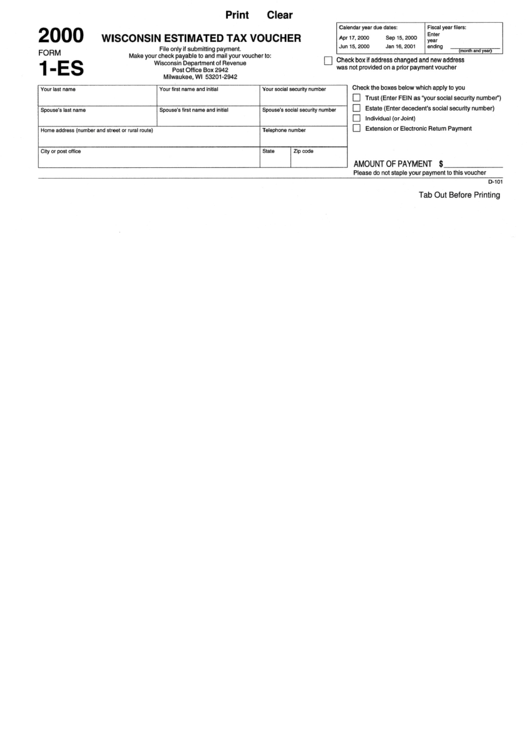

Wisconsin Estimated Tax Form

Wisconsin Estimated Tax Form - To claim exemption from withholding you must: Web popular forms & instructions; Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web if you filed a wisconsin income tax return last year, you can make estimated payments equal to 100% of your tax liability for last year. Submit full payment of your 2023 wisconsin estimated tax liability. Web 2022 individual income tax forms note: You can also make estimated. The amount of one of the last three payments made, or. Web 153 rows visit the prior year income tax forms webpage. Web video instructions and help with filling out and completing wisconsin form 1 es voucher 2018.

Watch our video to discover how you can easily complete the wisconsin estimated tax. Web if you filed a wisconsin income tax return last year, you can make estimated payments equal to 100% of your tax liability for last year. Please read to see if you qualify. Web enter the id number. Form wi sch ar, explanation of. Web 2022 income tax forms. Web video instructions and help with filling out and completing wisconsin form 1 es voucher 2018. Web yes, you can prepay your wisconsin income tax liability. Web when should i pay? Wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue.

Web video instructions and help with filling out and completing wisconsin form 1 es voucher 2018. Wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue. The amount of one of the last three payments made, or. Web 2022 income tax forms. Individual tax return form 1040 instructions; You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web if you filed a wisconsin income tax return last year, you can make estimated payments equal to 100% of your tax liability for last year. You can download or print current. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. You may pay all your estimated tax at that time or in four equal installments on or.

