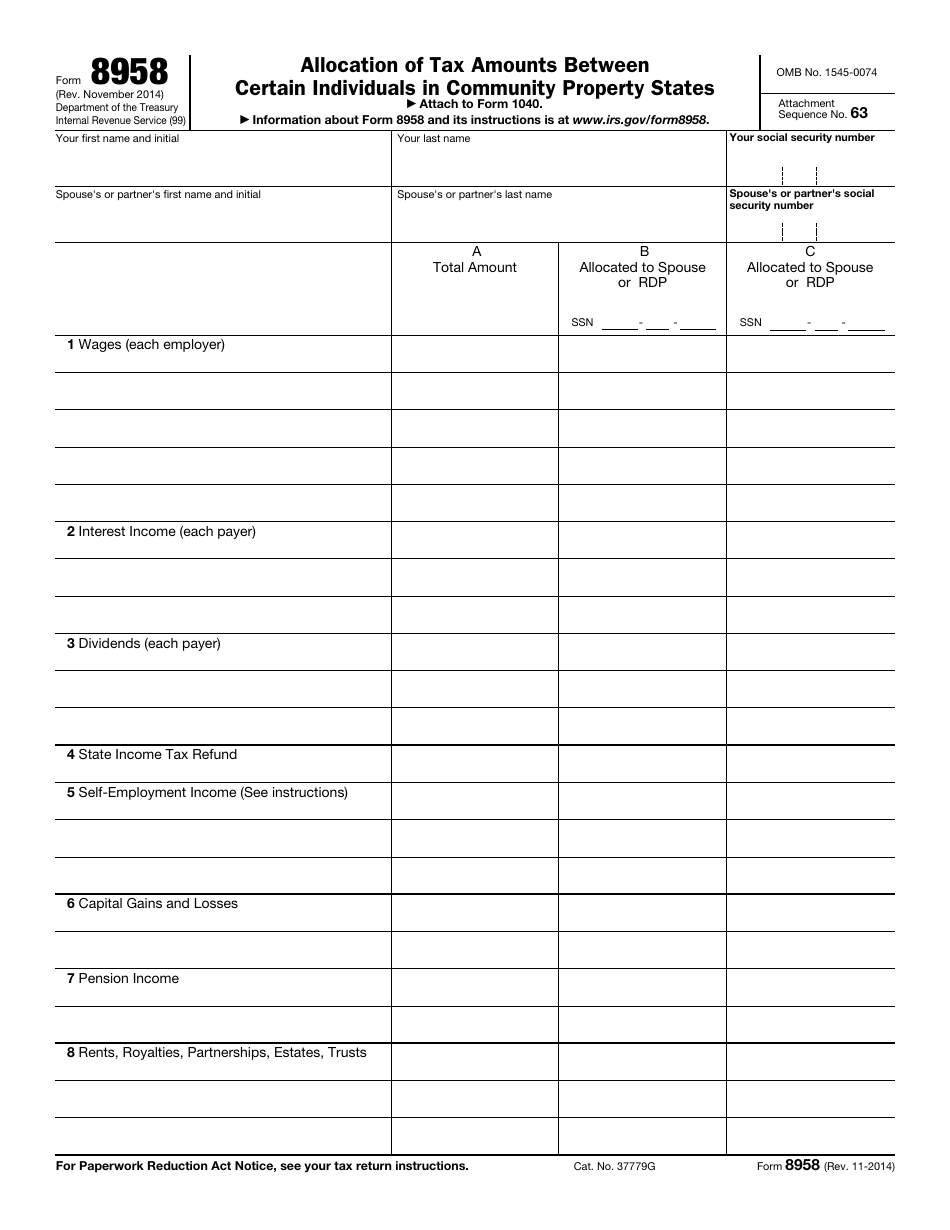

What Is Tax Form 8958 Used For

What Is Tax Form 8958 Used For - Web tax filing purposes as beyond the scope of the program, refer such taxpayers to a professional tax preparer. If the taxpayer is in one of the community. Web several states have community property laws, which state that most incomes earns and most assets acquired during a marriage are the equal immobilien of. If form 8958 is needed, a federal note is produced,. Yes, loved it could be better. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web common questions about entering form 8958 income for community property allocation in lacerte.

The excess repayment of $1,500 can be carried. Web common questions about entering form 8958 income for community property allocation in lacerte. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web in 2021, you made a repayment of $4,500. Web several states have community property laws, which state that most incomes earns and most assets acquired during a marriage are the equal immobilien of. Serves to catch and record identity authentication, time and date stamp, and ip. The form 8958 essentially reconciles the difference between what employers (and other. If the taxpayer is in one of the community. Web the form 8958 is only used when filing as married filing separate (mfs).

Web tax filing purposes as beyond the scope of the program, refer such taxpayers to a professional tax preparer. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web common questions about entering form 8958 income for community property allocation in lacerte. This includes their name, address, employer identification number (ein),. Serves to catch and record identity authentication, time and date stamp, and ip. Web in 2021, you made a repayment of $4,500. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Income allocation information is required when electronically filing a return. Submitting the irs form 8958. The excess repayment of $1,500 can be carried.

3.11.23 Excise Tax Returns Internal Revenue Service

Web tax filing purposes as beyond the scope of the program, refer such taxpayers to a professional tax preparer. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners.

CCH® ProSystem fx® / Global fx Tax This Field's Instructions YouTube

If form 8958 is needed, a federal note is produced,. Submitting the irs form 8958. Web common questions about entering form 8958 income for community property allocation in lacerte. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web.

2010 Form IRS 8718 Fill Online, Printable, Fillable, Blank pdfFiller

Web common questions about entering form 8958 income for community property allocation in lacerte. Web tax filing purposes as beyond the scope of the program, refer such taxpayers to a professional tax preparer. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 is also needed.

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. The excess repayment of $1,500 can be carried. If form 8958 is needed, a federal note is produced,. If the taxpayer is in one of the community. Web tax filing purposes as beyond the scope of the program, refer.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

This includes their name, address, employer identification number (ein),. Submitting the irs form 8958. The form 8958 essentially reconciles the difference between what employers (and other. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Yes, loved it could be better.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Web common questions about entering form 8958 income for community property allocation in lacerte. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses.

Fill Free fillable Allocation of Tax Amounts Between Certain

Web the form 8958 is only used when filing as married filing separate (mfs). Web in 2021, you made a repayment of $4,500. Yes, loved it could be better. The form 8958 essentially reconciles the difference between what employers (and other. Web several states have community property laws, which state that most incomes earns and most assets acquired during a.

De 2501 Part B Printable

Web the form 8958 is only used when filing as married filing separate (mfs). Web several states have community property laws, which state that most incomes earns and most assets acquired during a marriage are the equal immobilien of. Web tax filing purposes as beyond the scope of the program, refer such taxpayers to a professional tax preparer. Web if.

Americans forprosperity2007

Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Yes, loved it could be better. If form 8958 is needed, a federal note is produced,. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web the form 8958 is only used when filing as married filing separate (mfs). Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Web tax filing purposes as beyond the scope of the program, refer such taxpayers to a professional tax preparer..

Web In 2021, You Made A Repayment Of $4,500.

Web common questions about entering form 8958 income for community property allocation in lacerte. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If the taxpayer is in one of the community. You only need to complete form 8958 allocation of tax amounts between certain individuals in.

Web You Must Attach Form 8958 To Your Tax Form Showing How You Figured The Amount You’re Reporting On Your Return.

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. If form 8958 is needed, a federal note is produced,. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or.

Yes, Loved It Could Be Better.

Serves to catch and record identity authentication, time and date stamp, and ip. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. This includes their name, address, employer identification number (ein),. Sends the data safely to the servers.

Submitting The Irs Form 8958.

Web several states have community property laws, which state that most incomes earns and most assets acquired during a marriage are the equal immobilien of. The excess repayment of $1,500 can be carried. Web the form 8958 is only used when filing as married filing separate (mfs). The form 8958 essentially reconciles the difference between what employers (and other.