Who Needs To File Form 3520

Who Needs To File Form 3520 - Ad talk to our skilled attorneys by scheduling a free consultation today. If you need to file an extension to file your 3520, use form 7004. Owner, as well as between the trust and us beneficiary. Owner is required to file in order to report to the irs, and to the u.s. Web if you are a u.s. The form 3520 is generally required when a u.s. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. If you received a gift or a bequest of at least $14,723 from a foreign corporation or a foreign partnership, you will. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both.

Web who must file a form 3520; The irs f orm 3520 is used to report certain foreign transactions to the irs. Web who needs to file form 3520? Web you must include a statement on the form 3520 showing that you are a u.s. And possible penalties for filing the form 3520 late or filing incomplete or inaccurate. Web a foreign trust with a u.s. Form 3520 may not be required of every us citizen who receives a foreign gift. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both. If you received a gift or a bequest of at least $14,723 from a foreign corporation or a foreign partnership, you will. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000.

Web if you are a u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. When and where the form 3520 must be filed; The form 3520 is generally required when a u.s. Web who needs to file form 3520? Web a foreign trust with a u.s. Owner is required to file in order to report to the irs, and to the u.s. Form 3520 may not be required of every us citizen who receives a foreign gift. Not all trust owners need to file. Ad edit, fill, sign 3520 2018 pdf & more fillable forms.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Owner to satisfy its annual information reporting requirements under section 6048(b). Form 3520 may not be required of every us citizen who receives a foreign gift. Web who should file form 3520? Web see below the relevant section from form 3520 instructions.

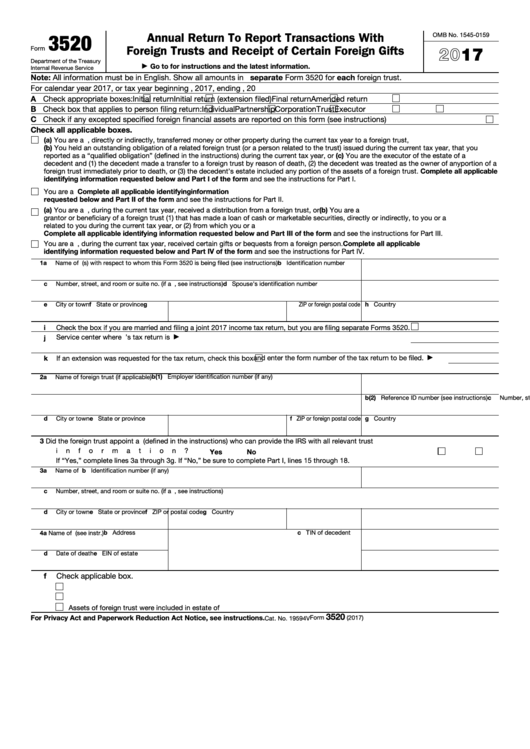

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Owner to satisfy its annual information reporting requirements under section 6048(b). Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval.

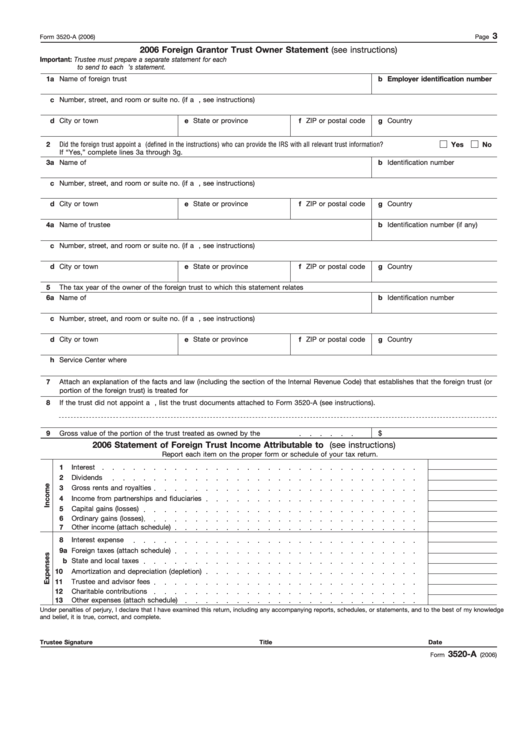

Fillable Form 3520A 2006 Foreign Grantor Trust Owner Statement

And possible penalties for filing the form 3520 late or filing incomplete or inaccurate. Web see below the relevant section from form 3520 instructions. Citizen or resident who meets one of these conditions. Owner to satisfy its annual information reporting requirements under section 6048(b). Send form 3520 to the.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

The value of the gift and who sent it to you are important factors in. Web who must file a form 3520; Owner is required to file in order to report to the irs, and to the u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15).

