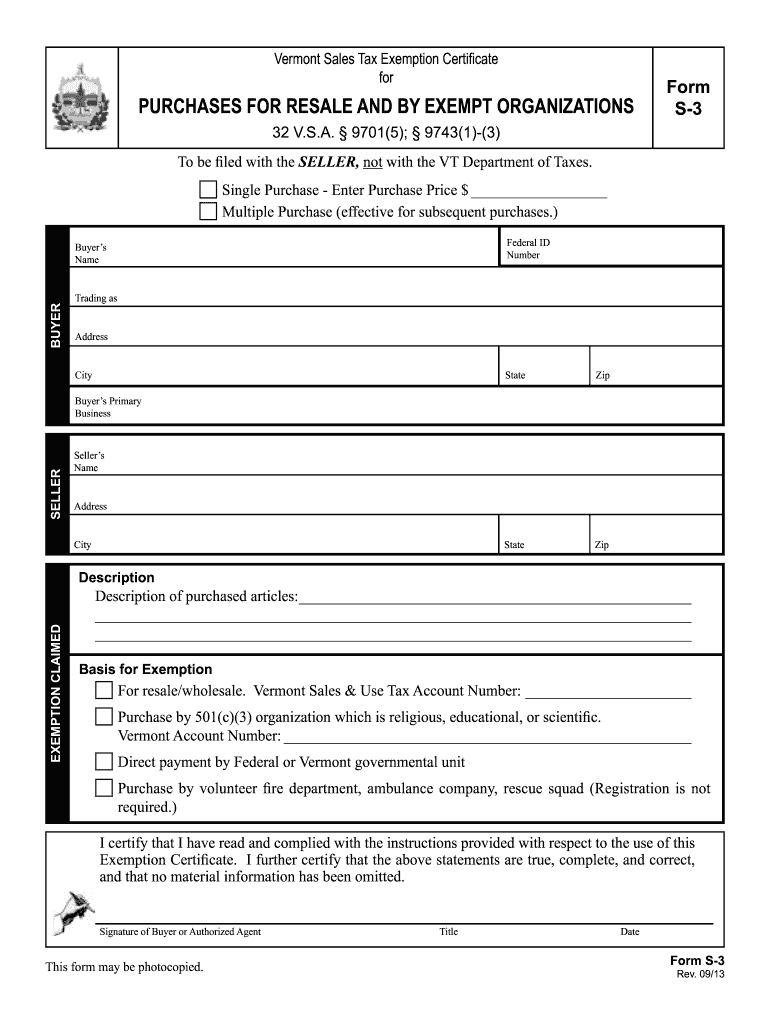

Vermont Sales Tax Form S 3 Fill Out and Sign Printable PDF Template

Corporate and business income taxes. 2021 vermont income tax return booklet. Most states will release updated tax forms between january and april. Web vermont imposes state taxes in five income brackets with tax rates ranging from 3.55% to 8.95% depending on income and filing status. Find forms for your industry in minutes.

Michigan 1040 Fill Out and Sign Printable PDF Template signNow

2021 vermont income tax return booklet. Be sure to verify that the form you are downloading is for the correct year. Residents must file state taxes using form. Web vermont imposes state taxes in five income brackets with tax rates ranging from 3.55% to 8.95% depending on income and filing status. Web the current tax year is 2022, with tax.

2021 Vermont Income Tax Return Booklet.

Animal licensure fillable pdf return form; Show entries showing 1 to 25 of 41. 2022 vermont income tax return booklet. This booklet includes forms and instructions for:

Web Find Forms And Documents From The Treasurer's Office Listed By Division:

Be sure to verify that the form you are downloading is for the correct year. Web instructions vermont income tax forms for current and previous tax years. Web the current tax year is 2022, with tax returns due in april 2023. The 2023 property tax credit is based on 2022 household income and.

The Vermont Department Of Taxes Offers Several Eservices For Individual Taxpayers And Businesses Through Myvtax, The Department's Online Portal.

Web vermont imposes state taxes in five income brackets with tax rates ranging from 3.55% to 8.95% depending on income and filing status. Web the credit is applied to your property tax and the town issues a bill for any balance due. Complete, edit or print tax forms instantly. Find forms for your industry in minutes.

Streamlined Document Workflows For Any Industry.

Residents must file state taxes using form. Web december 1, 2022 commissioner of taxes releases fy2024 education tax rate letter october 3, 2022 vermont tax department reminds of final deadline for property tax. This booklet includes forms and instructions for: Corporate and business income taxes.