What Is 2290 Form

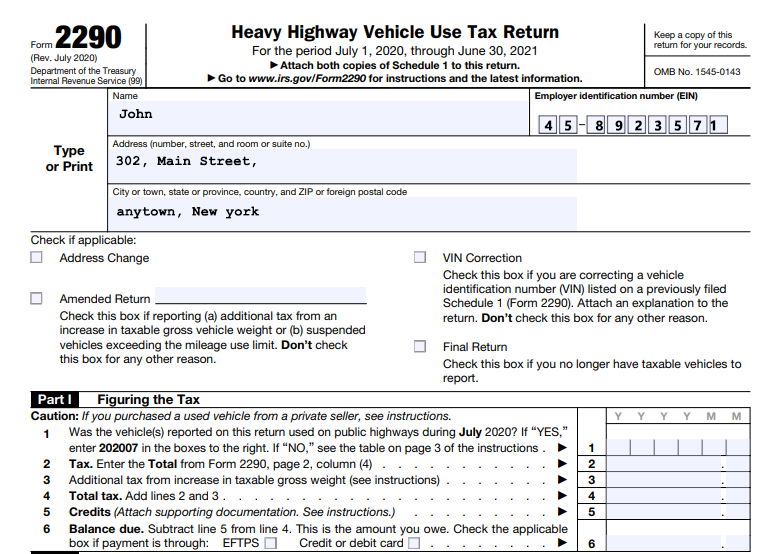

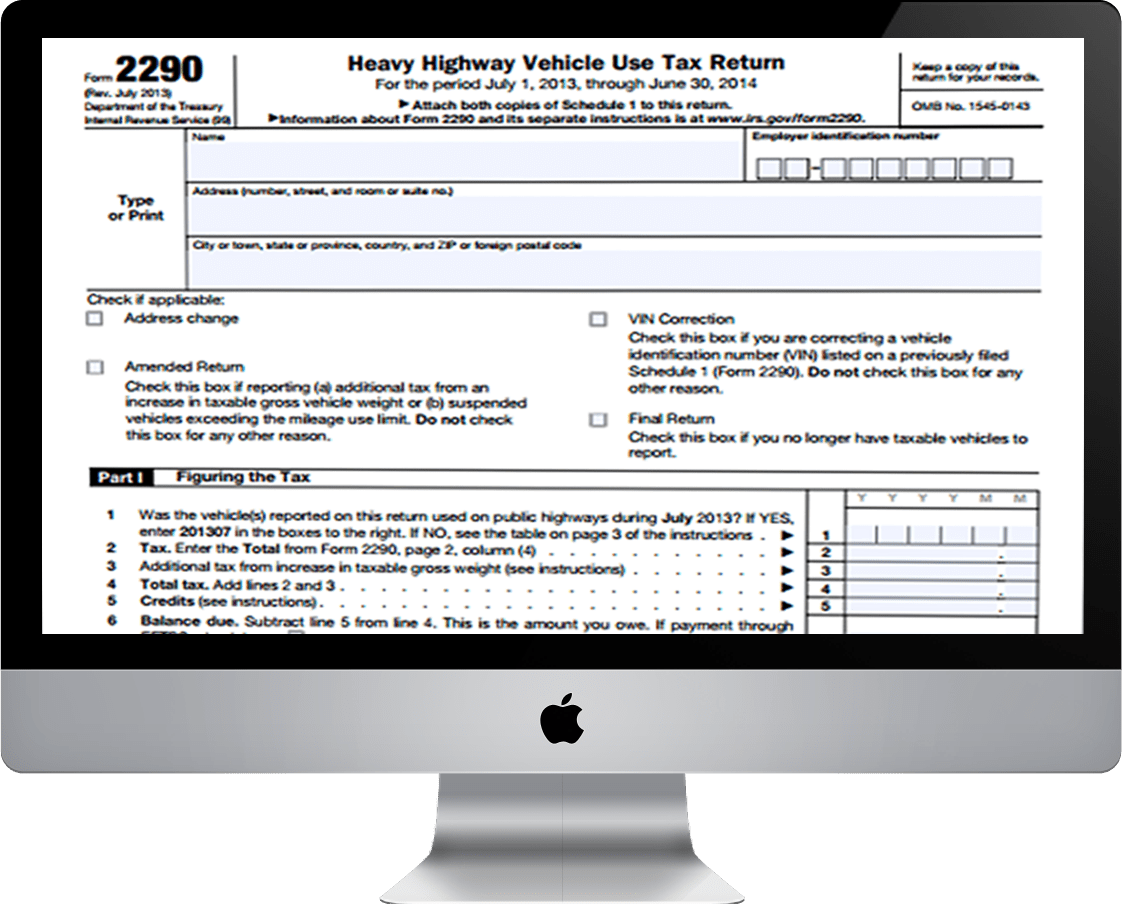

What Is 2290 Form - Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. The current period begins july 1, 2023, and ends. Web form 2290 is the annual truck tax form used to figure and pay heavy vehicle use taxes (hvut) to the internal revenue service. A 2290 form is the heavy highway vehicle use tax (hhvut). What is the irs form 2290 due date? Web irs 2290 form, also known as the heavy highway vehicle use tax (hvut) form, is a mandatory tax form required for truck owners operating vehicles with a gross. Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal. Use this va form if you want to apply for education benefits under the gi bill and other programs. Web the 2290 form is due annually between july 1 and august 31. Essentially, hvut is the federal program, and form 2290 is the tax return used.

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Ad choose electronic filing for faster processing of your tax returns. Filing of form 2290 is also required. It is due annually between july 1 and august 31 for vehicles that drive on american. Use this va form if you want to apply for education benefits under the gi bill and other programs. Web 1 day agothe tax is payable to the irs on form 2290, heavy highway vehicle use tax return. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web form 2290 is a unique tax form, which requires businesses to report information about the business, such as the taxable gross weight of the vehicle, vehicle. Internal revenue service for tax filing and.

It is due annually between july 1 and august 31 for vehicles that drive on american. This tax should be paid at a local irs. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Filing of form 2290 is also required. Complete, edit or print tax forms instantly. Web irs 2290 form, also known as the heavy highway vehicle use tax (hvut) form, is a mandatory tax form required for truck owners operating vehicles with a gross. Web form 2290 is the annual truck tax form used to figure and pay heavy vehicle use taxes (hvut) to the internal revenue service. Web what is a form 2290? For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and. What is the irs form 2290 due date?