Buy tickets for Form 3520/3520A Preparation on GoToWebinar, Tue Sep 8

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web gift recipient from a foreign corporation or trust: Owner to satisfy its annual information reporting requirements under section 6048(b). If you and your spouse are filing a joint income tax return for tax year.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Ad complete irs tax forms online or print government tax documents. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both. Owner is required to file in order to report to the irs, and to the u.s. Web you must include a statement on the form 3520 showing that you.

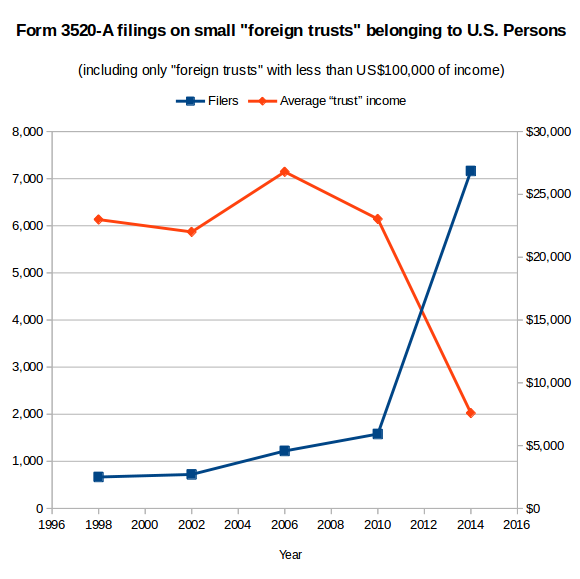

The Isaac Brock Society IRS “offshore trust” crusade finds thousands

The value of the gift and who sent it to you are important factors in. And possible penalties for filing the form 3520 late or filing incomplete or inaccurate. Web gift recipient from a foreign corporation or trust: Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15).

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Form 3520 may not be required of every us citizen who receives a foreign gift. The form 3520 is generally required when a u.s. Complete, edit or print tax forms instantly. Owner to satisfy its annual information reporting requirements under section 6048(b). Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to.

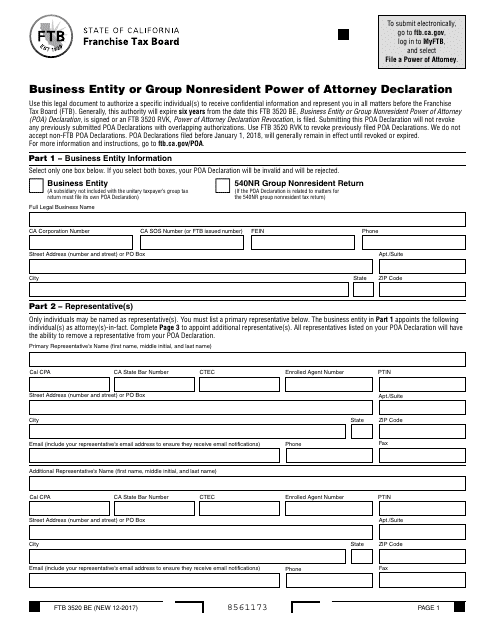

Form FTB 3520 BE Download Fillable PDF, Business Entity or Group

Ad talk to our skilled attorneys by scheduling a free consultation today. If you need to file an extension to file your 3520, use form 7004. The form 3520 is generally required when a u.s. Web gift recipient from a foreign corporation or trust: Web who should file form 3520?

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Form 3520 may not be required of every us citizen who receives a foreign gift. Web who needs to file form 3520? The form 3520 is generally required when a u.s. Not all trust owners need to file. When and where the form 3520 must be filed;

Web The Irs Requires The Taxpayer To Complete And Submit Irs Form 3520 In Situations Where The Taxpayer Receives A Gift Of A Certain Value From A Foreign Person Or A Foreign Estate, Or.

Citizen or resident who meets one of these conditions. If you received a gift or a bequest of at least $14,723 from a foreign corporation or a foreign partnership, you will. Web who needs to file form 3520? Not all trust owners need to file.

The Irs F Orm 3520 Is Used To Report Certain Foreign Transactions To The Irs.

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Owner, as well as between the trust and us beneficiary. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web who must file a form 3520;

If You Need To File An Extension To File Your 3520, Use Form 7004.

You live outside of the united states and. Form 3520, on the other hand, is due on. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly.

Web You Must Include A Statement On The Form 3520 Showing That You Are A U.s.

Web see below the relevant section from form 3520 instructions. Ad talk to our skilled attorneys by scheduling a free consultation today. Web if you are a u.s. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto.