What Is Federal Form 8886

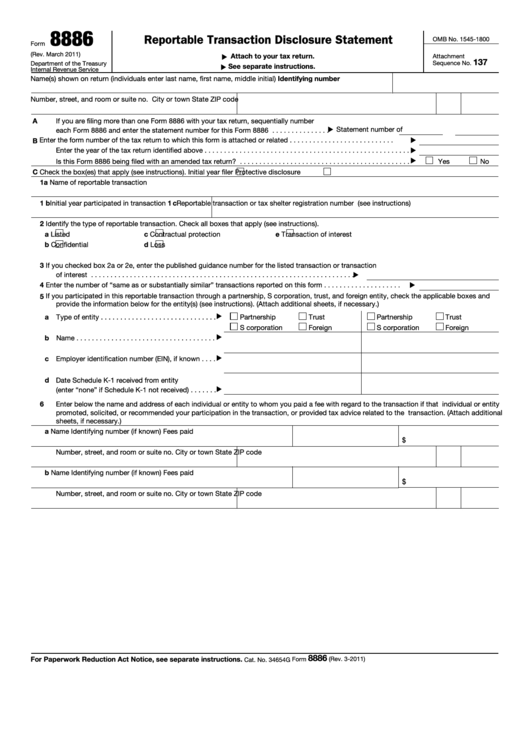

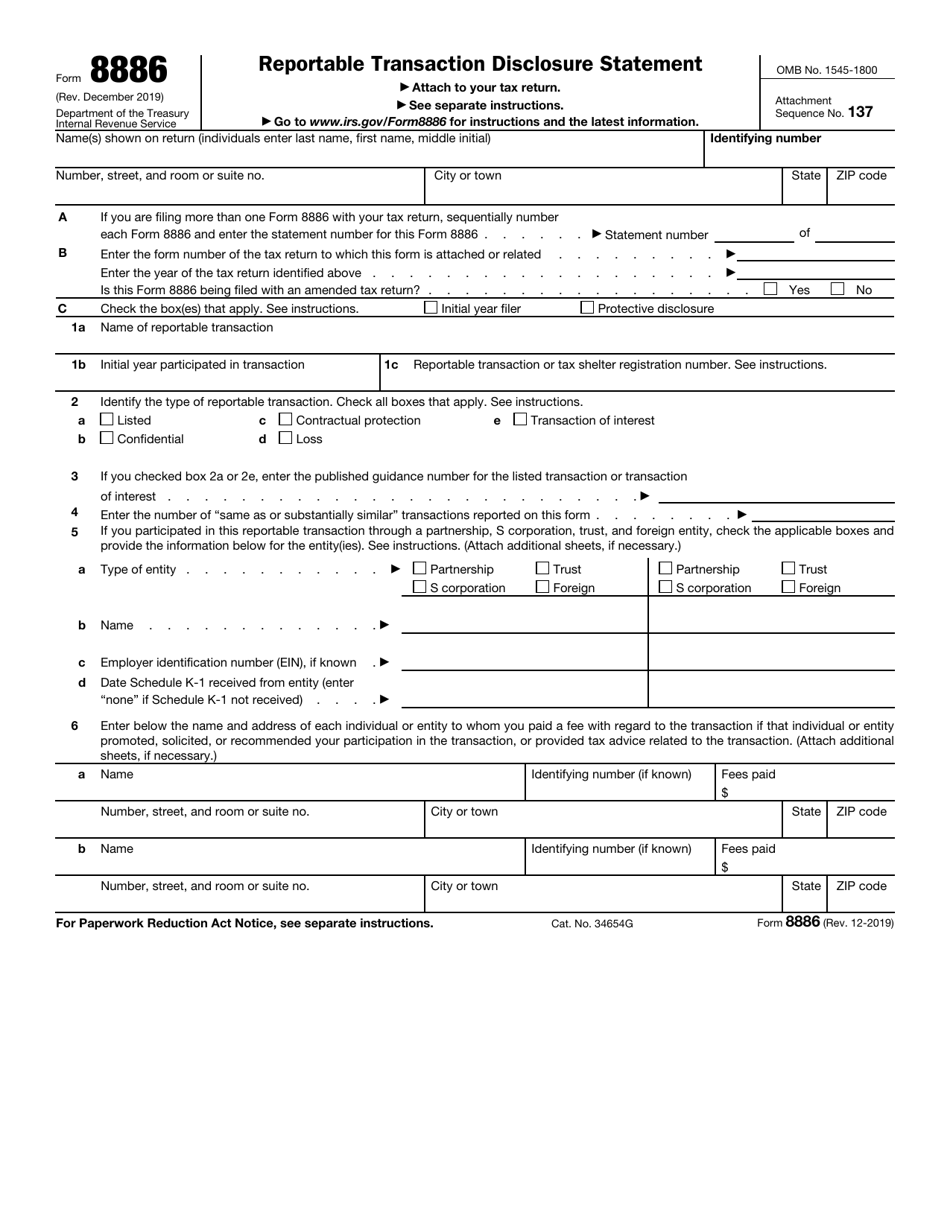

What Is Federal Form 8886 - Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. To be considered complete, the information provided on form 8886 must: Due diligence on the go! Web form 4868, also known as an “application for automatic extension of time to file u.s. Web what is form 8867? In general, these transactions include: Web use form 8886 to disclose information for five categories. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. Who must file any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. However, a regulated investment company (ric)

Due diligence on the go! Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Web the instructions to form 8886 (available at irs.gov) provide a specific explanation of what transactions must be disclosed on the form. Listed transactions, which the irs has specifically identified as tax avoidance transactions. Additionally, all reportable transactions must be disclosed on form 8886, reportable transaction disclosure statement, and, if applicable, on the correct. Individual income tax return,” is a form that taxpayers can file with the irs if they need more time to. Web federal income tax treatment of the transaction. Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. Who must file any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886.

Web form 4868, also known as an “application for automatic extension of time to file u.s. If this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. Transaction and is required to file a federal number. Web use form 8886 to disclose information for five categories. Taxpayer u is subject to two penalties under section 6707a: Web federal form 8886 if you filed federal form 8886, reportable transaction disclosure statement, with the irs, enter an “x” in part 3. Web federal income tax treatment of the transaction. Due diligence on the go! See form 8886, reportable transaction disclosure statement on the irs site for more information on federal form 8886, including links to the form and instructions, and requirements for filing the form.

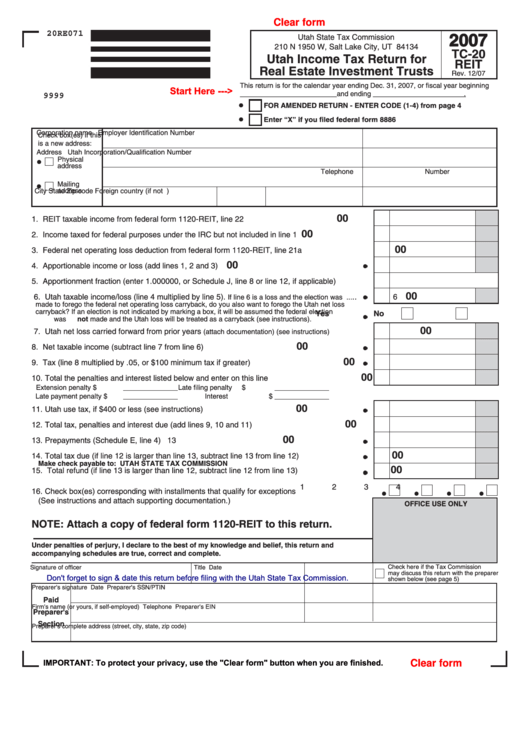

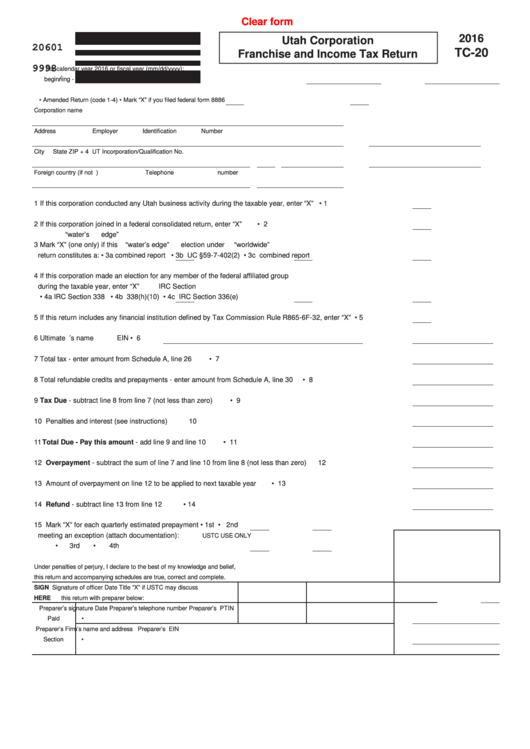

Fillable Form Tc20 Reit Utah Tax Return For Real Estate

Web what is form 8867? Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. However, a regulated investment company (ric) In general, these transactions include: Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction.

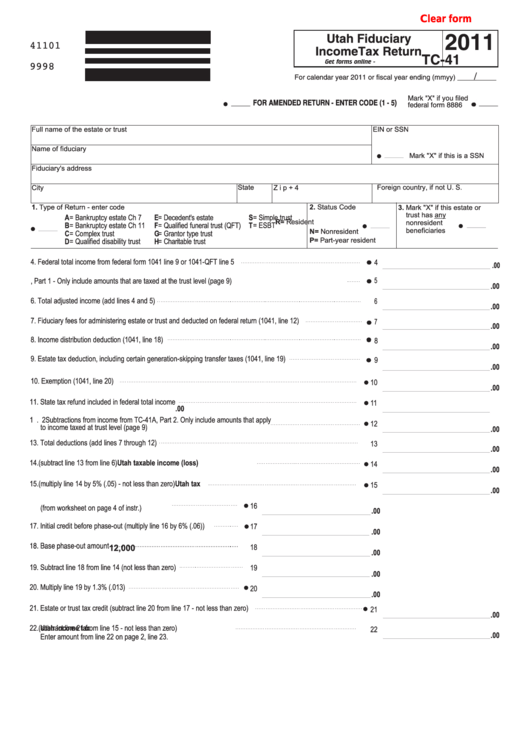

Fillable Form Tc41 Utah Fiduciary Tax Return 2011 printable

However, a regulated investment company (ric) Due diligence on the go! Generally, form 8886 must be attached to the tax return for each tax year in which participation in a reportable transaction has occurred. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or.

Fillable Form 8886 Reportable Transaction Disclosure Statement

Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement to the internal revenue service, you must also submit. Transaction and is required to file a federal number. Implementation and documentation of the. Describe the expected tax treatment and all potential tax.

Form 8886 Edit, Fill, Sign Online Handypdf

Let’s take a brief look at how the irs defines listed transactions — and what is required: Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. Describe the expected tax treatment and all potential.

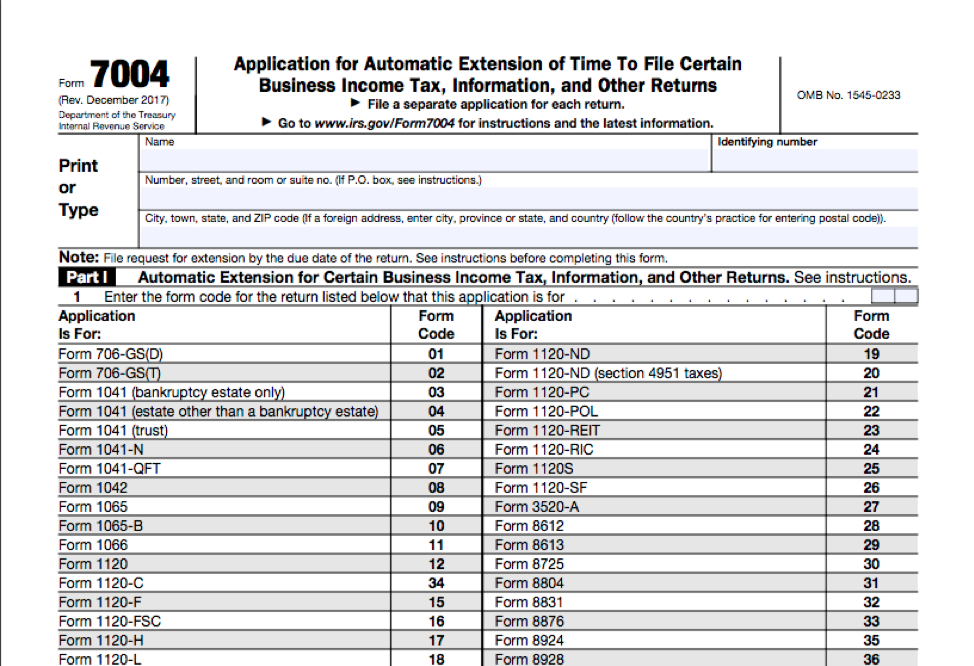

Filing an Extension for your Federal Tax Return CPA in Raleigh

Web as a result, the government requires that the taxpayer identify and report the listed transaction at the time of submitting their tax return — by submitting a form 8886. Also, available in spanish, publication 4687 sp pdf. Listed transactions, which the irs has specifically identified as tax avoidance transactions. Web the instructions to form 8886 (available at irs.gov) provide.

Fillable Form Tc20 Utah Corporation Franchise And Tax Return

Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. Transaction and.

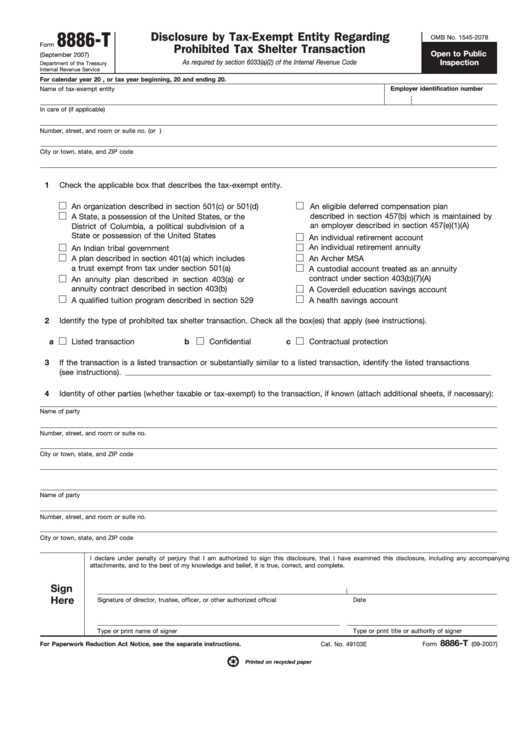

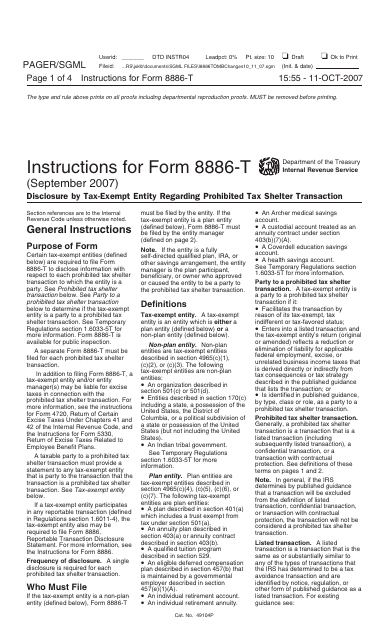

Fillable Form 8886T Disclosure By Tax Exempt Entity Regarding

Let’s take a brief look at how the irs defines listed transactions — and what is required: Also, available in spanish, publication 4687 sp pdf. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web federal income tax treatment of the transaction. Generally, form 8886 must be attached to the tax return for.

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

See form 8886, reportable transaction disclosure statement on the irs site for more information on federal form 8886, including links to the form and instructions, and requirements for filing the form. Web form 4868, also known as an “application for automatic extension of time to file u.s. However, a regulated investment company (ric) Implementation and documentation of the. Web the.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Describe the expected tax treatment and all potential tax benefits expected to result from the. However, a regulated investment company (ric) Additionally, all reportable transactions must be disclosed on form 8886, reportable transaction disclosure statement, and, if applicable, on the correct. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Taxpayer u is.

Download Instructions for IRS Form 8886T Disclosure by TaxExempt

Publication 4687 pdf, paid preparer due diligence, is a guide to help you comply with your due diligence requirements. Web federal income tax treatment of the transaction. In general, these transactions include: Taxpayer u is subject to two penalties under section 6707a: Also, available in spanish, publication 4687 sp pdf.

Taxpayer U Is Subject To Two Penalties Under Section 6707A:

One for the failure to attach form 8886 to its amended return for 2008 and another for the failure to attach form 8886 to its 2009 return. Web federal income tax treatment of the transaction. Web federal form 8886 if you filed federal form 8886, reportable transaction disclosure statement, with the irs, enter an “x” in part 3. Web federal and state tax return rules are more complex than ever, and differences of opinion on certain rules among tax authorities, tax professionals, and/or taxpayers are not unusual.

Web The Instructions To Form 8886 (Available At Irs.gov) Provide A Specific Explanation Of What Transactions Must Be Disclosed On The Form.

Web attach the federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Describe the expected tax treatment and all potential tax benefits expected to result from the. However, a regulated investment company (ric) To be considered complete, the information provided on form 8886 must:

If This Is The First Time The Reportable Transaction Is Disclosed On The Return, Send A Duplicate Copy Of The Federal Form 8886 To The Address Below.

Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Listed transactions, which the irs has specifically identified as tax avoidance transactions. Transaction and is required to file a federal number. Due diligence on the go!

Implementation And Documentation Of The.

See form 8886, reportable transaction disclosure statement on the irs site for more information on federal form 8886, including links to the form and instructions, and requirements for filing the form. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Additionally, all reportable transactions must be disclosed on form 8886, reportable transaction disclosure statement, and, if applicable, on the correct.