W 9 Form Ga

W 9 Form Ga - Status and avoid section 1446 withholding on your share of partnership income. Finding a legal expert, creating a scheduled appointment and coming to the office for a private conference makes completing a w 9. In the cases below, the. Request for taxpayer identification number (tin) and. Person (including a resident alien) and to request certain certifications and claims for exemption. Request for taxpayer identification number and certification. Web follow the simple instructions below: The forms will be effective with the. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Edit your georgia w 9 online type text, add images, blackout confidential details, add comments, highlights and more.

Sign it in a few clicks draw your signature, type it,. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Request for taxpayer identification number (tin) and. Request for taxpayer identification number and certification. Person (including a resident alien) and to request certain certifications and claims for exemption. The forms will be effective with the. December 2011) department of the treasury internal revenue service. It's a request for information about the contractors you pay as well as an agreement with those contractors that you won't be withholding income tax. Individual tax return form 1040 instructions; Citizen (including a us resident alien), to provide your correct tin to the person requesting it and, when applicable, to:

Request for taxpayer identification number and certification. The forms will be effective with the. Individual tax return form 1040 instructions; Person (including a resident alien) and to request certain certifications and claims for exemption. December 2011) department of the treasury internal revenue service. Sign it in a few clicks draw your signature, type it,. This includes their name, address, employer identification number (ein),. Citizen (including a us resident alien), to provide your correct tin to the person requesting it and, when applicable, to: Status and avoid section 1446 withholding on your share of partnership income. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to:

