Who Must File Form 8865

Who Must File Form 8865 - Web any us person with at least 10% interest in a controlled foreign partnership must file form 8865; See section 721(c) partnership, gain deferral method, and u.s. Department of the treasury internal revenue service. The form must be completed. Persons to report information regarding controlled foreign partnerships (irc section 6038), transfers to foreign partnerships (irc. Persons with respect to certain foreign partnerships. Transferor must file form 8865 with respect to that partnership. Web in general, a u.s. Web similarly, a u.s. Form 8865 is used by u.s.

Any person that is required to file form 8865, schedule k, for a partnership that has items relevant to the determination of u.s. Form 8865 is used by u.s. These instructions and the filing. Web any us person with at least 10% interest in a controlled foreign partnership must file form 8865; Transferor must file form 8865 with respect to that partnership. Control means that five or fewer u.s. Department of the treasury internal revenue service. Partners is required to file tax form 8865. Web who must file a u.s. See section 721(c) partnership, gain deferral method, and u.s.

Partners is required to file tax form 8865. See section 721(c) partnership, gain deferral method, and u.s. You are a us citizen who has control over the partnership (owning more than 50%. Persons to report information regarding controlled foreign partnerships (irc section 6038), transfers to foreign partnerships (irc. Web any us person with at least 10% interest in a controlled foreign partnership must file form 8865; The purpose of the form is to allow the irs to record. Web similarly, a u.s. Web form 8865 is an informational tax form that is required to be filed by u.s. Any person that is required to file form 8865, schedule k, for a partnership that has items relevant to the determination of u.s. Web who has to file form 8865?

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Web who must use this form? Web who has to file form 8865? Form 8865 is used by u.s. Web who must file a u.s. Web if either of these two scenarios apply to you, then you must file form 8865 under category 1:

Instructions for IRS Form 8865 Return of U.S. Persons With Respect to

Person qualifying under one or more of the categories of filers (see below) must complete and file form 8865. You are a us citizen who has control over the partnership (owning more than 50%. The purpose of the form is to allow the irs to record. Web who has to file form 8865? Transferor must file form 8865 with respect.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Person qualifying under one or more of the categories of filers (see below) must complete and file form 8865. Control means that five or fewer u.s. Persons to report information regarding controlled foreign partnerships (irc section 6038), transfers to foreign partnerships (irc. Transferor must file form 8865 with respect to that partnership. Persons who have an interest in a foreign.

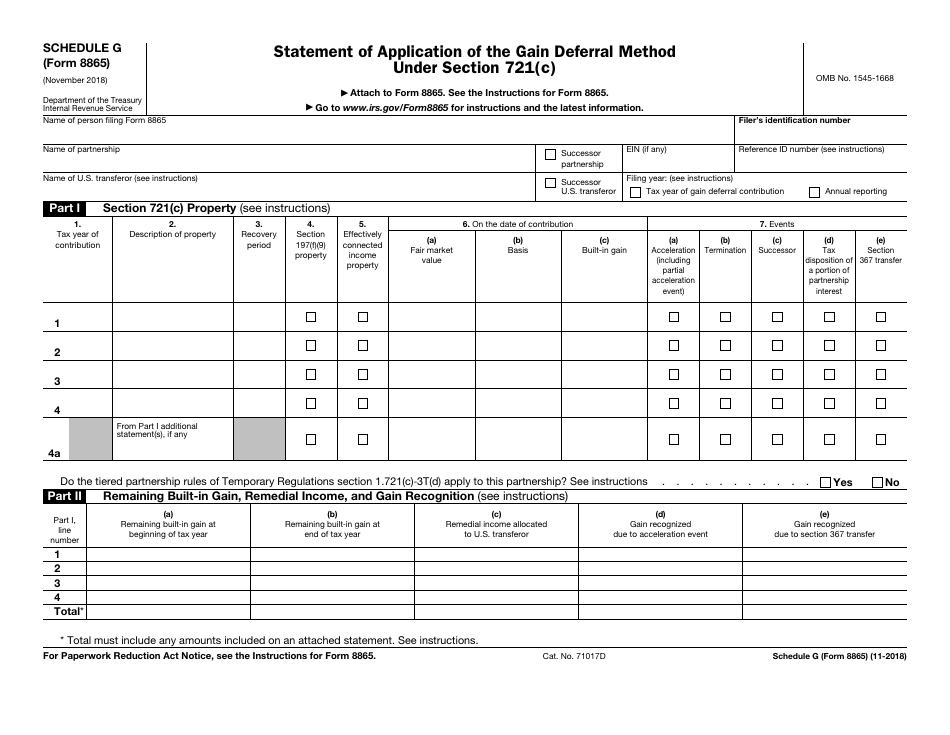

IRS Form 8865 Schedule G Download Fillable PDF or Fill Online Statement

Person who is a partner in a foreign partnership must file form 8865 to report the income and financial position of the partnership and to report certain. You are a us citizen who has control over the partnership (owning more than 50%. These instructions and the filing. Web in general, a u.s. The purpose of the form is to allow.

Fill Free fillable Form 8865 Return of Persons With Respect to

Person qualifying under one or more of the categories of filers (explained below) must complete and file form 8865. Person who is a partner in a foreign partnership must file form 8865 to report the income and financial position of the partnership and to report certain. A person will file form 8865 when they qualify as one of the four.

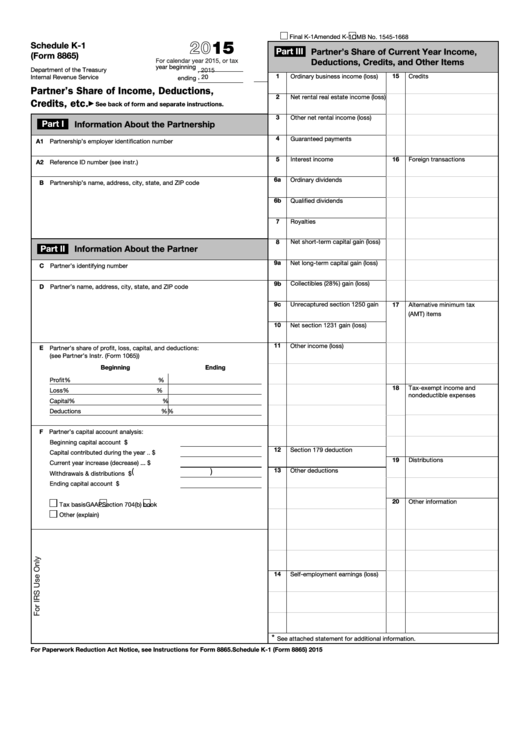

Fillable Form 8865 Schedule K1 Partner'S Share Of

Web in general, a u.s. A partnership formed in a foreign country that is controlled by u.s. The form must be completed. Web who must use this form? Form 8865 is used by u.s.