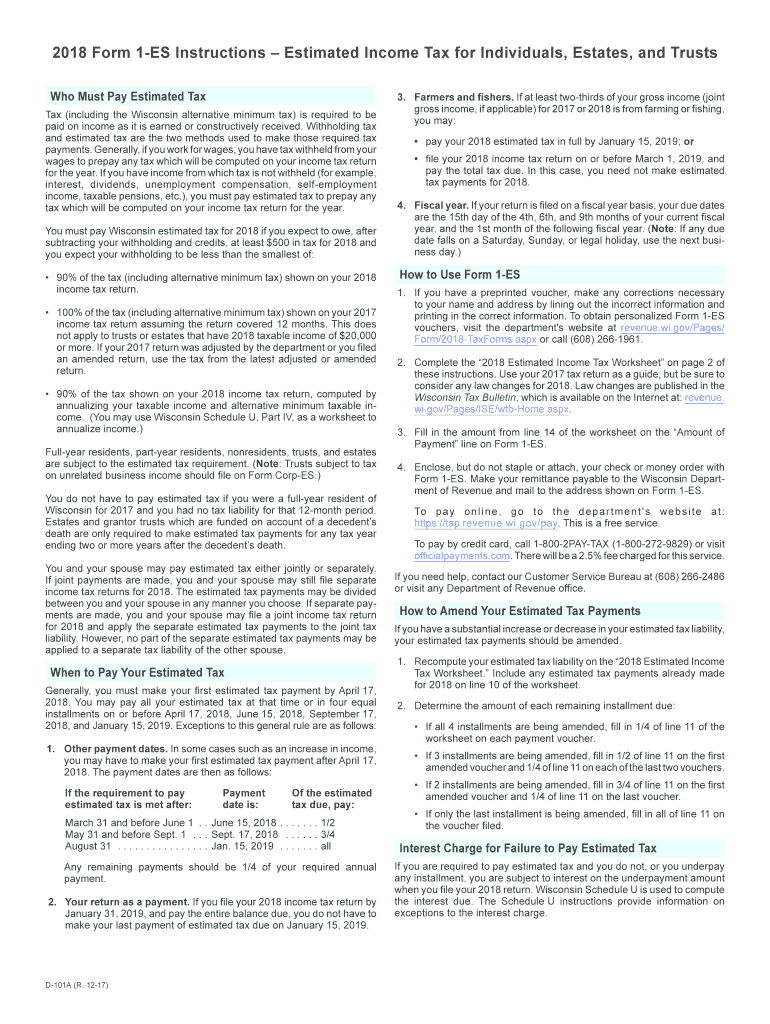

Wisconsin Form 1ES Instructions (Estimated Tax Instructions

You may pay all your estimated tax at that time or in four equal installments on or. Web yes, you can prepay your wisconsin income tax liability. Web wisconsin department of revenue: Web 2022 income tax forms. Form wi sch ar, explanation of.

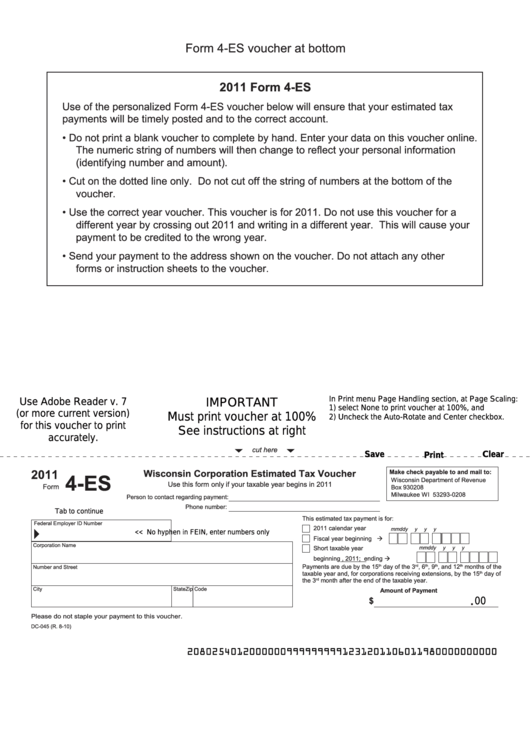

Fillable Form 4Es Wisconsin Corporation Estimated Tax Voucher 2011

Generally, you must make your first estimated tax payment by april 18, 2023. Individual tax return form 1040 instructions; Web when should i pay? Web 2022 individual income tax forms note: Please read to see if you qualify.

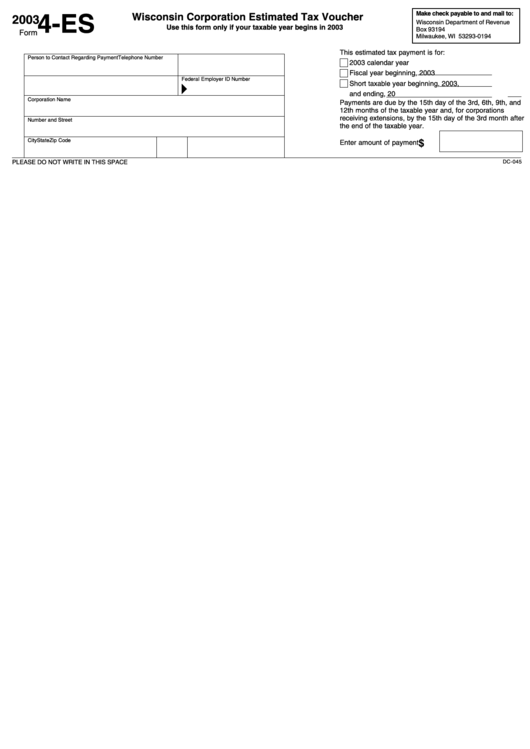

Form 4Es Wisconsin Corporation Estimated Tax Voucher 2003

You can download or print current. The amount of one of the last three payments made, or. Web when should i pay? You may pay all your estimated tax at that time or in four equal installments on or. Please read to see if you qualify.

