Where To Mail Form 2848

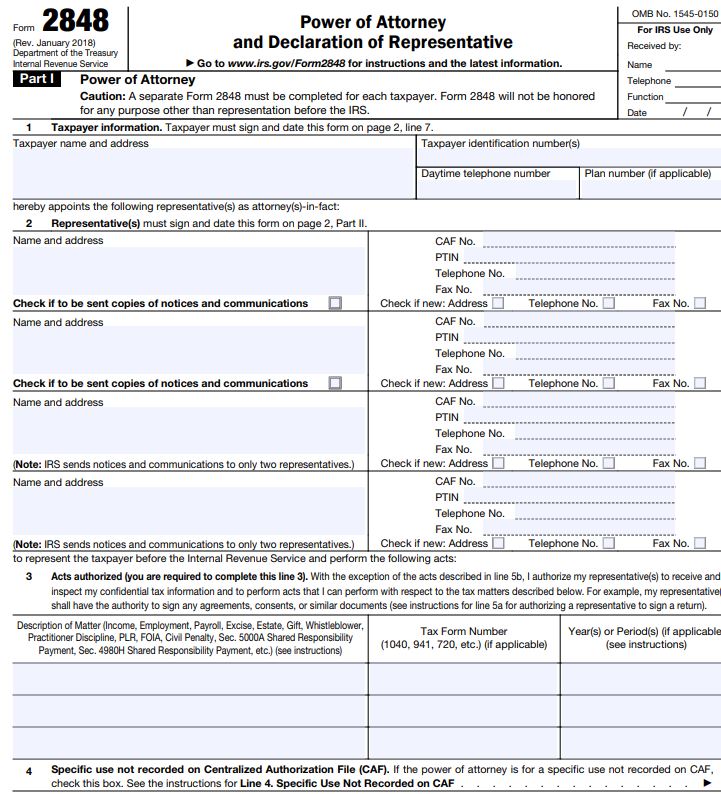

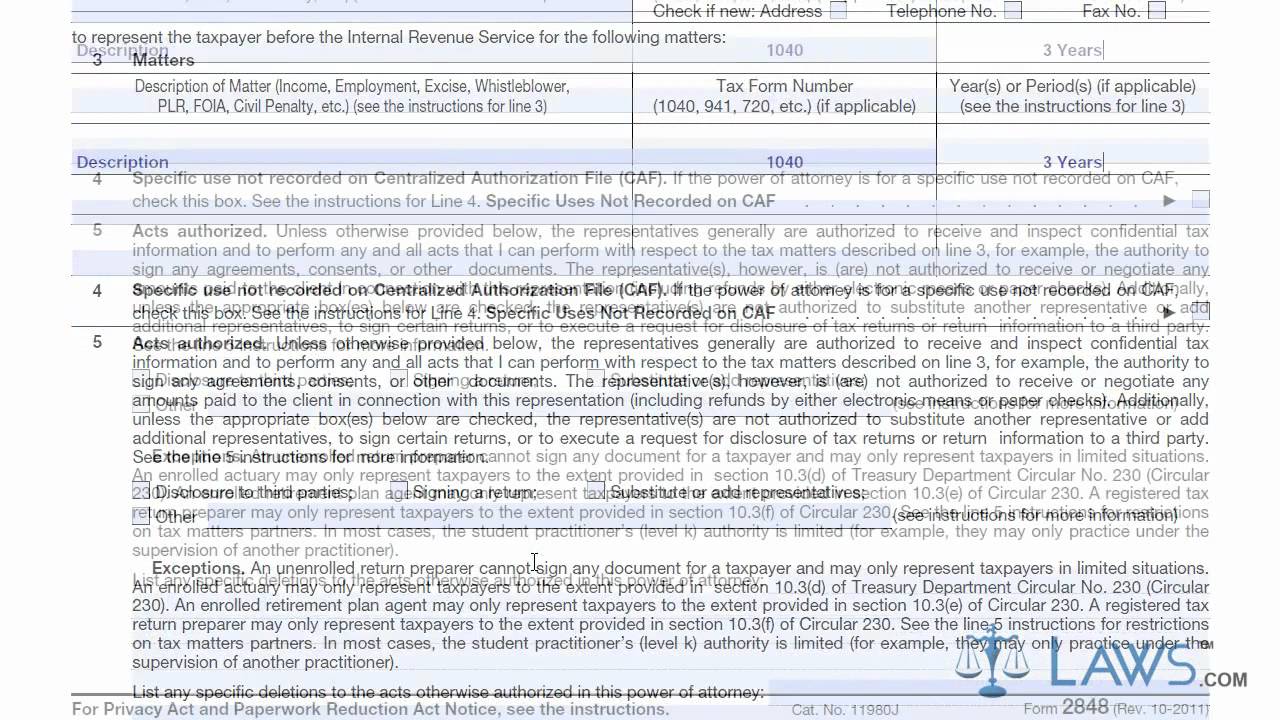

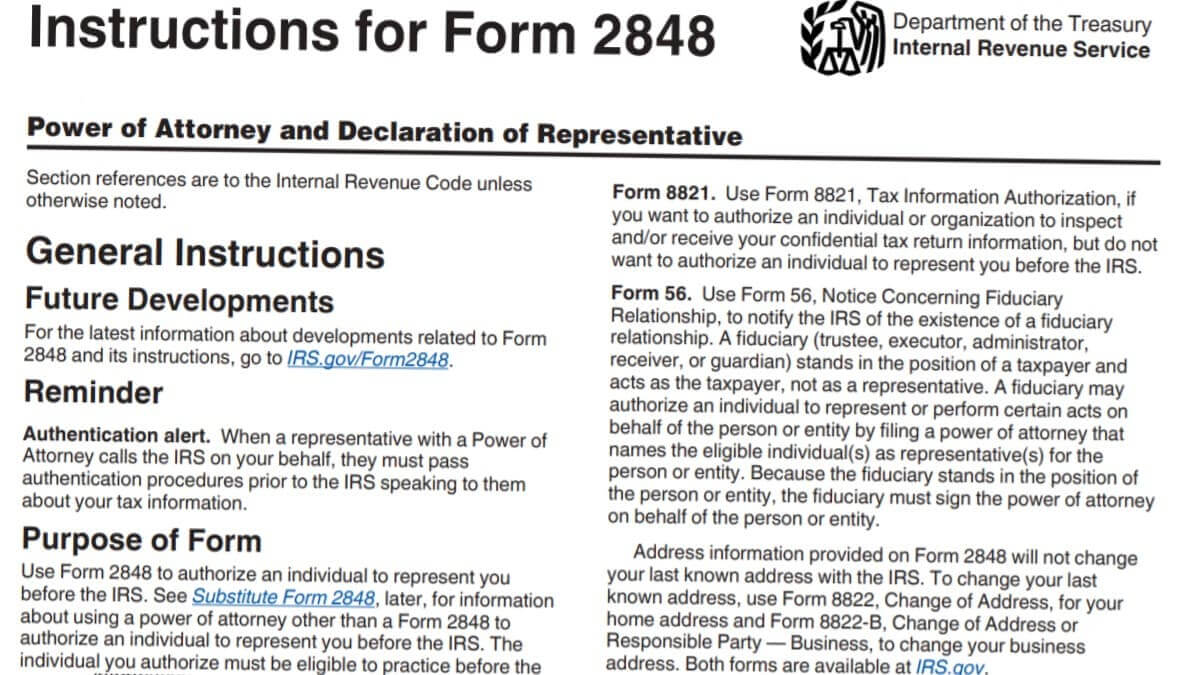

Where To Mail Form 2848 - Web otherwise, you'll need to mail or fax it to the irs. To submit multiple forms, select “submit another form and answer the questions about the authorization. When filing the form, include a copy of your parent’s document that designates you as power of attorney. Web upload a completed version of a signed form 8821 or form 2848. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848. Do not submit a form online if you've already submitted it by fax or mail. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. That mailing address or fax number depends on the state in which you live. Dec 24, 2021 · the completed power of attorney and declaration of representative form (irs form 2848) should be mailed to the appropriate regional irs office. Electronic signatures are not allowed.

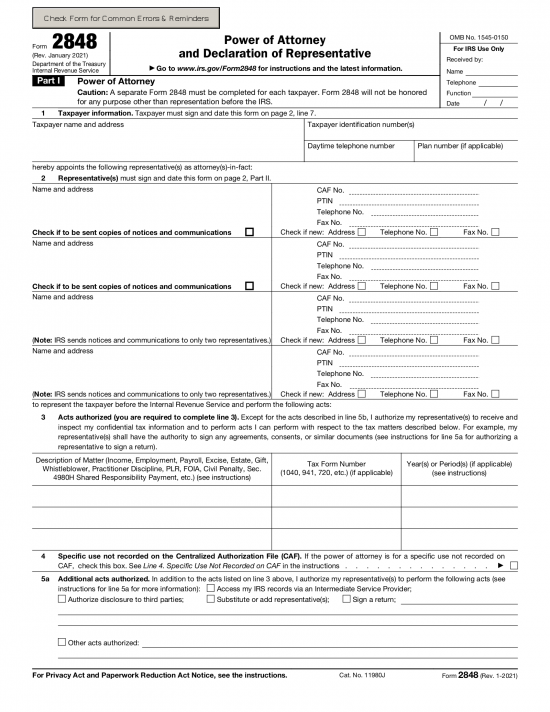

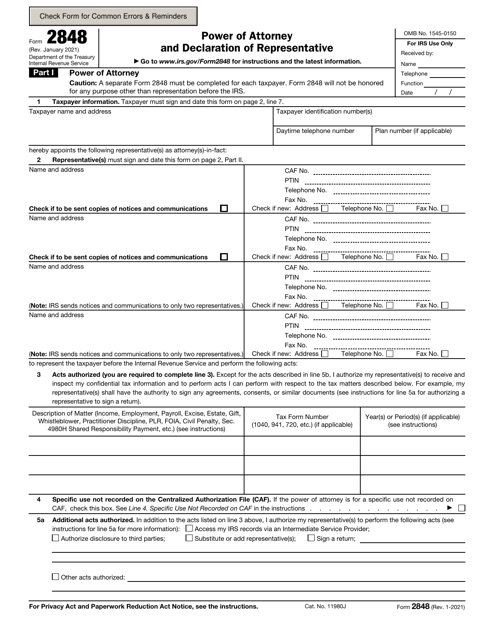

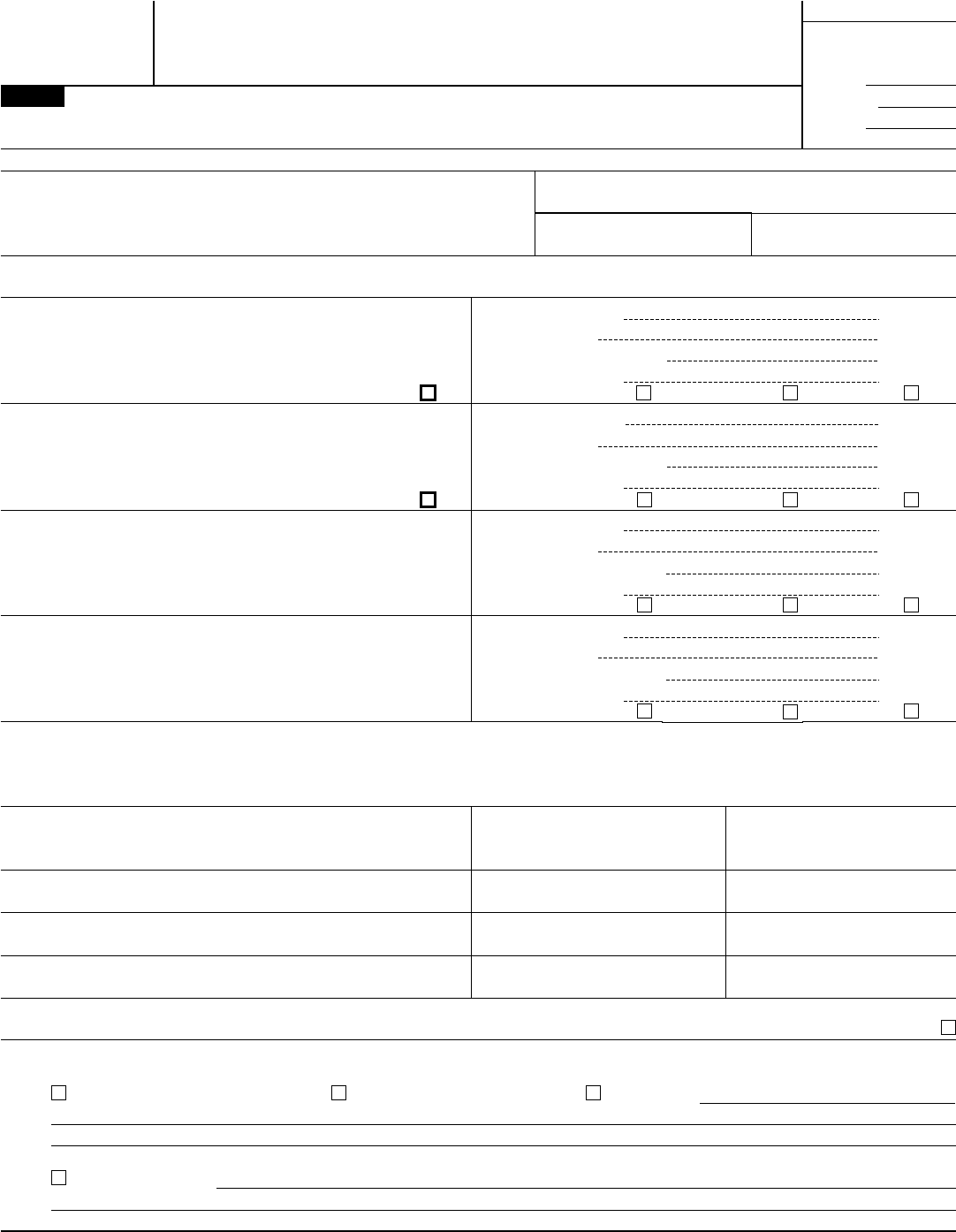

Electronic signatures are not allowed. Form 2848 is used to authorize an eligible individual to. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Signatures on mailed or faxed forms must be handwritten. Web upload a completed version of a signed form 8821 or form 2848. Most forms 2848 and 8821 are recorded. That mailing address or fax number depends on the state in which you live. They cannot currently provide a timeframe for completion. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848. Date / / part i power of attorney.

Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. To submit multiple forms, select “submit another form and answer the questions about the authorization. Signatures on mailed or faxed forms must be handwritten. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. That mailing address or fax number depends on the state in which you live. Most forms 2848 and 8821 are recorded. Web the process to mail or fax authorization forms to the irs is still available. Web how to complete form 2848?

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

When filing the form, include a copy of your parent’s document that designates you as power of attorney. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Dec 24, 2021 · the completed power of attorney and declaration of representative form (irs form 2848) should be.

Learn How to Fill the Form 2848 Power of Attorney and Declaration of

Most forms 2848 and 8821 are recorded. That mailing address or fax number depends on the state in which you live. Power of attorney and declaration of representative. Where to file chart if you live in. Signatures on mailed or faxed forms must be handwritten.

Form 2848 Edit, Fill, Sign Online Handypdf

Do not submit a form online if you've already submitted it by fax or mail. To submit multiple forms, select “submit another form and answer the questions about the authorization. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Web the process to mail or fax.

Form 2848 Instructions

Web upload a completed version of a signed form 8821 or form 2848. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848. January 2021) department of the treasury internal revenue service. Web how to complete form 2848? Date / / part i power of.

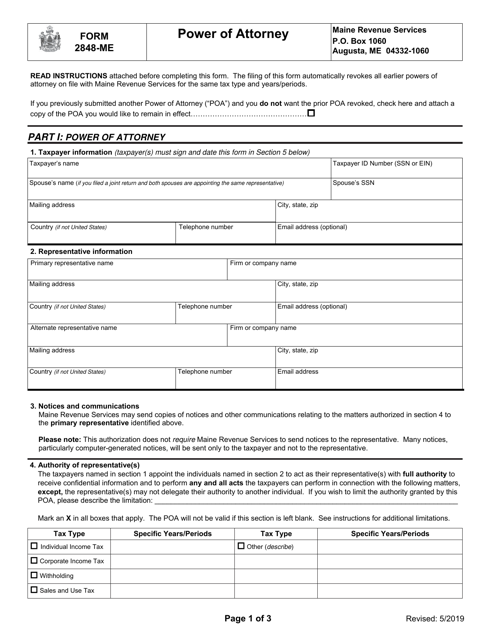

Form 2848ME Download Fillable PDF or Fill Online Power of Attorney

Power of attorney and declaration of representative. To submit multiple forms, select “submit another form and answer the questions about the authorization. Date / / part i power of attorney. Electronic signatures are not allowed. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart.

Where Do I Mail Form 2848 Power Of Attorney

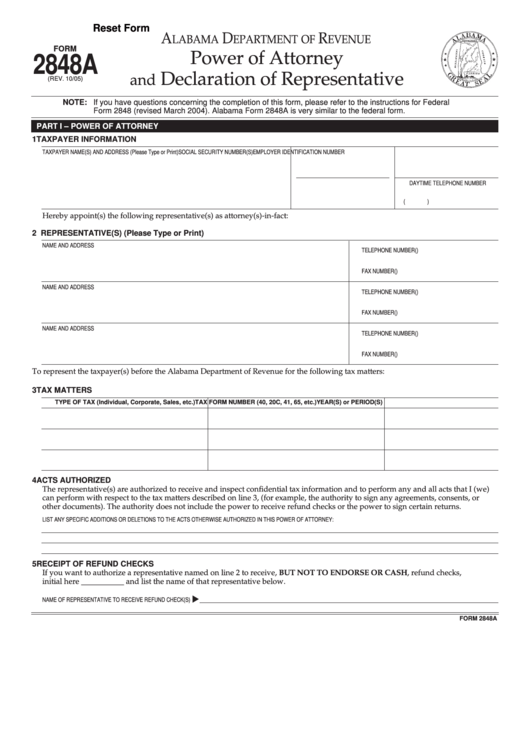

Dec 24, 2021 · the completed power of attorney and declaration of representative form (irs form 2848) should be mailed to the appropriate regional irs office. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Web upload a completed version of a signed form 8821 or form 2848. Fax number* alabama,.

Free IRS Power of Attorney Form 2848 Revised Jan. 2021 PDF eForms

Web the process to mail or fax authorization forms to the irs is still available. Do not submit a form online if you've already submitted it by fax or mail. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Most forms 2848 and 8821 are recorded. Web.

IRS Form 2848 Download Fillable PDF or Fill Online Power of Attorney

That mailing address or fax number depends on the state in which you live. They cannot currently provide a timeframe for completion. If your agent files a paper return, he or she should attach form 2848 to your return. Fax number* alabama, arkansas, connecticut, delaware, district of Web the instructions for form 2848 provide the address where you should file.

Form 2848 Edit, Fill, Sign Online Handypdf

Form 2848 is used to authorize an eligible individual to. January 2021) department of the treasury internal revenue service. Date / / part i power of attorney. For instructions and the latest information. Web upload a completed version of a signed form 8821 or form 2848.

All About IRS Form 2848 SmartAsset

Web upload a completed version of a signed form 8821 or form 2848. They cannot currently provide a timeframe for completion. If your agent files a paper return, he or she should attach form 2848 to your return. For instructions and the latest information. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related.

Form 2848 Is Used To Authorize An Eligible Individual To.

For instructions and the latest information. Do not submit a form online if you've already submitted it by fax or mail. Web the process to mail or fax authorization forms to the irs is still available. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart.

Power Of Attorney And Declaration Of Representative.

You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848. Web otherwise, you'll need to mail or fax it to the irs. Web upload a completed version of a signed form 8821 or form 2848. That mailing address or fax number depends on the state in which you live.

Fax Number* Alabama, Arkansas, Connecticut, Delaware, District Of

Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Dec 24, 2021 · the completed power of attorney and declaration of representative form (irs form 2848) should be mailed to the appropriate regional irs office. Most forms 2848 and 8821 are recorded. Web how to complete form 2848?

Signatures On Mailed Or Faxed Forms Must Be Handwritten.

Date / / part i power of attorney. Electronic signatures are not allowed. If your agent files a paper return, he or she should attach form 2848 to your return. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file.