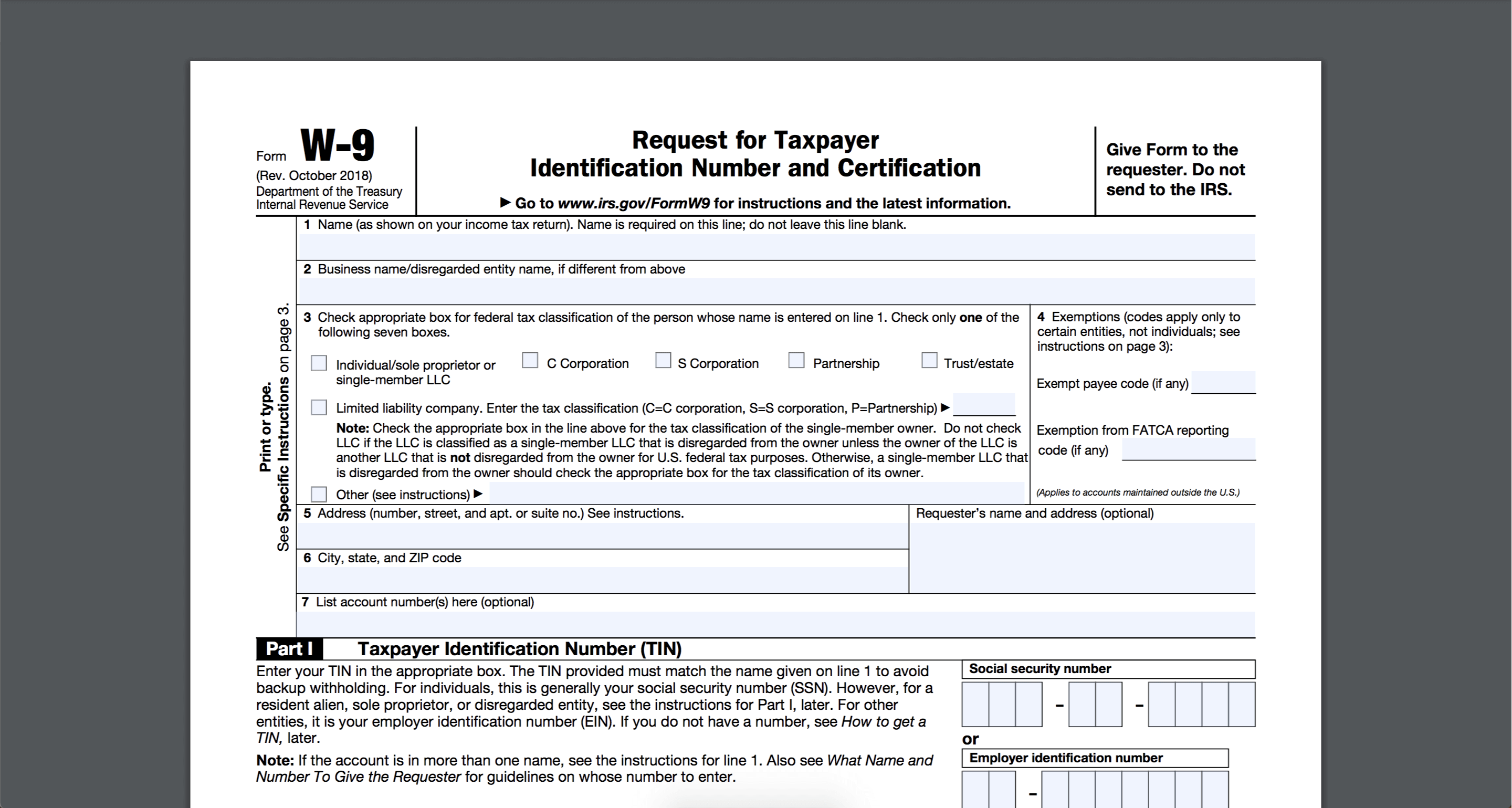

How to Fill Out and Sign Your W9 Form Online to Get Paid Faster

Edit your georgia w 9 online type text, add images, blackout confidential details, add comments, highlights and more. Citizen (including a us resident alien), to provide your correct tin to the person requesting it and, when applicable, to: Web follow the simple instructions below: Request for taxpayer identification number (tin) and. This includes their name, address, employer identification number (ein),.

