W4 Form Vs W9

W4 Form Vs W9 - Web limited liability companies. Any llcs must fill out a w9 form for their owners in order to report any income received. These forms also request information on tax. This ensures that the proper taxes are. Web be certain you understand the difference between two mandatory forms: See how your withholding affects your refund, paycheck or tax due. Web new hire & team management toast payroll:

Web limited liability companies. Web be certain you understand the difference between two mandatory forms: Web new hire & team management toast payroll: These forms also request information on tax. This ensures that the proper taxes are. See how your withholding affects your refund, paycheck or tax due. Any llcs must fill out a w9 form for their owners in order to report any income received.

Any llcs must fill out a w9 form for their owners in order to report any income received. See how your withholding affects your refund, paycheck or tax due. Web limited liability companies. This ensures that the proper taxes are. Web new hire & team management toast payroll: These forms also request information on tax. Web be certain you understand the difference between two mandatory forms:

W4 vs W2 vs W9 vs 1099 Tax Forms What Are the Differences?

Web new hire & team management toast payroll: Web be certain you understand the difference between two mandatory forms: See how your withholding affects your refund, paycheck or tax due. These forms also request information on tax. Any llcs must fill out a w9 form for their owners in order to report any income received.

What Is A W4 What Is A W2 Sorting Out The Differences —

These forms also request information on tax. See how your withholding affects your refund, paycheck or tax due. This ensures that the proper taxes are. Any llcs must fill out a w9 form for their owners in order to report any income received. Web limited liability companies.

