What Is A Form 7203

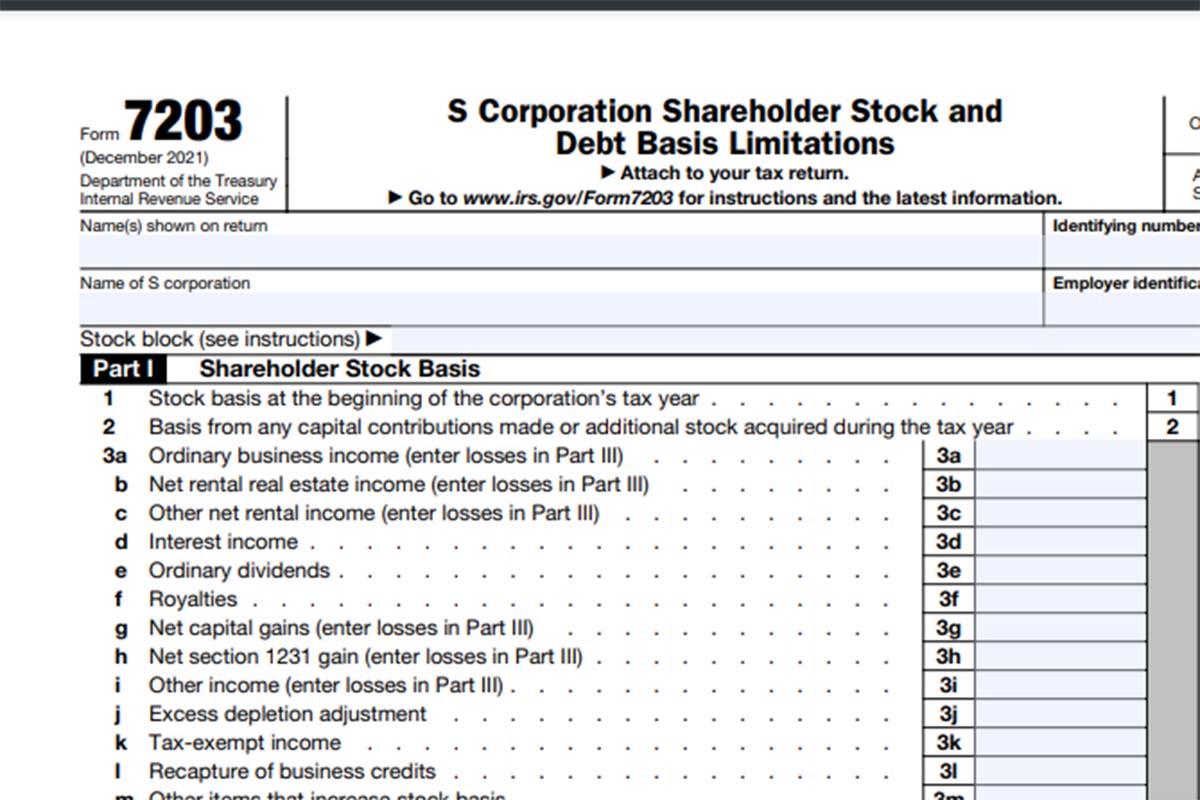

What Is A Form 7203 - How do i clear ef messages 5486 and 5851? Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. S corporation shareholders use form 7203 to figure the potential. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web shareholders will use form 7203 to calculate their stock and debt basis, ensuring the losses and deductions are accurately claimed. In prior years, the irs. By office of advocacy on jul 21, 2021. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax.

Web irs seeking comments on form 7203. Web form 7203 is filed by s corporation shareholders who: View solution in original post february 23,. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. S corporation shareholders use form 7203 to figure the potential. Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. By office of advocacy on jul 21, 2021. In prior years, the irs. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis.

This form is required to be attached. Web taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Form 7203 and the instructions are attached to this article. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. By office of advocacy on jul 21, 2021. Web irs seeking comments on form 7203. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. How do i clear ef messages 5486 and 5851? Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return.

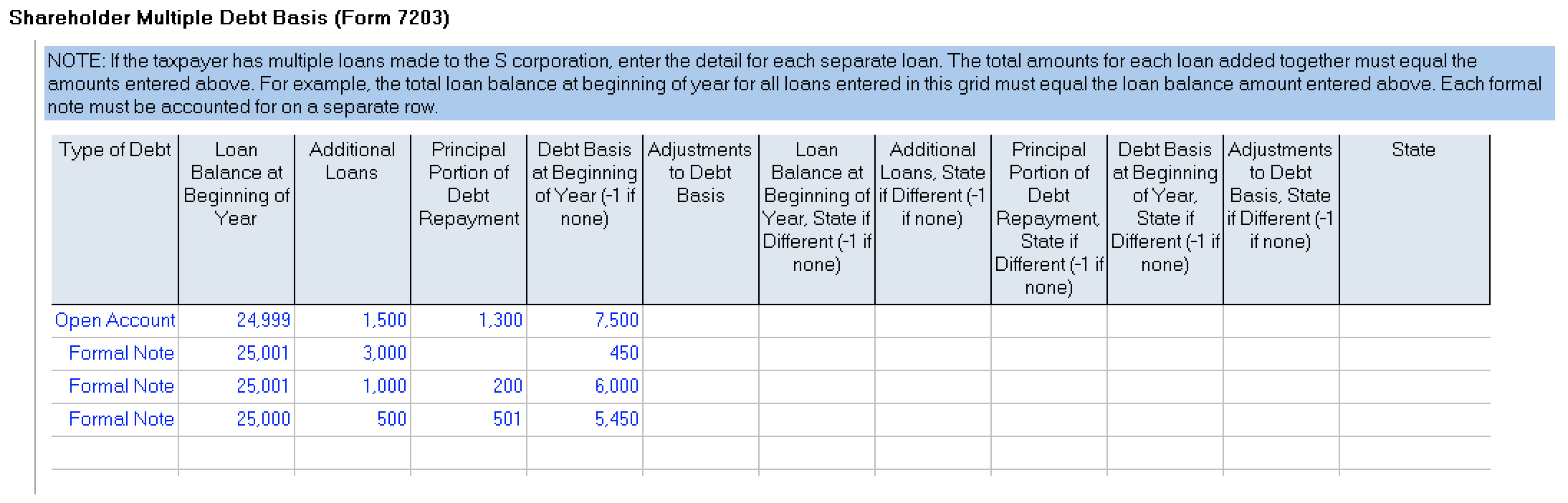

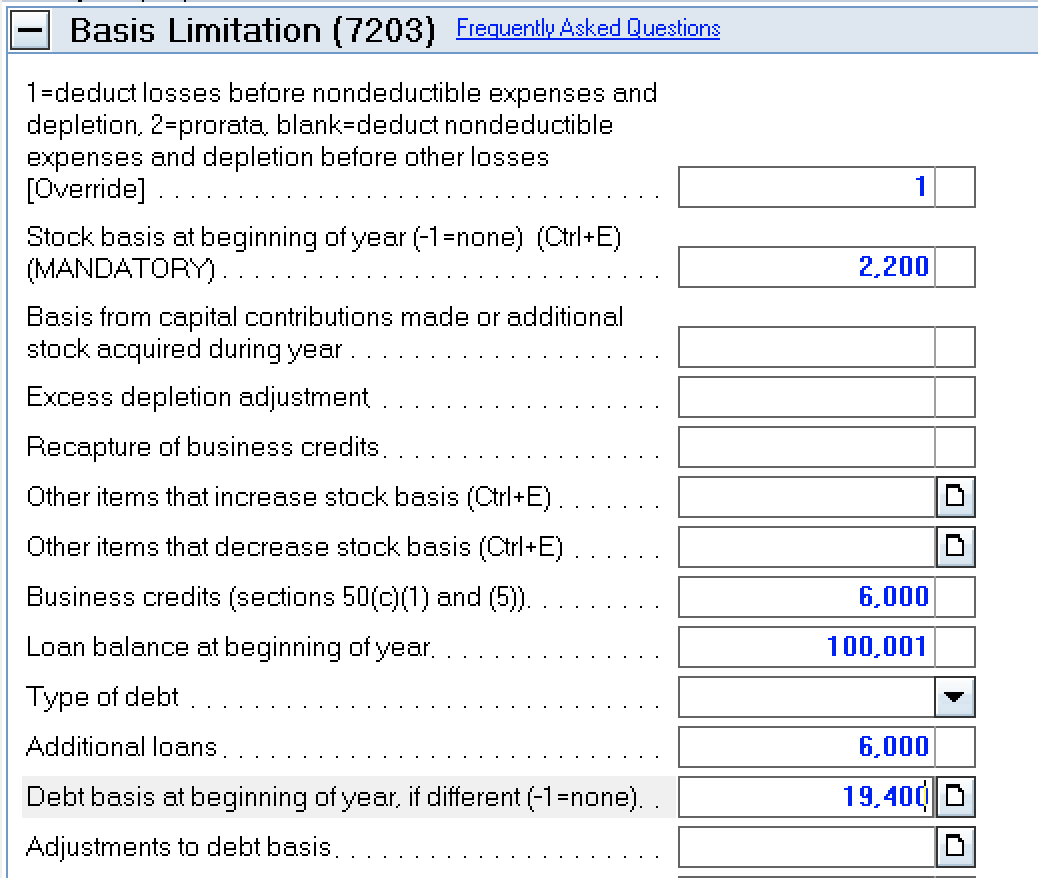

How to complete Form 7203 in Lacerte

In prior years, the irs. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web irs seeking comments on form 7203. Web what is form 7203? S corporation shareholders use form 7203 to figure the potential.

IRS Issues New Form 7203 for Farmers and Fishermen

Web form 7203 is filed by s corporation shareholders who: This form is required to be attached. I have read all of the instructions for form 7203, but cannot find anything. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. View solution in original post february 23,.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. By office of advocacy on jul 21, 2021. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. On july.

Peerless Turbotax Profit And Loss Statement Cvp

Web what is form 7203? Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web taxes get your taxes done dkroc.

More Basis Disclosures This Year for S corporation Shareholders Need

How do i clear ef messages 5486 and 5851? I have read all of the instructions for form 7203, but cannot find anything. Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. Form 7203 and the instructions are attached to this article. By office of advocacy on jul 21, 2021.

National Association of Tax Professionals Blog

View solution in original post february 23,. Web what is form 7203? Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

I have read all of the instructions for form 7203, but cannot find anything. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock.

National Association of Tax Professionals Blog

Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. Web about form 7203, s corporation shareholder stock and.

How to complete Form 7203 in Lacerte

Web taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. S corporation shareholders use form 7203 to figure the potential. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions,.

Form7203PartI PBMares

Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Web form 7203 is filed by s corporation shareholders who: Starting in tax year 2021, form.

In Prior Years, The Irs.

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items.

S Corporation Shareholders Use Form 7203 To Figure The Potential.

Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. I have read all of the instructions for form 7203, but cannot find anything. How do i clear ef messages 5486 and 5851? Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a.

Web Form 7203 Is Used To Figure Potential Limitations Of A Shareholder's Share Of An S Corporation's Deductions, Credits, Etc.

Web what is form 7203? Web irs seeking comments on form 7203. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s.

On July 19, 2021, The Internal Revenue Service (Irs) Issued A Notice And Request For.

View solution in original post february 23,. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. This form is required to be attached. Web taxes get your taxes done dkroc level 2 please explain stock block on form 7203.