Where To File Form 941X

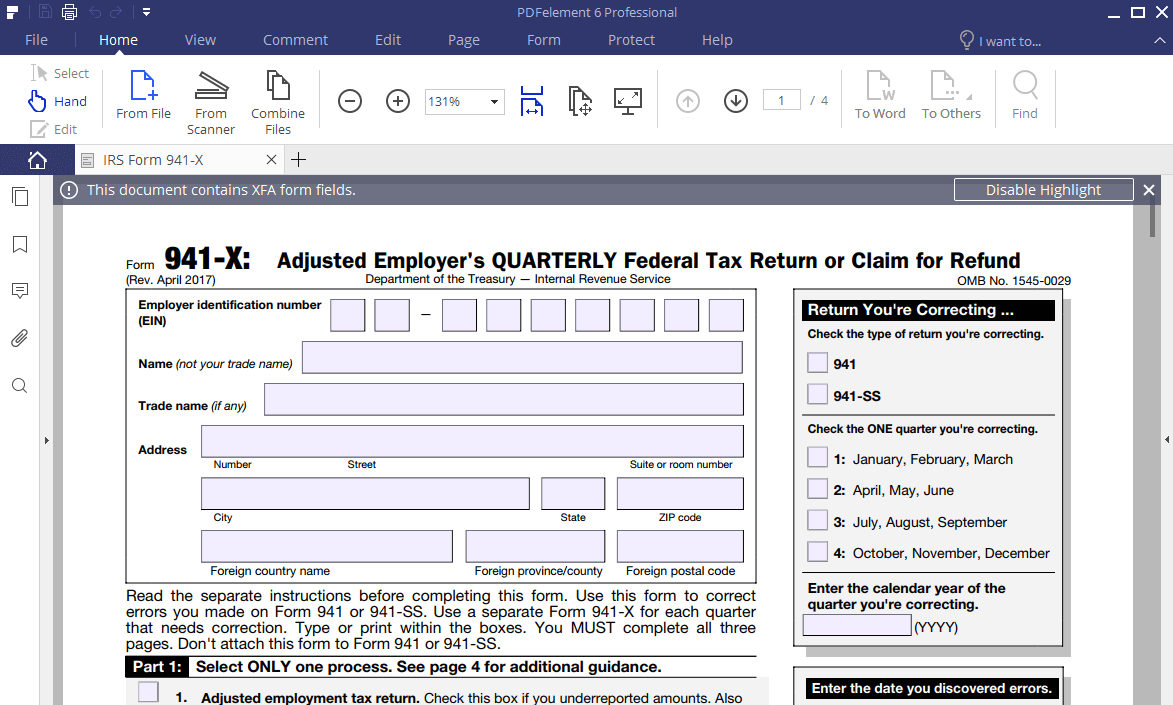

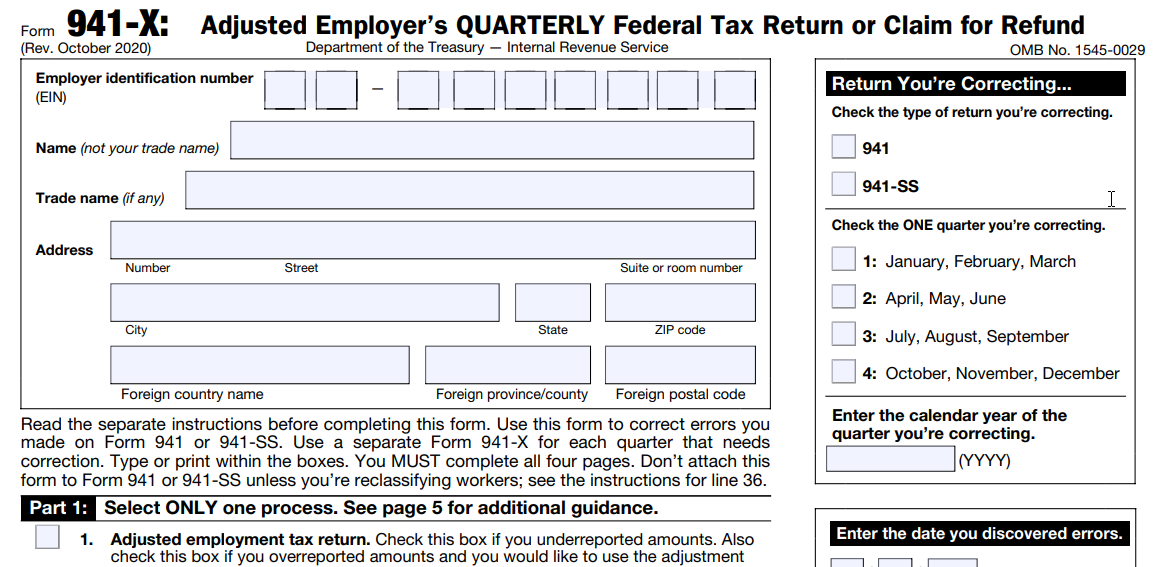

Where To File Form 941X - After march 12, 2020, and before jan. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Determine which payroll quarters in 2020 and 2021 your business qualifies for. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. Employer identification number (ein) — name (not your trade name) trade name (if. How to claim follow guidance for the period when qualified wages were paid: If you are located in. See section 13 of pub.

Determine which payroll quarters in 2020 and 2021 your business qualifies for. See section 13 of pub. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Employer identification number (ein) — name (not your trade name) trade name (if. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. The adjustments also entail administrative errors and alterations to employee retention tax credits. After march 12, 2020, and before jan. If you are located in.

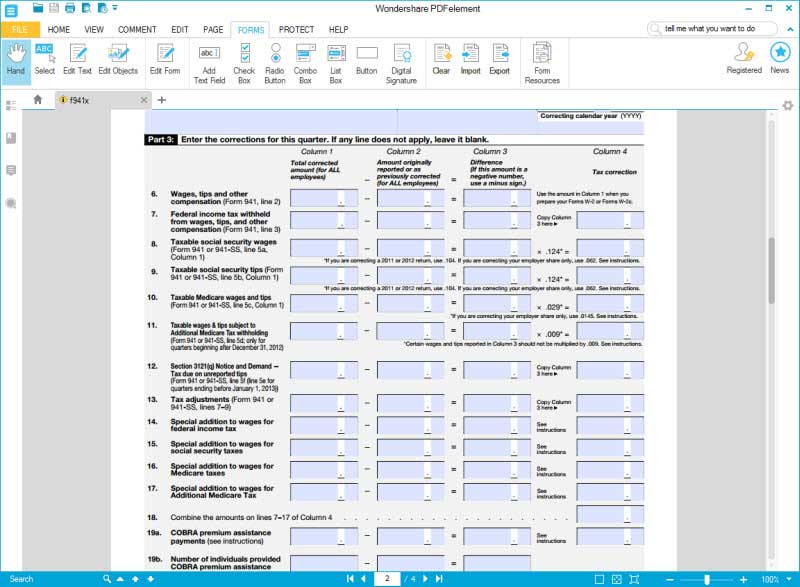

The adjustments also entail administrative errors and alterations to employee retention tax credits. How to claim follow guidance for the period when qualified wages were paid: After march 12, 2020, and before jan. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. Determine which payroll quarters in 2020 and 2021 your business qualifies for. If you are located in. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding.

IRS Form 941X Learn How to Fill it Easily

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. How to claim follow guidance for the period when qualified wages were paid: After march 12, 2020, and before jan. The adjustments also entail administrative errors and alterations to employee retention tax credits. Employer identification number (ein) —.

Worksheet 2 941x

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. How to claim follow guidance for the period when qualified wages were paid: See section 13 of pub. Web limitations wages reported as payroll costs for ppp loan forgiveness or.

ERTC REFUND DEADLINE How to get ERTC Tax Credit 2021 [ERC 2020] IRC

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. How to claim follow guidance for the period when qualified wages were.

Worksheet 1 941x

Determine which payroll quarters in 2020 and 2021 your business qualifies for. Employer identification number (ein) — name (not your trade name) trade name (if. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you are located in. How to claim follow guidance for the period.

Form 941x Due Date [How Long to File Form 941X] How Long to File for

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. After march 12, 2020, and before jan. See section 13 of pub. How to claim follow guidance for the period when qualified wages were paid: The adjustments also entail administrative.

941x Worksheet 1 Excel

Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example,.

EFile Form 941 for 2022 File 941 Electronically at 4.95

An employer is required to file an irs 941x in the event of an error on a previously filed form 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Therefore, you may need to amend your income tax.

How to Apply for the Employee Retention Tax Credit with Form 941X

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you are located in. After march 12, 2020, and before jan. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web limitations wages reported.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

If you are located in. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. April 2023) adjusted employer’s quarterly federal tax return.

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

See section 13 of pub. Determine which payroll quarters in 2020 and 2021 your business qualifies for. How to claim follow guidance for the period when qualified wages were paid: If you are located in. Employer identification number (ein) — name (not your trade name) trade name (if.

The Adjustments Also Entail Administrative Errors And Alterations To Employee Retention Tax Credits.

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. How to claim follow guidance for the period when qualified wages were paid: An employer is required to file an irs 941x in the event of an error on a previously filed form 941. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

If You Are Located In.

Determine which payroll quarters in 2020 and 2021 your business qualifies for. See section 13 of pub. After march 12, 2020, and before jan. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period.

Employer Identification Number (Ein) — Name (Not Your Trade Name) Trade Name (If.

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction.

![ERTC REFUND DEADLINE How to get ERTC Tax Credit 2021 [ERC 2020] IRC](https://i.ytimg.com/vi/8McDcwKoEGg/maxresdefault.jpg)

![Form 941x Due Date [How Long to File Form 941X] How Long to File for](https://i.ytimg.com/vi/qyMsYQmVJhk/maxresdefault.jpg)

.jpg)