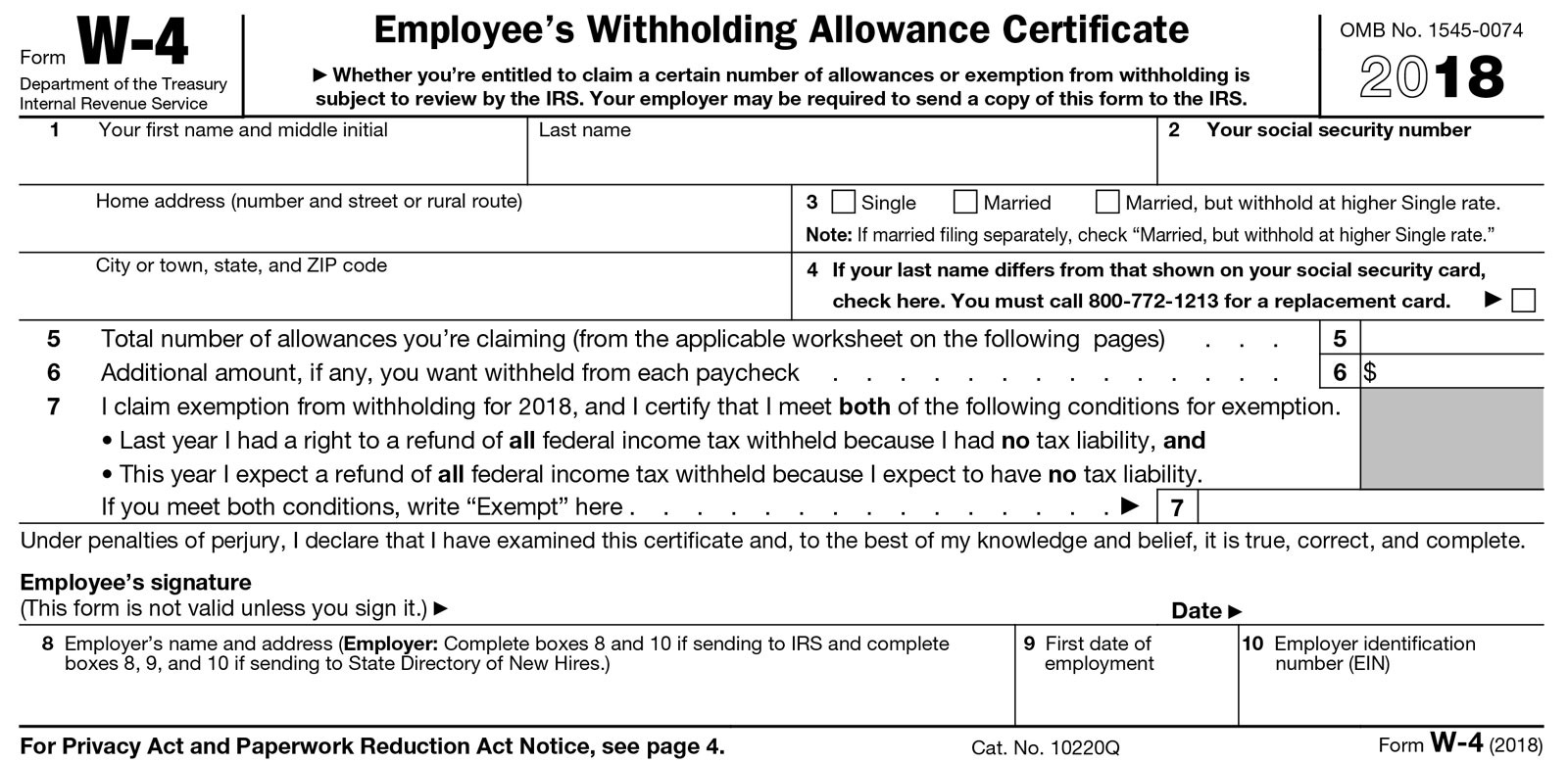

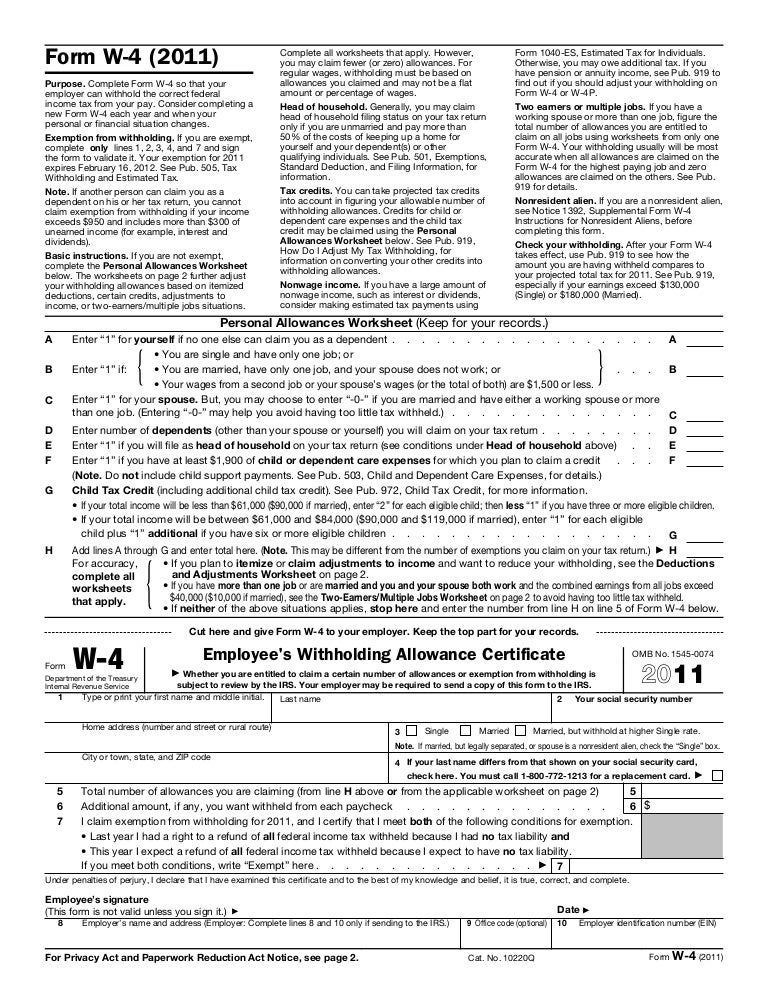

Il W 4 2020 2022 W4 Form

This ensures that the proper taxes are. These forms also request information on tax. Web be certain you understand the difference between two mandatory forms: Web new hire & team management toast payroll: Any llcs must fill out a w9 form for their owners in order to report any income received.

How Many Allowances Should I Claim on My W4?

This ensures that the proper taxes are. Web be certain you understand the difference between two mandatory forms: These forms also request information on tax. Web new hire & team management toast payroll: Web limited liability companies.

W2 vs. W4 vs. W9 vs. I9 YouTube

These forms also request information on tax. See how your withholding affects your refund, paycheck or tax due. Web be certain you understand the difference between two mandatory forms: Any llcs must fill out a w9 form for their owners in order to report any income received. This ensures that the proper taxes are.

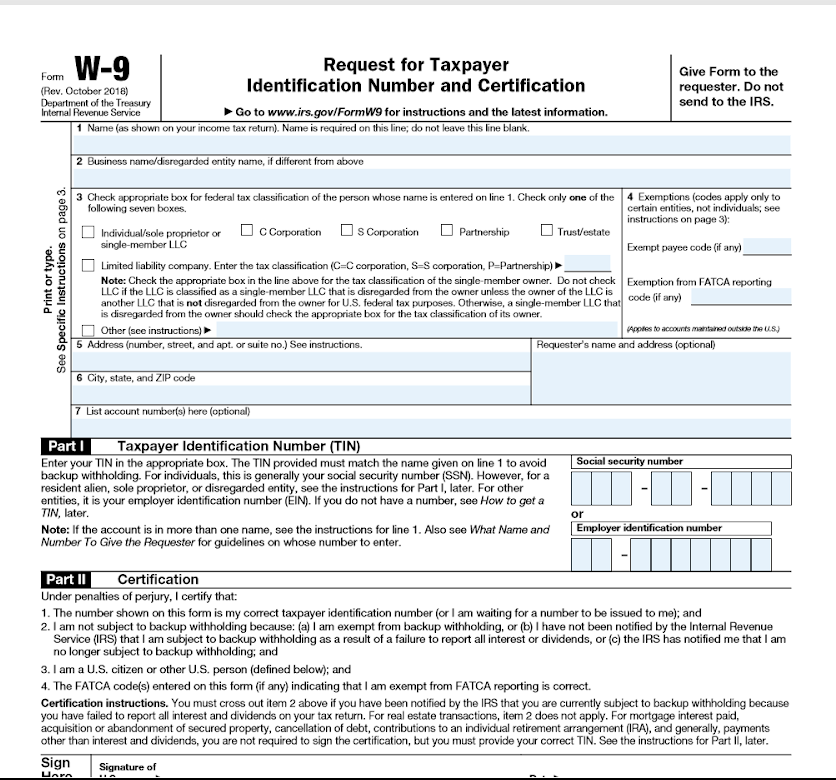

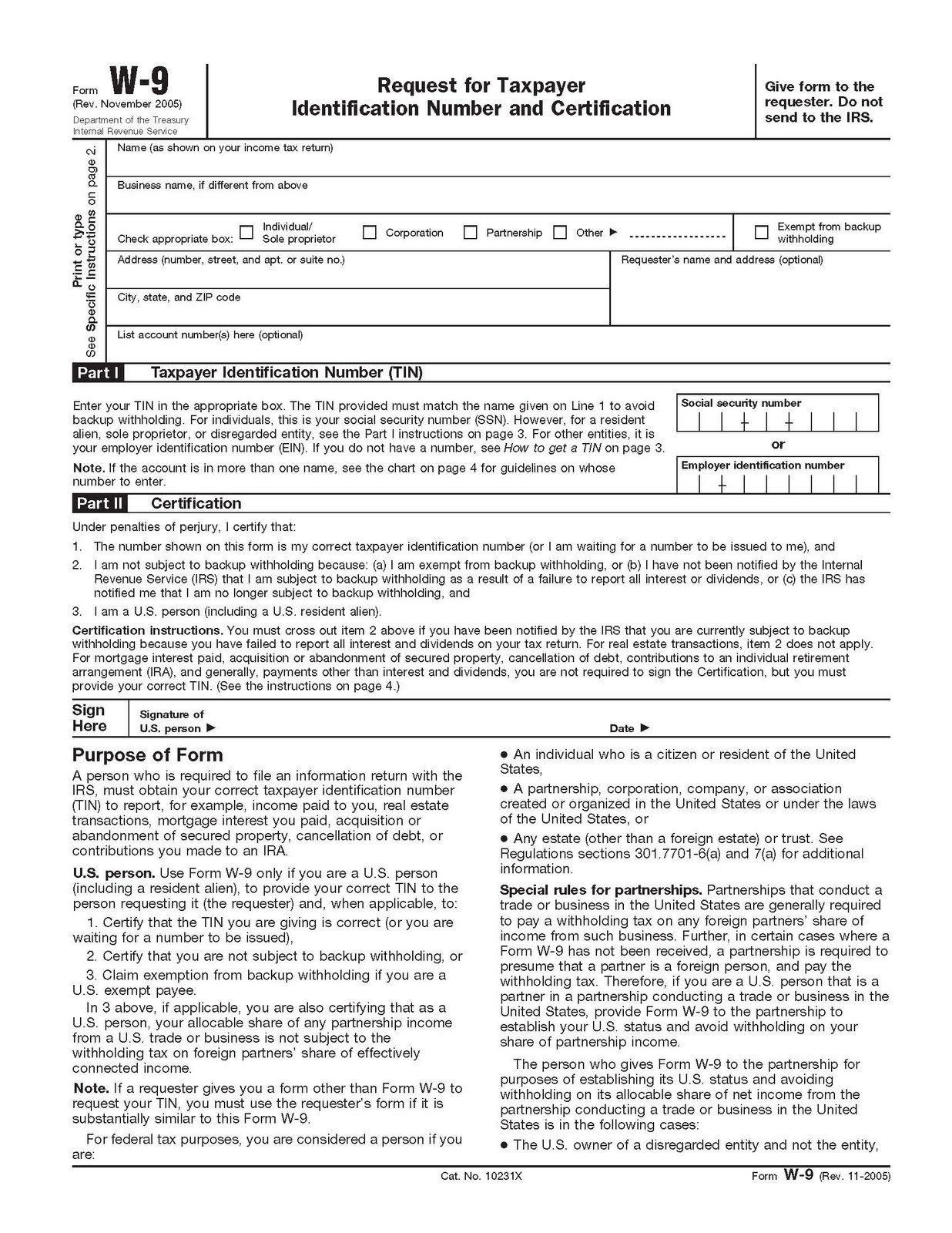

Free Printable W9 Form From Irs

Any llcs must fill out a w9 form for their owners in order to report any income received. See how your withholding affects your refund, paycheck or tax due. This ensures that the proper taxes are. Web limited liability companies. These forms also request information on tax.

Difference Between W2 W4 and W9 W2 vs W4 vs W9

See how your withholding affects your refund, paycheck or tax due. Web be certain you understand the difference between two mandatory forms: Web limited liability companies. Any llcs must fill out a w9 form for their owners in order to report any income received. These forms also request information on tax.

Blank W 9 Printable Form Template 2021 Calendar Template Printable

These forms also request information on tax. Web new hire & team management toast payroll: Web be certain you understand the difference between two mandatory forms: This ensures that the proper taxes are. Any llcs must fill out a w9 form for their owners in order to report any income received.

Form w4

Any llcs must fill out a w9 form for their owners in order to report any income received. Web be certain you understand the difference between two mandatory forms: Web new hire & team management toast payroll: Web limited liability companies. These forms also request information on tax.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Any llcs must fill out a w9 form for their owners in order to report any income received. Web limited liability companies. Web be certain you understand the difference between two mandatory forms: This ensures that the proper taxes are. See how your withholding affects your refund, paycheck or tax due.

See How Your Withholding Affects Your Refund, Paycheck Or Tax Due.

Web be certain you understand the difference between two mandatory forms: Web new hire & team management toast payroll: Web limited liability companies. Any llcs must fill out a w9 form for their owners in order to report any income received.

These Forms Also Request Information On Tax.

This ensures that the proper taxes are.