When Does Form 5498 Come Out

When Does Form 5498 Come Out - 31 for fmv and rmds, and april. However, that does not appear to be the case for 2022. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. The fair market value listed on my form 5498 is zero. Web in 2021, the irs extended this deadline to june 30. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web updated for tax year 2022 • june 2, 2023 08:44 am overview if you made contributions to an ira in the preceding tax year, you can expect to receive irs form. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the.

However, that does not appear to be the case for 2022. What if an irs form 5498 has not been received or has been misplaced? Plan administrators should use form 5498 to report. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. Web in 2021, the irs extended this deadline to june 30. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. We’ll be mailing irs form 5498 to ira policyholders who had. The fair market value listed on my form 5498 is zero. Web up to 10% cash back these contributions can be reported on a form 5498 for the year in which the contribution is made (e.g., made in 2022 for the 2021 tax year).

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web in 2021, the irs extended this deadline to june 30. Web updated for tax year 2022 • june 2, 2023 08:44 am overview if you made contributions to an ira in the preceding tax year, you can expect to receive irs form. Web for example, if you made contributions to a traditional ira for the 2020 tax year between january 31, 2020 and april 15, 2021, you should receive a form 5498 in may of 2021. Web up to 10% cash back these contributions can be reported on a form 5498 for the year in which the contribution is made (e.g., made in 2022 for the 2021 tax year). Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the. Web the form will be mailed to you in late may after all contributions have been made for that year. The fair market value listed on my form 5498 is zero.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Web for example, if you made contributions to a traditional ira for the 2020 tax year between january 31, 2020 and april 15, 2021, you should receive a form 5498 in may of 2021. Web up to 10% cash back these contributions can be reported on a form 5498 for the year in which the contribution is made (e.g., made.

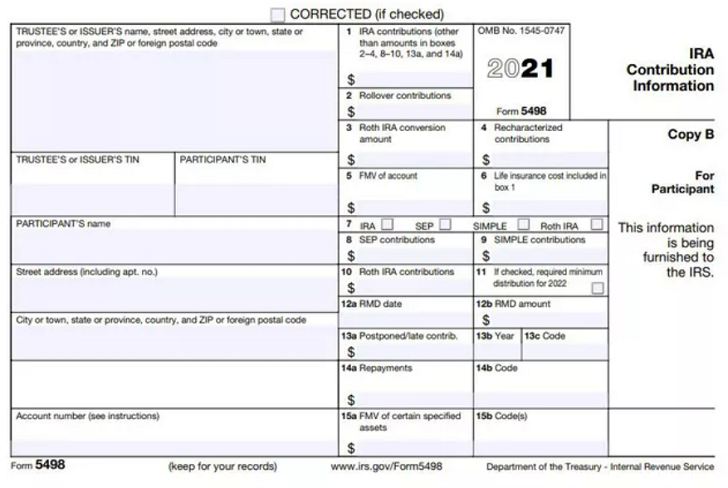

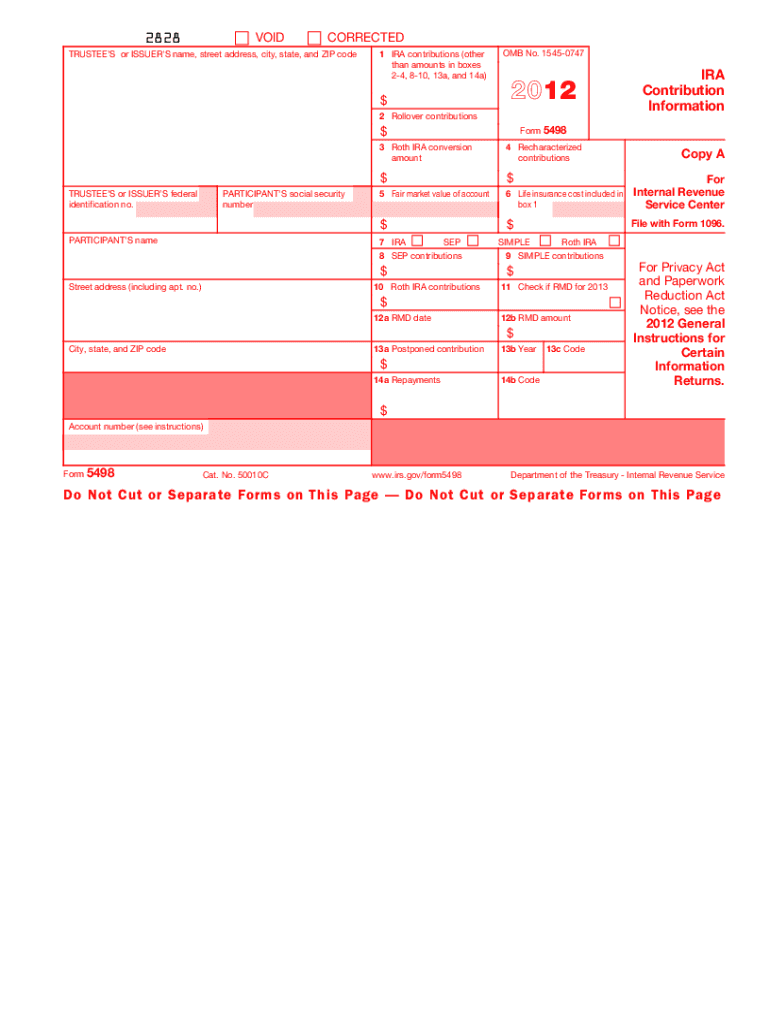

IRS Form 5498 IRA Contribution Information

Plan administrators should use form 5498 to report. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira.

What is Form 5498? New Direction Trust Company

When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Plan administrators should use form 5498 to report. We’ll be mailing irs form 5498 to ira policyholders who had. Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute.

IRS Form 5498 Instructions for 2021 Line by Line 5498 Instruction

Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web the form will be mailed to you in late may after all contributions have been made for that year. Web the.

The Purpose of IRS Form 5498

Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the. Web updated for tax year 2022 • june 2, 2023 08:44 am overview if you made contributions to an ira in the preceding tax year, you.

Form 5498 For Fill Out and Sign Printable PDF Template signNow

We’ll be mailing irs form 5498 to ira policyholders who had. The fair market value listed on my form 5498 is zero. Web irs form 5498s are mailed out from pacific life to qualifying owners by may 31. However, that does not appear to be the case for 2022. Web updated for tax year 2022 • june 2, 2023 08:44.

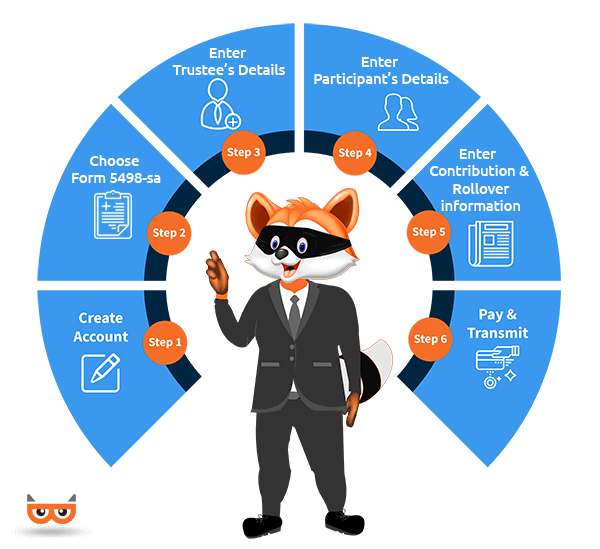

5498 Software to Create, Print & EFile IRS Form 5498

Web irs form 5498s are mailed out from pacific life to qualifying owners by may 31. Web for example, if you made contributions to a traditional ira for the 2020 tax year between january 31, 2020 and april 15, 2021, you should receive a form 5498 in may of 2021. However, that does not appear to be the case for.

An Explanation of IRS Form 5498

Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. Web up to 10% cash back these contributions can be reported on a form 5498 for the year in which the contribution is made (e.g., made in 2022 for the 2021 tax year). Web for example, if you.

File 2020 Form 5498SA Online EFile as low as 0.50/Form

Web irs form 5498s are mailed out from pacific life to qualifying owners by may 31. Web since everyone usually has until april 15 to make contributions, the irs usually gives custodians until may 31 to send form 5498. Web for example, if you made contributions to a traditional ira for the 2020 tax year between january 31, 2020 and.

IRS Form 5498 What It Is and What The IRS Extension Means For Your IRA

Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the. Plan administrators should use form 5498 to report. We’ll be mailing irs form 5498 to ira policyholders who had. Web the form will be mailed to.

Plan Administrators Should Use Form 5498 To Report.

Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. 31 for fmv and rmds, and april. Web in 2021, the irs extended this deadline to june 30. Web the form will be mailed to you in late may after all contributions have been made for that year.

We’ll Be Mailing Irs Form 5498 To Ira Policyholders Who Had.

When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web irs form 5498s are mailed out from pacific life to qualifying owners by may 31. Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the. However, that does not appear to be the case for 2022.

Web Up To 10% Cash Back These Contributions Can Be Reported On A Form 5498 For The Year In Which The Contribution Is Made (E.g., Made In 2022 For The 2021 Tax Year).

Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. Web updated for tax year 2022 • june 2, 2023 08:44 am overview if you made contributions to an ira in the preceding tax year, you can expect to receive irs form. Web since everyone usually has until april 15 to make contributions, the irs usually gives custodians until may 31 to send form 5498. The fair market value listed on my form 5498 is zero.

Web For Example, If You Made Contributions To A Traditional Ira For The 2020 Tax Year Between January 31, 2020 And April 15, 2021, You Should Receive A Form 5498 In May Of 2021.

Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. There are two form 5498 mailing periods: Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. What if an irs form 5498 has not been received or has been misplaced?

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

/487097635-57a631af5f9b58974a3aceb1.jpg)