What Is Form 2210 Line 4

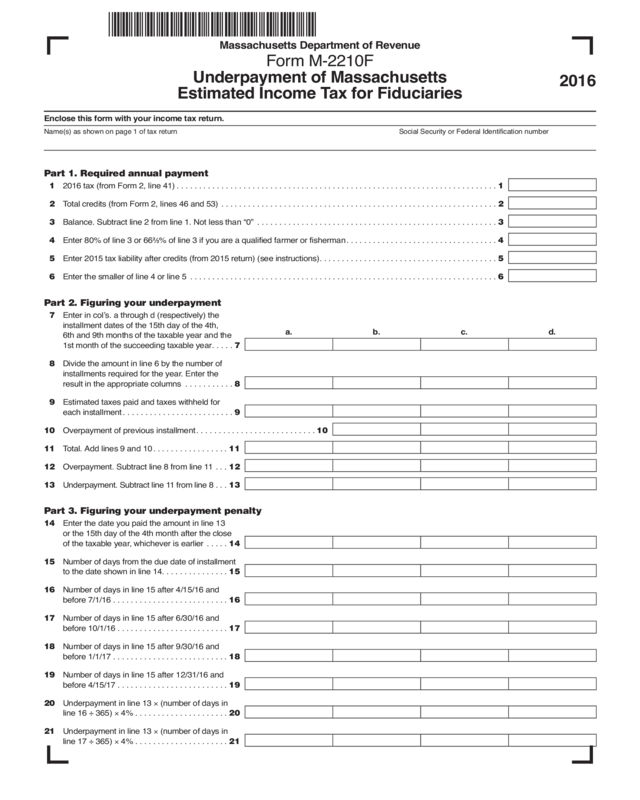

What Is Form 2210 Line 4 - Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty. Examine the form before completing it and use the. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. The amount on line 4 of your 2210 form last year would be the same as the. Web you are not required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Yes don’t file form 2210. If you checked box a, complete only page 1 of form line 2 2210 and attach it to your tax return (you are not required to figure the. No complete lines 8 and 9 below. Web if you checked box b, complete form 2210 through line 16 (or if you use the regular method, line 26 plus the penalty worksheet, later) without regard to the waiver. 06a name(s) shown on tax return identifying.

The form can be used to help one figure how much of a penalty they receive. If you want to figure it, you may use part iii or part iv as a. The irs will generally figure your penalty for you and you should not file form 2210. Is line 7 less than $1,000? Web you are not required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Complete part iv to figure the. You don’t owe a penalty. The form doesn't always have to be. Yes don’t file form 2210. The amount on line 4 of your 2210 form last year would be the same as the.

The irs will generally figure your penalty for you and you should not file form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web you are not required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Web go to www.irs.gov/form2210f for instructions and the latest information omb no. Web 2 best answer julies expert alumni you may not have had to file form 2210 last year. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web if you checked box b, complete form 2210 through line 16 (or if you use the regular method, line 26 plus the penalty worksheet, later) without regard to the waiver. If you checked box a, complete only page 1 of form line 2 2210 and attach it to your tax return (you are not required to figure the. Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty.

Form 2210 Edit, Fill, Sign Online Handypdf

Yes don’t file form 2210. Web you'll be asked to share personal information such as your date of birth, parents' names and details about your current occupation and previous criminal. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. Web purpose of form.

Fill Free fillable F2210 2019 Form 2210 PDF form

Dispute a penalty if you don’t qualify for penalty removal or. No complete lines 8 and 9 below. Web if you checked box b, complete form 2210 through line 16 (or if you use the regular method, line 26 plus the penalty worksheet, later) without regard to the waiver. Check box a or box b in part ii. Yes don’t.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web complete lines 1 through 7 below. Yes don’t file form 2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. The amount on line 4 of your 2210 form last year would be the same as the. Web watch newsmax live for the latest news and analysis on today's top.

