When Is Ca Form 568 Due

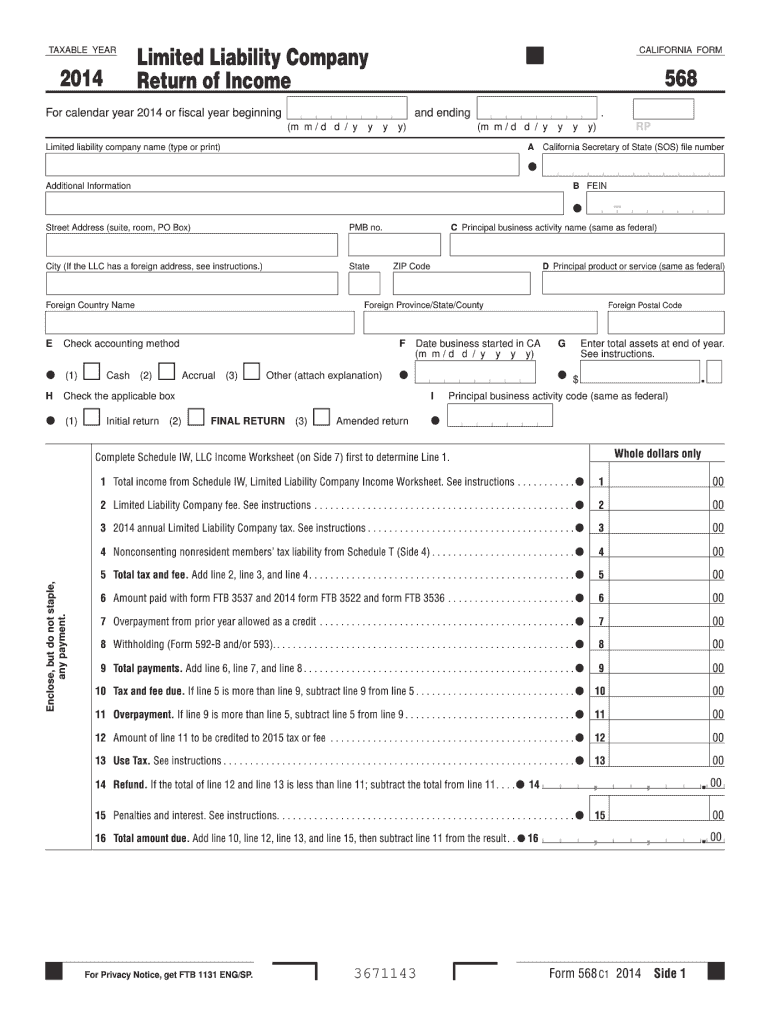

When Is Ca Form 568 Due - (m m / d d / y y y y) (m. Web do not mail the $800 annual tax with form 568. If you are married, you and your spouse are considered one owner and can elect to be. Web if your llc has one owner, you’re a single member limited liability company (smllc). How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web form 568 payment due date. January 1, 2015, and to. For calendar year 2020 or fiscal year beginning and ending. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. 2017 limited liability company return of income.

Web do not mail the $800 annual tax with form 568. Web form 568 payment due date. For calendar year 2020 or fiscal year beginning and ending. You can find out how much you owe in state income. (m m / d d / y y y y) (m. You and your clients should be aware that a disregarded smllc is required to: Web you still have to file form 568 if the llc is registered in california. Web 2022 instructions for form 568, limited liability company return of income. Form 3522, or the llc tax voucher, needs to be filed to pay the franchise tax. Aside from the $800 fixed tax, you are required to pay your state income taxes by april 15.

Web file limited liability company return of income (form 568) by the original return due date. Web file a tax return (form 568) pay the llc annual tax; Web do not mail the $800 annual tax with form 568. For calendar year 2020 or fiscal year beginning and ending. (m m / d d / y y y y) (m m / d d / y y y y) rp. If your llc files on an extension, refer to payment for automatic extension for llcs. For calendar year 2017 or fiscal year beginning and ending. 2017 limited liability company return of income. You can download or print. Web if your llc has one owner, you’re a single member limited liability company (smllc).

Download Instructions for Form 568 Schedule EO PassThrough Entity

You and your clients should be aware that a disregarded smllc is required to: January 1, 2015, and to. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. Pay the llc fee (if applicable) additionally, we have received questions about.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. Web we last updated california form 568 in february 2023 from the california franchise tax board. If your llc files on an extension, refer to payment for automatic extension for llcs. How to fill in california form 568 if you have an.

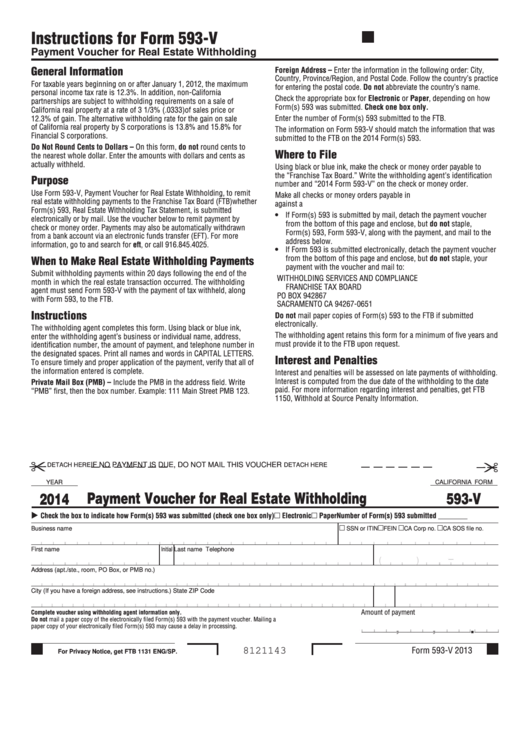

Fillable California Form 593V Payment Voucher For Real Estate

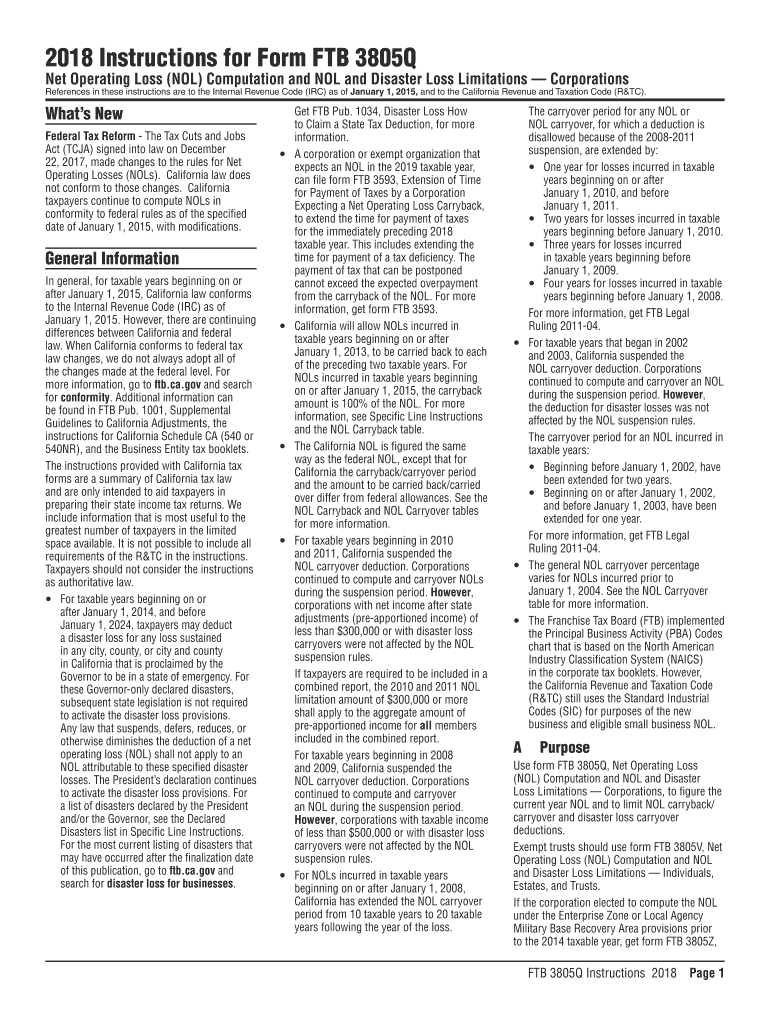

For calendar year 2017 or fiscal year beginning and ending. If your llc files on an extension, refer to payment for automatic extension for llcs. References in these instructions are to the internal revenue code (irc) as of. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web.

Form 568 Fill Out and Sign Printable PDF Template signNow

Web file limited liability company return of income (form 568) by the original return due date. You can find out how much you owe in state income. (m m / d d / y y y y) (m. Web file a tax return (form 568) pay the llc annual tax; January 1, 2015, and to.

Notice of Unavailability for Annual Form Updates DocHub

(m m / d d / y y y y) (m m / d d / y y y y) rp. You can download or print. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web form 568 payment due date. Web we require an smllc to file.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

References in these instructions are to the internal revenue code (irc) as of. Web do not mail the $800 annual tax with form 568. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. You can download or print. If you are married, you and your spouse are considered.

NEW! Ca Form 568 Instructions 2020 Coub

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web although the individual's due date was postponed to may 17, 2021, an smllc that was owned by an individual still had the original due date of april 15, 2021, to file a form 568. You and your clients should be aware that.

Instructions For Form 568 Limited Liability Company Return Of

Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. References in these instructions are to the internal revenue code (irc) as of. (m m / d d / y y y y) (m m / d d / y y y y) rp. (m m / d d /.

Form 568 Booklet Fill Out and Sign Printable PDF Template signNow

For calendar year 2017 or fiscal year beginning and ending. If your llc files on an extension, refer to payment for automatic extension for llcs. If the due date falls on a saturday,. January 1, 2015, and to. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web if your llc has one owner, you’re a single member limited liability company (smllc). If your llc files on an extension, refer to payment for automatic extension for llcs. If the due date falls on a saturday,. Web file a tax return (form 568) pay the llc annual tax; Web california form 568 i (1) during this taxable year,.

For Calendar Year 2020 Or Fiscal Year Beginning And Ending.

Web we last updated california form 568 in february 2023 from the california franchise tax board. (m m / d d / y y y y) (m. Web under section 23101 of revenue and taxation code, all disregarded entities or partnerships doing business in california must file form 568 for limited liability company return of. Web form 568 payment due date.

You Can Find Out How Much You Owe In State Income.

(m m / d d / y y y y) (m m / d d / y y y y) rp. References in these instructions are to the internal revenue code (irc) as of. If you are married, you and your spouse are considered one owner and can elect to be. Pay the llc fee (if applicable) additionally, we have received questions about assembly bill 85 and whether or not this.

You Can Download Or Print.

Web llcs classified as partnerships use form 568, due the 15th day of the 3rd month after the close of the company’s tax year. If your llc files on an extension, refer to payment for automatic extension for llcs. Web file a tax return (form 568) pay the llc annual tax; 2017 limited liability company return of income.

Web You Still Have To File Form 568 If The Llc Is Registered In California.

Web 2022 instructions for form 568, limited liability company return of income. Aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business. Web smllcs, owned by an individual, are required to file form 568 on or before april 15.