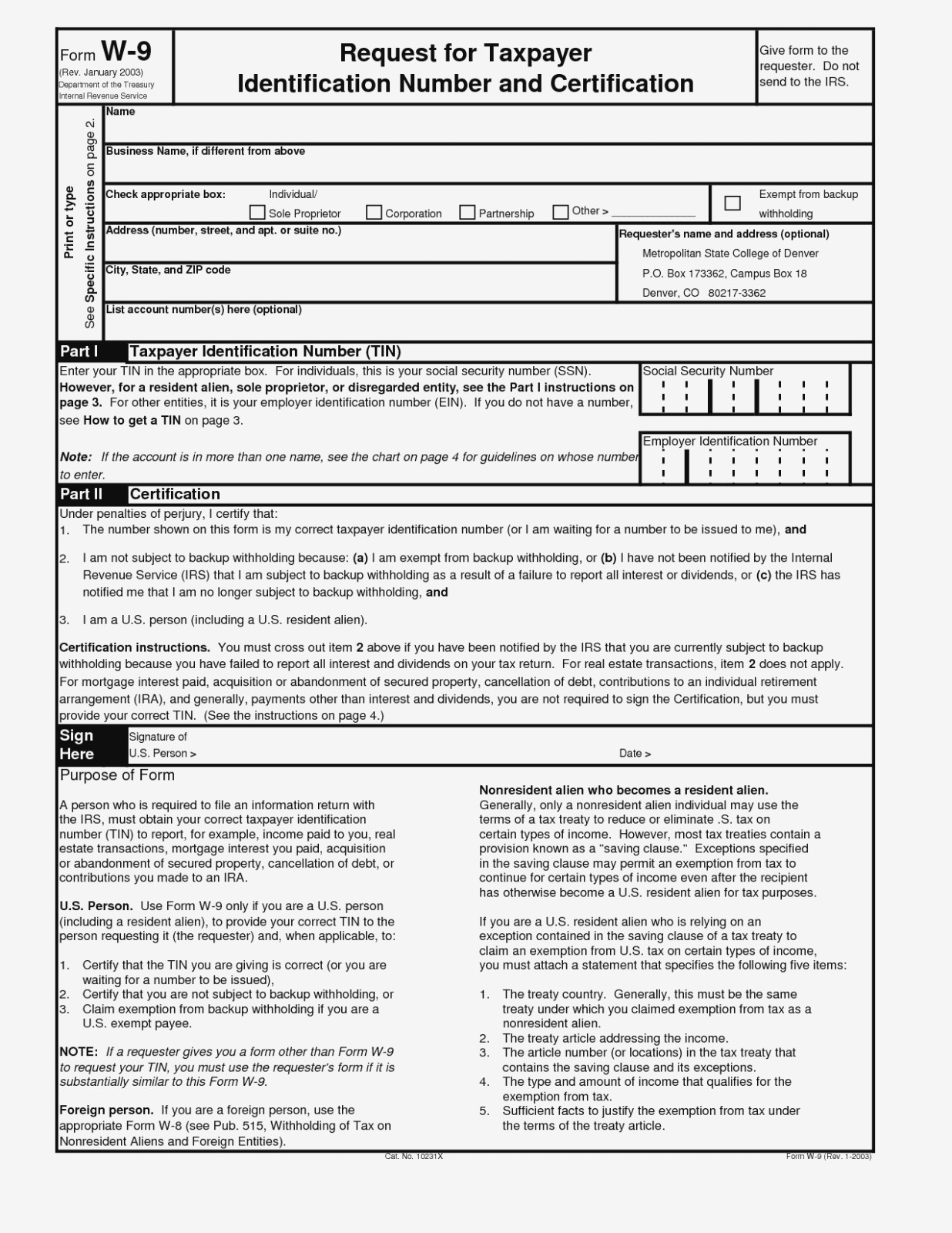

Printable W 9 Form Gameshacksfree Blank Arkansas Pj5 Vawebs W9 Free

This includes their name, address, employer identification number (ein),. Status and avoid section 1446 withholding on your share of partnership income. Request for taxpayer identification number and certification. Sign it in a few clicks draw your signature, type it,. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to:

Form W9, Request for Taxpayer Identification Number and Certification

This includes their name, address, employer identification number (ein),. Edit your georgia w 9 online type text, add images, blackout confidential details, add comments, highlights and more. Request for taxpayer identification number (tin) and. Individual tax return form 1040 instructions; Person (including a resident alien) and to request certain certifications and claims for exemption.

W 9 South Dakota Fill Online, Printable, Fillable, Blank pdfFiller

December 2011) department of the treasury internal revenue service. In the cases below, the. Sign it in a few clicks draw your signature, type it,. The forms will be effective with the. Status and avoid section 1446 withholding on your share of partnership income.

Form W9, Request for Taxpayer Identification Number and Certification

Web follow the simple instructions below: The forms will be effective with the. Person (including a resident alien) and to request certain certifications and claims for exemption. Citizen (including a us resident alien), to provide your correct tin to the person requesting it and, when applicable, to: Status and avoid section 1446 withholding on your share of partnership income.

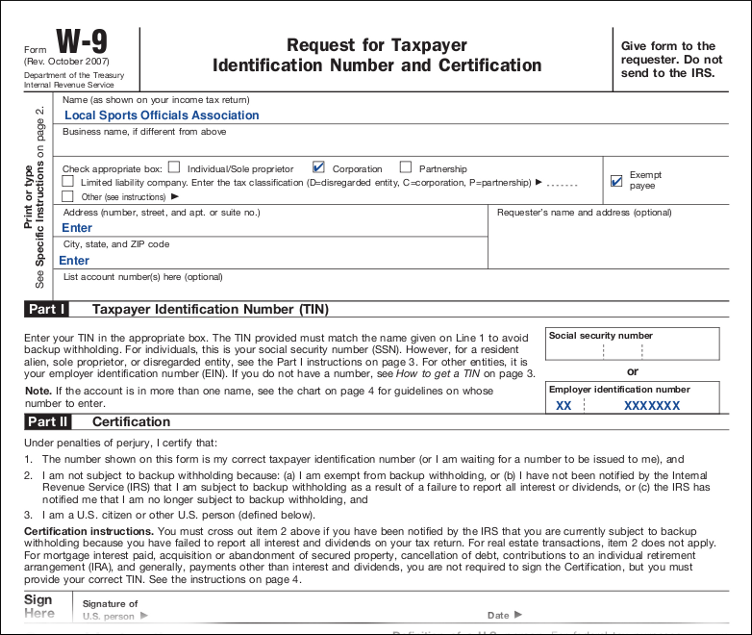

Downlodable Freeware DOWNLOAD W9 TAX FORM

Web follow the simple instructions below: December 2011) department of the treasury internal revenue service. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: It's a request for information about the contractors you pay as well as an agreement with those contractors that you won't be withholding income.

