What Is Form 2555

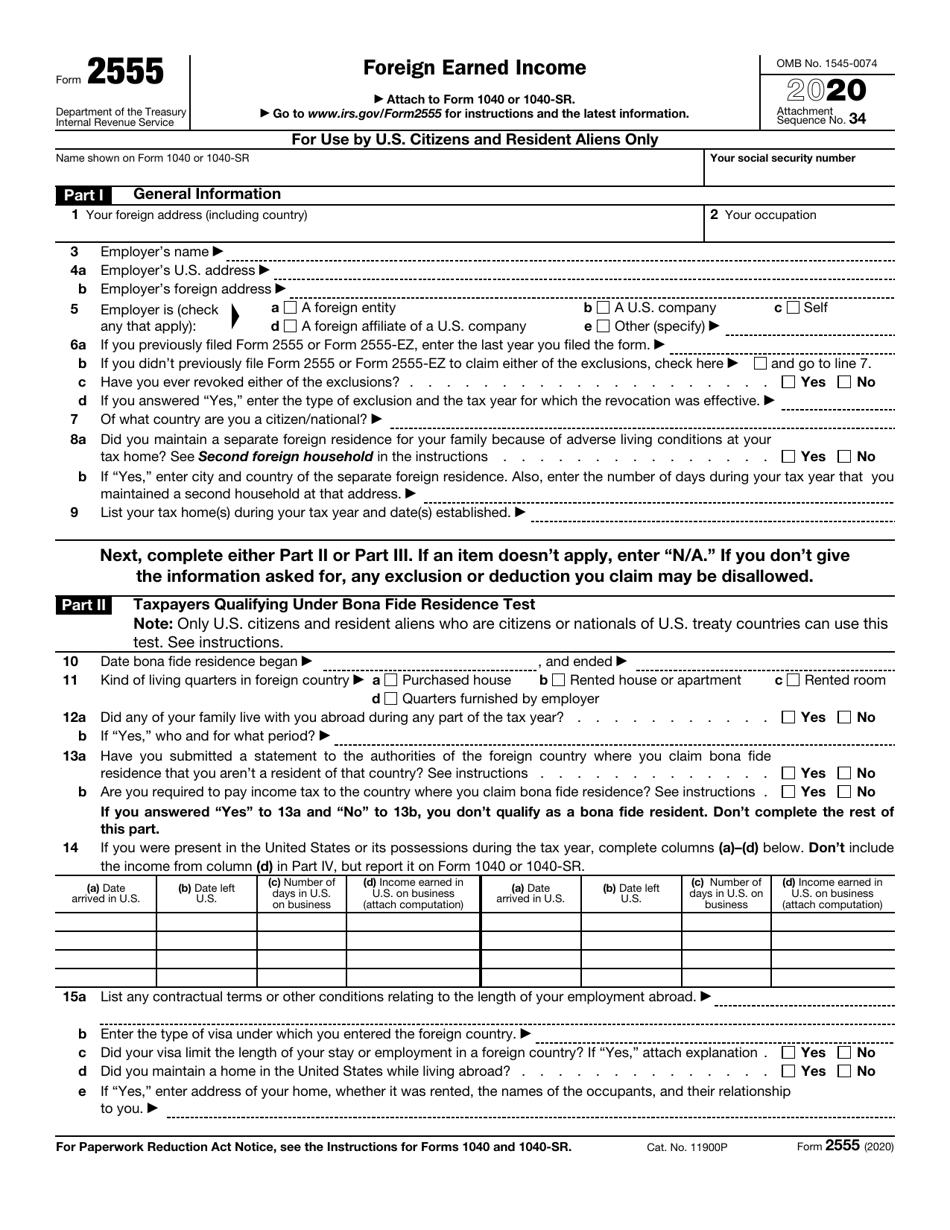

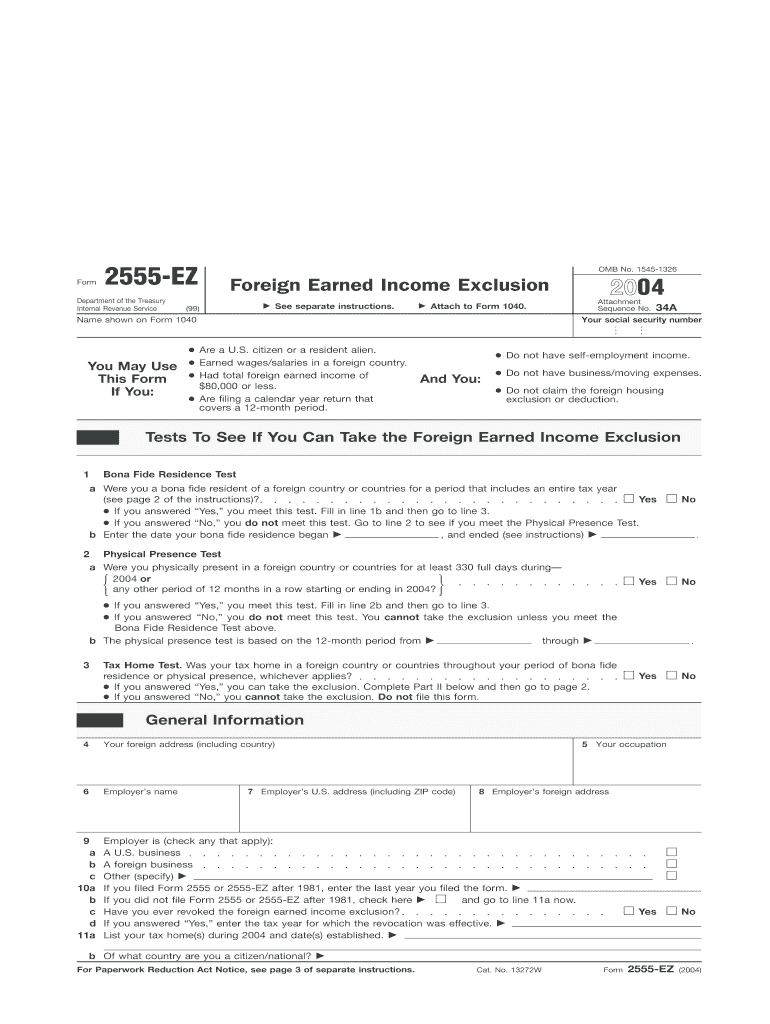

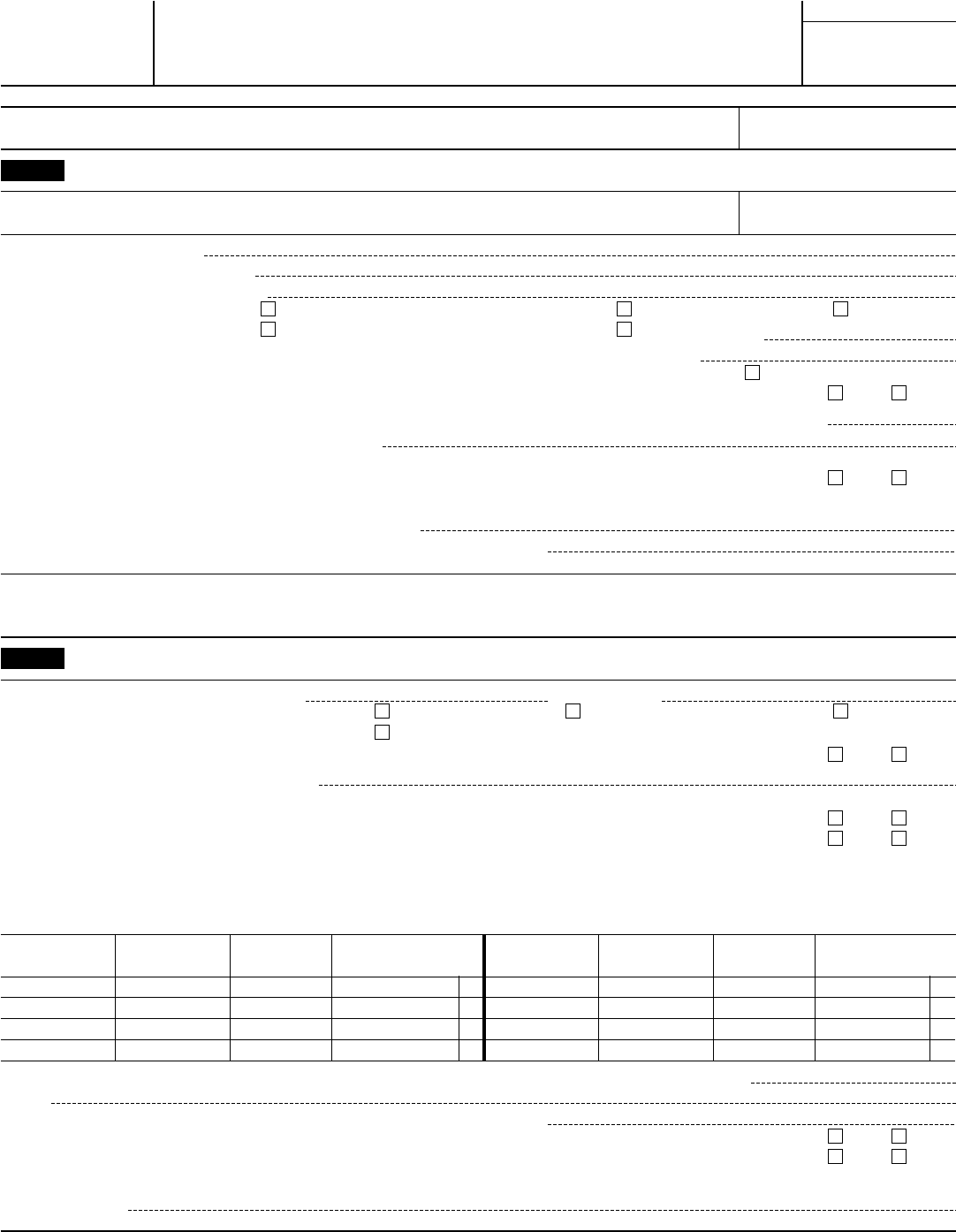

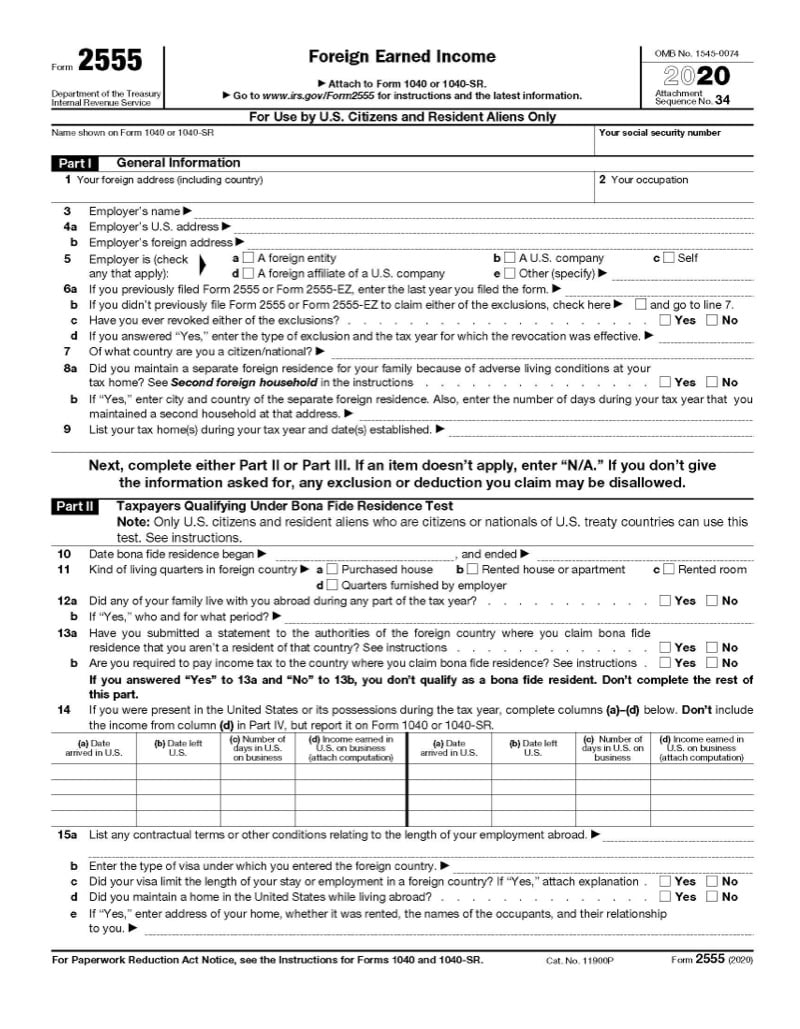

What Is Form 2555 - The form is used primarily by expats who meet the irs foreign earned income exclusion. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. To report your foreign income on form 2555 in turbotax follow these steps: Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. Go to www.irs.gov/form2555 for instructions and the latest information. Web what is the foreign earned income exclusion (form 2555)? Web the irs form 2555 is the foreign earned income exclusion form. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. 34 for use by u.s.