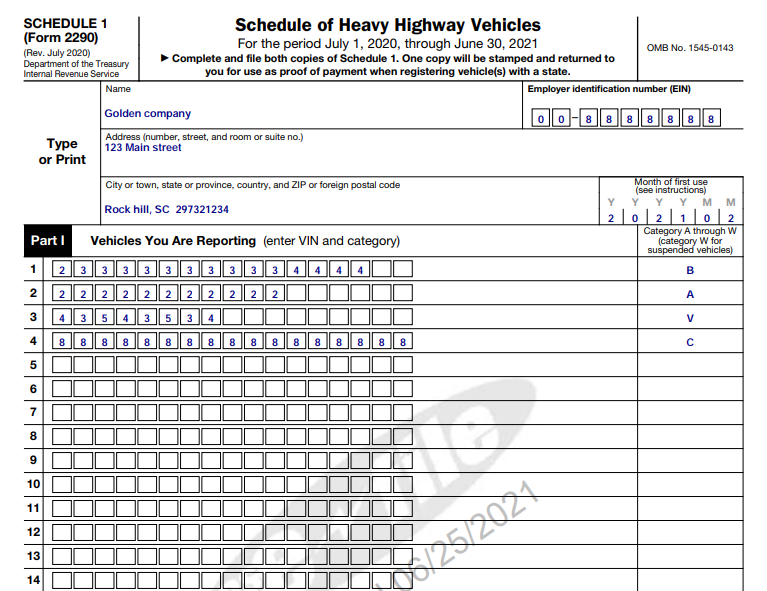

Fillable Form 2290 20232024 Create, Fill & Download 2290

Internal revenue service for tax filing and. Web form 2290, heavy vehicle use tax return is used to figure and pay taxes for the vehicles with the taxable gross weight of 55,000 pounds or more. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web what is.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web form 2290, heavy vehicle use tax return is used to figure and pay taxes for the vehicles with the taxable gross weight of 55,000 pounds or more. We've been in the trucking business for over 67+ years. Web the gross taxable weight of a vehicle is determined by adding the unloaded weight of the motor vehicle and any trailers.

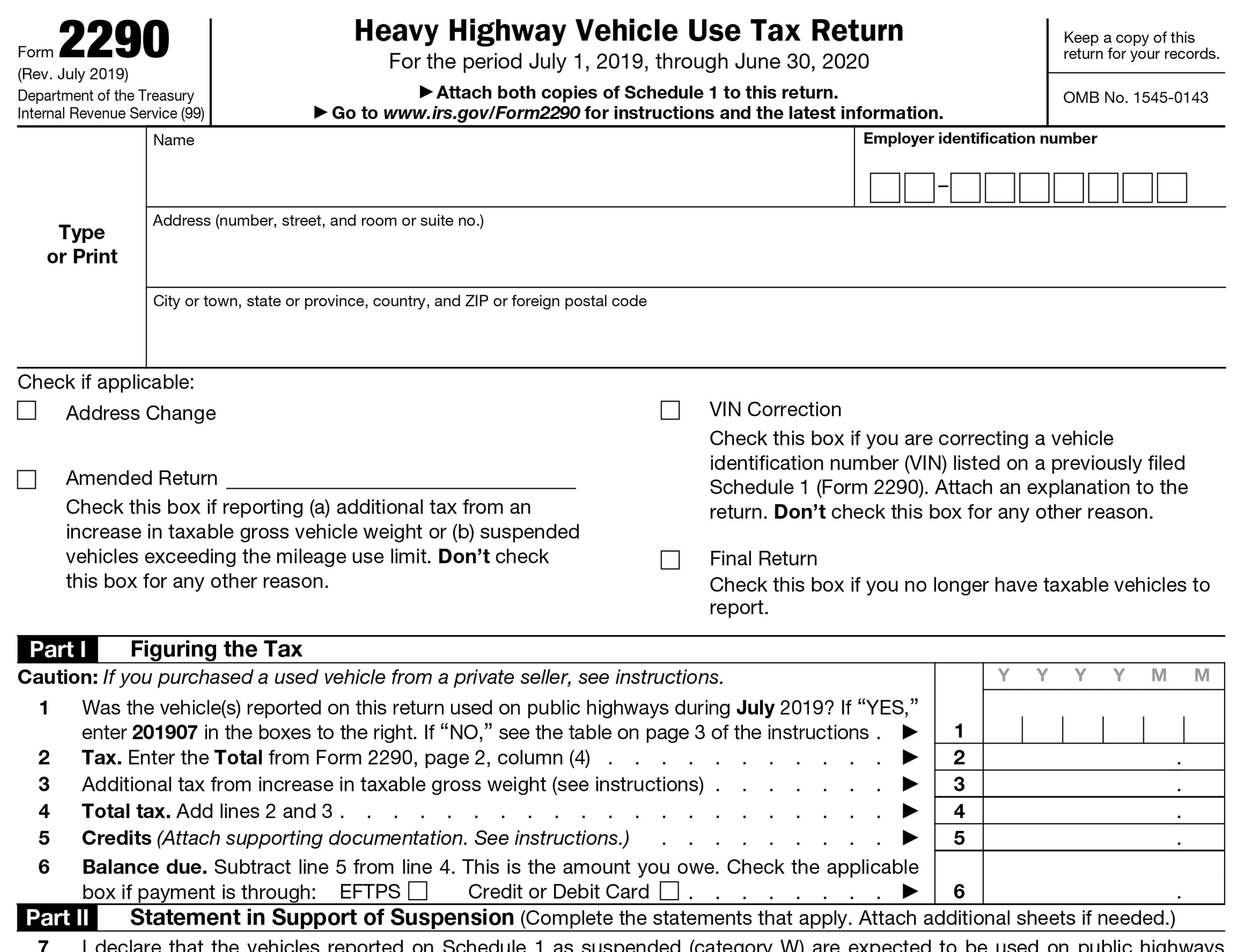

Printable IRS Form 2290 for 2020 Download 2290 Form

Web form 2290 is the annual truck tax form used to figure and pay heavy vehicle use taxes (hvut) to the internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today. Web the 2290 form is due annually between july 1 and august 31. Web form 2290 is an heavy vehicle use tax.

How to Efile Form 2290 for 202223 Tax Period

Web form 2290 is a unique tax form, which requires businesses to report information about the business, such as the taxable gross weight of the vehicle, vehicle. We've been in the trucking business for over 67+ years. Web the gross taxable weight of a vehicle is determined by adding the unloaded weight of the motor vehicle and any trailers together.

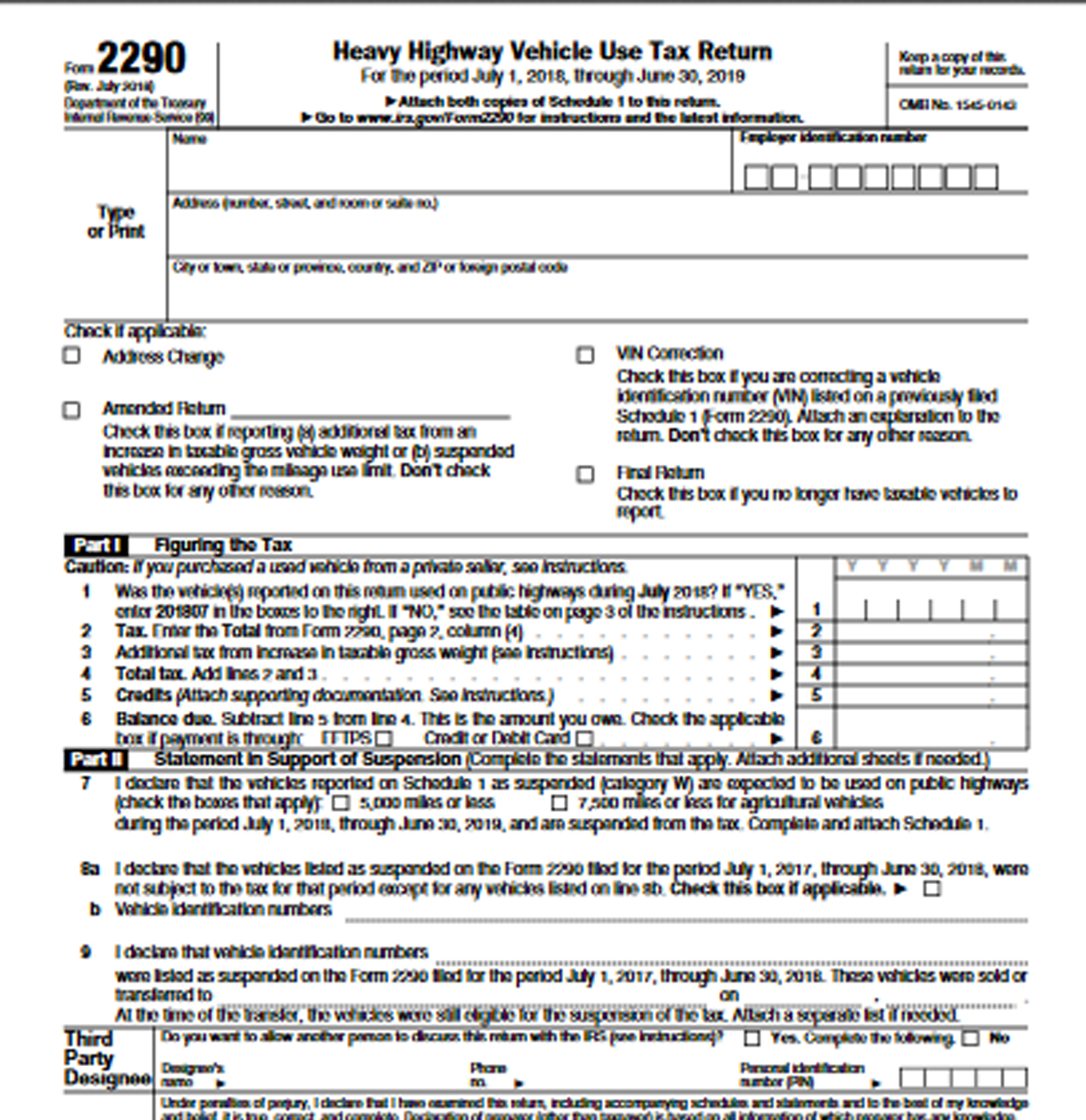

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Ad choose electronic filing for faster processing of your tax returns. Ad choose electronic filing for faster processing of your tax returns. Internal revenue service for tax filing and. Both the tax return and the heavy highway vehicle use tax must be paid by the.

Electronic IRS Form 2290 2018 2019 Printable PDF Sample

Complete, edit or print tax forms instantly. A 2290 form is the heavy highway vehicle use tax (hhvut). Do your truck tax online & have it efiled to the irs! Internal revenue service for tax filing and. If you have vehicles with a.

Irs.gov Form 2290 Form Resume Examples

In the simplest terms, the first use month policy means that if you started using a new truck in january of 2020, your form 2290. Web irs form 2290 is a heavy vehicle use tax imposed by the federal government on any vehicle 55,000 lbs. In short, a form 2290 is a tax document used to record and calculate the.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web when form 2290 taxes are due. Web what is a form 2290? This tax should be paid at a local irs. What is the irs form 2290 due date? This form will be recorded by the u.s.

form 2290 20182022 Fill Online, Printable, Fillable Blank

Web form 2290 is a unique tax form, which requires businesses to report information about the business, such as the taxable gross weight of the vehicle, vehicle. What is the irs form 2290 due date? Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. We've been in the trucking business for over 67+ years..

Irs Form 2290 Download MBM Legal

Use this va form if you want to apply for education benefits under the gi bill and other programs. Web irs form 2290 first use month. Ad choose electronic filing for faster processing of your tax returns. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Do.

Use Coupon Code Get20B & Get 20% Off.

A form 2290 is also known as a heavy highway vehicle use tax return. Ad choose electronic filing for faster processing of your tax returns. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. It is due annually between july 1 and august 31 for vehicles that drive on american.

We've Been In The Trucking Business For Over 67+ Years.

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web what is a form 2290? Web irs 2290 form, also known as the heavy highway vehicle use tax (hvut) form, is a mandatory tax form required for truck owners operating vehicles with a gross. The irs mandates that everyone who owns a heavy vehicle.

Web Form 2290 Is A Unique Tax Form, Which Requires Businesses To Report Information About The Business, Such As The Taxable Gross Weight Of The Vehicle, Vehicle.

What is the irs form 2290 due date? Do your truck tax online & have it efiled to the irs! Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal. The irs uses the collected taxes for highway.

A 2290 Form Is The Heavy Highway Vehicle Use Tax (Hhvut).

This tax should be paid at a local irs. Essentially, hvut is the federal program, and form 2290 is the tax return used. Web the 2290 form is due annually between july 1 and august 31. It must be filed and paid annually for every truck that drives on public.