Fillable Form W9 Request For Taxpayer Identification with Blank W 9

Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: It's a request for information about the contractors you pay as well as an agreement with those contractors that you won't be withholding income tax. Person (including a resident alien) and to request certain certifications and claims for exemption..

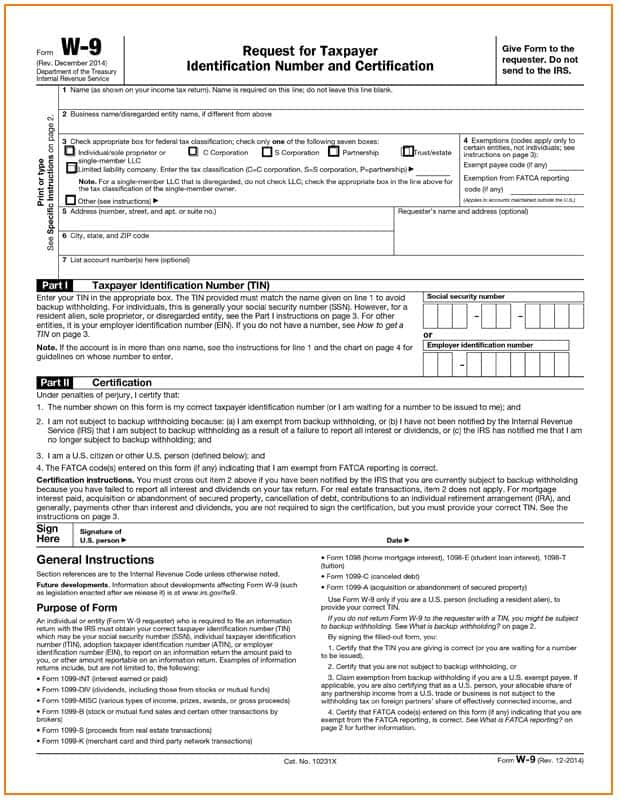

W9 Form PDF Template by airSlate, Inc.

Finding a legal expert, creating a scheduled appointment and coming to the office for a private conference makes completing a w 9. Citizen (including a us resident alien), to provide your correct tin to the person requesting it and, when applicable, to: Person (including a resident alien) and to request certain certifications and claims for exemption. December 2011) department of.

W9 Form 2021 Ga New Printable Form & Letter for 2021

Finding a legal expert, creating a scheduled appointment and coming to the office for a private conference makes completing a w 9. The forms will be effective with the. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Edit your georgia w 9 online type text, add images,.

W 9 Form PDF Withholding Tax Tax Exemption

December 2011) department of the treasury internal revenue service. Edit your georgia w 9 online type text, add images, blackout confidential details, add comments, highlights and more. It's a request for information about the contractors you pay as well as an agreement with those contractors that you won't be withholding income tax. Request for taxpayer identification number (tin) and. Sign.

December 2011) Department Of The Treasury Internal Revenue Service.

In the cases below, the. The forms will be effective with the. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Person (including a resident alien) and to request certain certifications and claims for exemption.

Web Follow The Simple Instructions Below:

This includes their name, address, employer identification number (ein),. Individual tax return form 1040 instructions; Request for taxpayer identification number and certification. Edit your georgia w 9 online type text, add images, blackout confidential details, add comments, highlights and more.

Finding A Legal Expert, Creating A Scheduled Appointment And Coming To The Office For A Private Conference Makes Completing A W 9.

Status and avoid section 1446 withholding on your share of partnership income. Request for taxpayer identification number (tin) and. Sign it in a few clicks draw your signature, type it,. Citizen (including a us resident alien), to provide your correct tin to the person requesting it and, when applicable, to: