What Is Form 8958

What Is Form 8958 - Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. If form 8958 is needed, a federal note is produced,. Form 8958 is also used for registered domestic partners who. If your resident state is a community property state, and you file a federal tax return separately from your. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web registered domestic partners should report wages, other income items, and deductions according to the instructions to form 1040, u.s. I got married in nov 2021. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit.

Yes, loved it could be better no one. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. I got married in nov 2021. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. My wife and i are filing married, filing. Web the internal revenue service (irs) created form 8958 to allow couples into community properties states to correctly allocation income for each spouse this may not. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit.

Quick guide on how to complete irs. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web the internal revenue service (irs) created form 8958 to allow couples into community properties states to correctly allocation income for each spouse this may not. Yes, loved it could be better no one. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Form 8958 is also used for registered domestic partners who. Web registered domestic partners should report wages, other income items, and deductions according to the instructions to form 1040, u.s. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. I got married in nov 2021.

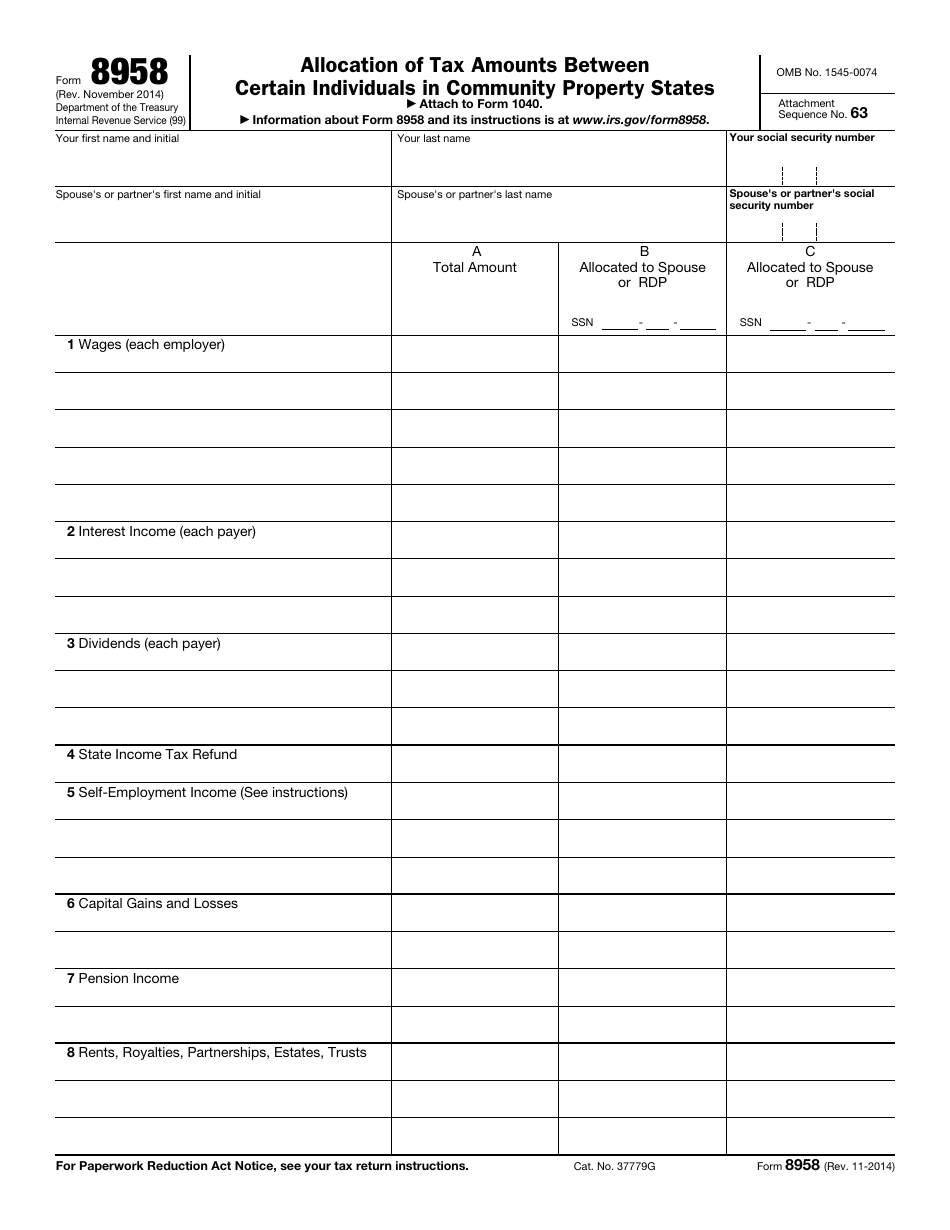

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Quick guide on how to complete irs. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web level 1 how to.

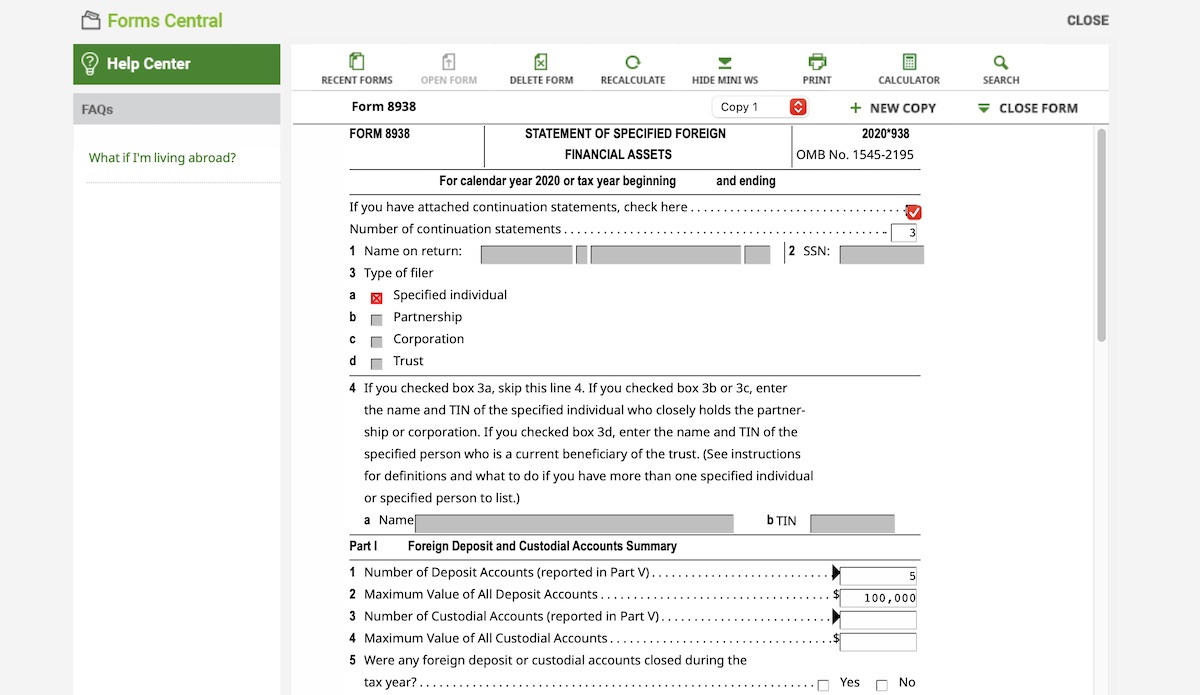

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

If form 8958 is needed, a federal note is produced,. If your resident state is a community property state, and you file a federal tax return separately from your. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web form 8958 is also.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web income allocation information is required when electronically filing a return with.