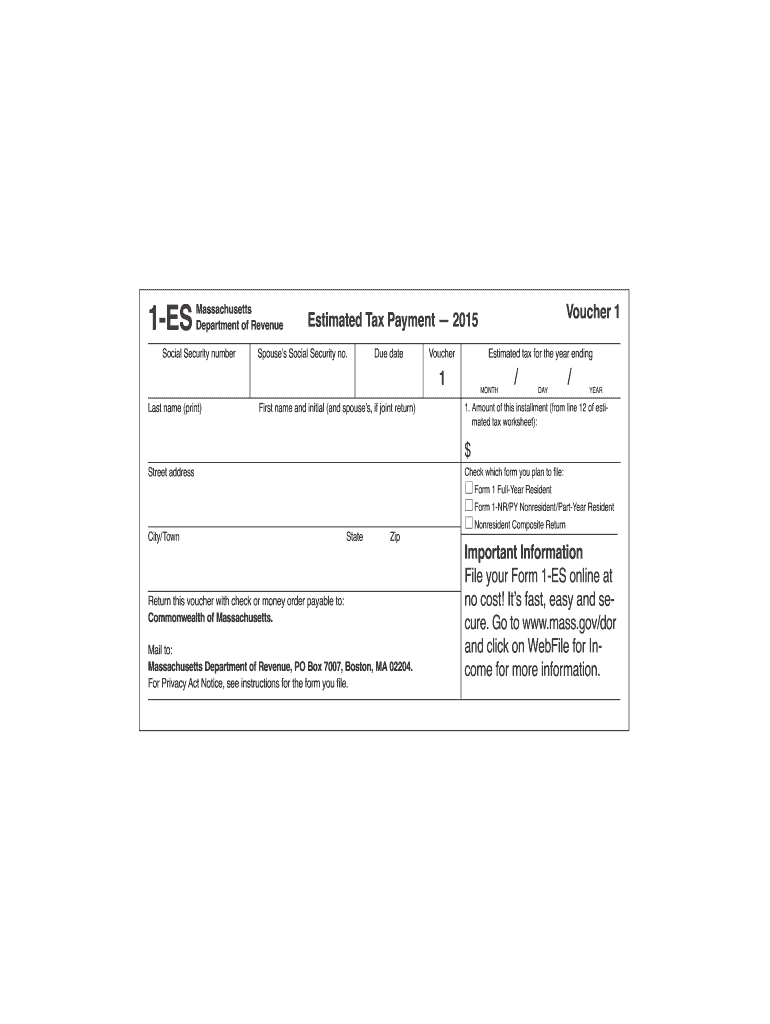

Maryland Estimated Tax Form 2020

Web estimated tax payments must be sent to the wisconsin department of revenue on a quarterly basis. Web 2022 income tax forms. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search.

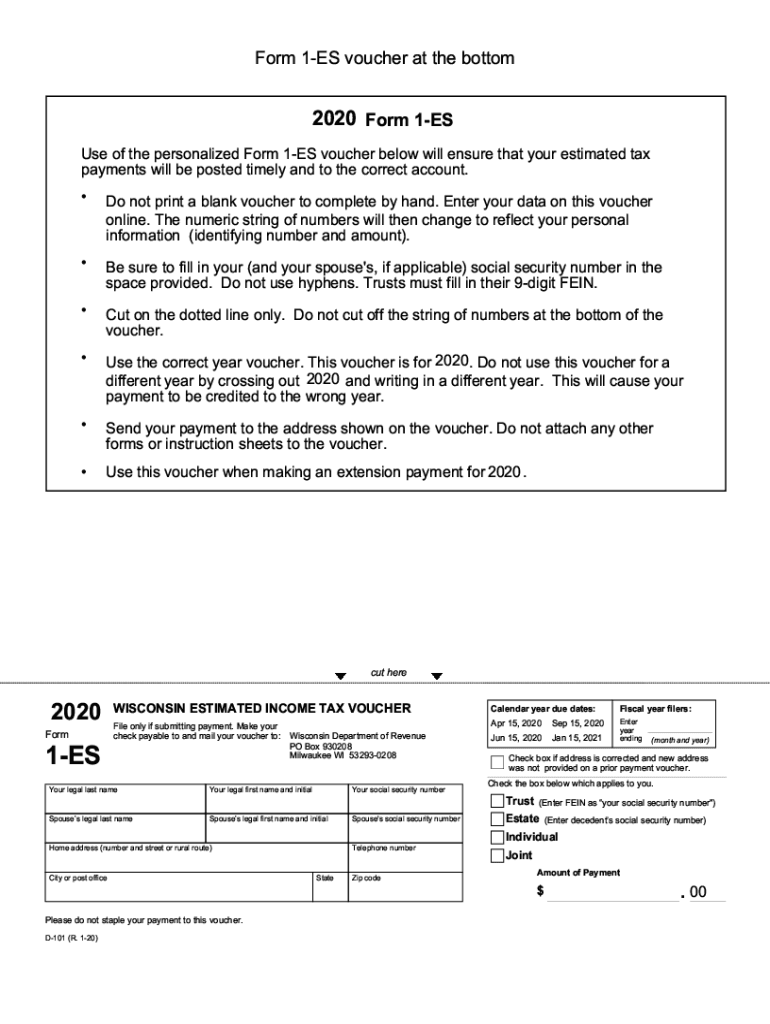

Form 1 ES, Wisconsin Estimated Tax Voucher Form 1 ES, Wisconsin

Web 2022 income tax forms. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Submit full payment of your 2023 wisconsin estimated tax liability. Web 153 rows visit the prior year income tax forms webpage. Generally, you must make your first estimated tax payment by april 18, 2023.

2019 Wisconsin Form 1 Es Printable Fill Out and Sign Printable PDF

Wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web yes, you can prepay your wisconsin income tax liability. Web when should i pay? Submit full payment of your 2023 wisconsin.

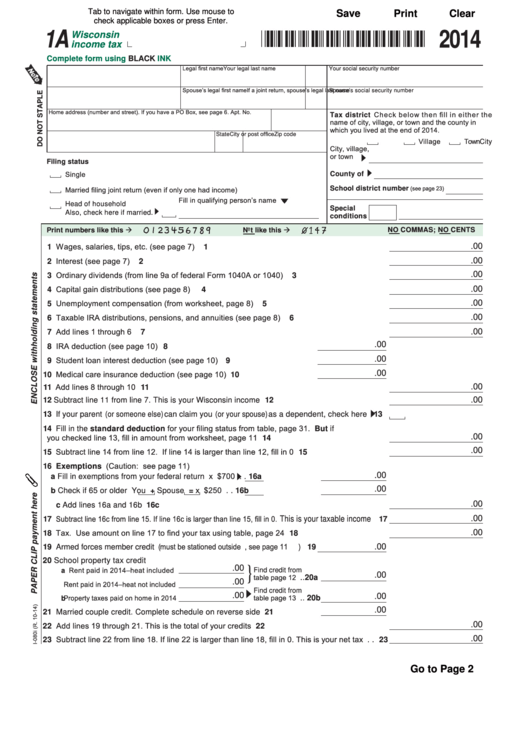

Fillable Form 1a Wisconsin Tax 2014 printable pdf download

Web wisconsin department of revenue: Enter one of the following: Please read to see if you qualify. The amount of one of the last three payments made, or. Web popular forms & instructions;

Wisconsin estimated tax payment fillable 2012 form Fill out & sign

This form is for income earned in tax year 2022, with tax returns due in april. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Web 153 rows visit the prior year income tax forms webpage. You must pay estimated income tax if.

Fillable Form 1Es Wisconsin Estimated Tax Voucher printable pdf download

Wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue. Form wi sch ar, explanation of. Web yes, you can prepay your wisconsin income tax liability. You can also make estimated. Generally, you must make your first estimated tax payment by april 18, 2023.

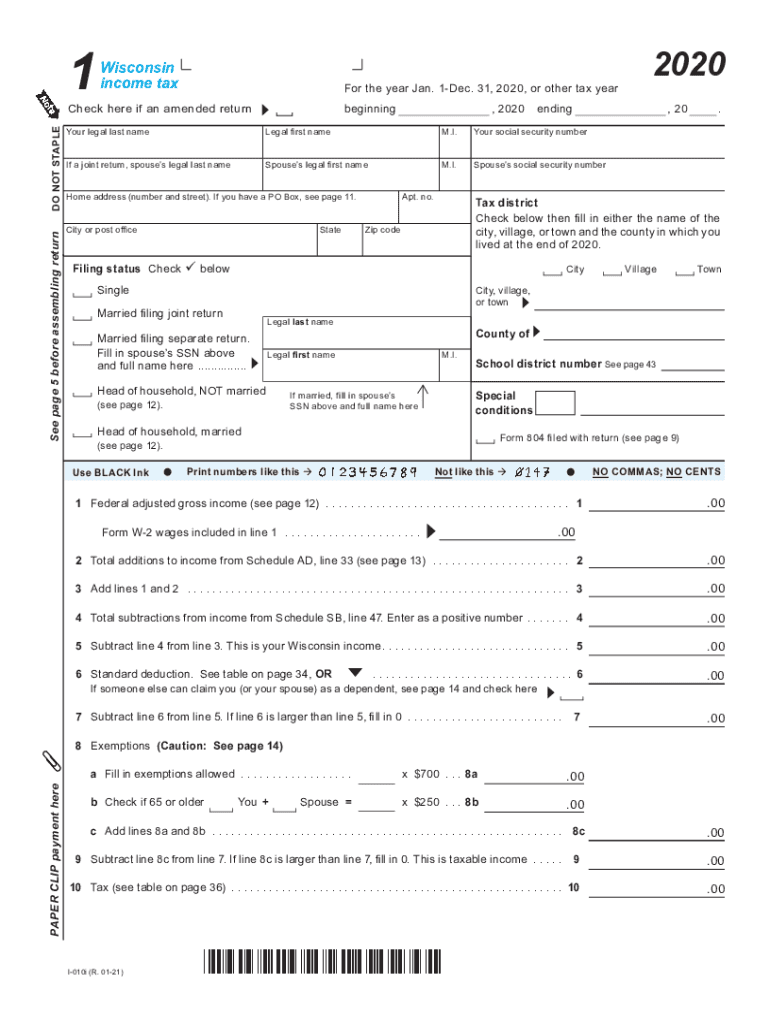

Wisconsin Tax Form 1 Fill Out and Sign Printable PDF Template

Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Enter one of the following: Web enter the id number. This form is for income earned in tax year 2022, with tax returns due in april. Web yes, you can prepay your wisconsin income.

Form Wi Sch Ar, Explanation Of.

Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web estimated tax payments must be sent to the wisconsin department of revenue on a quarterly basis. Wisconsin has a state income tax that ranges between 4% and 7.65% , which is administered by the wisconsin department of revenue. Generally, you must make your first estimated tax payment by april 18, 2023.

Web Enter The Id Number.

Watch our video to discover how you can easily complete the wisconsin estimated tax. Please read to see if you qualify. You can download or print current. Individual tax return form 1040 instructions;

You Can Also Make Estimated.

Web 153 rows visit the prior year income tax forms webpage. Web wisconsin department of revenue: Web yes, you can prepay your wisconsin income tax liability. Web popular forms & instructions;

You Must Pay Estimated Income Tax If You Are Self Employed Or Do Not Pay Sufficient Tax Withholding.

Web if you filed a wisconsin income tax return last year, you can make estimated payments equal to 100% of your tax liability for last year. Submit full payment of your 2023 wisconsin estimated tax liability. Enter one of the following: If an audit by the irs or dwd.