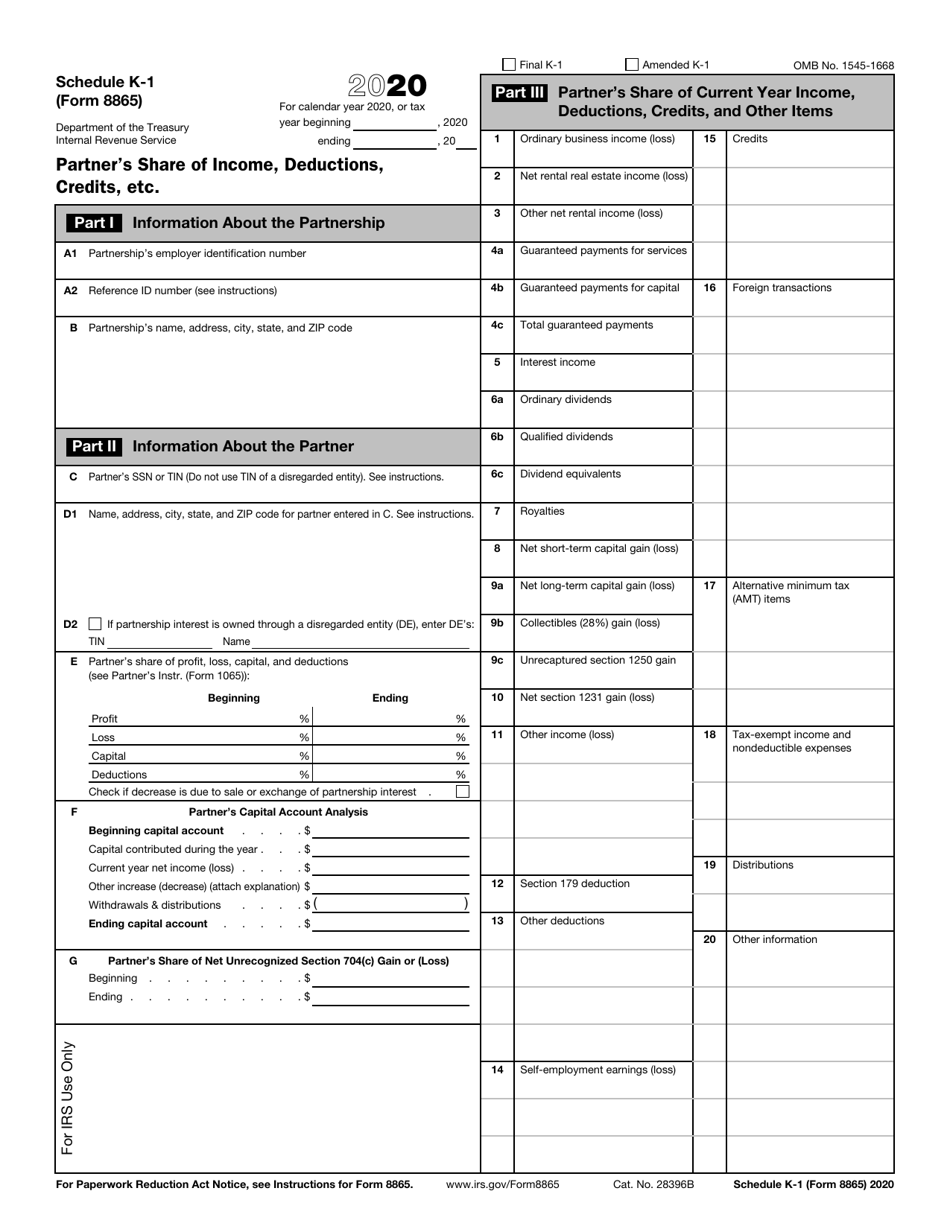

IRS Form 8865 Schedule K1 Download Fillable PDF or Fill Online Partner

The form must be completed. Person qualifying under one or more of the categories of filers (see below) must complete and file form 8865. The purpose of the form is to allow the irs to record. Person qualifying under one or more of the categories of filers (see below) must complete and file form 8865. See section 721(c) partnership, gain.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Persons who have an interest in a foreign partnership. Department of the treasury internal revenue service. Control means that five or fewer u.s. Person qualifying under one or more of the categories of filers (see below) must complete and file form.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Persons to report information regarding controlled foreign partnerships (irc section 6038), transfers to foreign partnerships (irc. A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Attach to your.

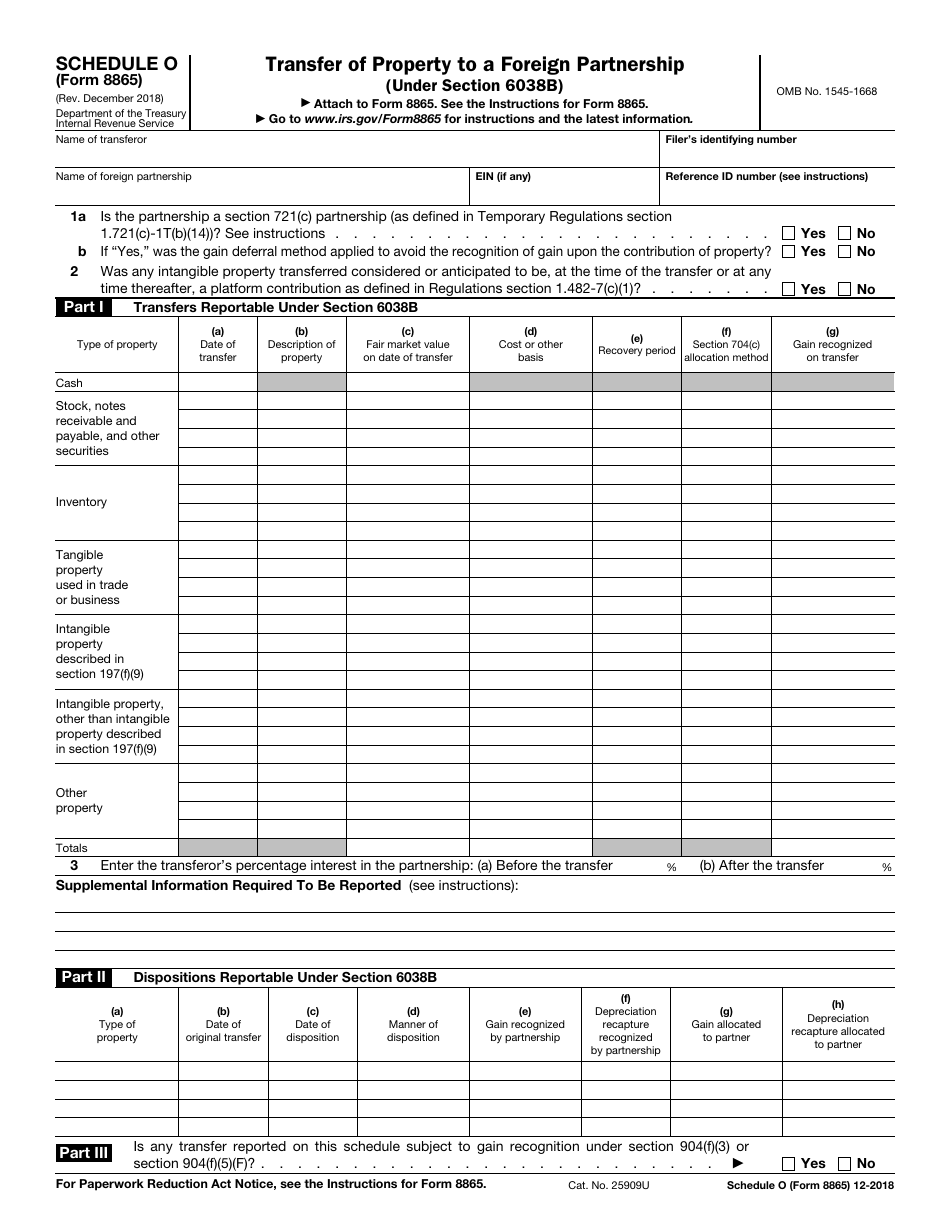

IRS Form 8865 Schedule O Download Fillable PDF or Fill Online Transfer

Web any us person with at least 10% interest in a controlled foreign partnership must file form 8865; Form 8865 is used by u.s. Web if either of these two scenarios apply to you, then you must file form 8865 under category 1: Web form 8865 is an informational tax form that is required to be filed by u.s. Web.

Person Qualifying Under One Or More Of The Categories Of Filers (See Below) Must Complete And File Form 8865.

The purpose of the form is to allow the irs to record. These instructions and the filing. Persons with respect to certain foreign partnerships. These instructions and the filing.

Person Filing Form 8865 With Respect To A Foreign Partnership That Has Made An Mtm Election Described In Treas.

Web form 8865 can be electronically filed only if the form 8865 electronic file is attached to the filer's form 1040, 1120, 1120s, 1065, or 1041 return, prior to creating the filer's electronic. Web form 8865 is an informational tax form that is required to be filed by u.s. The form must be completed. Department of the treasury internal revenue service.

Persons Who Have An Interest In A Foreign Partnership.

Web in general, a u.s. Web what is form 8865? Transferor must file form 8865 with respect to that partnership. Web any us person with at least 10% interest in a controlled foreign partnership must file form 8865;

Web Who Must Use This Form?

Person who is a partner in a foreign partnership must file form 8865 to report the income and financial position of the partnership and to report certain. Web who must file a u.s. Form 8865 is used by u.s. Web who has to file form 8865?