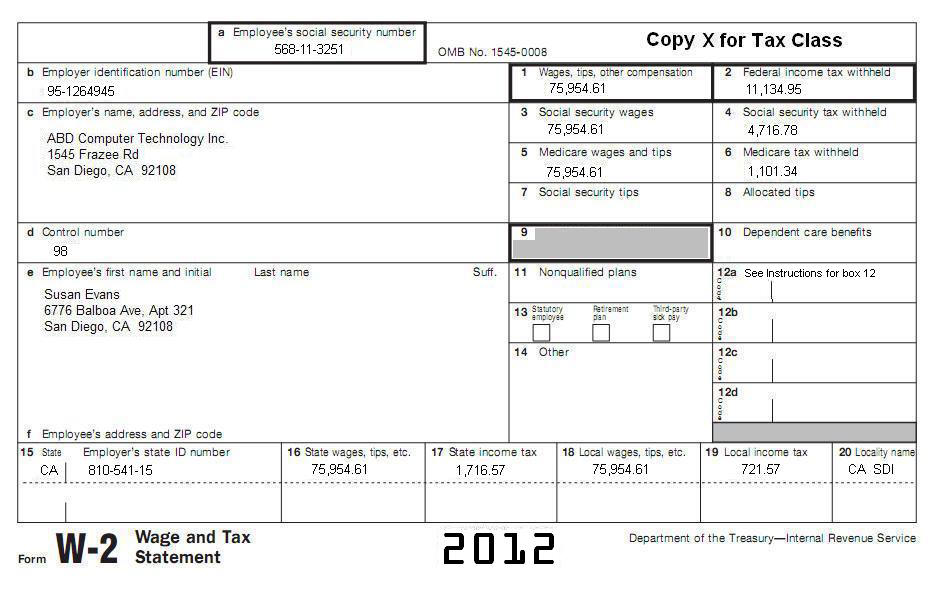

bd irs pdf

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Quick guide on how to complete.

Tax Subject CA1 Filing a California Tax Return

Web the internal revenue service (irs) created form 8958 to allow couples into community properties states to correctly allocation income for each spouse this may not. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 is also needed for the two separately filed tax returns.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web level 1 how to properly fill out form 8958.

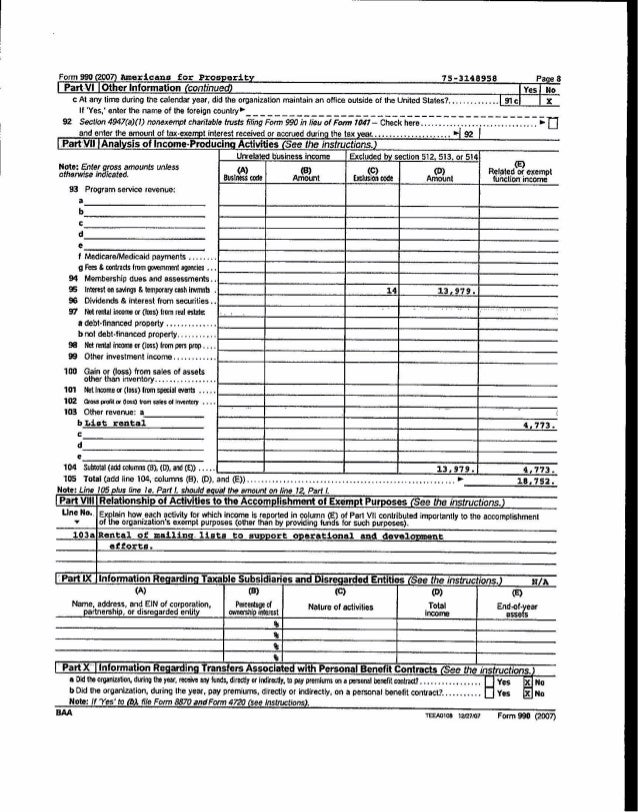

Americans forprosperity2007

I got married in nov 2021. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web the internal revenue service (irs) created form 8958 to allow couples into community properties states to correctly allocation income for each spouse this may.

Community property / Form 8958 penalty for r/tax

Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Web registered domestic partners should report wages, other income items, and deductions according to the instructions to form 1040, u.s. My wife and i are filing married, filing. Web the form 8958 essentially reconciles the difference between.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

If your resident state is a community property state, and you file a federal tax return separately from your. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web form 8958 is also needed for the two separately filed tax returns of registered.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Form 8958 is also used for registered domestic partners who. Web the internal revenue service (irs) created form 8958 to allow couples into community properties states to correctly allocation income for each spouse this may not. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property.

Web The Form 8958 Essentially Reconciles The Difference Between What Employers (And Other Income Sources) Have Reported To The Irs And What The Spouses Will Be.

If form 8958 is needed, a federal note is produced,. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded.

Yes, Loved It Could Be Better No One.

My wife and i are filing married, filing. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Web registered domestic partners should report wages, other income items, and deductions according to the instructions to form 1040, u.s.

Form 8958 Is Also Used For Registered Domestic Partners Who.

I got married in nov 2021. If your resident state is a community property state, and you file a federal tax return separately from your. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return.

Web Income Allocation Information Is Required When Electronically Filing A Return With A Married Filing Separately Or Registered Domestic Partner Status In The Individual Module Of Intuit.

Web the internal revenue service (irs) created form 8958 to allow couples into community properties states to correctly allocation income for each spouse this may not. Quick guide on how to complete irs.