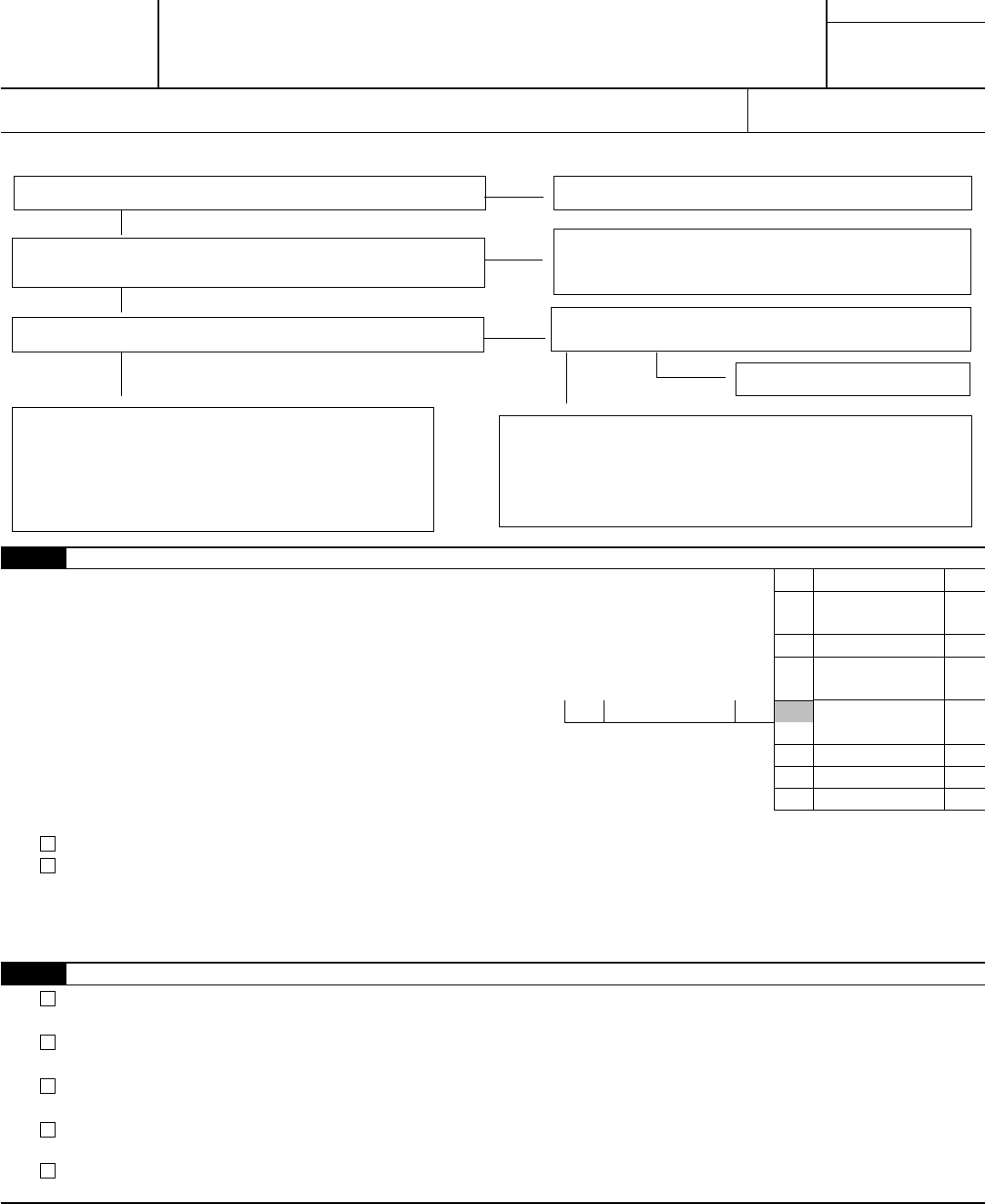

Form M2210F Edit, Fill, Sign Online Handypdf

The amount on line 4 of your 2210 form last year would be the same as the. If you want to figure it, you may use part iii or part iv as a. Is line 6 equal to or more than. Web if you checked box b, complete form 2210 through line 16 (or if you use the regular method,.

IRS Form 2210Fill it with the Best Form Filler

Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. Web if you checked box b, complete form 2210 through line 16 (or if you use the regular method, line 26 plus the penalty worksheet, later) without regard to the waiver. The form doesn't.

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals

Complete part iv to figure the. 06a name(s) shown on tax return identifying. If you checked box a, complete only page 1 of form line 2 2210 and attach it to your tax return (you are not required to figure the. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax..

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Is line 7 less than $1,000? If you want to figure it, you may use part iii or part iv as a. Complete part iv to figure the. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated. Web you'll be asked.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Complete part iv to figure the. Web form 2210 is a government irs form used by individuals who underpay a tax. The form doesn't always have to be. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. The amount on line 4 of.

Form 2210Underpayment of Estimated Tax

Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a. The irs will generally figure your penalty for you and you should not file form 2210. The form doesn't always have to be. Web watch newsmax live for the latest.

MI2210_260848_7 michigan.gov documents taxes

Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated. If you want to figure it,.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Yes don’t file form 2210. The form can be used to help one figure how much of a penalty they receive. Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some form, not everyone pays standard. Web 2 best answer julies expert alumni you may not have had to file form 2210 last year.

Web Complete Form 2210, Schedule Ai, Annualized Income Installment Method Pdf (Found Within The Form).

The form doesn't always have to be. Web if you checked box b, complete form 2210 through line 16 (or if you use the regular method, line 26 plus the penalty worksheet, later) without regard to the waiver. You don’t owe a penalty. No complete lines 8 and 9 below.

Web Form 2210 Is Used To Determine How Much You Owe In Underpayment Penalties On Your Balance Due.

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Dispute a penalty if you don’t qualify for penalty removal or. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. Web is line 4 or line 7 less than $1,000?

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated. Web form 2210 is a government irs form used by individuals who underpay a tax. 06a name(s) shown on tax return identifying. The amount on line 4 of your 2210 form last year would be the same as the.