What Is The Due Date For Form 1041 In 2022

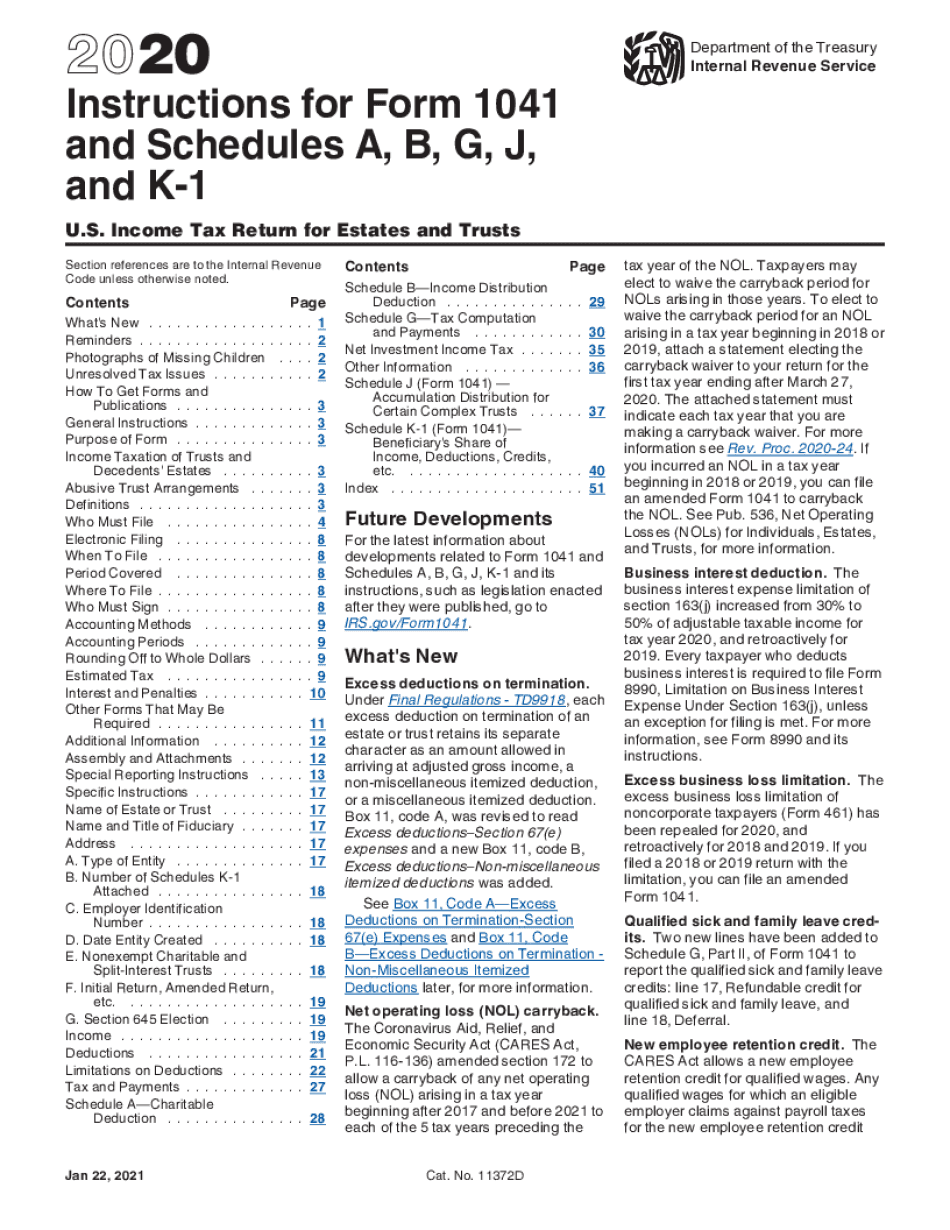

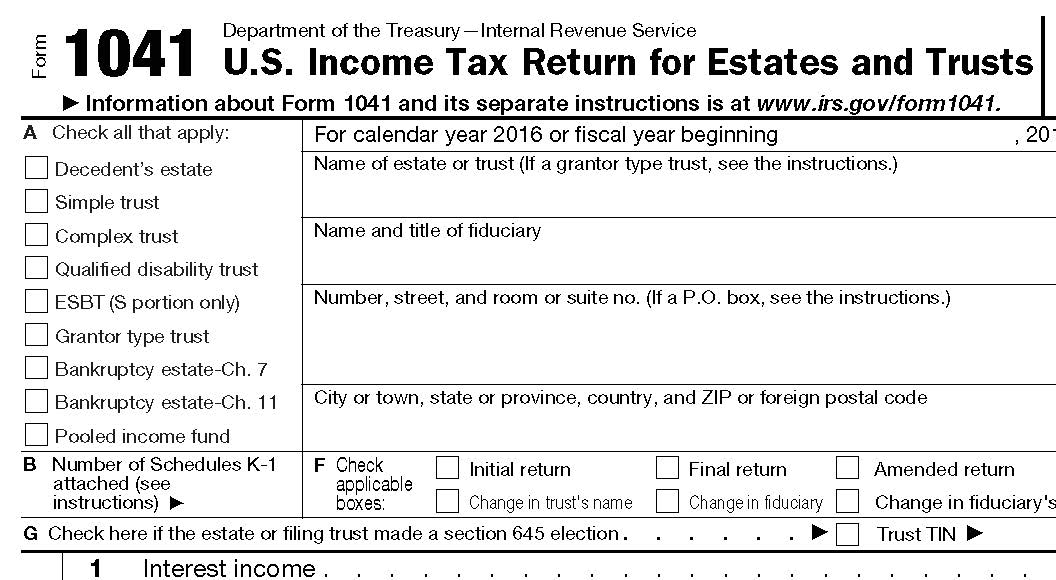

What Is The Due Date For Form 1041 In 2022 - As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web tax year 2022 filing due dates. As an employer, you are liable to file form 941 before the deadline regardless of. Search site you are here. Web 7 rows irs begins accepting form 1041 electronic tax returns. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Web october 31, 2023. Which extension form is used for form 1041? Web payroll tax returns.

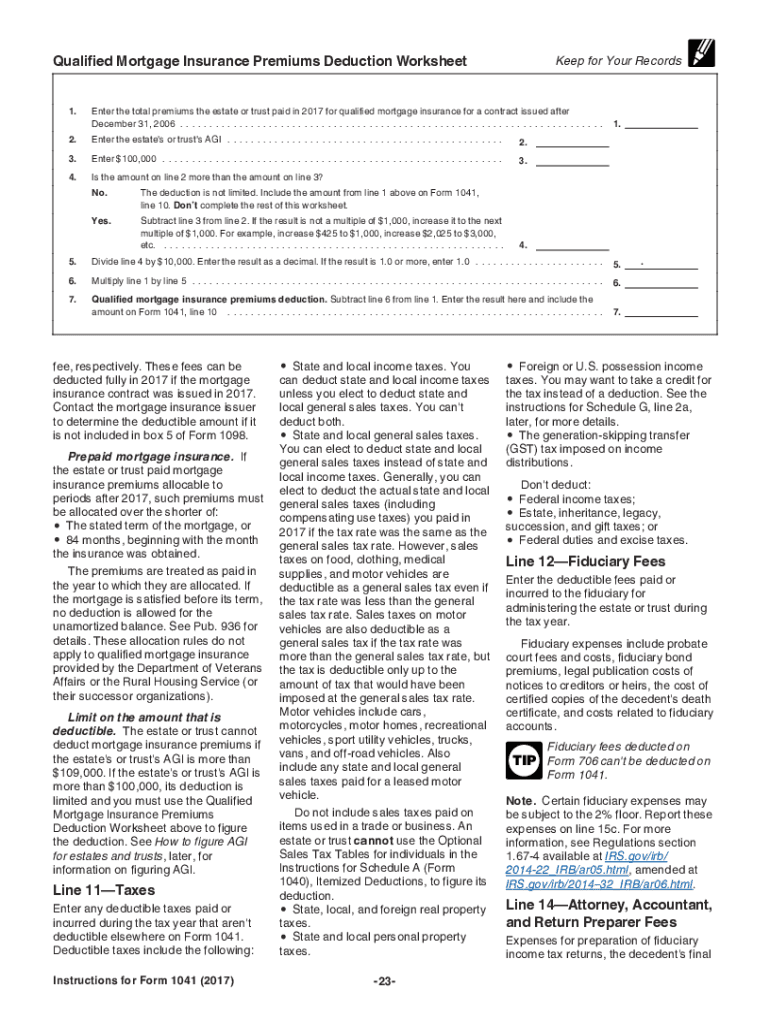

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Here are the current statutory due dates for. Web payroll tax returns. Web jan 4, 2022 | tax due dates, tax news mcb tax cpas have compiled a list of 2022 tax filing deadlines and extensions for the 2021 tax year. Web october 31, 2023. Web usually, form 941 due date falls by the last day of the month following the reporting quarter. Reference the aicpa tax section’s state and local tax. • 1041 on extension due: As an employer, you are liable to file form 941 before the deadline regardless of. Web for fiscal year, file by the 15th day of the fourth month following the tax year close (form 1041).

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For fiscal year estates and trusts, file form 1041. Search site you are here. Web october 31, 2023. Partnerships (form 1065) march 15, 2022: Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. As an employer, you are liable to file form 941 before the deadline regardless of. Web jan 4, 2022 | tax due dates, tax news mcb tax cpas have compiled a list of 2022 tax filing deadlines and extensions for the 2021 tax year. Web simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Web december 8, 2021 it has been a couple of strange and stressful years, with due dates that seemed to be ever shifting.

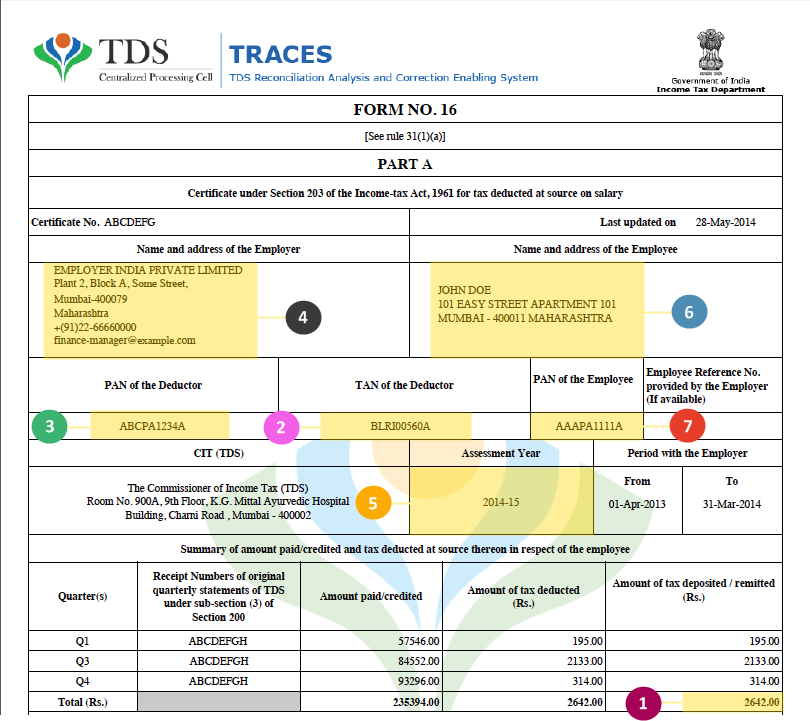

DUE DATE for issuing Form 16 extended Studycafe

2nd installment.june 15, 2023 3rd installment.sept. Search site you are here. Web type of form: For fiscal year estates and trusts,. If the tax year for an estate ends on june 30, 2020,you must file by.

Due date for filing of TDS statement extended to 10th July 2019 Due

2nd installment.june 15, 2023 3rd installment.sept. Those returns are processed in. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Web download this quick reference chart for a summary of common federal tax deadlines for tax year.

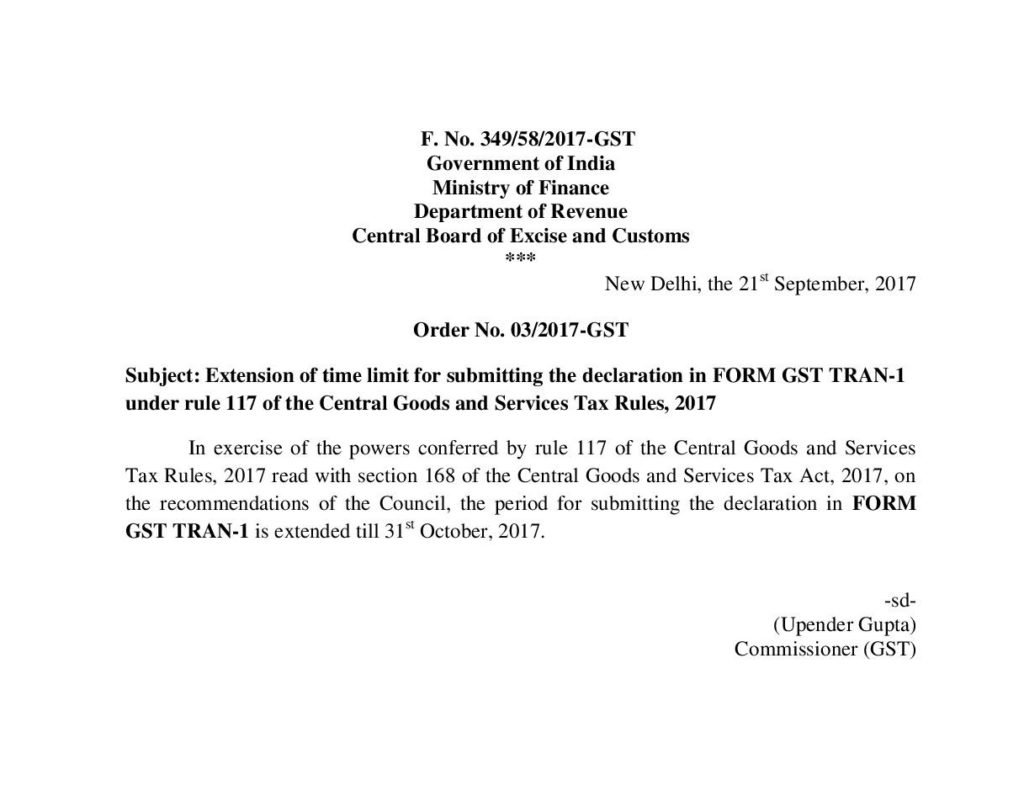

Extension Due Date for Submitting the Declaration in FORM GST TRAN1 II

Web payroll tax returns. For fiscal year estates and trusts, file form 1041. Since april 15 falls on a saturday, and emancipation day. Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Search site you are here.

Due Date for furnishing FORM GSTR1 for April 2021 extended amid COVID19

Web 7 rows irs begins accepting form 1041 electronic tax returns. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. For example, for a trust or. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Since april 15 falls on a.

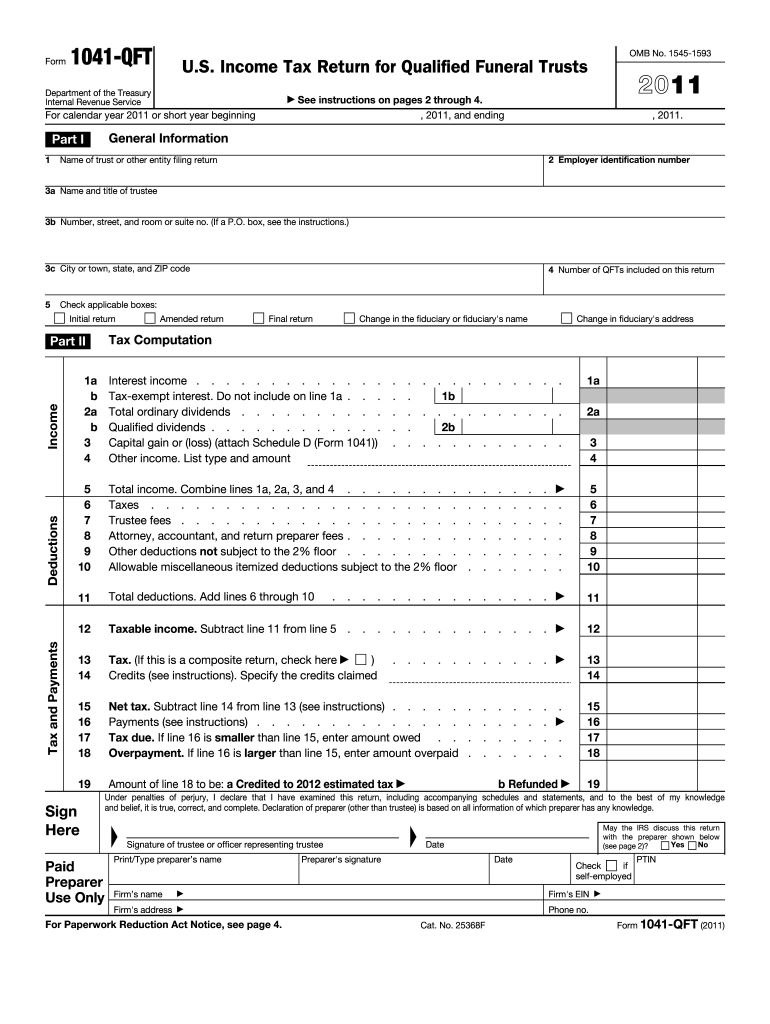

Form 1041 Qft Fill Out and Sign Printable PDF Template signNow

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web estates & trusts (form 1041) april 18, 2022: Search site you are here. Web simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Web 7 rows irs begins accepting form 1041 electronic tax returns.

Form 1041 Tax Fill Out and Sign Printable PDF Template signNow

Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022. For example, for a trust or. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web individuals and families. 11 pooled income fund b number of.

Form 1041 U.S. Tax Return for Estates and Trusts

Web for fiscal year, file by the 15th day of the fourth month following the tax year close (form 1041). Which extension form is used for form 1041? As an employer, you are liable to file form 941 before the deadline regardless of. Web payroll tax returns. Since april 15 falls on a saturday, and emancipation day.

IRS Form 2290 Due Dates for the Tax Year 20112012 Blog

11 pooled income fund b number of. Web four equal installments due by the following dates. Partnerships (form 1065) march 15, 2022: Web type of form: For example, for a trust or.

form 1041 schedule d Fill Online, Printable, Fillable Blank form

Web tax year 2022 filing due dates. If the tax year for an estate ends on june 30, 2020,you must file by. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. 2nd installment.june 15, 2023 3rd installment.sept. Web simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch.

Estate Tax Return When is it due?

11 pooled income fund b number of. Web simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. • 1041 on extension due: Web october 31, 2023.

For Fiscal Year Estates And Trusts, File Form 1041.

Here are the current statutory due dates for. If the tax year for an estate ends on june 30, 2020,you must file by. Web jan 4, 2022 | tax due dates, tax news mcb tax cpas have compiled a list of 2022 tax filing deadlines and extensions for the 2021 tax year. Those returns are processed in.

Web Tax Year 2022 Filing Due Dates.

• 1041 on extension due: Which extension form is used for form 1041? Web estates & trusts (form 1041) april 18, 2022: Web download this quick reference chart for a summary of common federal tax deadlines for tax year 2022.

Form 1120 Generally Shall Be A Six.

Web for fiscal year, file by the 15th day of the fourth month following the tax year close (form 1041). As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Since april 15 falls on a saturday, and emancipation day. 11 pooled income fund b number of.

As An Employer, You Are Liable To File Form 941 Before The Deadline Regardless Of.

2nd installment.june 15, 2023 3rd installment.sept. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Reference the aicpa tax section’s state and local tax. Web 7 rows irs begins accepting form 1041 electronic tax returns.

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)