Tax if i live overseas? If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. To report your foreign income on form 2555 in turbotax follow these steps: If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the. Common questions we receive include: Most countries implement some sort of tax on income earned within their borders. What if i already paid tax on the income overseas? Go to www.irs.gov/form2555 for instructions and the latest information. The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie).

The form is used primarily by expats who meet the irs foreign earned income exclusion. To report your foreign income on form 2555 in turbotax follow these steps: If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. What if i already paid tax on the income overseas? 34 for use by u.s. You may also qualify to exclude certain foreign housing amounts. Most countries implement some sort of tax on income earned within their borders. Tax if i live overseas? Web the irs form 2555 is the foreign earned income exclusion form. If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the.

IRS Form 2555 Download Fillable PDF or Fill Online Foreign Earned

Common questions we receive include: Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. The form is used primarily by expats who meet the irs foreign earned income exclusion..

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

Tax if i live overseas? Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web the irs form 2555 is the foreign earned income exclusion form. The form is used primarily by expats who meet the irs foreign earned income exclusion. Go to www.irs.gov/form2555 for instructions and the latest information.

Form 2555 Edit, Fill, Sign Online Handypdf

34 for use by u.s. What if i already paid tax on the income overseas? If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. Web what is the foreign earned income exclusion (form 2555)? Most countries implement some sort of tax on income earned within.

Form 2555 Claiming Foreign Earned Exclusion Jackson Hewitt

Web the irs form 2555 is the foreign earned income exclusion form. Irs form 2555 is intended for the reporting of foreign earned income to the internal revenue service (irs). Citizens and resident aliens only. The form is used primarily by expats who meet the irs foreign earned income exclusion. To report your foreign income on form 2555 in turbotax.

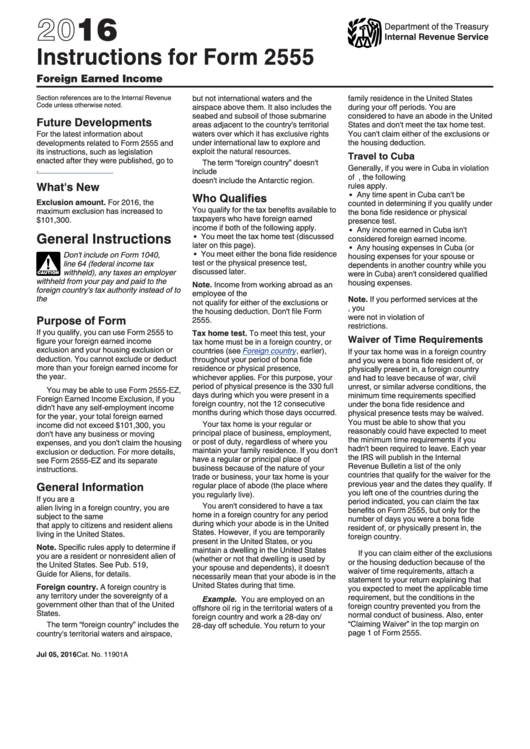

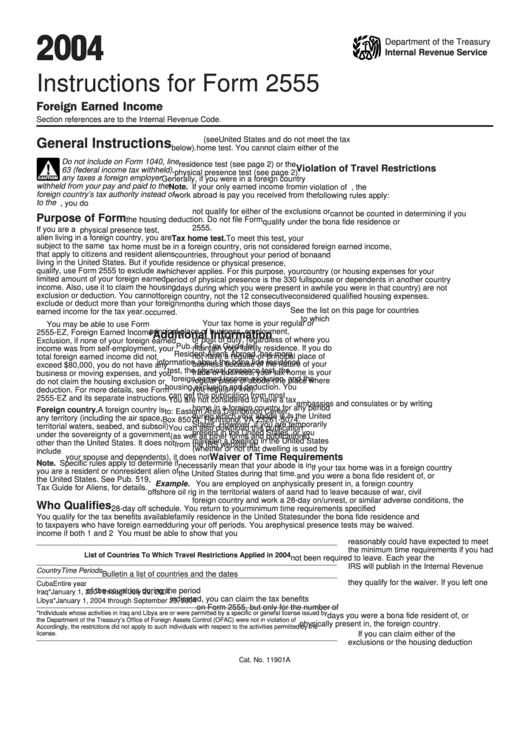

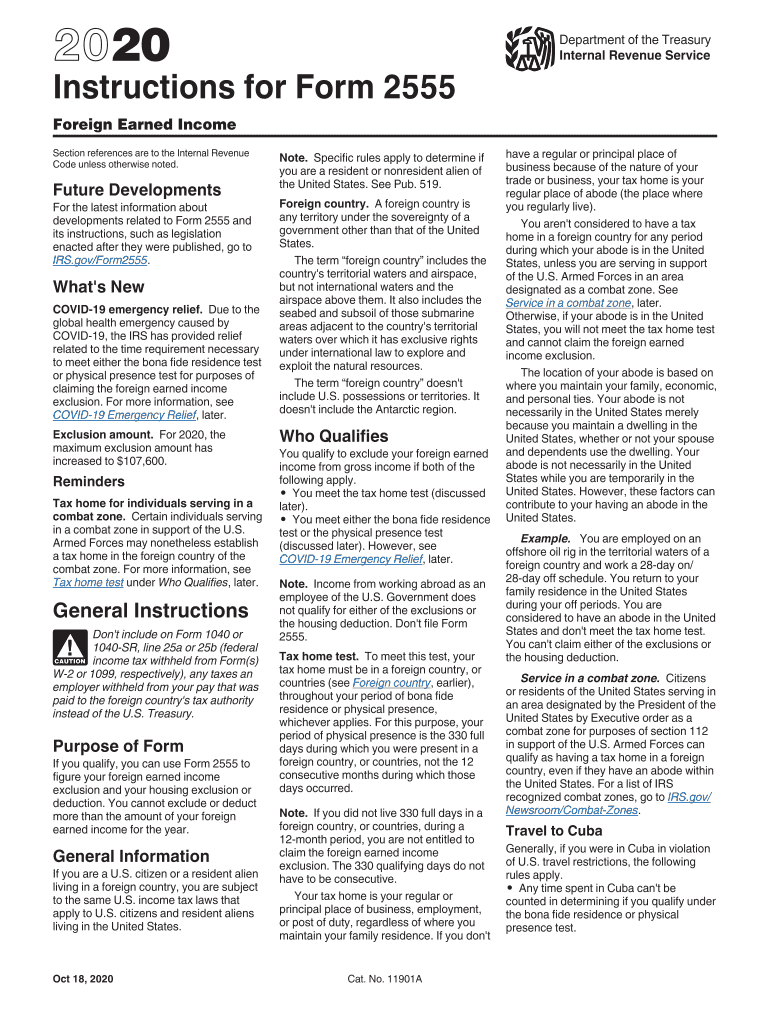

Instructions For Form 2555 2016 printable pdf download

Tax if i live overseas? Irs form 2555 is intended for the reporting of foreign earned income to the internal revenue service (irs). Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). Web the irs form 2555 is the foreign earned income exclusion form. Web form 2555 is the form you file to.

Instructions For Form 2555 printable pdf download

Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Most countries implement some sort of tax on income earned within their borders. Sign in to your account if it is not open Irs form 2555 is intended for the reporting of foreign earned income to the internal revenue service (irs)..

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Citizens and resident aliens only. The form is used primarily by expats who meet the irs foreign earned income exclusion. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. You may also qualify to exclude certain foreign housing amounts. 34 for use by u.s.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

To report your foreign income on form 2555 in turbotax follow these steps: Web the irs form 2555 is the foreign earned income exclusion form. Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). The form is used primarily by expats who meet the irs foreign earned income exclusion. Web form 2555 shows.

2013 Form IRS 2555 Fill Online, Printable, Fillable, Blank PDFfiller

Sign in to your account if it is not open Go to www.irs.gov/form2555 for instructions and the latest information. To report your foreign income on form 2555 in turbotax follow these steps: Most countries implement some sort of tax on income earned within their borders. Web form 2555 shows how you qualify for the bona fide residence test or physical.

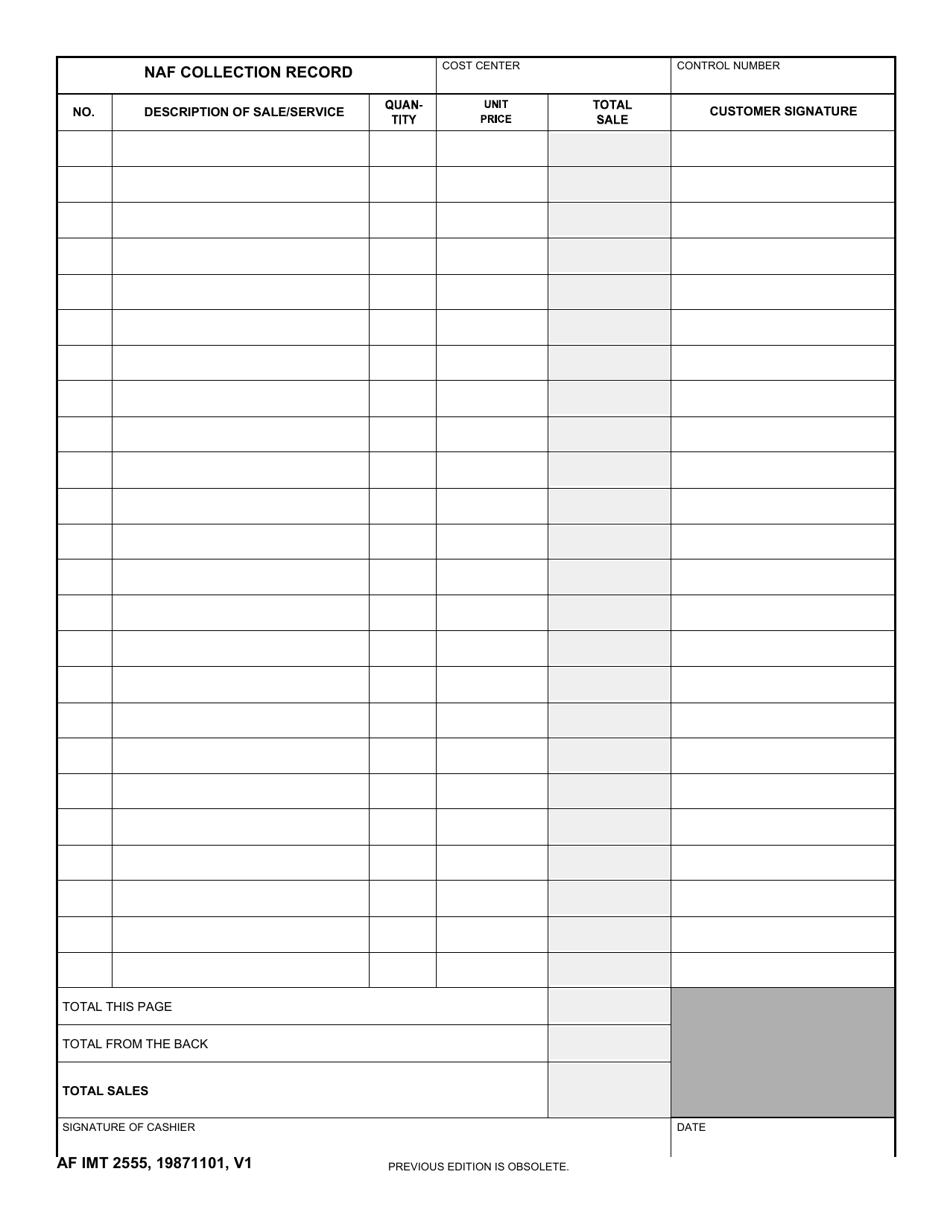

AF IMT Form 2555 Download Fillable PDF or Fill Online NAF Collection

Sign in to your account if it is not open You may also qualify to exclude certain foreign housing amounts. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. To report your foreign income on form 2555 in turbotax follow these steps: Common questions we.

If You Are Living And Working Abroad, You May Be Entitled To Exclude Up To $112,000 (2022) Of Your Foreign Income From Your Return.

Web the irs form 2555 is the foreign earned income exclusion form. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year.

34 For Use By U.s.

Go to www.irs.gov/form2555 for instructions and the latest information. Irs form 2555 is intended for the reporting of foreign earned income to the internal revenue service (irs). Citizens and resident aliens only. To report your foreign income on form 2555 in turbotax follow these steps:

Web What Is Form 2555?

Web what is the foreign earned income exclusion (form 2555)? Sign in to your account if it is not open Common questions we receive include: You may also qualify to exclude certain foreign housing amounts.

What If I Already Paid Tax On The Income Overseas?

The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Most countries implement some sort of tax on income earned within their borders. If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the. Tax if i live overseas?